Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 13,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

If you haven’t done so already, SUBSCRIBE and hit that LIKE button to show your appreciation and help us grow!

Grab your coffee and let’s dive in.

Market Talk

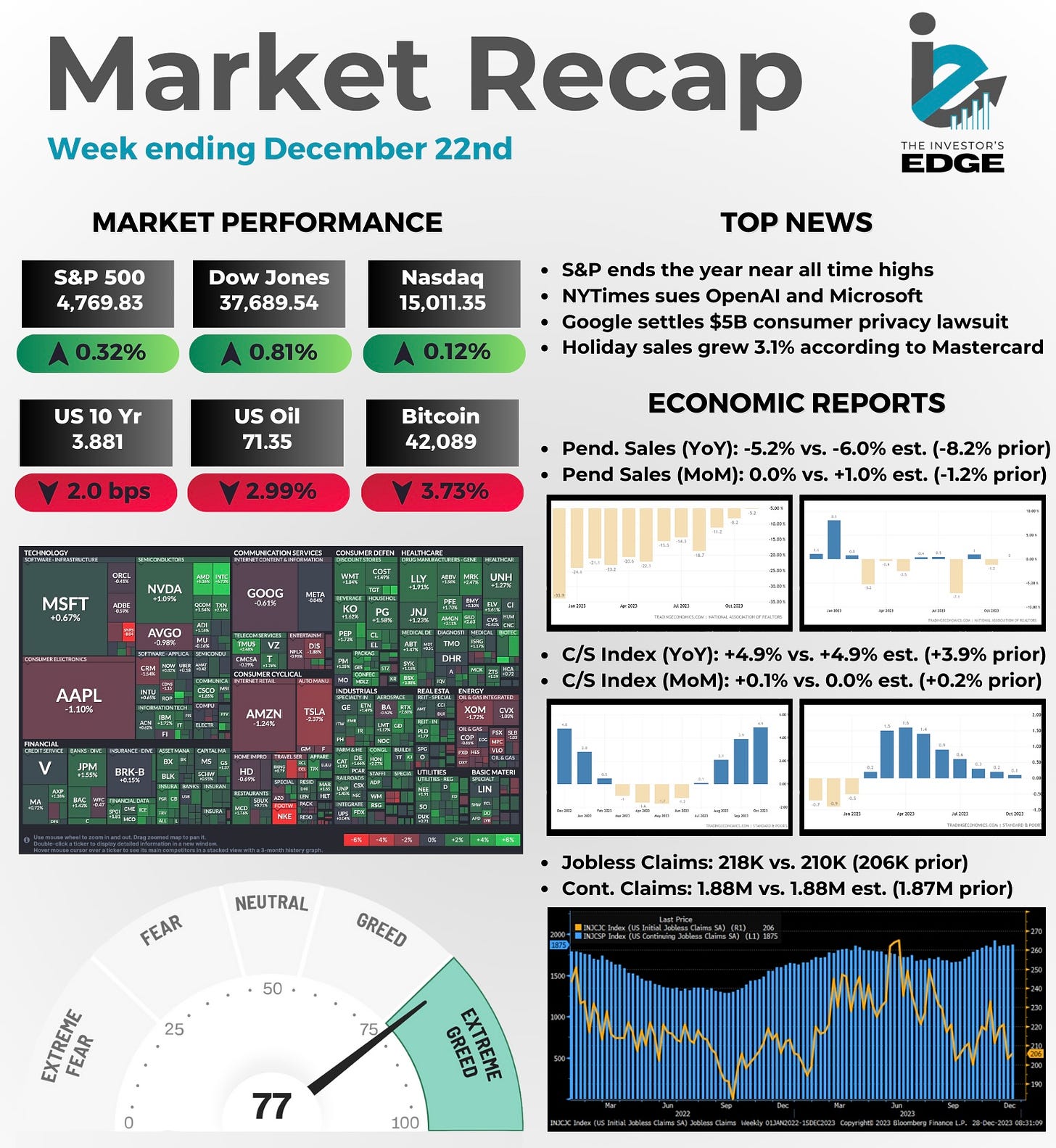

The major indexes rose again last week to end the year on a strong note.

5 Stories Moving the Market

These are some of the biggest stories from the past week that had an influence on market action.

2023 Year in Review

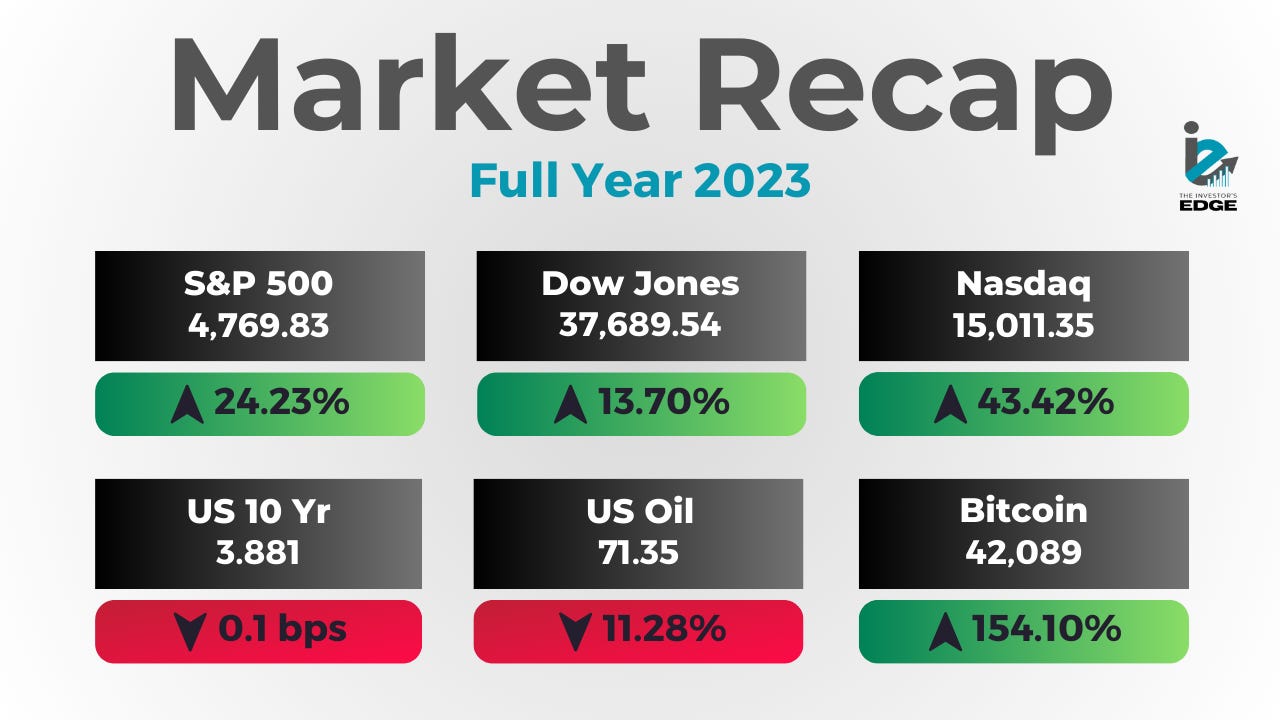

The S&P 500 ended the year higher by 24%, while the Dow gained 14% and the Nasdaq rose 43%. The 2023 market strength was buoyed by the “Magnificent 7” mega cap tech stocks — Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft and Tesla. All seven stocks had returns that more than doubled the S&P 500’s gains on the year.

It wasn’t all rainbows and sunshine though, there were some hiccups along the way. A banking crisis in March caused several regional banks to fail and the entire market to drop 10%. The Fed stepped in and saved the day by ensuring deposits above the $250k FDIC guarantee would be recovered. Then the seasonal September effect put fear into investors and led to another 10% decline in the S&P. Lastly, the 10 year treasury yield touched 5% in October, which led to mortgage rates above 8% and put a strain on lending overall.

Despite the obstacles, the market was able to overcome it all and end the year on a strong note. The S&P rose nearly 17% from the October lows and ended 2023 right near all time highs.

The question now is will the momentum carry into 2024? To see our full 2024 outlook, become a member and check out our latest Edge Report.

We are currently running a holiday promotion before prices INCREASE in the new year.

NY Times sues OpenAI, Microsoft for infringing copyrighted works

The New York Times sued OpenAI and Microsoft on Wednesday, accusing them of using millions of the newspaper's articles without permission to help train chatbots to provide information to readers. The Times said it is the first major U.S. media organization to sue OpenAI, creator of the popular artificial-intelligence platform ChatGPT, and Microsoft, an OpenAI investor and creator of the AI platform now known as Copilot, over copyright issues associated with its works.

The newspaper's complaint, filed in Manhattan federal court, accused OpenAI and Microsoft of trying to "free-ride on The Times's massive investment in its journalism" by using it to provide alternative means to deliver information to readers. OpenAI and Microsoft have said that using copyrighted works to train AI products amounts to "fair use," a legal doctrine governing the unlicensed use of copyrighted material.

Google settles $5 billion consumer privacy lawsuit

Alphabet’s Google has agreed to settle a lawsuit claiming it secretly tracked the internet use of millions of people who thought they were doing their browsing privately. The lawsuit had sought at least $5 billion. Settlement terms were not disclosed, but the lawyers said they have agreed to a binding term sheet through mediation, and expected to present a formal settlement for court approval by Feb. 24, 2024.

The plaintiffs alleged that Google’s analytics, cookies and apps let the Alphabet unit track their activity even when they set Google’s Chrome browser to “Incognito” mode and other browsers to “private” browsing mode. They said his turned Google into an “unaccountable trove of information” by letting the company learn about their friends, hobbies, favorite foods, shopping habits, and “potentially embarrassing things” they seek out online.

US holiday retail sales grow 3.1%, down from prior year, Mastercard says

U.S. retail sales rose 3.1% between Nov. 1 and Dec. 24, as shoppers looked for last-minute Christmas deals amid big promotions, a Mastercard report showed. The increase is lower than the 3.7% growth Mastercard forecast in September and last year's 7.6% rise as higher interest rates and inflation pressured consumer spending. E-commerce sales grew at the slower pace of 6.3% compared to last year's 10.6% as the popularity of online shopping came off pandemic highs, the report also showed.

Amazon and Walmart ramped up promotions through November in the United States to entice bargain-hunting shoppers, but analysts said that the discounts were not as deep as the prior year, when retailers were saddled with excess stock after the pandemic.

You can save more than ever for retirement in 2024 — here are the new contribution limits

If you’re looking to max out your retirement savings, you’ll be happy to hear that the contribution limits have been bumped up by $500 for most retirement savings plans in 2024, the IRS announced. Contribution maximums will increase from $22,500 to $23,000 for 401(k), 403(b) and most 457 plans, while contribution limit on individual retirement accounts will increase by $500 in 2024, from $6,500 to $7,000.

The amount you can contribute to a Roth IRA phases out based on your adjusted gross income: In 2024, that range will increase to between $146,000 and $161,000 for single individuals and heads of households, up from between $138,000 and $153,000 in 2023. For married couples filing jointly, the range increases to between $230,000 and $240,000.

Looking for more of an Edge? Join the IE Club today!

Like the content you have seen so far? This is only the tip of the iceberg when it comes to the Investor Edge community.

This is your last chance to subscribe and SAVE 20% before we raise prices in the new year. Deal ends December 31st at midnight!

Subscribers get access to all of the following premium benefits:

Monthly Portfolio Updates

The Weekly Edge Report

1 Stock Deep Dive Per Week

Weekly Earnings Recaps

And More

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the IE club today and take your investing to the next level!

The Week Ahead

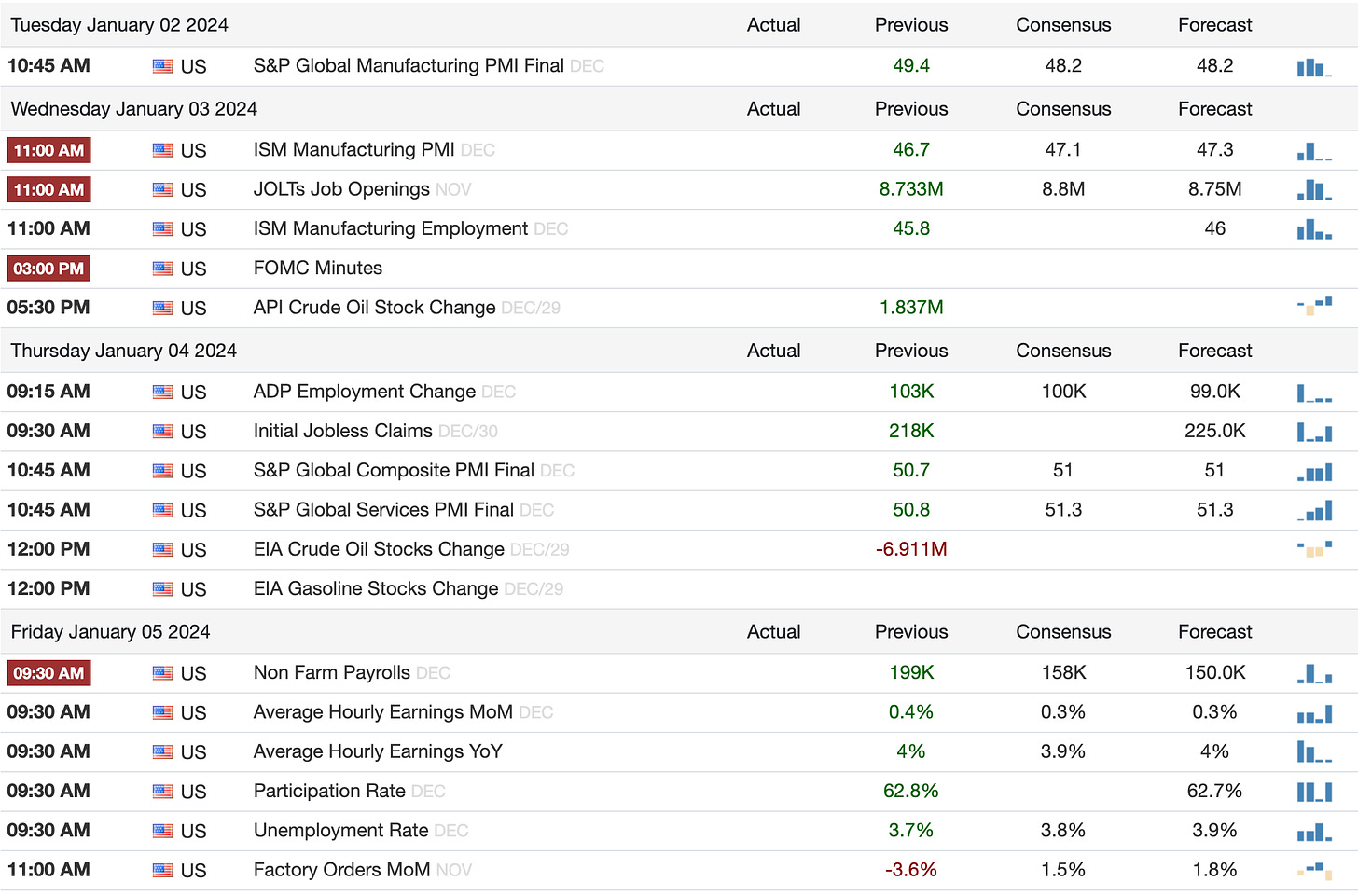

2024 starts off with a bang as we get several key jobs reports next week. These reports will dictate how the year starts for markets.

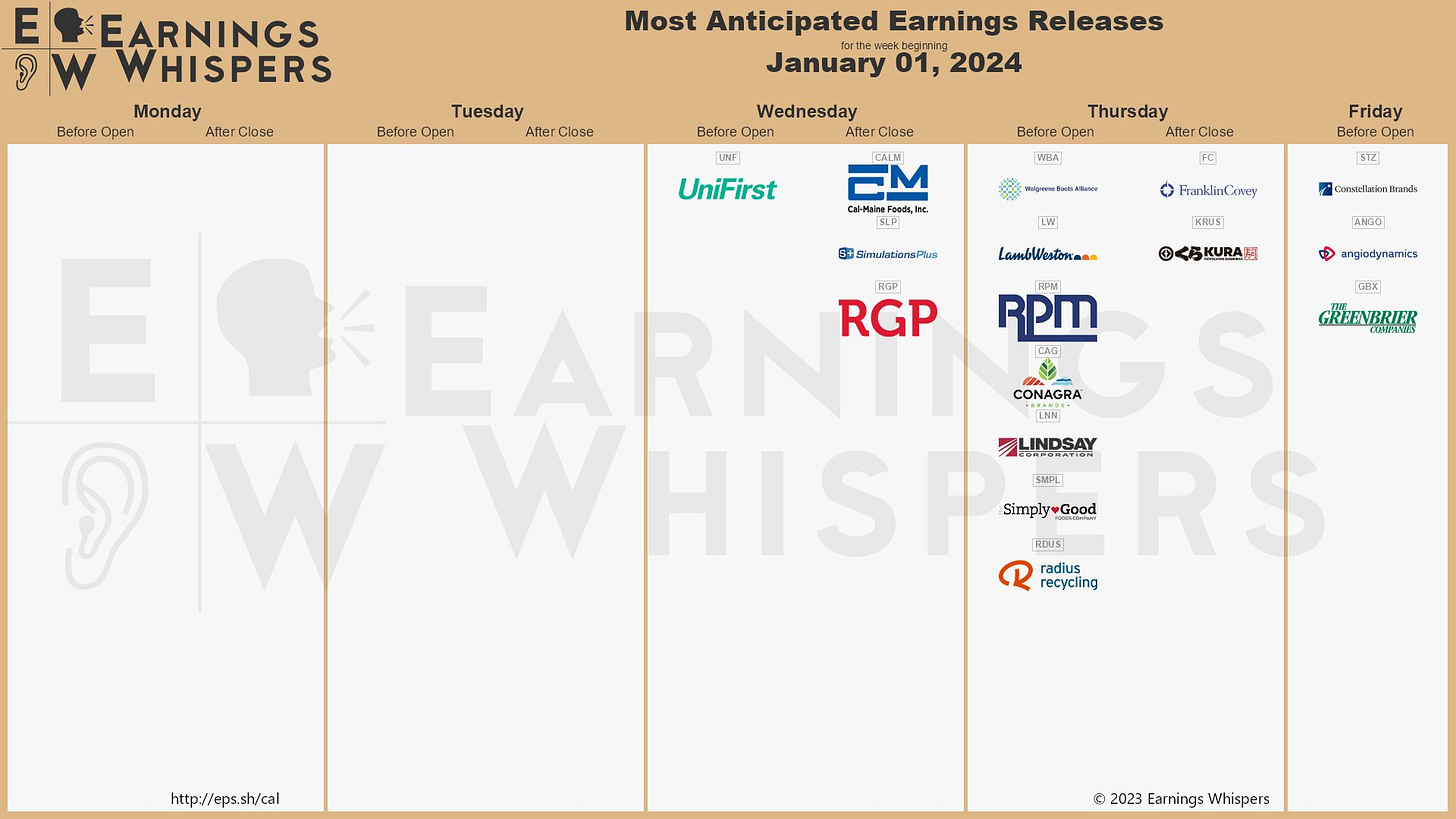

Earnings Reports

No major earnings reports scheduled next week, though Walgreens and Constellation Brands will give insights into the consumer and their spending habits so we’ll be keeping our eyes on them.

Economic Reports

The labor market has held up surprisingly well in the face of higher interest rates. As we’ve been saying, the jobs market is the indicator to watch when it comes to the overall economy. If unemployment starts to rise with current interest rates and record debt levels, it will lead to a drop off in consumer spending and thus, a slowdown of the economy.

Poll of the Week 📊

Want even more from us? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up.

If you enjoyed this newsletter, be sure to subscribe, leave a like and comment your thoughts below!

And remember - sharing is caring. If you found this edition of the Weekly Wrap-Up informative and valuable, please consider sharing it with your friends and family. Your support is the cornerstone of our growth and the more people that see this the better. Thank you all!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.