Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 24,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

Despite the slew of earnings and economic news, markets ended the week strong with mega caps pulling up the overall indexes.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Netflix Beats, But Expectations Beat Back

Netflix $NFLX ( ▲ 2.17% ) delivered a strong second quarter, with revenue up 17% and EPS of $7.19 topping estimates. It raised full-year revenue guidance to as high as $45.2 billion and boosted free cash flow targets, aided by FX tailwinds, price hikes, and rising ad revenue. Yet despite the healthy beat, shares slid 5% on Friday as investors deemed the results not good enough to justify Netflix’s premium valuation. The bar was high—and the reaction shows just how unforgiving the setup had become.

🔑 Key Points

Revenue Beat +17% YoY: Sales climbed to $11.08B, topping consensus and lifted by subscription pricing, FX tailwinds, and accelerating ad revenue.

Margin Expansion: Operating margin hit 34.1%, up nearly 700bps YoY, but guidance warns of 2H compression due to higher content and marketing costs.

FCF Powerhouse: Free cash flow surged 91% YoY to $2.3B; full-year FCF outlook was raised to $8–8.5B, reinforcing Netflix’s capital efficiency.

Ad Tier Scaling: Netflix now boasts 94M global ad-supported users and expects ad revenue to double to ~$3B in 2025, aided by price hikes and engagement.

Content and Engagement: Upcoming titles like Wednesday, Stranger Things, and new sports/live programming set up a strong H2, with churn still low.

👀 What You Need to Know

Netflix delivered strong headline numbers, but the selloff underscores how much was already priced in. With shares up 42% YTD and trading at 40x forward earnings, even clean beats aren’t being rewarded. Ad-tier momentum and a blockbuster second-half slate support the long-term story, but near-term margin compression and muted disclosure around monetization raise questions. Investors will want to see traction translate into ARPU upside, and Edge+ members can access our Edge scoring breakdown, CMG strength signals, and what levels we’re watching for a potential reentry.

🔐 Edge Takeaway: Netflix’s Q2 print was solid, but at 45x forward earnings, and with shares up 42% YTD, the…upgrade to Edge+ to read the Full Edge Takeaway.

Congress Approves Major Crypto Bills in Pivotal Week for U.S. Regulation

Three major cryptocurrency bills advanced in the House this week following late-night negotiations and direct pressure from former President Trump. The GENIUS stablecoin bill passed both chambers and now heads to his desk, while the CLARITY Act and Anti-CBDC legislation await Senate debate. The developments sparked a strong rally in Coinbase and MARA shares, while Bitcoin briefly touched a new all-time high.

🔑 Key Points

GENIUS Bill Passes: The stablecoin-focused bill cleared both chambers and now awaits Trump’s signature, marking a legislative milestone.

CLARITY Act Advances: The crypto market structure bill passed the House 294–134 and could redefine how tokens are classified and traded.

Anti-CBDC Bill Moves Ahead: The bill to ban a U.S. central bank digital currency passed narrowly and faces a tough Senate path.

Trump Flipped the Votes: Trump intervened with GOP holdouts after a procedural block, helping break the standoff and secure support.

Critics Sound Alarms: Watchdogs warn the bills may open loopholes for Big Tech and allow shadow banks to operate with weak oversight.

👀 What You Need to Know

This week’s crypto votes mark the clearest signal yet that the U.S. may finally embrace digital asset regulation, but not without controversy. Trump’s influence has made crypto a partisan issue, and Senate resistance could still stall the broader framework. The GENIUS bill is a win for stablecoin players, yet banking groups and regulators fear a new, underregulated financial tier. For investors, early optimism is justified, but the long-term impact hinges on how these bills evolve in the Senate.

🔐 Edge Takeaway: The House just took its biggest step yet toward real crypto regulation and markets are responding, with…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: What are stablecoins, and what do the new laws mean?

Stablecoins are crypto tokens designed to stay at a fixed value, usually tied to the U.S. dollar. They're backed by reserves like cash or Treasuries and are used to move money across crypto networks without the volatility of other digital assets.

Core Function: Stablecoins enable fast, low-cost transactions and are widely used for payments, trading, and settlement across blockchain ecosystems.

Reserve Structure: To maintain their peg, they must be backed one-to-one by secure reserves, typically short-term Treasuries or cash equivalents.

Regulatory Concerns: Lawmakers and regulators have raised flags about transparency, auditing standards, and the risk of unregulated growth.

New Legal Framework: The GENIUS Act introduces federal rules for reserve quality, licensing, and disclosures to bring structure to the stablecoin market.

With new legislation in motion, stablecoins are evolving from a gray-zone utility into a formally recognized part of the U.S. financial system.

Chevron Secures Hess Deal After Arbitration Win Over Exxon

Chevron $CVX ( ▼ 0.46% ) has officially closed its $53 billion all-stock acquisition of Hess after winning an arbitration battle with ExxonMobil over Guyana asset rights. The International Chamber of Commerce ruled that Exxon and CNOOC's right of first refusal did not apply to corporate-level M&A, clearing the last obstacle to the merger. With the deal complete, Chevron gains a 30% stake in Guyana’s Stabroek Block, one of the most valuable offshore oil fields in the world.g

🔑 Key Points

Deal Approved: The ICC ruled against Exxon’s preemption claims, allowing Chevron to close its $53B Hess acquisition.

Guyana Access Secured: Chevron now controls a 30% stake in the Stabroek Block, estimated to hold over 11B barrels of oil.

Exxon Statement: Exxon disagreed with the ruling but accepted the arbitration outcome and welcomed Chevron to the venture.

Layoffs Expected: Chevron expects workforce reductions as part of post-merger integration and a broader cost-cutting plan.

Strategic Catch-Up: The deal boosts Chevron’s long-term growth profile as it looks to close the performance gap with Exxon.

👀 What You Need to Know

This ruling ends nearly two years of uncertainty and hands Chevron one of the most valuable oil assets discovered in decades. The Stabroek Block offers production growth and free cash flow visibility into the 2030s, a critical win for a company that’s lagged peers. It also affirms legal precedent that corporate M&A bypasses asset-level rights, with implications for future dealmaking. Investors will now shift focus to integration execution and capital returns.

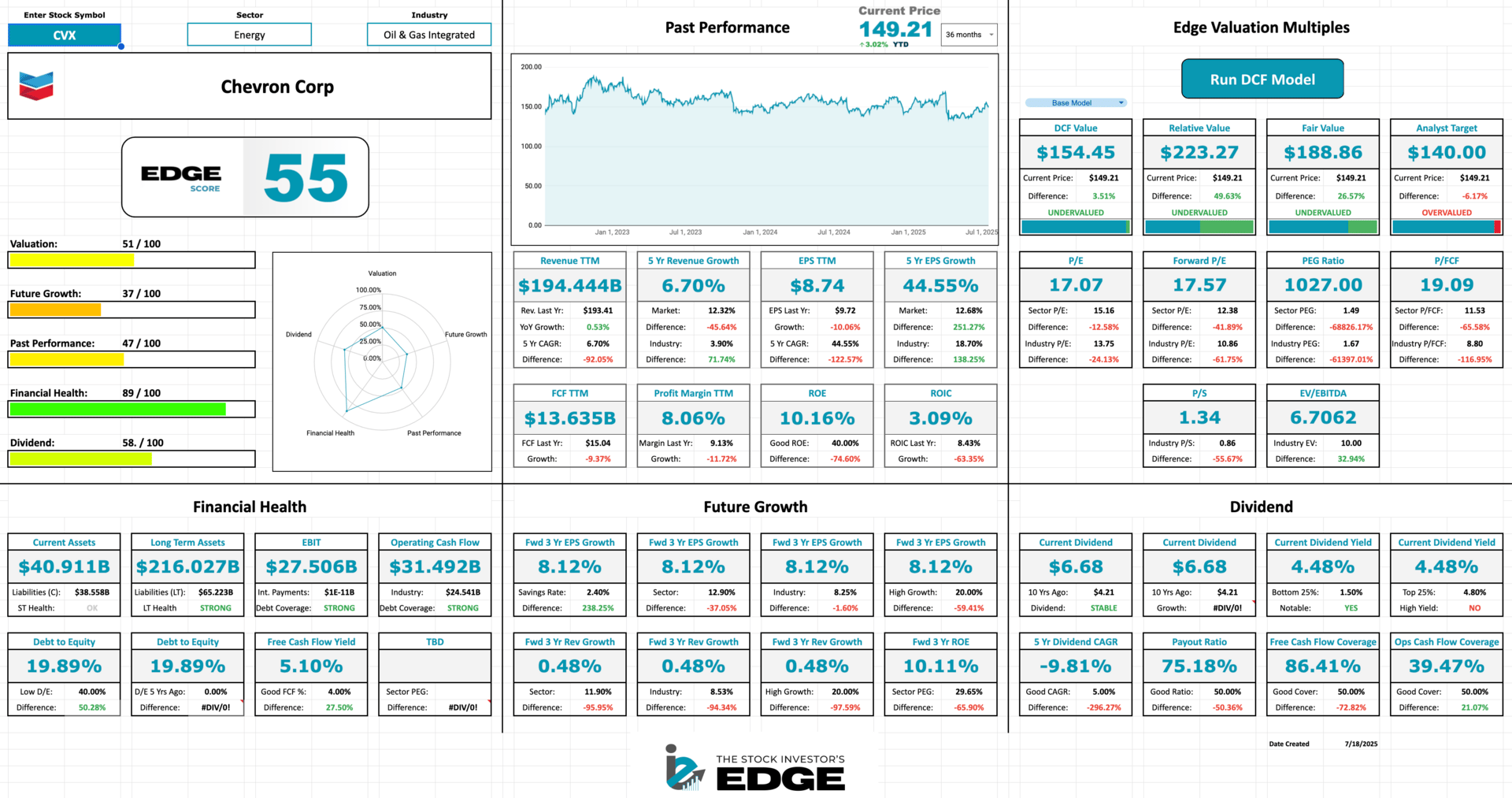

📊 Edge Score: Chevron earns a 55, driven by excellent Financial Health, a stable Dividend, and modest Valuation support. Chevron’s strong balance sheet and 4.5% dividend yield offer investors durability, and now with the Hess deal closed, a path to reignite long-term production and cash flow growth.

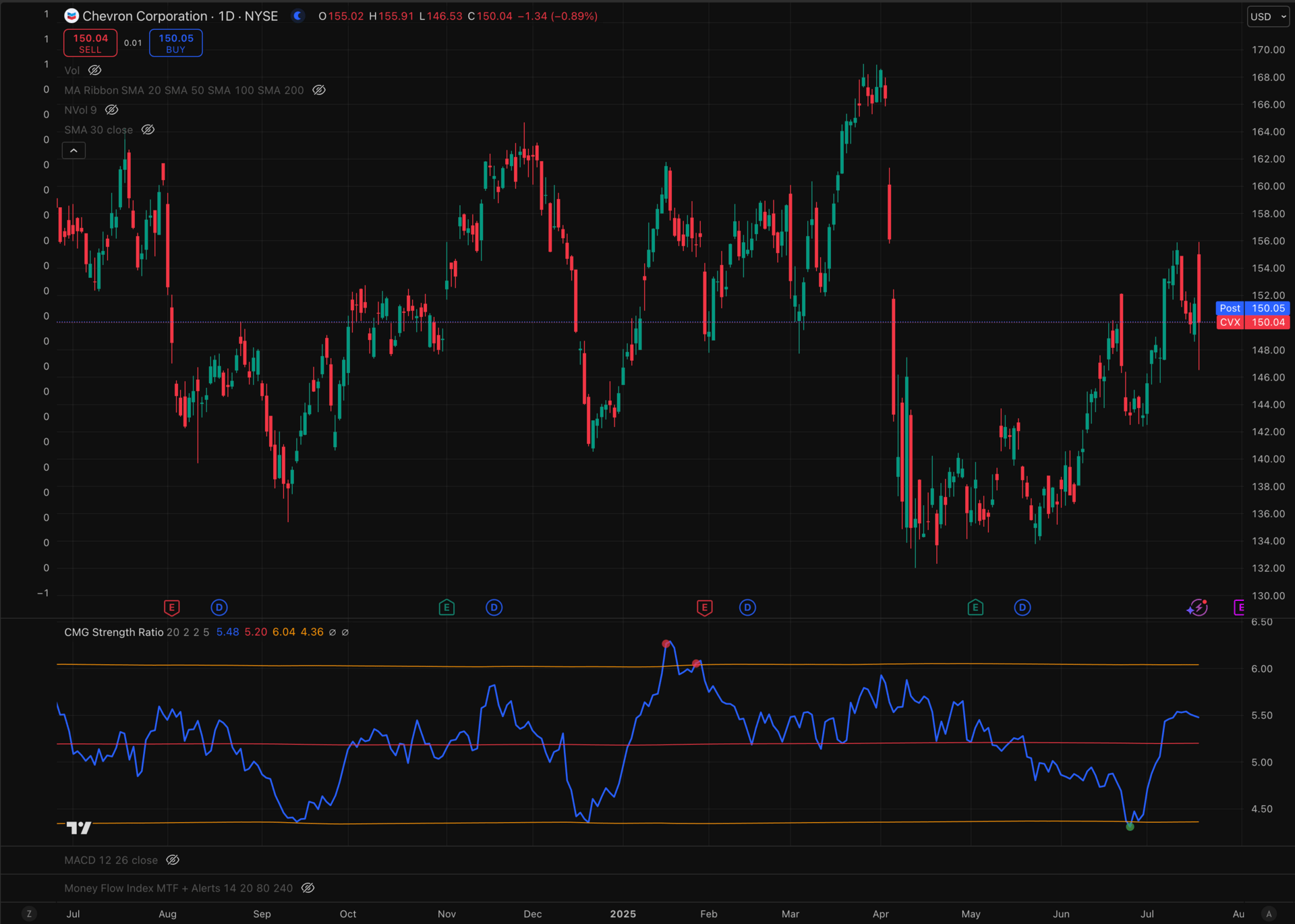

💪 CMG Strength: The indicator triggered a buy signal on June 25, and strength has steadily climbed since, breaking through the mean this week for the first time in months. The move tracked cleanly with the price rally off the June lows, confirming real momentum beneath the surface.

Want access to these Edge Tools? Upgrade to Edge+ today!

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming inflation reports, the start of earnings season, and our thoughts on the market strength here. See the latest full report here:

Portfolio Update - July

Every month we share a full access look into our portfolios, including holdings, performance, activity and our watchlists for the upcoming month. You can see both of our portfolios here and see what moves we made in June:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Taiwan Semi, Netflix, JPMorgan, and more. See this week’s recap:

The Week Ahead

Earnings will be the major catalyst next week as several major names report that will give us insights into the consumer and the overall state of the economy.

Earnings Reports

Earnings season is in full swing and we will be busy as 10 stocks we cover are set to report. Here is the list of names we will be covering:

Monday 7/21: Verizon

Tuesday 7/22: Coca-Cola, Lockheed Martin, and General Motors

Wednesday 7/23: Alphabet, Tesla, IBM, and Chipotle

Thursday 7/24: Intel and L3Harris

Friday 7/25: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

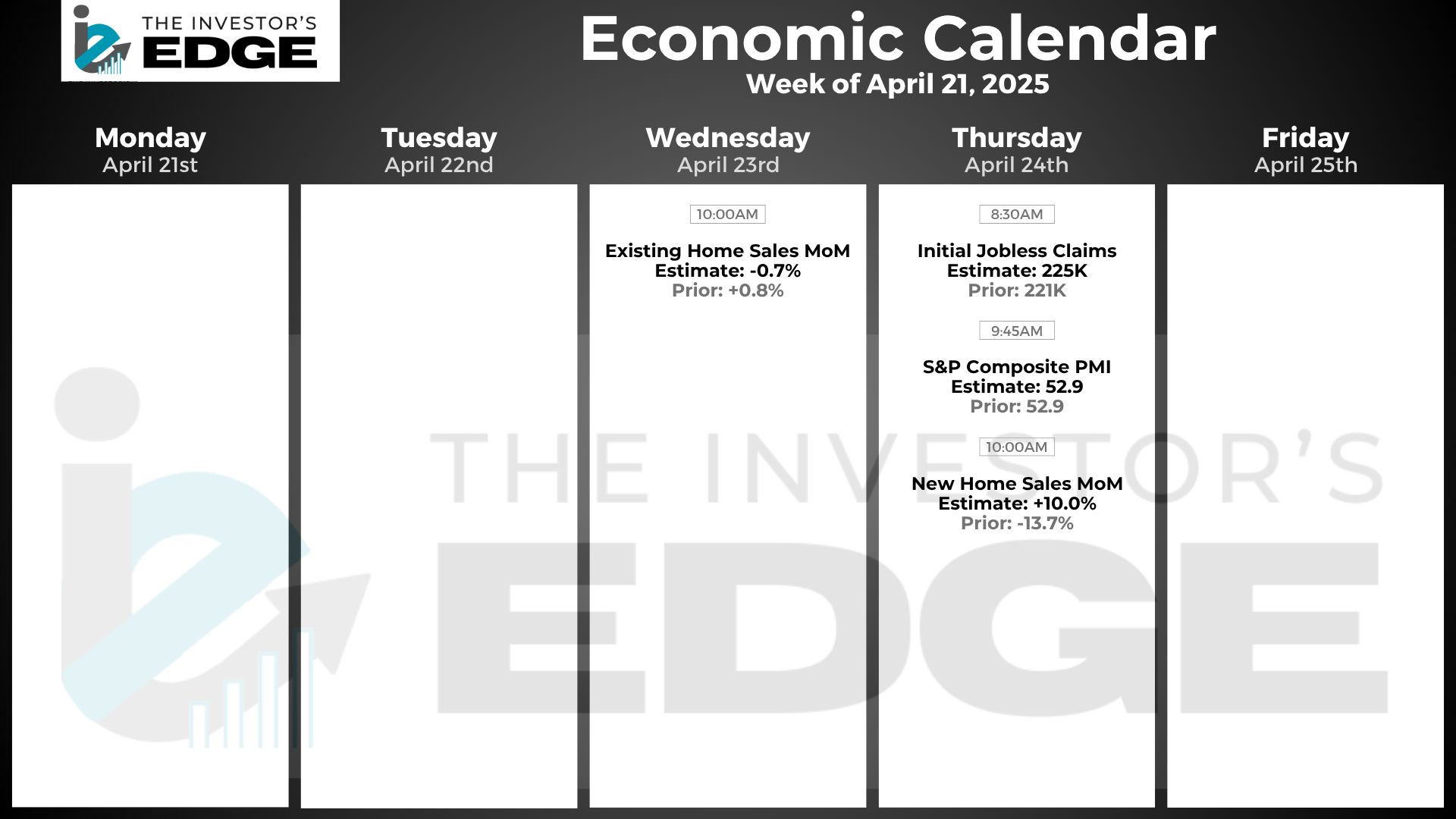

Next week is relatively quiet on the economic front, though we do get two key housing reports, initial jobless claims, and PMI data.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.