Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 24,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

The major indexes all ended the week green, with all three making new record highs.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Trump spars with Powell over renovation costs during Fed visit, backs off firing threats

President Trump visited the Federal Reserve on Thursday and publicly clashed with Chair Jerome Powell over renovation costs. Trump claimed the project had topped $3.1 billion, while Powell pushed back, saying the figure included a separate building finished years earlier. Trump again called for rate cuts but backed off prior threats to fire Powell, framing the renovation as symbolic of broader mismanagement.

🔑 Key Points

Renovation Tensions: Trump blasted the Fed’s building project as a $3.1B overreach, while Powell insisted the figure is inflated.

Rate-Cut Demands: Trump renewed his push for rate cuts, arguing they’d slash interest costs on the $1.1T U.S. debt burden.

Firing Threat Fades: Trump called it “highly unlikely” he’d remove Powell, unless evidence of fraud emerges.

Political Optics: GOP allies like Bill Pulte and Russ Vought are using the project to escalate criticism of Powell’s leadership.

Rare Fed Visit: Trump became just the fourth president to tour the Fed, and the first while publicly pushing for policy changes.

👀 What You Need to Know

Trump’s visit adds pressure on Powell ahead of the Fed’s next meeting. His allies are escalating criticism over cost overruns while floating names like Bessent as potential replacements. Rate cuts are expected in September, but any delay could fuel more public attacks. Powell’s ability to hold the line on policy may erode if political pressure keeps rising. Markets will be watching both the next dot plot and who’s standing next to Trump.

🔐 Edge Takeaway: Trump’s visit to the Fed was a political setup meant to paint Powell as wasteful and unwilling to act, while building a narrative that blames him for high interest costs. But Powell…upgrade to Edge+ to read the Full Edge Takeaway.

Google Cloud Nabs $1.2B Deal With ServiceNow

Alphabet’s $GOOGL ( ▲ 4.01% ) Google Cloud has reportedly secured a $1.2 billion, five-year deal with enterprise software leader ServiceNow, expanding its push into cloud infrastructure. ServiceNow didn’t disclose contract specifics in its filing, but Bloomberg confirmed the figure. The agreement adds to Google Cloud’s momentum after recent wins like Salesforce and OpenAI, reinforcing its growing presence in the enterprise cloud market.

🔑 Key Points

$1.2B Deal: ServiceNow will spend $1.2B over 5 years with Google Cloud, according to Bloomberg sources citing undisclosed details.

Broader Commitments: The company reported $4.8B in total cloud commitments through 2030 but did not name individual vendors.

Momentum Building: Google Cloud is stacking major enterprise wins, including Salesforce and OpenAI, as its AI investments bear fruit.

Revenue Surge: Google Cloud grew revenue 32% YoY to $13.6B in Q2, solidifying it as Alphabet’s fastest-growing segment.

Key Ties: ServiceNow’s Chief Product Officer is a former Google Cloud exec, potentially aiding alignment and strategy fit.

👀 What You Need to Know

This deal reinforces Google Cloud’s growing credibility in the enterprise market, especially as AI becomes central to corporate infrastructure strategies. While Amazon and Microsoft still dominate the space, Google’s accelerated customer wins and strong Q2 growth show it’s closing the gap. Investors should watch for sustained growth and signs of operating leverage as Google Cloud scales.

See our full breakdown of Alphabet’s earnings in this week’s Earnings Recap

🔐 Edge Takeaway: Alphabet’s Q2 earnings confirmed that Google Cloud is no longer just a growth story, it’s…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: What is cloud computing (and why it matters)?

Cloud computing lets companies access computing power, storage, and software over the internet, without owning physical servers. Instead of building data centers, businesses “rent” what they need from providers like Google Cloud, AWS, or Microsoft Azure.

Scalable: Companies can scale up or down based on demand, avoiding heavy upfront costs.

Subscription-Based: Cloud services typically operate on a pay-as-you-go or multi-year contract model.

Always On: Apps and services stay live and backed up across global server networks.

AI-Ready: Cloud is the foundation for running advanced tools like machine learning, LLMs, and data analytics.

Cloud isn’t just tech, it’s infrastructure. Companies like Google grow recurring revenue by becoming the digital backbone of the modern economy.

UnitedHealth confirms DOJ probes into Medicare Advantage billing practices

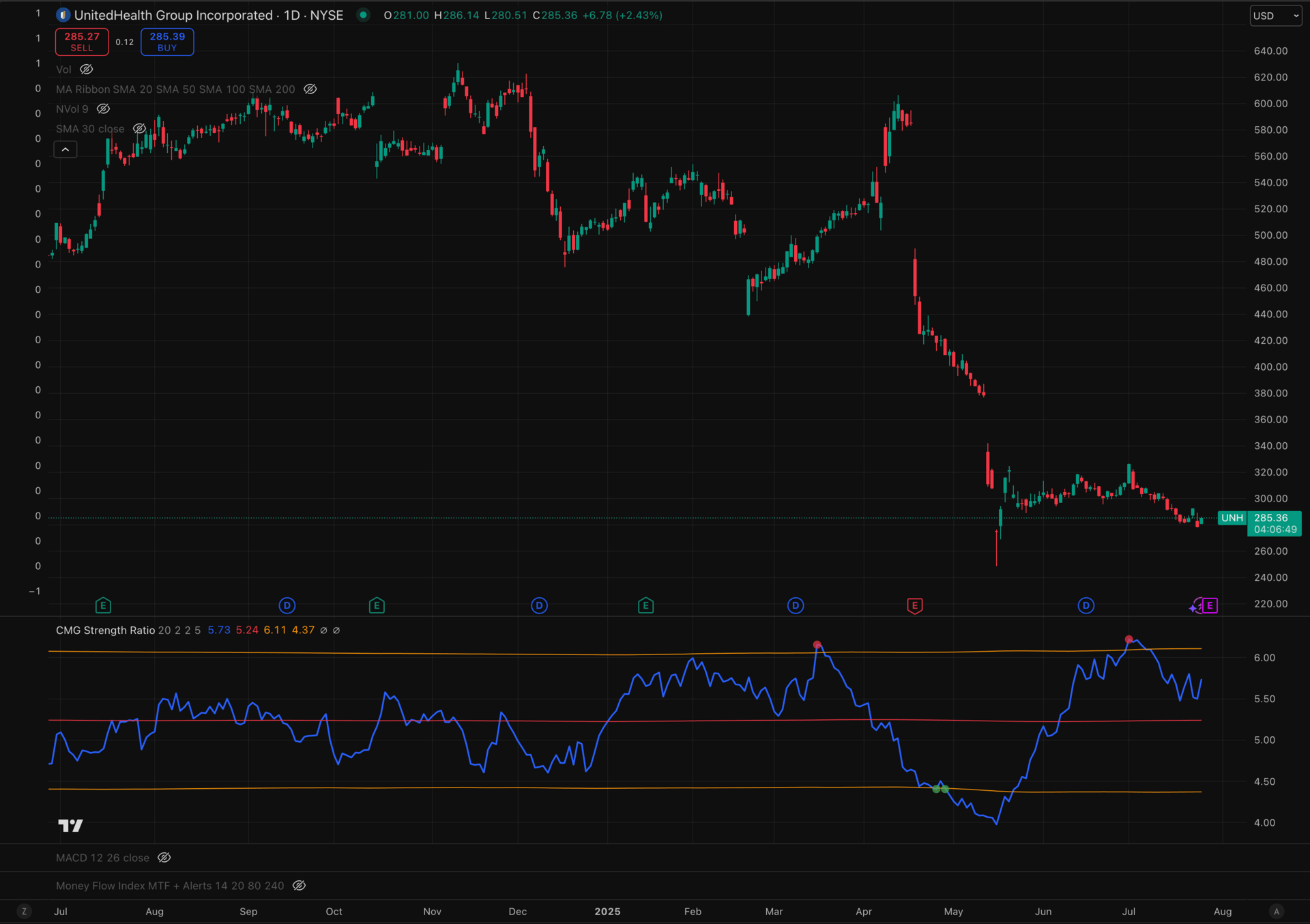

UnitedHealth Group $UNH ( ▲ 0.02% ) disclosed it’s under civil and criminal investigation by the Department of Justice over Medicare Advantage billing. The company says it is cooperating and expects to complete an internal third-party review by Q3. This comes amid a turbulent year marked by a CEO exit, rising medical costs, and intensifying scrutiny of its largest business segment. Shares are down -45% YTD.

🔑 Key Points

DOJ Probes Admitted: UnitedHealth confirmed both civil and criminal investigations tied to Medicare Advantage billing practices.

Doctor Pressure Allegations: The DOJ interviewed physicians on whether they were encouraged to overstate diagnoses.

Internal Review in Motion: A third-party audit of business practices is underway and due by the end of Q3.

Core Revenue Risk: The Medicare & Retirement segment generated $139B in 2023, nearly 45% of company revenue.

Previous Legal Win Cited: A special master previously recommended dismissal of a $2B DOJ case due to lack of evidence.

👀 What You Need to Know

This probe directly threatens UnitedHealth’s most profitable business line and raises broader questions about the Medicare Advantage model. Management’s about-face from denial to cooperation could pressure credibility heading into earnings. With over 40% of revenue tied to this unit, regulatory or legal fallout could damage margins and growth expectations. July 29’s earnings call will be critical to assess tone, disclosures, and risk posture.

🔐 Edge Takeaway: UNH is already down 45% this year, but pricing still reflects margin stability. Next week’s earnings report and/or call need to.…upgrade to Edge+ to read the Full Edge Takeaway.

📊 Edge Score: UnitedHealth scores an 80, with strong valuation and dividend metrics, but ongoing DOJ fraud investigations cast a shadow over an otherwise compelling fundamental profile.

💪 CMG Strength: The ratio is still holding above the mean, but momentum is fading and strength hasn’t translated into sustained buying as price continues to drift sideways, now near the lows.

Want access to these Edge Tools? Upgrade to Edge+ today!

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming earnings and what we were watching. See the latest full report here:

Weekly Options Recap

This report is a breakdown of every options trade we made this week—what we opened, what we closed, and how our open trades are performing. Each edition gives you full transparency on our strategy, including entry points, premiums collected or paid, trade rationale, and risk/reward setups. See this week’s recap:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Alphabet, Tesla, Coca-Cola, and more. See this week’s recap:

The Week Ahead

Next week has the makings to bring a ton of fireworks as we get the latest rate decision, a slew of earnings, and key inflation and labor market data. Should be fun!

Earnings Reports

It will be the biggest week of the earnings season and we will busy providing breakdowns as each report is released. Here is the list of names we will be covering:

Monday 7/28: --

Tuesday 7/29: Procter & Gamble, UnitedHealth, Merck, Starbucks, American Tower, UPS, and PayPal

Wednesday 7/30: Microsoft, Meta, Qualcomm, Lam Research, and VICI

Thursday 7/31: Apple, Amazon, Mastercard, AbbVie, and Coinbase

Friday 8/1: ExxonMobil, Chevron, and Enbridge

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week’s calendar is jam packed with economic releases, with three major market moving events in the PCE report, nonfarm payrolls, and of course the latest interest rate decision from the Fed.

While those are guaranteed to cause volatility in the markets, we also get initial jobless claims, JOLTS job openings, ADP employment, several housing reports, and the latest GDP data.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.