Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 21,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Monthly Meeting

🚨 REMINDER 🚨

Today, 1/18, is the Monthly Meeting exclusively for Edge+ members. The meeting will be hosted by Mark at 10 AM EST.

Here's what we will be covering

A deep dive into Mark's personal portfolio, recent moves, and his top 10 individual holdings

Exclusive insights into the stocks we’re watching closely, complete with Edge scores and analysis

A breakdown of the most intriguing charts we’ve seen recently

PLUS, a live, interactive Q&A to get your burning questions answered

Don’t sit this one out! Upgrade to Edge+ now and join us for this call. Your portfolio will thank you. 👇

Market Talk

Better than expected inflation data sent all three major indexes higher while treasury yields fell.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Apple has worst day since August following reports of China, AI struggles

Apple's stock dropped 4% on Thursday, marking its worst day since August 5th. Shares are now down nearly 12% from their December peak, making Apple the worst performer among the seven largest tech stocks in 2025.

A report by Canalys revealed Apple fell to third place in China's 2024 smartphone market, behind Vivo and Huawei. Apple's shipments accounted for 15% of the 284 million phones sold in China last year, a 17% YoY decline, while Vivo and Huawei saw growth.

TSMC, Apple's key chip supplier, forecasted a 6% sequential drop in smartphone-related sales for Q1, attributing it to seasonality. TSMC noted that AI chips surpassed smartphones as its largest revenue driver in Q4 2024.

Analysts expect iPhone shipments to decline 6% YoY in the first half of 2025, primarily in Q2. The weakness can be attributed to the lack of impact from Apple Intelligence, the company’s AI system, on hardware upgrades or service demand.

Apple will release its December quarter earnings on January 30.

👉 EDGE TAKEAWAY: This week's news of declining iPhone sales in China and a projected 6% drop in 2025 shipments reinforce…upgrade to Edge+ to read the Full Edge Takeaway.

Supreme Court upholds TikTok ban

The Supreme Court upheld a law requiring TikTok’s China-based owner, ByteDance, to divest from the platform by Sunday, potentially leading to a U.S. ban if no sale occurs.

The unsigned decision rejected TikTok's free speech challenge, though enforcement remains uncertain as both the Trump and incoming Biden administrations signal they may not act immediately.

The law reflects concerns over Chinese government influence, but bipartisan anti-TikTok sentiment has waned.

White House Press Secretary Karine Jean-Pierre called for national security concerns to be addressed without banning the app, leaving implementation to the next administration. President-elect Trump hinted at a decision "in the not too distant future" and discussed TikTok with Chinese President Xi Jinping.

TikTok CEO Shou Chew expressed hope for a resolution to keep the platform available.

📚 EDGE-UCATION: Why does the U.S. want to ban TikTok and what does it mean for users?

The potential TikTok ban in the United States stems from concerns over national security and data privacy. TikTok, owned by China-based company ByteDance, has faced scrutiny due to fears that the Chinese government could access U.S. user data through the app or influence content. Critics argue that this poses risks to user privacy, data security, and even the dissemination of information.

Proposed Actions:

Divestment Requirement: A law upheld by the Supreme Court mandates ByteDance to divest TikTok’s U.S. operations to reduce Chinese influence. If this does not happen, the app could face a nationwide ban.

Bipartisan Push: Both Republican and Democratic lawmakers have raised alarms about TikTok, although anti-TikTok sentiment has softened in some areas recently.

What It Means for Users:

Access Issues: TikTok could be removed from app stores, blocking downloads and updates, or completely restricted.

Impact on Creators: Disruption to content creators, influencers, and communities, with potential loss of followers and income.

Migration to Alternatives: Users may shift to platforms like Instagram Reels, YouTube Shorts, or other competitors.

Uncertainty: Until the situation is resolved, users and creators face uncertainty about the app’s future availability.

Potential Changes: If TikTok is sold to a U.S.-based company, it might alleviate security concerns but could bring policy or feature changes.

The outcome remains unclear, leaving millions of users and creators in limbo.

Sponsored by 1440 Media

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

TSMC net profit hits record high as fourth-quarter results top expectations on robust AI chip demand

Taiwan Semiconductor Manufacturing Company (TSMC) reported record-breaking Q4 revenue and profit, exceeding expectations due to strong demand for advanced AI chips.

Revenue rose 38.8% YoY, while profit surged 57%. High-performance computing (HPC), including AI and 5G applications, drove 53% of revenue, up 19% from the prior quarter. AI chips for clients like Nvidia and Apple played a key role, with TSMC projecting AI accelerator revenue to double in 2025.

Despite robust growth, TSMC faces potential headwinds in 2025, including U.S. restrictions on semiconductor exports to China and uncertainty around trade policies under President-elect Donald Trump.

See our takeaways from TSMC’s report in this week’s Earnings Recap.

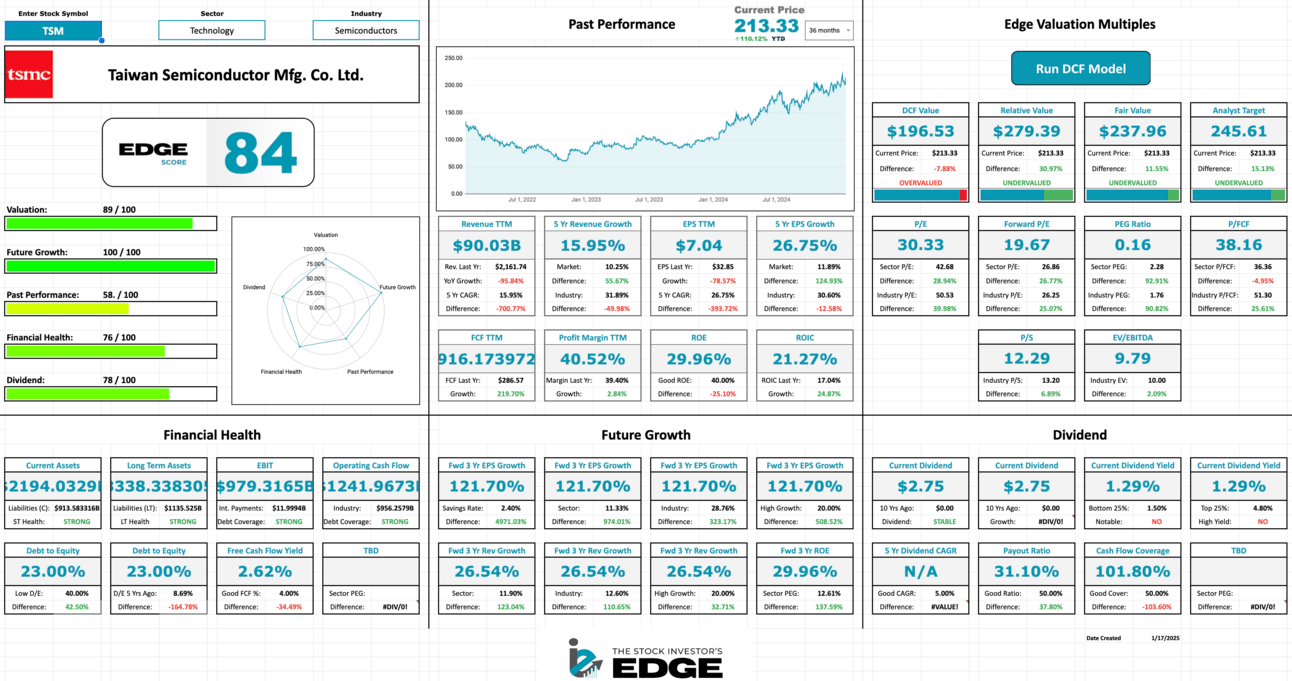

📊 EDGE SCORE: Here’s a look at Taiwan Semi’s Edge Score - even with the move higher this week, the score remains above 80 👀:

Want access to your own Edge Scores? Upgrade to Edge+ today and be one of the first to use the dashboard:

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming inflation reports, the start of earnings season and how we were preparing for the week. See the latest full report here:

The Options Edge Report

This week, we dropped the second Edge Options Report for our members—packed with actionable insights and options strategies. This week we broke down a play on Nvidia. See the latest report here:

Portfolio Update - January

Every month we share a full access look into our portfolios, including holdings, performance, activity and our watchlists for the upcoming month. You can see both of our portfolios here and see whether we beat the market in 2024:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Broadcom, Costco, Oracle, and more. See this week’s recap:

The Week Ahead

It’s a holiday shortened week with Martin Luther King Day on Monday, but earnings season carries on and will keep investors busy.

The presidential inauguration is also on Monday and a new administration could create ripple effects in the market.

Earnings Reports

Earnings season is officially underway. Here is the list of names we will be covering next week:

Monday 1/21: --

Tuesday 1/22: Netflix, Charles Schwab, Prologis, and 3M

Wednesday 1/23: Procter & Gamble, Johnson & Johnson, and Abbott Labs

Thursday 1/24: Union Pacific

Friday 1/25: Verizon

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week is very quiet week from an economic news perspective. We get initial jobless claims, PMI data, existing home sales and consumer sentiment.

The new administration will be the major catalyst for macro trends.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.