Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 16,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

It was a tough week for both the Nasdaq and S&P 500 as the technology sector saw a huge sell-off.

The Investor’s Edge Discord is growing!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us.

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech and the crypto sell-off. Members also dove into the number of jobs reports and shared their views on the overall economy.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

CrowdStrike issue causes major outage affecting businesses around the world

On Friday, a content update from cybersecurity firm CrowdStrike caused a major IT outage, disrupting businesses globally.

The financial services sector, general practitioners' offices, TV broadcasters, and air travel were notably affected, with grounded planes and delayed services.

CrowdStrike’s CEO, George Kurtz, clarified that the issue was a defect in a Windows update and not a security incident or cyberattack. He confirmed that Mac and Linux systems were unaffected, and a fix has been deployed.

Meanwhile, Microsoft also restored its cloud services after being affected by the outage, though some users continued to face issues.

👉 EDGE TAKEAWAY: This could have huge implications on the company going forward as…upgrade to Edge+ to read the Full Edge Takeaway. Take advantage of our 4th of July Sale and get 30% off our regular price!

Amazon Prime Day drives U.S. online sales to record $14.2 billion

During Amazon's 48-hour Prime Day event, U.S. online spending surged 11% year over year to $14.2 billion, surpassing estimates and setting a record, according to Adobe Analytics.

This increase was driven by back-to-school shopping and consumers buying new electronics like tablets, TVs, and Bluetooth speakers, contrasting with last year's focus on household essentials.

Amazon reported record-breaking Prime Day revenue but didn't disclose total sales. They highlighted their Rufus shopping assistant, which uses AI to suggest products and provide order updates, as a significant aid for shoppers.

Numerator found that the average order size increased to $57.97 from $54.05 last year, with popular items including Amazon-branded products, Premier protein shakes, and Liquid IV packets. However, shoppers bought fewer big-ticket items and made fewer multiple orders, indicating a shift to more conscious shopping and saving over splurging.

📚 EDGE-UCATION: What is Amazon Prime Day and why did it start?

Amazon Prime Day is an annual shopping event exclusively for Amazon Prime members, featuring significant discounts and deals across a wide range of products.

Initially created to celebrate Amazon’s 20th anniversary and to boost Prime memberships, the first Prime Day in 2015 was a one-day event. It was highly successful, leading to record sales and increased Prime memberships.

Due to its success, Prime Day was extended to 30 hours in 2017, 36 hours in 2018, and 48 hours in 2019 and beyond. Initially available in nine countries, it has expanded to include more countries each year, reaching a global audience.

Each year, Prime Day has set new sales records and has become a major revenue driver for Amazon, often exceeding Black Friday and Cyber Monday sales combined.

Other retailers have started offering their own sales around Prime Day to compete, making it a significant period for the entire retail industry.

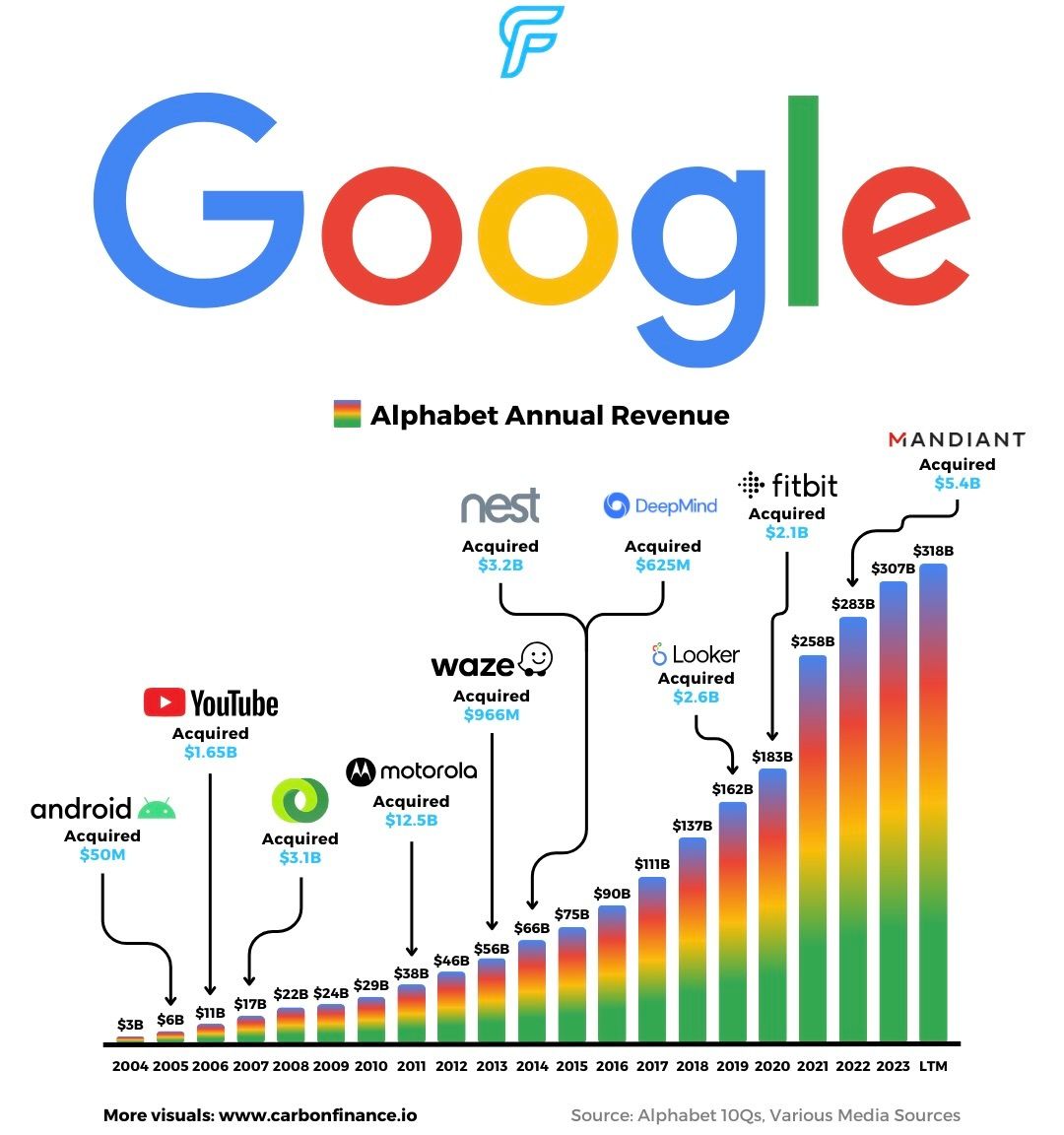

A word from our friend - Carbon Finance

Tired of boring, text-heavy investing newsletters?

My good friend Carbon Finance sends out a weekly visual newsletter with the most important infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join nearly 16,000+ investors! Click the button below to automatically subscribe 👇

Netflix beats estimates as ad-supported memberships rise 34%

Netflix reported second-quarter earnings, highlighting its leading position in the streaming industry as it added more global subscribers and saw significant growth in its advertising business.

The ad-supported memberships grew 34% compared to the same quarter last year, with advertising becoming an important revenue model for profitability. Revenue for the quarter was approximately $9.6 billion, up 17% from the previous year.

Global paid memberships increased 16.5% year over year to 278 million.

Netflix announced that it will stop providing quarterly membership numbers or average revenue per user starting in 2025, focusing instead on revenue, operating margin, and customer engagement as primary metrics.

Netflix's stock has benefited from its efforts to increase subscribers on its cheaper, ad-supported tier and its crackdown on password sharing. Shares are up over 100% since announcing the crackdown.

🚨 EDGE ALERT: In case you missed it, we broke down the entire earnings report from Netflix and provided our takeaways in yesterday’s Earnings Recap.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these reports, but they also get expert market analysis straight to their inbox as well as access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

IE+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming earnings reports and potential volatility ahead. See the latest full report here:

Earnings Recap

Every week during earnings season we share a recap of the quarterly reports from stocks that we cover. This week Edge+ subscribers received two reports to their inboxes. You can see this week’s earnings recaps here:

The Week Ahead

Earnings will take center stage as investors look to these major companies' guidance for a clearer understanding of the economic outlook. We also get a major inflation report that could determine whether we get the first rate cut soon.

Earnings Reports

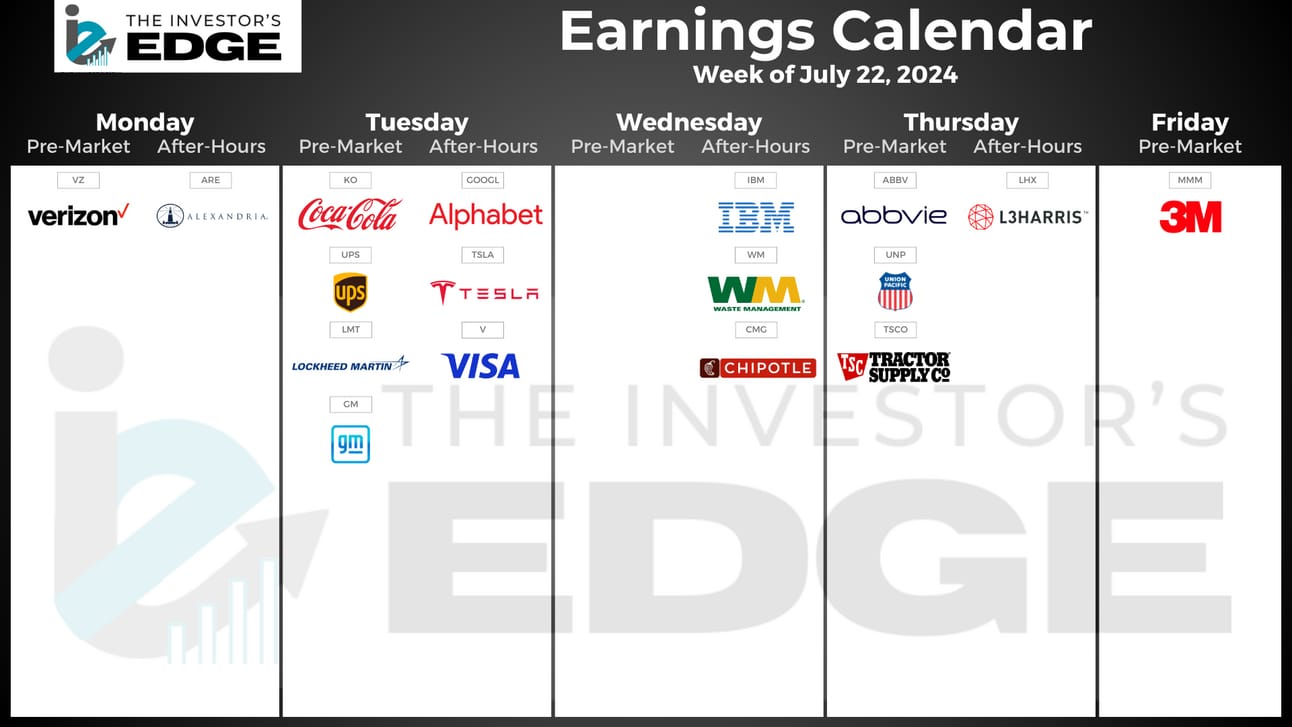

Let the earnings season begin. Here is the list of names we will be covering next week:

Monday 7/22: Verizon and Alexandria Real Estate

Tuesday 7/23: Alphabet, Tesla, Visa, Coca-Cola, UPS, Lockheed Martin, and General Motors

Wednesday 7/24: IBM, Waste Management, and Chipotle

Thursday 7/25: Abbvie, Union Pacific, Tractor Supply, and L3Harris

Friday 7/26: 3M

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

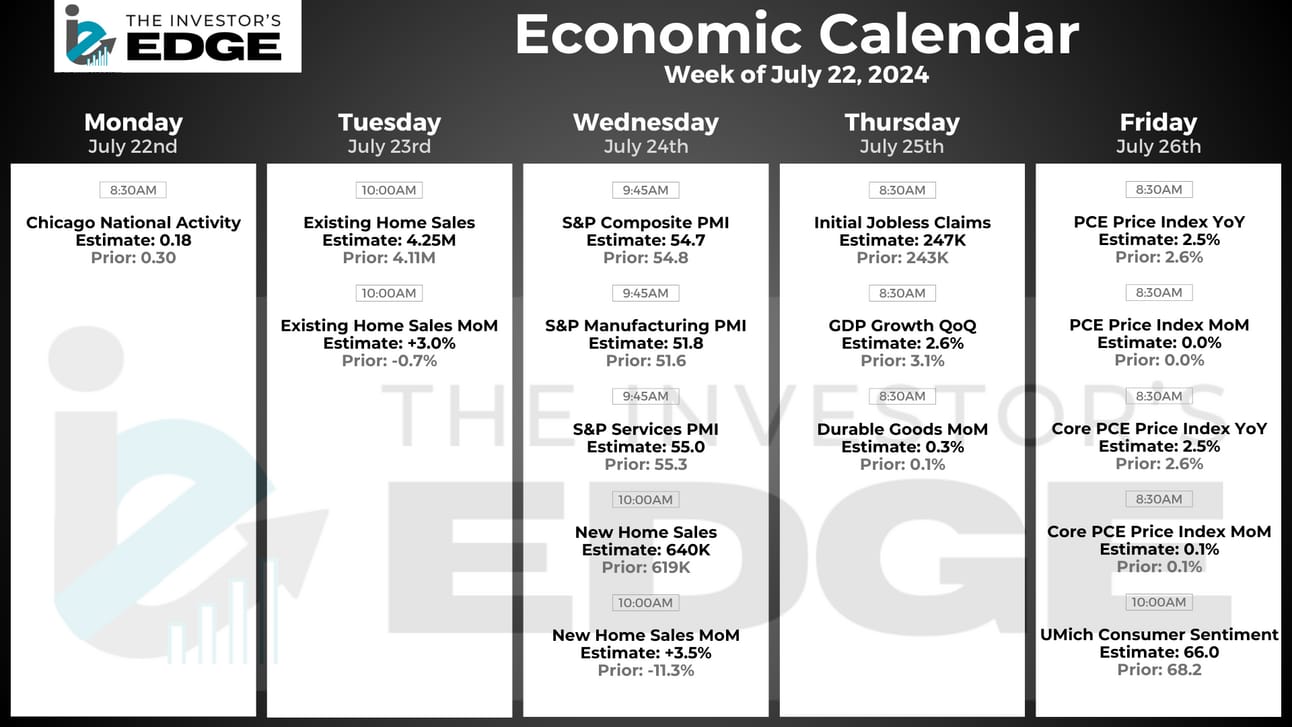

Economic Reports

Next week's calendar includes several significant events, such as housing reports, crucial PMI and GDP data, and the now closely monitored jobless claims report. However, the most critical event is Friday’s PCE inflation report. The Fed, the market, and investors will be paying close attention to this report to determine if the trend of decreasing inflation persists.

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.