Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 14,500 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

March Recap

With March in the rear view mirror, let’s revisit the top 10 stocks we were watching last month and see how they performed:

By comparison, here is how the major indexes performed in March:

👉 THE EDGE: If you’re not an Edge+ subscriber by now, what are you waiting for? The results speak for themselves and member portfolios are already reaping the rewards. With our exclusive top stocks to watch report for April hitting inboxes next week, there’s no better time to join the club.… Upgrade to IE+ today and save 25% off your subscription. Your portfolio will thank you.

Market Talk

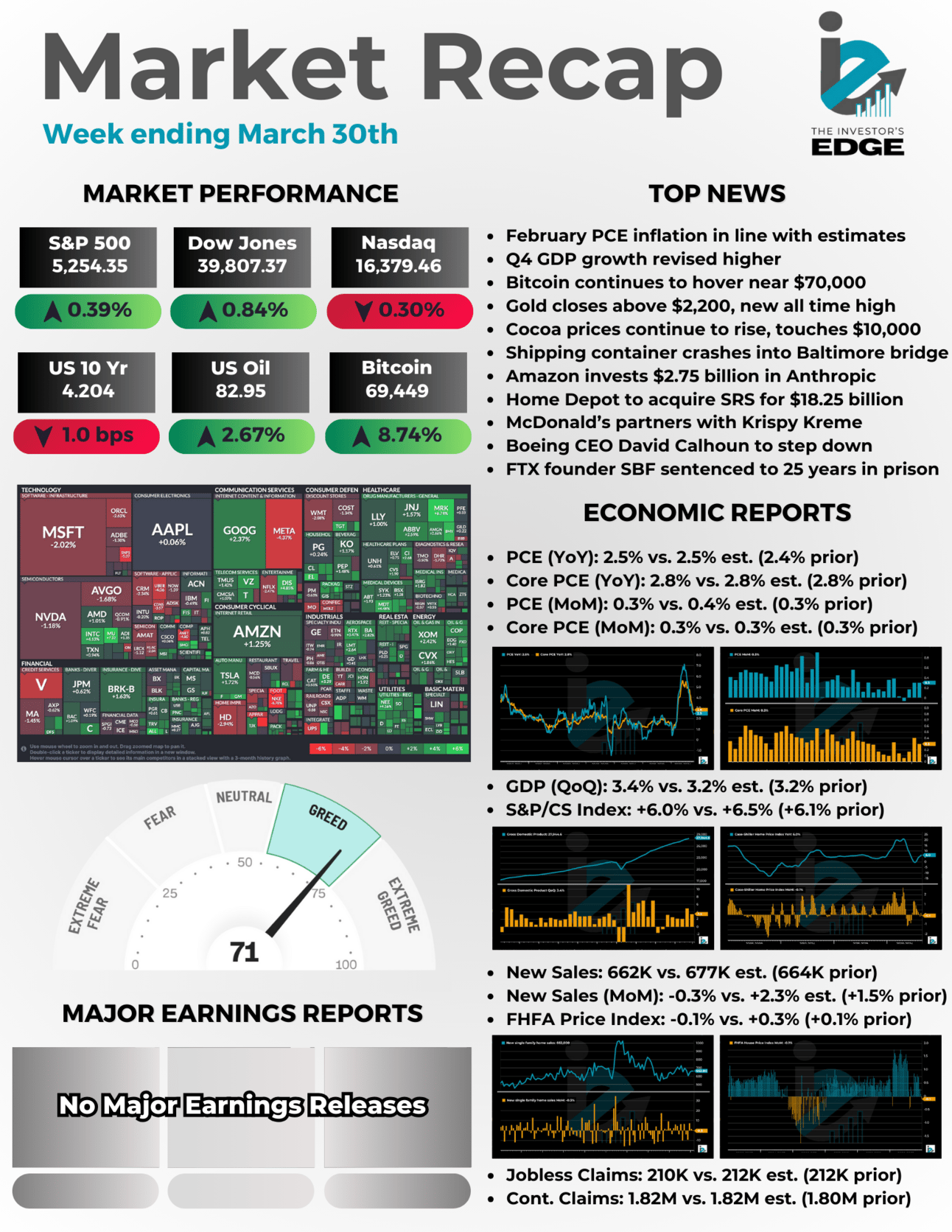

The Fed’s preferred inflation metric was in line with expectations in February, but slightly higher from January. Meanwhile, the S&P 500 made new all time highs once again.

5 Stories Moving the Market

These are some of the biggest stories from the past week that had an influence on market action.

Key Fed inflation gauge rose 2.8% annually in February, as expected

In February, inflation increased in line with expectations, with the Personal Consumption Expenditures (PCE) price index, excluding food and energy, rising by 2.5% from a year ago and 0.3% month-over-month, compared to estimates for 2.5% and 0.4%.

Excluding volatile food and energy costs, core PCE inflation rose 2.8% on a 12-month basis and 0.3% from the previous month, matching analyst estimates.

The Federal Reserve views core inflation as a more reliable indicator and considers it when making policy decisions.

Core PCE inflation has remained above the Fed's target of 2% annually for three years. These figures suggest that the Fed is likely to maintain its current stance on interest rates rather than considering cuts in the near future.

Logistics companies scramble after bridge collapse closes Port of Baltimore until further notice

A major Baltimore bridge collapsed early Tuesday after it was hit by a large container ship. The collapse of the Francis Scott Key Bridge has caused significant disruptions to logistics and trade along the East Coast.

With the Port of Baltimore shut down, logistics companies are urgently rerouting shipments to other ports such as New York/New Jersey, Norfolk, and Southeastern ports. This diversion will impact cargo flow and increase volumes at alternate ports.

The Port of Baltimore, a major hub for auto imports and exports, will likely remain closed for months, affecting various industries including retail, automotive, and energy. Alternate supply routes for commodities like coal and gasoline will need to be established, leading to additional costs. Rail services are temporarily suspended, exacerbating delays and congestion.

Despite these challenges, industry experts expect the logistics system to adapt, albeit with increased costs and potential delays for exporters and importers.

Cocoa prices hit $10,000 per metric ton for the first time ever

Cocoa prices reached a record high on Tuesday, with May delivery futures surpassing $10,000 per metric ton for the first time ever.

This surge reflects supply constraints stemming from difficult weather conditions and disease affecting cocoa production in West Africa, which accounts for 70% of global cocoa output.

Ivory Coast and Ghana, the two largest producers, have experienced heavy rain, dry heat, and disease outbreaks. These challenges have led to a significant decline in cocoa arrivals at ports in both countries compared to the previous year.

The rising cocoa prices have impacted companies like Hershey, which has forecast flat earnings growth for the year due to the increased costs.

Many commodities are on the rise this year. Here are some other notable moves:

Gold: +8.3% YTD, +12.5% since February

Copper: +3.3% YTD, +9.7% since February

Oil: +16.5% YTD

Who wouldn’t want an edge when it comes to gambling? That’s why we are happy to team up with OddJams for this week’s sponsor:

How did @TheArbFather make $10,000+ profit in February?

His secret sauce: Arbitrage betting.

Instead of getting bettings tips from slick-talking handicappers, TheArbFather bets on both sides of an outcome to guarantee a risk-free return. An example of this is betting on a game total to be over 224.5 AND under 224.5.

This might sound too good to be true, but the reason this can happen is sportsbooks set their lines for games independently. Sometimes, they make mistakes and there are situations where FanDuel’s odds are different from DraftKings’ odds.

Unless you are a PhD-wielding, Python-coding, Excel-Wizard… finding arbitrage opportunities consistently has been out of reach. Until now…

OddsJam scans millions of odds every second and finds these need-in-a-haystack opportunities that you can bet on to secure a risk-free profit.

Home Depot to acquire specialty distributor SRS for $18.25 billion

Home Depot is acquiring SRS Distribution in an $18.25 billion deal, marking its largest acquisition to date.

With a focus on expanding its professional customer base, Home Depot aims to bolster its presence in lucrative construction markets. SRS Distribution, which serves professionals in landscaping, pool, and roofing businesses, operates across 47 states with a sizable fleet and dedicated salesforce.

This acquisition follows Home Depot's previous moves to strengthen its pro offerings, including the acquisition of HD Supply in 2020 and companies International Designs Group and Temco last year.

CEO Ted Decker views the deal as a strategic complement to Home Depot's efforts to attract more professional customers and expand its total addressable market. Despite increasing regulatory scrutiny, Decker expresses confidence in securing approval for the deal.

Boeing CEO to step down in broad management shake-up

Boeing CEO Dave Calhoun will step down by the end of 2024 as part of a broader management overhaul at the aerospace company.

Larry Kellner, the current chairman of the board, will not seek reelection in May, with Steve Mollenkopf set to succeed him. Stan Deal, president and CEO of Boeing's commercial airplanes unit, is leaving the company immediately, replaced by Stephanie Pope, Boeing's chief operating officer.

These changes come amid increased pressure from airlines and regulators following multiple quality and manufacturing issues with Boeing planes. Calhoun, who took over in 2020 after the previous CEO was ousted, has faced challenges in resolving these issues.

The Federal Aviation Administration has heightened oversight, delaying Boeing's production plans. Customer dissatisfaction, notably from airlines like United and Ryanair, underscores the urgency for Boeing to address its manufacturing quality and production concerns.

Stock Madness Championship

64 stocks started this year’s Stock Madness bracket but there can only be only winner. Today is the championship match and it looks like Microsoft and Apple will be going head to head to see who is the top stock of 2024.

Be sure to cast your vote on our Instagram stories.

Winners of the bracket challenge will be announced this week so be on the lookout!

Looking for more of an Edge? Become an IE+ member today

Like the content you have seen so far? To be honest, this is nothing compared to what subscribers to the Investor’s Edge+ get. And this weekend, we are having a 25% Off Easter Sale!

You can now get access to all of the following benefits for 25% off:

Monthly Portfolio Updates

Monthly Top 10 Stock Buy List

The Weekly Edge Report

1 Stock Deep Dive Per Week

Timely Earnings Recaps

Investing Guides / Courses (coming soon)

And More

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the IE+ club today and take your investing to the next level!

IE+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed end of quarter rebalancing, the PCE report and shared an options strategy to add insurance to your portfolio going into Q2. See the full report here:

Stock Deep Dive - Costco

Our Deep Dive focused on Costco this week. We not only broke down the financials of the third largest retail company in the world but we also shared our valuation models and price targets for 2024. You can see the full analysis here:

The Week Ahead

There’s a lot on the calendar next week but all eyes will be on the jobs report.

Earnings Reports

It’s another quiet week for earnings next week and for the second week in a row, none of the stocks we cover here at The Investor’s Edge are scheduled to report.

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week is all about the jobs reports. The labor market is one of the major keys to the economy and investors will be looking for any signs of weakness in the hopes the Fed will begin to cut rates.

Here is the full calendar of events we will be watching:

Want even more from us? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

You can now earn REWARDS when you share our newsletter! All you need is one referral and you will receive our graphic with the Top Stock Picks from investing legends like Warren Buffett, Ray Dalio, Bill Ackman and more.

But we know a single graphic might not be exciting — that’s why we’ve got IE swag on the way!

That’s right, we will be giving you free stuff for sharing a link. One link.

Hats, shirts, sweatshirts and more for subscribers who reach 5, 10 or 25+ referrals! Start sharing today.

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.