Good morning investors!

During the ever important earnings season, we publish our “Earnings Recap” — an in-depth summary of the earnings reports for stocks that we cover on a regular basis.

Q3 earnings season continued this week and we are here to keep you well informed on all of the names we cover.

Let’s dive in.

Tesla (TSLA)

Tesla $TSLA ( ▲ 2.39% ) reported mixed Q3 results, with revenue above expectations but profit margins still under pressure. The stock is -3.9% so far this week.

EPS: $0.50 vs $0.56

Revenue: $28.10B vs $26.54B

Automotive Revenue: +6% YoY to $21.2B, driven by record Model Y and 3 deliveries.

Energy Growth: +44% YoY to $3.4B on record Megapack and Powerwall deployments.

Margins Compressed: Operating margin fell to 5.8% from 10.8% amid tariffs and AI R&D costs.

Cash Strength: Free cash flow hit $4.0 B (+46% YoY) with cash reserves rising to $41.6 B.

Guidance: Maintains focus on AI, Robotaxi, and Megapack 3 expansion despite macroeconomic uncertainty.

🔐 Edge Takeaway: Tesla’s Q3 delivered record $28.1B revenue and record free cash flow near $4.0B, but operating margin stayed thin at 5.8% as tariffs, mix, and higher R&D offset volume. Deliveries hit ~497k, Energy deployments climbed to 12.5 GWh with record profit near $1.1B, and cash and investments reached ~$41.6B. Management acknowledged that…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

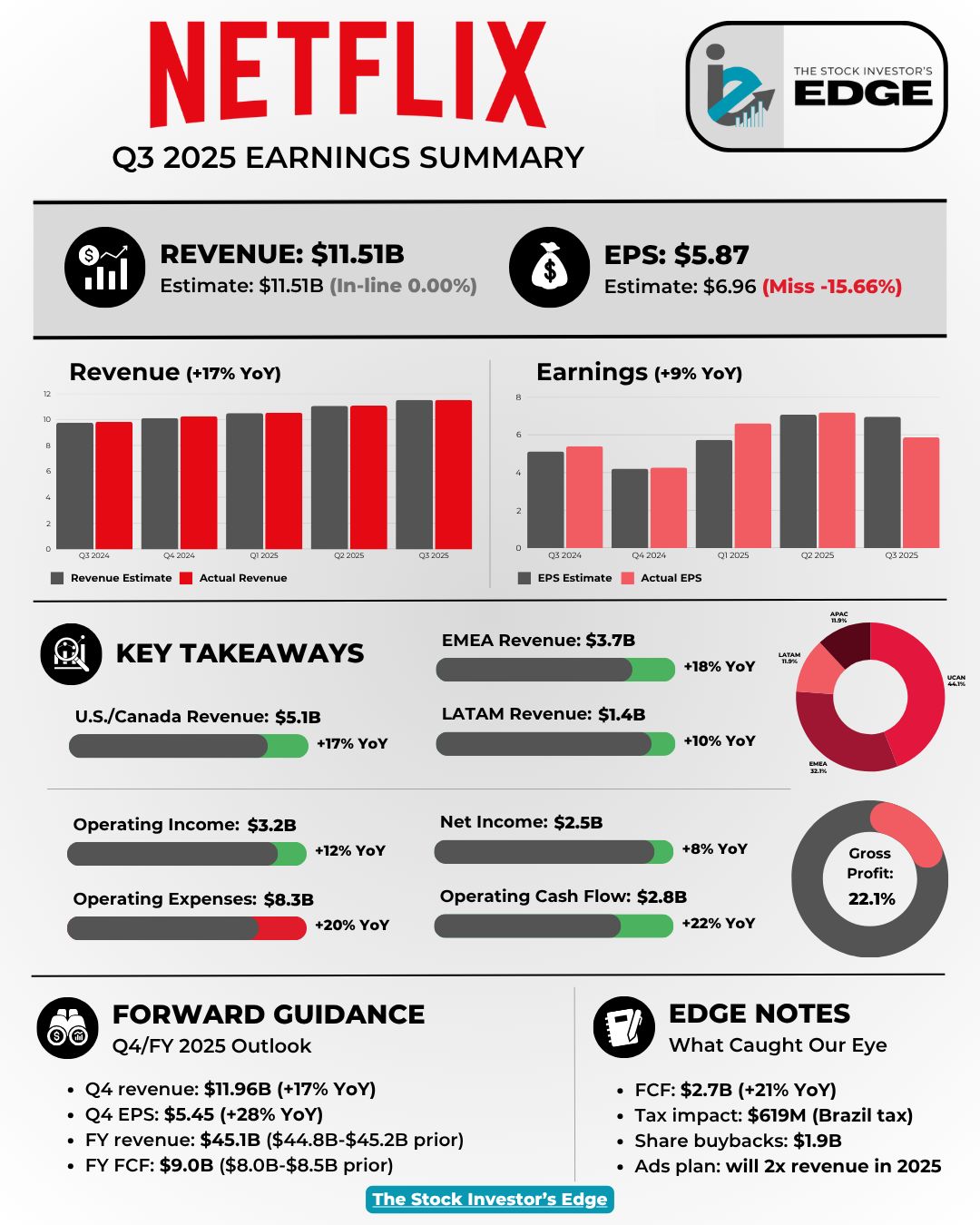

Netflix (NFLX)

Netflix $NFLX ( ▲ 2.66% ) missed profit expectations as a $619M Brazilian tax charge offset strong ad and revenue growth. The stock is -7.4% so far this week.

EPS: $5.87 vs $6.96 est.

Revenue: $11.51B vs $11.51B est.

Tax impact: $619M Brazil charge cut operating margin by ~5 points to 28%.

Ad momentum: Record quarter with U.S. upfront commitments doubling YoY.

Cash flow: Free cash flow +21% YoY to $2.7B on lower content spend.

Buybacks: $1.9B repurchased with $10.1B authorization remaining.

Guidance: Q4 revenue +17% YoY to $11.96B, EPS +28% to $5.45, margin 23.9%.

🔐 Edge Takeaway: The 10% post-earnings drop is the market telling you Netflix…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

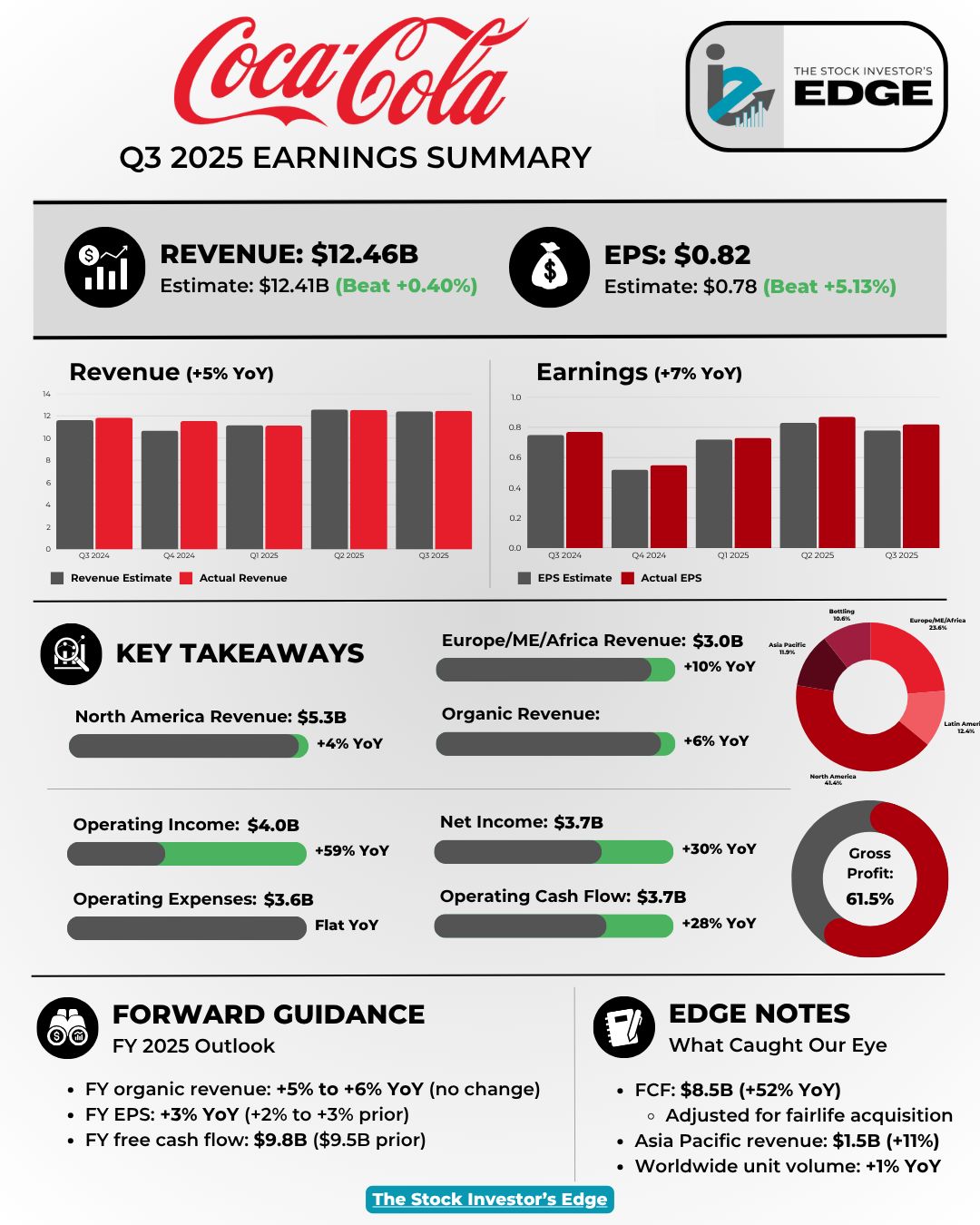

Coca-Cola (KO)

Coca-Cola $KO ( ▲ 0.2% ) delivered a strong Q3 beat driven by pricing power, margin expansion, and resilient global demand. The stock is +2.2% so far this week.

EPS: $0.82 vs $0.7

Revenue: $12.46B vs $12.41B

Pricing and volume: Price/mix +6% and unit case volume +1% drove organic revenue +6%.

Segments: North America +4%, EMEA +10%, Asia Pacific +11%, LatAm -4%.

Margins: Operating margin 32% vs 21% prior year on cost discipline.

Cash flow: Free cash flow +52% YoY to $8.5B excluding fairlife payment.

Guidance: FY organic revenue +5-6% YoY, EPS +3%, FCF raised to $9.8B.

🔐 Edge Takeaway: Coca-Cola’s Q3 showed why investors keep paying up for reliability even as growth stays modest. The company…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

IBM (IBM)

IBM $IBM ( ▲ 2.67% ) beat on both revenue and EPS as AI and mainframe strength drove margin expansion. The stock is +0.8% so far this week.

EPS: $2.65 vs $2.45

Revenue: $16.33B vs $16.09B

Software growth: +9% YoY to $7.2 B on automation (+22%) and Red Hat bookings (+20%).

Infrastructure: Revenue +15% to $3.6B driven by IBM Z (+59%) and hybrid infrastructure (+26%).

Consulting: Revenue +2% to $5.3B with improving margins (+200 bps).

Gen AI: Book of business exceeded $9.5B with $1.5B in new consulting bookings.

Guidance: FY revenue growth > 5% and free cash flow ~$14 B (up from $13.5B).

🔐 Edge Takeaway: IBM delivered a decisive beat and raise but drew scrutiny around…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

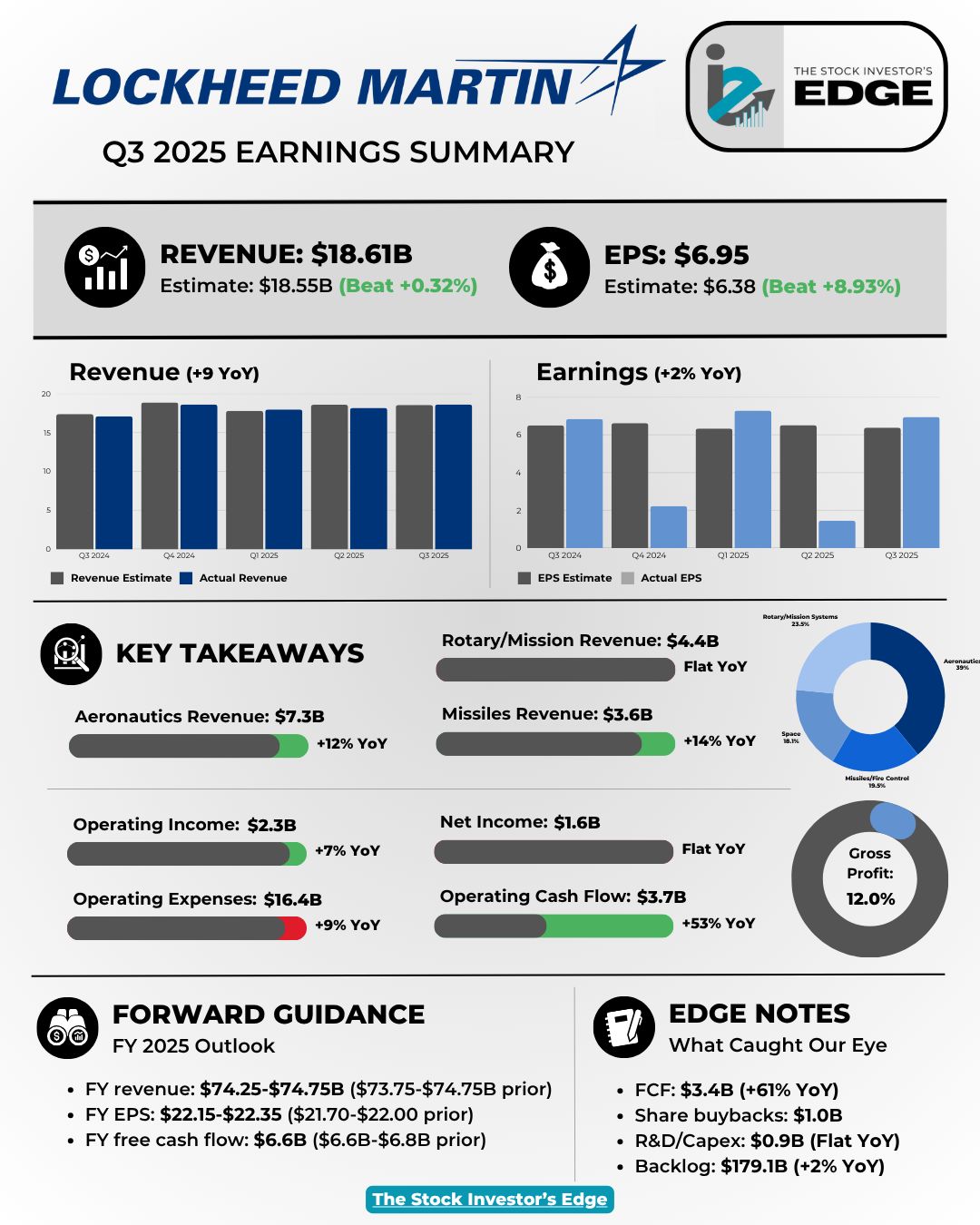

Lockheed Martin (LMT)

Lockheed Martin $LMT ( ▲ 0.58% ) delivered a clean beat with record backlog and strong cash generation. The stock is -1.2% so far this week.

EPS: $6.95 vs $6.38

Revenue: $18.61B vs $18.55B

Aeronautics: Revenue +12% on higher F-35 production volumes and deliveries.

Missiles: Sales +14% from PAC-3 and JASSM/LRASM production ramps.

Space: Revenue +9% on FBM and Next Gen Interceptor program volume.

Cash Flow: FCF +61% to $3.3B, $1.8B returned via dividends and buybacks.

Backlog: Record $179B (+2% YoY) supports multi-year visibility and growth.

Guidance: FY 2025 EPS raised to $22.15-$22.35 on $74.25-$74.75 B revenue (+5% YoY).

🔐 Edge Takeaway: Lockheed’s quarter underscored why defense cash flow keeps commanding a premium multiple. Sales…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out!

Before we continue with the rest of the earnings recap, please don’t forget to join our our Discord server!

If you want these recaps as soon as the earnings are released, you need to be on the Discord:

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this week’s Earnings Recap.

If you enjoyed this newsletter, be sure to give this a LIKE and LEAVE US A COMMENT. You can share your thoughts on the earnings, let us know that you appreciate the content or even just say hello.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.