Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 14,500 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

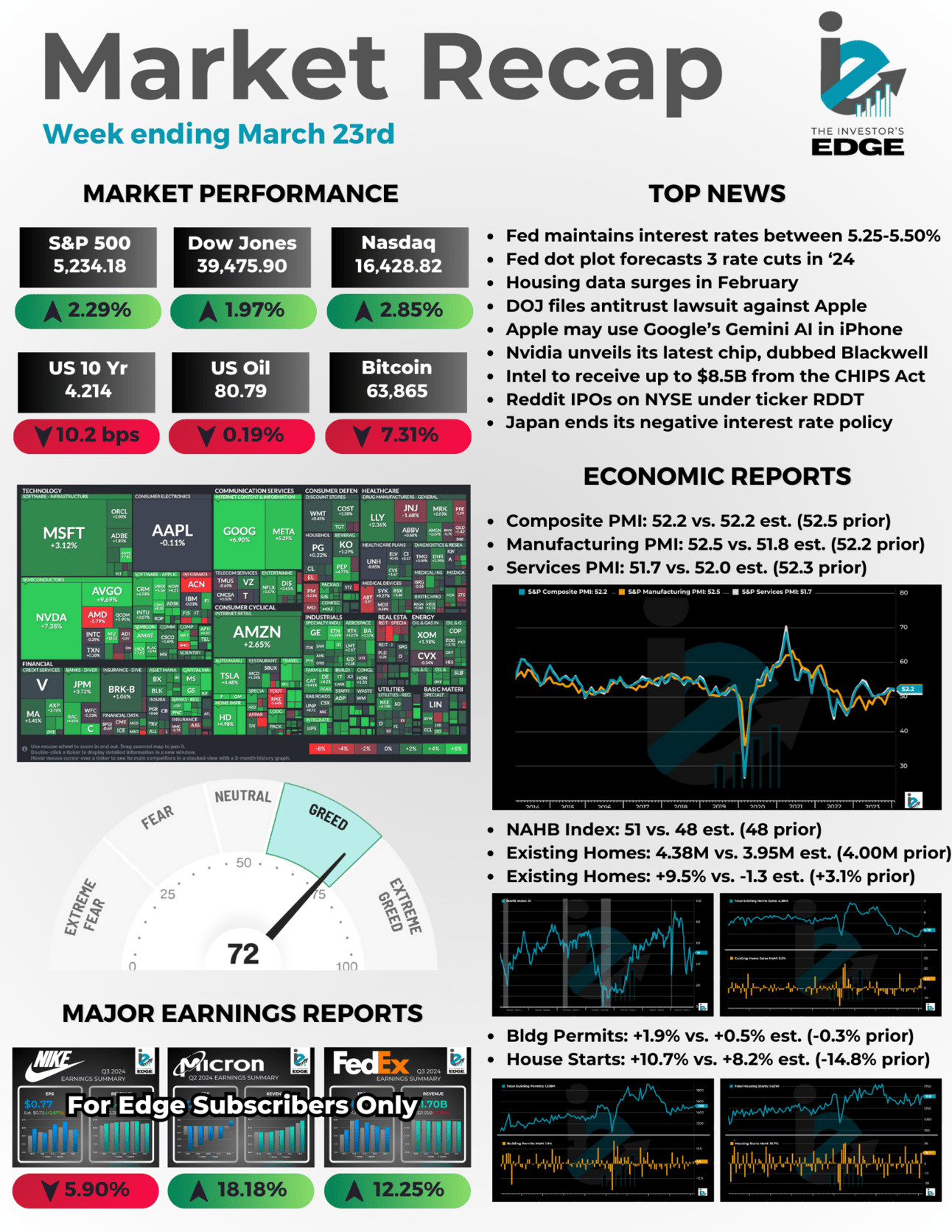

The Fed kept rates steady and maintained its forecast for three rate cuts this year. The market liked the news with the S&P 500 making new all time highs.

👉 EARNINGS EDGE: Micron shares surged over 18% after it blew away analyst estimates for both earnings and revenue. The chipmaker also raised its outlook for the upcoming quarter as it benefits from…upgrade to Edge+ to read the full Earnings Edge.

5 Stories Moving the Market

These are some of the biggest stories from the past week that had an influence on market action.

Fed holds rates steady and maintains rate cut forecast despite raising GDP and inflation outlook

The Federal Reserve kept interest rates unchanged, maintaining its benchmark rate between 5.25% and 5.5%, and hinted at multiple cuts by the end of the year.

Fed officials anticipate three quarter-percentage point cuts by the end of 2024, based on projections in the "dot plot" from the 19 members of the Federal Open Market Committee. Market expectations suggest a 75% chance of the first cut occurring at the June meeting.

Chair Jerome Powell stated that the timing of these cuts is contingent on economic data. Powell indicated that the Fed may begin dialing back policy restraint this year if the data progresses as expected.

Meanwhile, the Fed’s own economic projections show accelerated GDP growth, with the economy expected to run at a 2.1% annualized rate, a decrease in the unemployment rate forecast to 4%, and a slight increase in core inflation to 2.6%.

DOJ sues Apple over iPhone monopoly in landmark antitrust case

The Department of Justice and 16 attorneys general sued Apple, alleging that its iPhone ecosystem constitutes a monopoly, leading to inflated prices and limited choices for consumers, developers, and competitors.

The lawsuit accuses Apple of anti-competitive practices across various services beyond just iPhones and Apple Watches, including advertising, browsing, FaceTime, and news offerings.

The government is considering structural remedies, potentially including breaking up Apple, which would be a rare move under the Sherman Act.

Apple has stated its disagreement with the lawsuit, arguing that it would stifle innovation and set a precedent for government overreach in technology design.

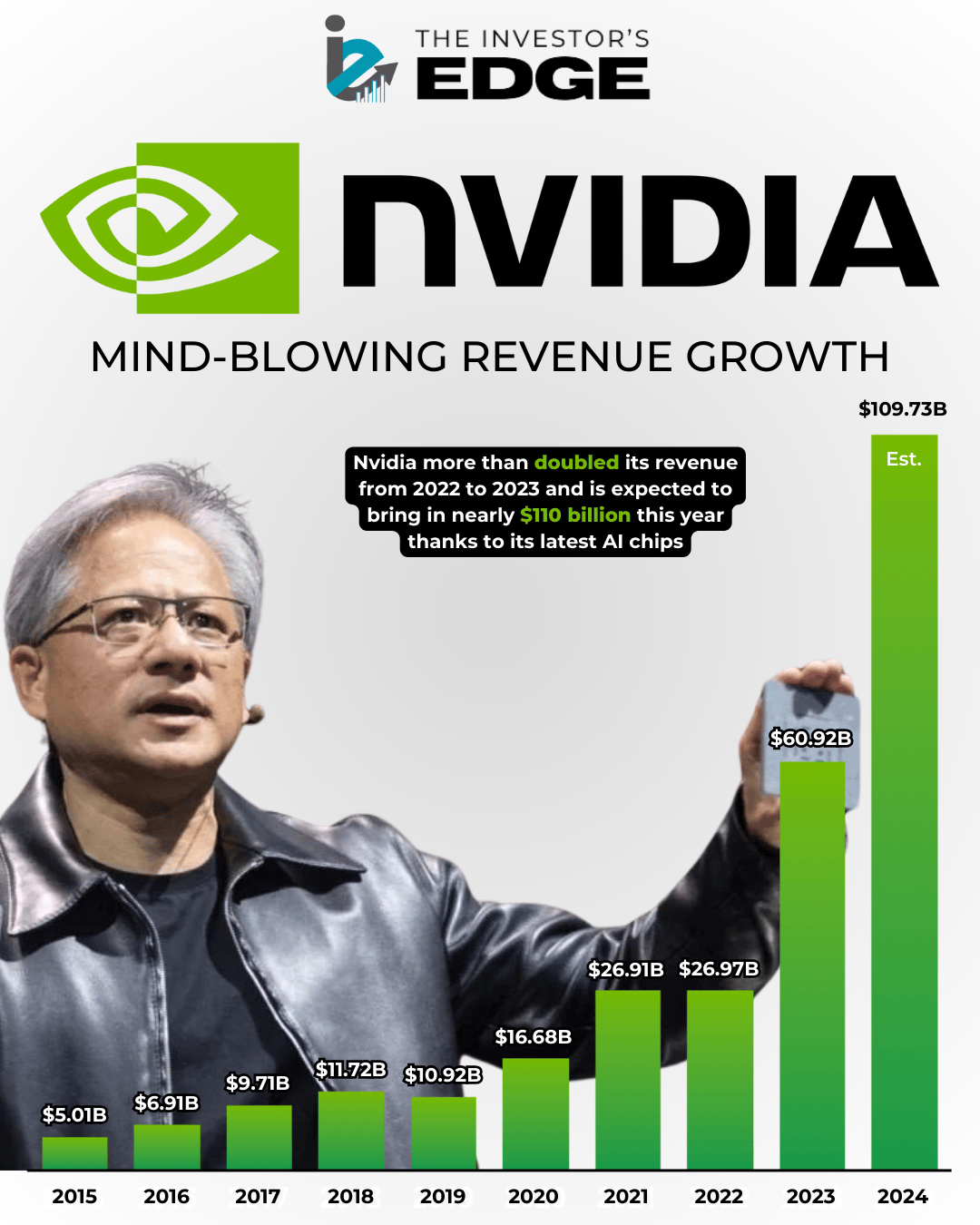

Nvidia announces new AI chips at developer’s conference

Nvidia unveiled a new line of artificial intelligence chips and accompanying software at its developer's conference, aiming to reinforce its dominance as the leading supplier for AI technologies.

The announcement comes amidst Nvidia's exponential growth in sales and share price since the onset of the AI boom in late 2022. The high-end server GPUs offered by Nvidia are crucial for training and deploying large AI models, with major companies like Microsoft and Meta heavily investing in these chips.

The new generation of AI graphics processors, named Blackwell, features the GB200 chip, set to be released later this year. Nvidia is enticing customers with more powerful chips to drive new orders, especially as demand remains high for current-generation chips like the Hopper H100s.

Additionally, Nvidia introduced revenue-generating software called NIM, simplifying AI deployment and providing customers with further incentive to choose Nvidia over emerging competitors.

Who doesn’t want to build wealth while they sleep? Automated investing and 4.75% APY on your savings account is certainly a great way to do it. That’s why we are happy to team up with Betterment for this week’s sponsor:

Make your money rise and grind while you sit and chill, with the automated investing and savings app that makes it easy to be invested.

Alphabet shares surged after reports emerged of Apple's discussions to license Gemini, Google's suite of generative artificial intelligence tools, for future iPhones.

The report stated that Apple and Google are actively negotiating for Gemini to power new features in iPhone software expected to launch later this year, potentially introduced during Apple's Worldwide Developers Conference.

This move suggests Apple's significant investment in AI, as indicated by CEO Tim Cook during the company's recent shareholder meeting.

Apple also recently held discussions with OpenAI and has considered using its model, according to the same report.

Intel awarded up to $8.5 billion in CHIPS Act grants, with billions more in loans available

The White House disclosed that Intel has been granted up to $8.5 billion in funding from the CHIPS Act to bolster semiconductor manufacturing in the United States, with the potential for an additional $11 billion in loans from the CHIPS and Science Act.

While Intel has faced challenges relative to its competitors like Nvidia and AMD, it retains a unique position due to its operation of chip factories alongside chip design.

Other chipmakers operate on a fabless model, where they design the chips and then use Taiwan’s TSMC for the manufacturing and production process.

This move aims to maintain America's leadership in innovation within the semiconductor industry. The funding will be allocated to Intel's facilities and research centers across several U.S. states, supporting the company's previously announced plans to spend $100 billion to enhance its leading-edge manufacturing capabilities by 2026.

Looking for more of an Edge? Become an IE+ member today

Like the content you have seen so far? To be honest, this is nothing compared to what subscribers to the Investor’s Edge+ get.

IE+ members get access to all of the following benefits:

Monthly Portfolio Updates

Monthly Top 10 Stock Buy List

The Weekly Edge Report

1 Stock Deep Dive Per Week

Timely Earnings Recaps

Investing Guides / Courses (coming soon)

And More

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the IE+ club today and take your investing to the next level!

IE+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even get a sneak peek into our systems and models. This week we discussed the Nvidia conference and the FOMC rate hike decision. See the full report here:

ETF Deep Dive - SCHD

Our Deep Dive focused on SCHD, Charles Scwhab’s dividend ETF, this week. We not only broke down the latest reconstitution of the index but we also explored the ETF’s historical performance and dividend growth. You can see the full analysis here:

Deep Dive #31 - SCHD

The Dividend ETF Gets A New Look

theinvestorsedge.beehiiv.com/p/deep-dive-31-schd

Earnings Recap

Every week during earnings season we share a recap of the quarterly reports from stocks that we cover. You can see this week’s earnings recaps here:

The Week Ahead

There’s a lot on the calendar next week but all eyes will be on the jobs report.

Earnings Reports

It’s a relatively calm week in terms of earnings next week, but it’s especially quiet here at The Investor’s Edge as none of the stocks we cover are scheduled to report.

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

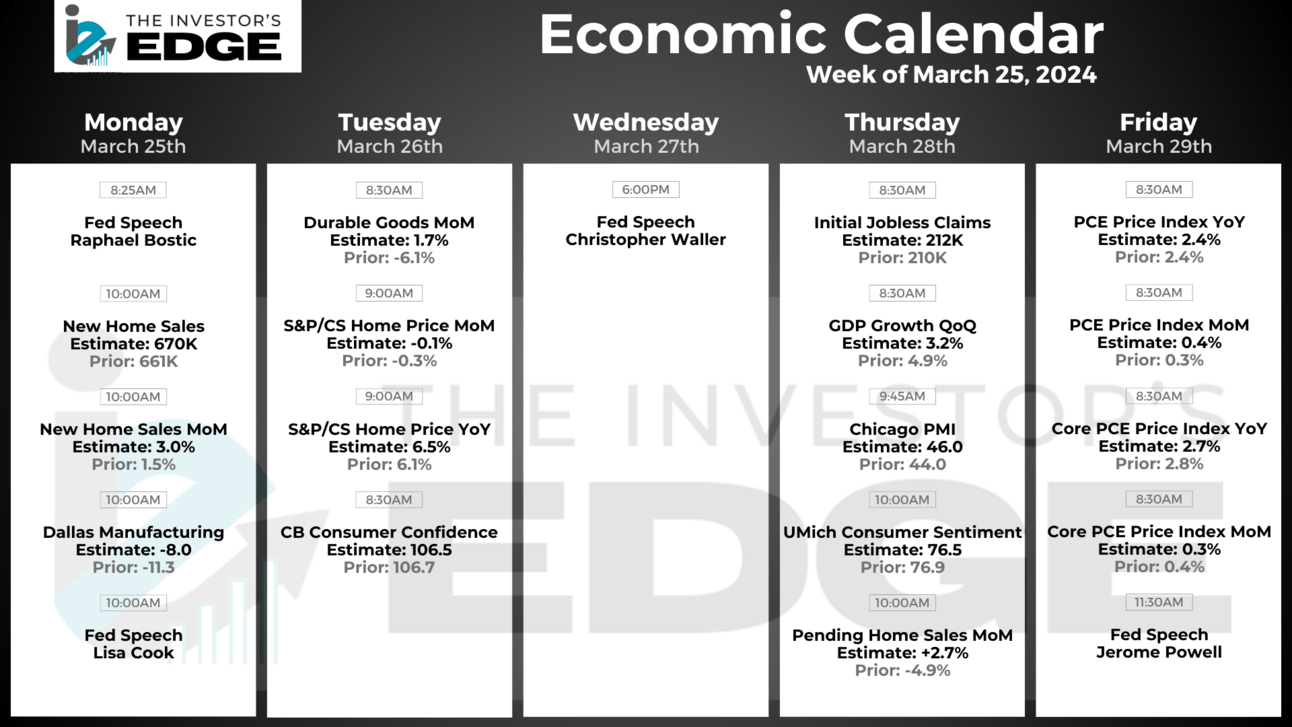

Economic Reports

Next week is another busy week. We get important inflation data on Friday as the Fed’s preferred metric, the PCE index, is set to be released. We also get several housing reports after last week’s data indicated a strong rebound in real estate as well as the all important GDP report.

Here is the full calendar of events we will be watching:

Want even more from us? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Before you go, did you know that you can earn REWARDS when you share our newsletter? All you need is one referral and you will receive our graphic with the Top Stock Picks for 2024 from Six Investing Legends.

But we know a single graphic might not be exciting — that’s why we’ve got IE swag on the way!

That’s right, we will be giving you free stuff for sharing a link. One link.

Hats, shirts, sweatshirts and more for subscribers who reach 5, 10 or 25+ referrals! Start sharing today.

Thank you for reading this edition of the Weekly Wrap-Up.

If you enjoyed this newsletter and found it valuable, be sure to SUBSCRIBE and SHARE THE INVESTOR’S EDGE WITH FRIENDS AND FAMILY!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.