Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 14,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

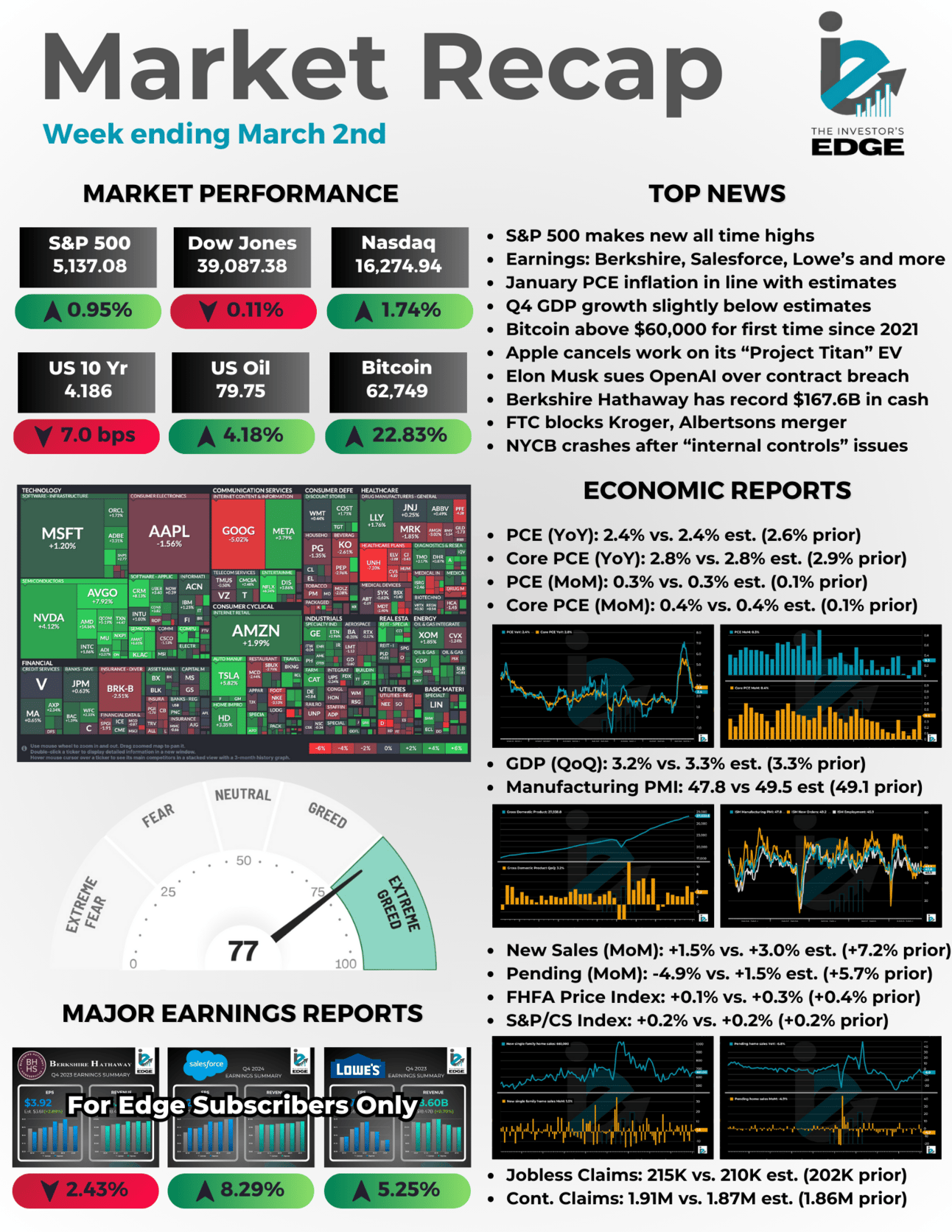

The S&P 500 makes new all time highs while Bitcoin surges past $60,000.

👉 EARNINGS EDGE: Berkshire Hathaway, Salesforce, and Lowe’s may have gotten all the media attention but we had a major earnings win from a smaller name here at the Investor’s Edge. Celsius jumped 24% after the beverage company blew away analyst estimates for earnings and revenue. The most impressive takeaway from Celsius’s report was…upgrade to Edge+ to read the full Earnings Edge.

5 Stories Moving the Market

These are some of the biggest stories from the past week that had an influence on market action.

Bitcoin closes the week above $62,000 for the first time since 2021

Bitcoin prices continued to rise, with the cryptocurrency closing the week above $62,000 for the first time since 2021. Bitcoin also had its best month since December 2020, gaining nearly 45% in February.

Investors attribute this surge to Bitcoin's supply and demand dynamics, citing the introduction of the new Bitcoin ETFs and the upcoming halving as key factors.

Bitcoin ETFs witnessed over $2 billion in inflows, driven by the need for more bitcoin supply to build these funds, which ends up driving prices up, particularly in the near term.. The ETFs experienced a record $677 million in daily net inflows on Wednesday alone.

Meanwhile, the impending halving, set for April, is expected to cut mining rewards from 6.25 Bitcoin per block to 3.125, creating a scarcity effect and influencing crypto prices.

Elon Musk sues OpenAI and CEO Sam Altman over contract breach

Elon Musk has filed a lawsuit against Microsoft-backed OpenAI and its CEO, Sam Altman, alleging a departure from the company's original mission of developing artificial intelligence for the benefit of humanity.

Musk, a co-founder of OpenAI in 2015, initially agreed to form a nonprofit lab focused on artificial general intelligence (AGI). However, Musk stepped down from the board in 2018 after saying AI is “potentially more dangerous than nukes.”

Musk’s lawsuit claims that OpenAI has deviated from its mission and become a closed-source subsidiary of Microsoft, prioritizing profit over the broader benefit to humanity.

Musk's legal action contends that OpenAI's focus on maximizing profits for Microsoft breaches the original agreement and the organization's stated mission.

Apple cancels work on an electric car, employees will now focus on generative AI

Apple has reportedly abandoned its decade-long effort to build an electric car, redirecting employees from the "Project Titan" initiative to the company's artificial intelligence division.

This shift comes amidst disappointing electric vehicle (EV) sales in the industry, with several carmakers pulling back on investments and slashing prices.

Apple aims to capitalize on the momentum in AI, viewing it as having transformative potential. Tim Cook, Apple's CEO, expressed a strong belief in the breakthrough potential of generative AI, emphasizing the company's significant investments in this area during the annual shareholder meeting.

The move reflects a strategic reallocation of resources to leverage opportunities in AI, potentially positioning Apple against rivals like Microsoft and Google in this rapidly evolving field.

Warren Buffett’s Berkshire Hathaway is sitting on a record $168 billion in cash

Berkshire Hathaway's annual report disclosed a record-high cash position of $167.6 billion at the close of 2023.

The surge in cash from $128.5 billion to $167.6 billion, or an increase of 31% year-over-year, resulted from robust business performance with its operating earnings increasing 21% increase to $37.4 billion. The company also benefited from being a net seller of its stock holdings in 2023.

Berkshire is using the cash wisely, as is usually the case under Warren Buffett’s direction. Berkshire currently holds $133.4 billion in Treasury bills yielding 5-5.4%, potentially generating $7 billion in 2024. The company is also using the money for share repurchases, amounting to $9.2 billion in 2023, which contributed to reducing shares outstanding by 1.1%.

There are challenges for Berkshire and its cash position though. The major one being Berkshire's market capitalization of nearly $900 billion, which makes finding stocks worth buying that will make a meaningful return very difficult. Buffett touched on this point in his most recent annual shareholder letter: "Given Berkshire's present size, building positions through open-market purchases takes a lot of patience and an extended period of "friendly" prices. The process is like turning a battleship. That is an important disadvantage which we did not face in our early days at Berkshire."

Despite its ample cash pile, Buffett remains cautious, citing the need for a reserve against catastrophic losses and aims to maintain a minimum of $30 billion in cash and cash equivalents. Additionally, he seeks to shield the company from economic crises akin to the 2008 Great Recession.

FTC sues to block Kroger, Albertsons merger

The U.S. Federal Trade Commission (FTC) is taking legal action to prevent the $24.6 billion merger of Kroger and Albertsons, two major grocery chains.

The FTC argues that the merger would result in higher grocery prices, adding financial strain on consumers, and negatively impact workers' wages and conditions. A bipartisan group of nine attorneys general from various states has joined the lawsuit.

Kroger argues that blocking the deal would harm consumers and workers, potentially leading to higher food prices and fewer grocery stores, especially during a period of high inflation and existing challenges like food deserts.

Albertsons contends that federal regulators are neglecting the dominance of larger retailers like Walmart, Amazon, and Costco, suggesting that the merger would strengthen competition.

Looking for more of an Edge? Become an IE+ member today

Like the content you have seen so far? To be honest, this is nothing compared to what subscribers to the Investor’s Edge+ get.

IE+ members get access to all of the following benefits:

Monthly Portfolio Updates

Monthly Top 10 Stock Buy List

The Weekly Edge Report

1 Stock Deep Dive Per Week

Timely Earnings Recaps

Investing Guides / Courses (coming soon)

And More

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the IE+ club today and take your investing to the next level!

IE+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even get a sneak peek into our systems and models. This week we dove into recent hedge fund activity and shared an options strategy for a potential pullback in Celsius. See the full report here:

Stock Deep Dive - Lowe’s

Our Deep Dive focused on Lowe’s this week. We not only broke down the financials of the second largest home improvement company in the U.S., but we also shared our valuation models and price targets for 2024. You can see the full analysis here:

Earnings Recap

Every week during earnings season we share a recap of the quarterly reports from stocks that we cover. You can see this week’s earnings recaps here:

The Week Ahead

There’s a lot on the calendar next week but all eyes will be on the jobs report.

Earnings Reports

Earnings season may be coming to an end, but there are still a few names we will be watching here at The Investor’s Edge. We will be covering the quarterly reports from Broadcom, Costco, Target and Crowdstrike.

Source: Earnings Whispers

Economic Reports

Next week is all about the jobs reports. Much of the economic data lately is mixed which has caused uncertainty among investors in regards to interest rates. But unless the labor market starts to show signs of weakness, the Fed will continue to maintain rates at these levels.

Source: Trading Economics

Want even more from us? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Before you go, did you know that you can earn REWARDS when you share our newsletter? All you need is one referral and you will receive our graphic with the Top Stock Picks for 2024 from Six Investing Legends.

But we know a single graphic might not be exciting — that’s why we’ve got IE swag on the way!

That’s right, we will be giving you free stuff for sharing a link. One link.

Hats, shirts, sweatshirts and more for subscribers who reach 5, 10 or 25+ referrals! Start sharing today.

Thank you for reading this edition of the Weekly Wrap-Up.

If you enjoyed this newsletter and found it valuable, be sure to SUBSCRIBE and SHARE THE INVESTOR’S EDGE WITH FRIENDS AND FAMILY!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.