Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

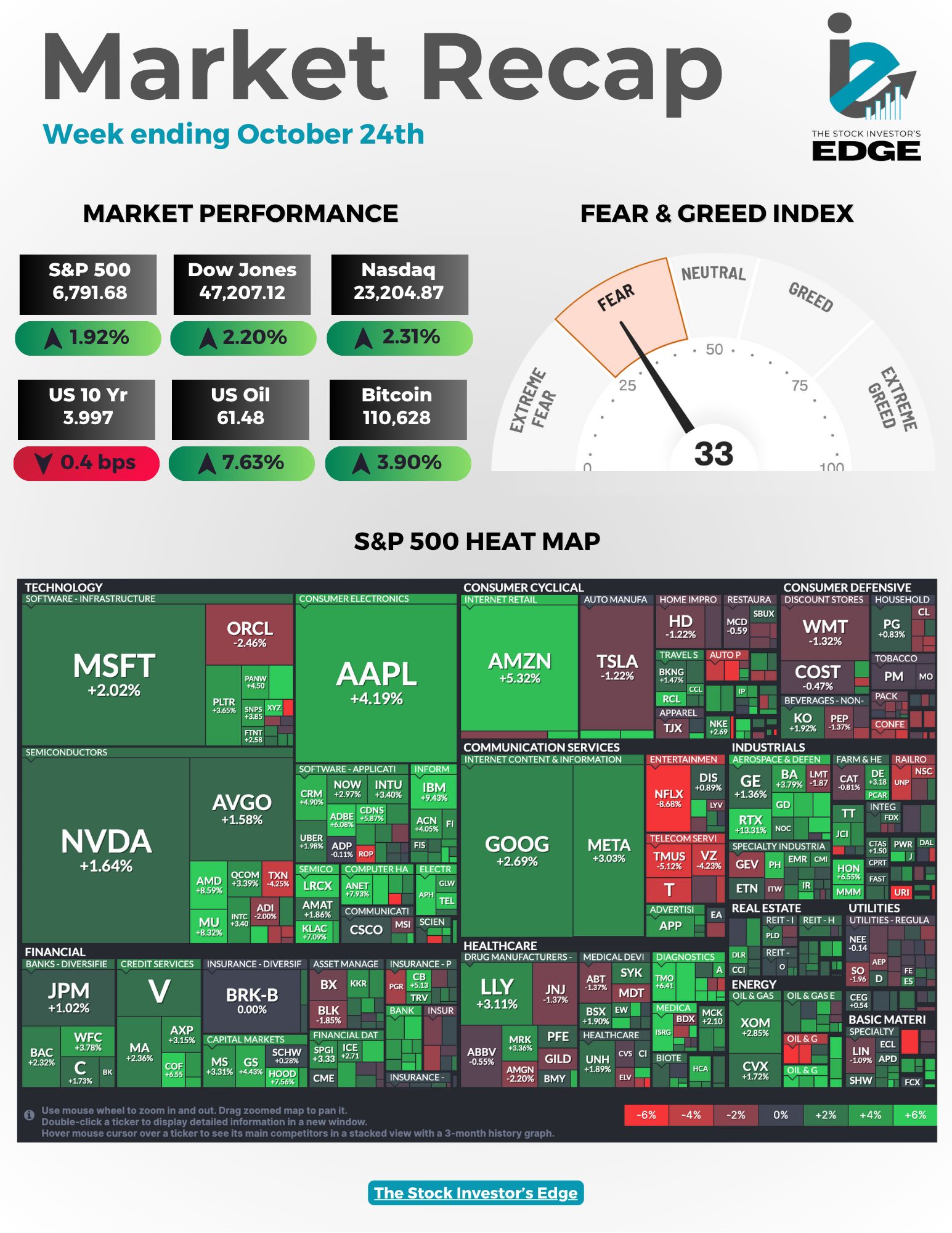

Friday’s cooler than expected CPI report sent all three major indexes to all-time highs.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

CPI Cools to 3%, Strengthening Case for Fed Rate Cut Next Week

Inflation rose less than expected in September, with the Consumer Price Index easing from August levels. Released amid the shutdown, this print arrives as the lone official data point before the coming policy meeting, shaping market expectations toward additional easing. Together with softer labor signals and fading shelter momentum, it strengthens the case for a near term cut without reigniting broad price pressure.

🔑 Key Points

Headline CPI: Up 0.3% MoM and 3% YoY vs 0.4% and 3.1% expected.

Core Inflation: Up 0.2% MoM and 3% YoY, both cooler than forecasts.

Energy: Gasoline prices jumped 4.1%, but broader energy inflation stayed contained at +2.8% YoY.

Shelter: Rose only 0.2% MoM, signaling a notable slowdown in the biggest CPI component.

Market Reaction: Equities rose, yields dipped, and traders priced in a near-certain quarter-point Fed cut.

👀 What You Need to Know

This CPI report is the only major data released during the shutdown, giving markets rare visibility ahead of the Fed’s decision. Inflation remains sticky but stable, allowing policymakers to focus more on weakening labor data than price pressure. With core CPI cooling and shelter decelerating, the Fed is expected to cut rates by 25 bps next week and may follow with another in December. The bigger question is whether tariffs or energy costs reheat prices in Q4, complicating the easing path into 2026.

🔐 Edge Takeaway: Inflation was better than expected, but still sticky enough to keep Powell boxed in. What matters now is…upgrade to Edge+ to read the Full Edge Takeaway. Today is the last day of our Earnings Season Sale!

Trump Rekindles Trade Wars as Tariff Politics Escalate on Two Fronts

President Trump abruptly terminated U.S. trade negotiations with Canada after Ontario aired a Reagan-themed anti-tariff ad. The fallout comes just days before Trump’s high-stakes meeting with China’s Xi Jinping at the APEC summit, where tariffs again dominate the agenda. Together, these moves signal a renewed willingness to weaponize trade policy heading into 2026.

🔑 Key Points

Reagan controversy: Ontario’s $75 million ad invoked Reagan’s 1987 speech on free trade, prompting Trump to halt all talks.

Legal tension: The Reagan Foundation accused Ontario of editing remarks without consent, calling the ad “misleading.”

Tariff stance: Trump doubled down, claiming Reagan “loved tariffs” for national security and vowing new 100% levies.

China summit: Trump will meet Xi Jinping next week, aiming to reset negotiations amid rare earth and tech disputes.

Policy signal: The two episodes underscore tariffs’ return as both economic leverage and political theater.

👀 What You Need to Know

Tariffs are once again dictating global trade policy. Trump’s abrupt break with Canada and his planned sit-down with Xi underscore how quickly trade relationships can be weaponized. The unpredictability alone is inflationary, adding friction to supply chains already under strain. With tariff threats spreading across allies and rivals alike, markets should expect continued volatility in industrials, commodities, and currencies tied to cross-border demand.

🔐 Edge Takeaway: These tariff headlines are brutal to manage because they distort everything that drives positioning, including…upgrade to Edge+ to read the Full Edge Takeaway. Last day to take advantage of our Earnings Season sale!

📚 Edge-ucation: How Tariffs Hit Markets Before They Hit Consumers

Tariffs don’t just raise prices at checkout; they ripple through markets almost instantly. Investors react to the expectation of pressure long before it shows up in earnings or inflation data. Understanding that lag helps explain why markets sell first and confirm later.

Headlines move risk: Even the hint of new tariffs pushes futures lower and volatility higher as traders price in uncertainty.

Guidance reacts first: Companies cut outlooks preemptively to manage cost expectations, hitting valuations before margins move.

Margins take the hit: Input costs rise faster than pricing power, squeezing profitability weeks before CPI data reflects it.

Repricing leads reality: By the time economic data confirms stress, equities have already adjusted, often ahead of the official print.

The takeaway: tariffs are priced in expectations first, fundamentals later, and the smartest investors trades that gap before the data catches up.

Sponsored by Masterworks

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Q3 Earnings Season: This Week’s Roundup

Several major names reported this week, with results generally better than feared. Pricing, backlog, and cost control helped most companies top expectations, while guidance was steady to higher in several cases.

Procter & Gamble $PG ( ▲ 1.4% ) delivered solid top-line growth and held guidance.

EPS: $1.99 core vs $1.90 est.

Revenue: $22.39B vs $22.18B est.

Highlights: Organic sales +2%, Beauty +6%, Grooming +5%, core EPS +3% YoY, FY26 sales and EPS outlook maintained.

Lam Research $LRCX ( ▲ 3.17% ) posted strong margins and a slight beat on the quarter.

EPS: $1.26 vs $1.22 est.

Revenue: $5.32B vs $5.22B est.

Highlights: Gross margin 50.6%, operating margin 35.0%, China 43% of revenue, next-quarter revenue guide ~$5.2B.

Intel $INTC ( ▼ 1.14% ) beat expectations and guided Q4 within the range, as the turnaround shows progress.

EPS: $0.23 vs $0.02 est.

Revenue: $13.65B vs $13.20B est.

Highlights: Gross margin ~40%, Q4 revenue guide $12.8B-$13.8B, commentary pointed to demand outpacing supply in areas and ongoing cost discipline.

Honeywell $HON ( ▲ 1.33% ) beat on both lines and raised full-year EPS guidance.

EPS: $2.82 vs $2.59 est.

Revenue: $10.41B vs $10.15B est.

Highlights: Organic sales +6%, OCF $3.3B, FCF $1.5B, FY25 EPS raised to $10.60-$10.70, update on Solstice spin timing.

Ford $F ( ▲ 1.67% ) topped estimates but trimmed its full-year outlook due to the Novelis plant fire impact.

EPS: $0.45 adj. vs $0.35 est.

Revenue: $50.53B vs $47.05B est.

Highlights: Net income $2.4B, consolidated revenue +9% YoY, FY25 adjusted EBIT now $6.0B-$6.5B, management outlined actions to mitigate supply disruption.

🔐 Edge Takeaway: P&G’s print was a clean beat, but the message was “slow grind” growth with tighter margins and tariff friction, which makes the valuation…upgrade to Edge+ to read the Full Edge Takeaway. Our Earnings Season sale ends today!

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming inflation report as well as several major earnings on the calendar. See the latest full report here:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Tesla, Netflix, Coca-Cola, and more. See this week’s recap:

The Week Ahead

It is the one of the biggest weeks of the year with over 30% of S&P 500 companies scheduled to report earnings, including five of the largest companies in the world. Meanwhile, the government shutdown continues to throw a wrench in economic data being released though the Fed will deliver its much anticipated interest rate decision on Wednesday.

Earnings Reports

Next week is the biggest week of the Q3 earnings season with 5 of the MAG7 names reporting, and 21 of companies that we cover expected to report:

Monday 10/27: --

Tuesday 10/28: Visa, UnitedHealth, UPS, and PayPal

Wednesday 10/29: Microsoft, Alphabet, Meta, Verizon, Starbucks, and Chipotle

Thursday 10/30: Apple, Amazon, Eli Lilly, Mastercard, Merck, Coinbase, L3Harris, and VICI

Friday 10/31: Exxon Mobil, AbbVie, and Chevron

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

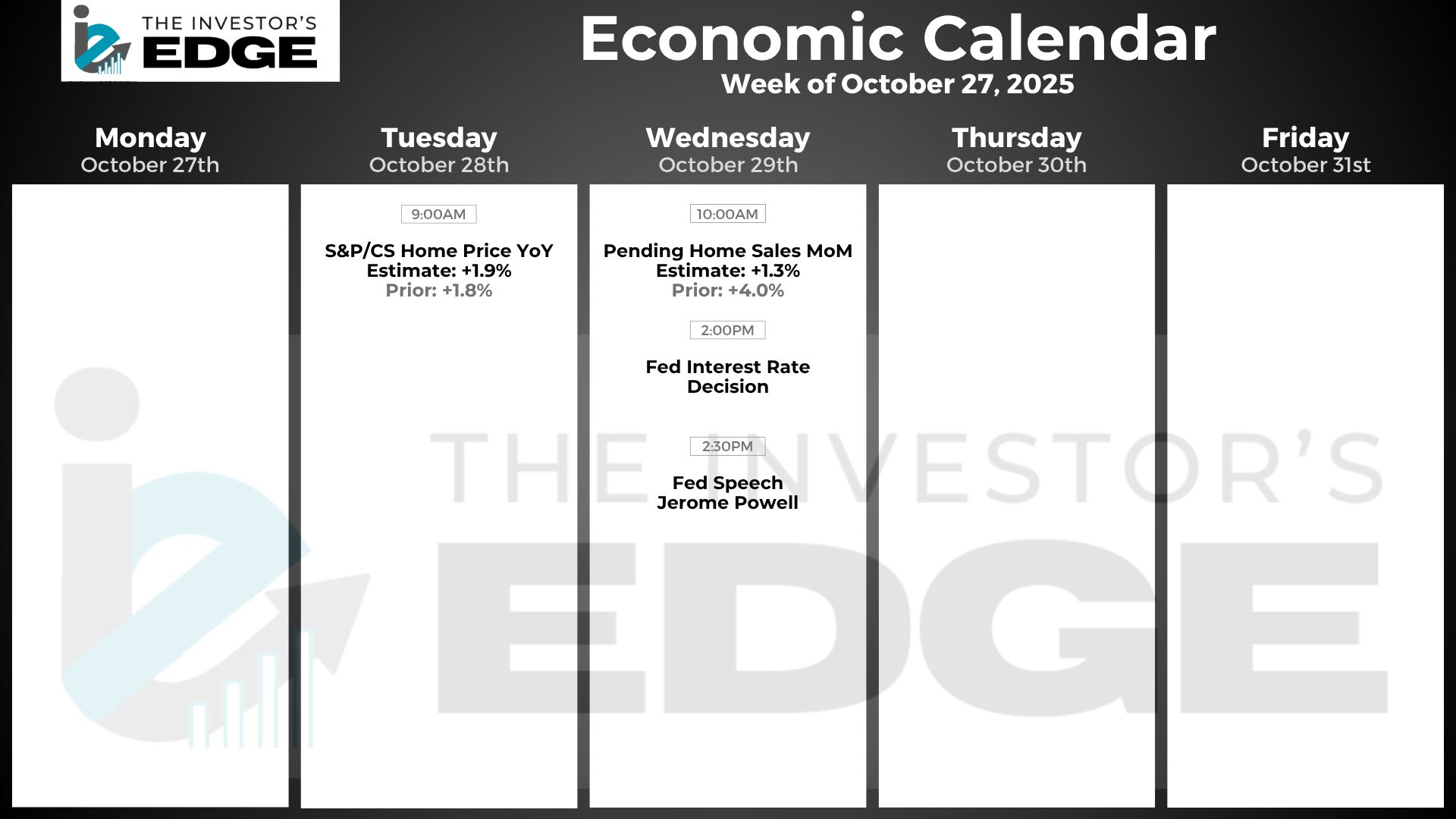

Economic Reports

All eyes will be on the Fed’s interest rate decision next week. The market believes we will get 2 rate cuts by year end, and we will see if the Fed agrees on Wednesday.

We will also get pending home sales data and the S&P/Case Shiller home price report.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.