Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

It was a mixed week for the major indexes as markets digested the jobs market data.

3 Stories Moving the Market

These are some of the biggest stories from this week that had an influence on market action.

Hiring Slows Sharply as August Jobs Report Misses Expectations

The U.S. labor market stumbled in August, with nonfarm payrolls adding just 22,000 versus expectations for 75,000. The unemployment rate ticked up to 4.3%, the highest since October 2021, while revisions cut prior months’ job gains further. Markets are now pricing in near-certainty of a Fed rate cut later this month as both equities and Treasury yields slid sharply on the news.

🔑 Key Points

Weak Hiring: Payrolls grew by only 22,000 in August, far below July’s 79,000 and well short of the 75,000 estimate.

Unemployment Higher: The jobless rate rose to 4.3% while broader U-6 underemployment climbed to 8.1%.

Sector Splits: Health care (+31K) and social assistance (+16K) led gains, while government (-15K), manufacturing (-12K), and wholesale trade (-12K) dragged.

Political Overhang: Report was the first under acting BLS leadership after Trump fired Commissioner McEntarfer, raising concerns about data integrity.

Fed Implications: Futures markets fully priced a 25bps September cut, with some bets on 50bps as growth risks mount.

👀 What You Need to Know

The August jobs miss virtually locks in a September rate cut, but it also raises questions about whether hiring softness is turning into broader weakness. Manufacturing losses show tariffs are weighing on demand, while wage growth slowing to 3.7% eases near-term inflation risk. That relief gives the Fed space to cut, but investors should brace for turbulence if inflation re-accelerates against a weakening labor backdrop.

🔐 Edge Takeaway: The August jobs miss, just 22K gains and unemployment up to 4.3%, leaves Powell boxed in. But with inflation running near 3%, the…upgrade to Edge+ to read the Full Edge Takeaway.

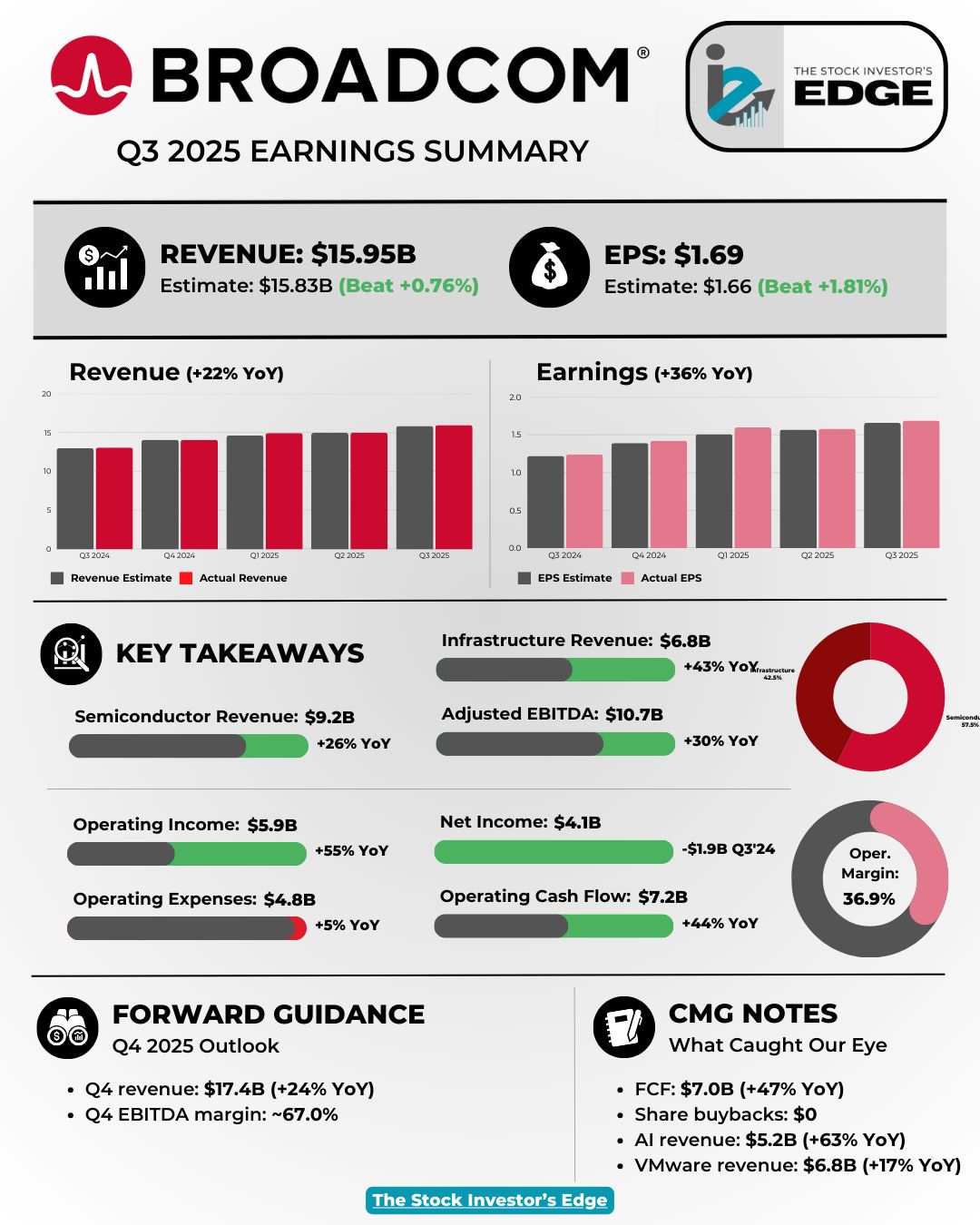

Broadcom secures $10B AI chip order, stock surges double digits

Broadcom $AVGO ( ▲ 0.14% ) reported Q3 FY25 earnings that beat expectations, with revenue rising 43% YoY to $24.2B and EPS of $12.43 topping estimates. Guidance for Q4 points to $17.4B in sales vs. $17.02B consensus, with AI revenue forecast at $6.2B. Shares surged after CEO Hock Tan revealed a new $10B XPU order from a fourth hyperscale customer, widely believed to be OpenAI.

🔑 Key Points

Revenue growth: Total sales rose 43% YoY to $24.2B, well above consensus, fueled by hyperscale AI demand.

XPU order: Broadcom confirmed a $10B order from a fourth AI chip customer (likely OpenAI), with shipments starting in 2026.

AI momentum: Management suggested AI growth could exceed the prior 50–60% range, citing “immediate and fairly substantial demand.”

Street reaction: Mizuho lifted its FY26 AI revenue forecast to $35B (+76% YoY), driving total sales estimates toward $82B.

Diversification: Infrastructure software revenue, boosted by VMware, climbed 43% YoY to $6.79B, providing stability beyond semis.

👀 What You Need to Know

Broadcom’s $10B XPU win signals that hyperscale buyers are hedging against Nvidia dominance and validates its custom accelerator roadmap. If OpenAI is indeed the customer, the deal reshapes Broadcom’s AI trajectory heading into 2026, with analysts now projecting ~30% companywide revenue growth. But at a stretched valuation and with heavy reliance on a handful of hyperscalers, execution risk and customer concentration remain key factors investors must weigh.

🔐 Edge Takeaway: Broadcom cleared its AI bar with $5.2B in revenue and a new $10B+ hyperscaler customer, but…upgrade to Edge+ to read the Full Edge Takeaway.

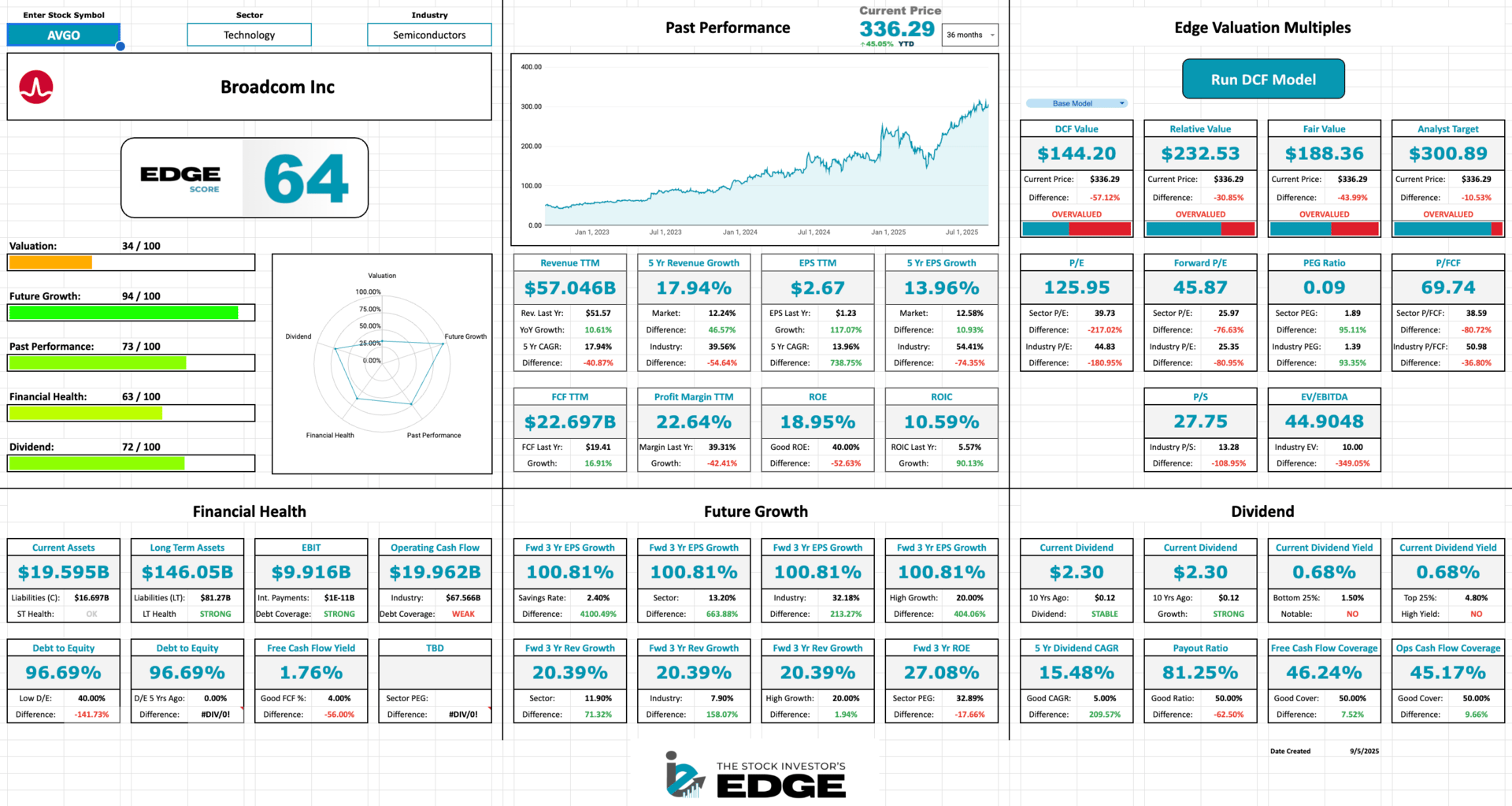

📊 Edge Score: Broadcom earns an Edge Score of 64, with powerful AI-driven growth and strong cash generation offset by premium valuation and high leverage that leave shares exposed to volatility.

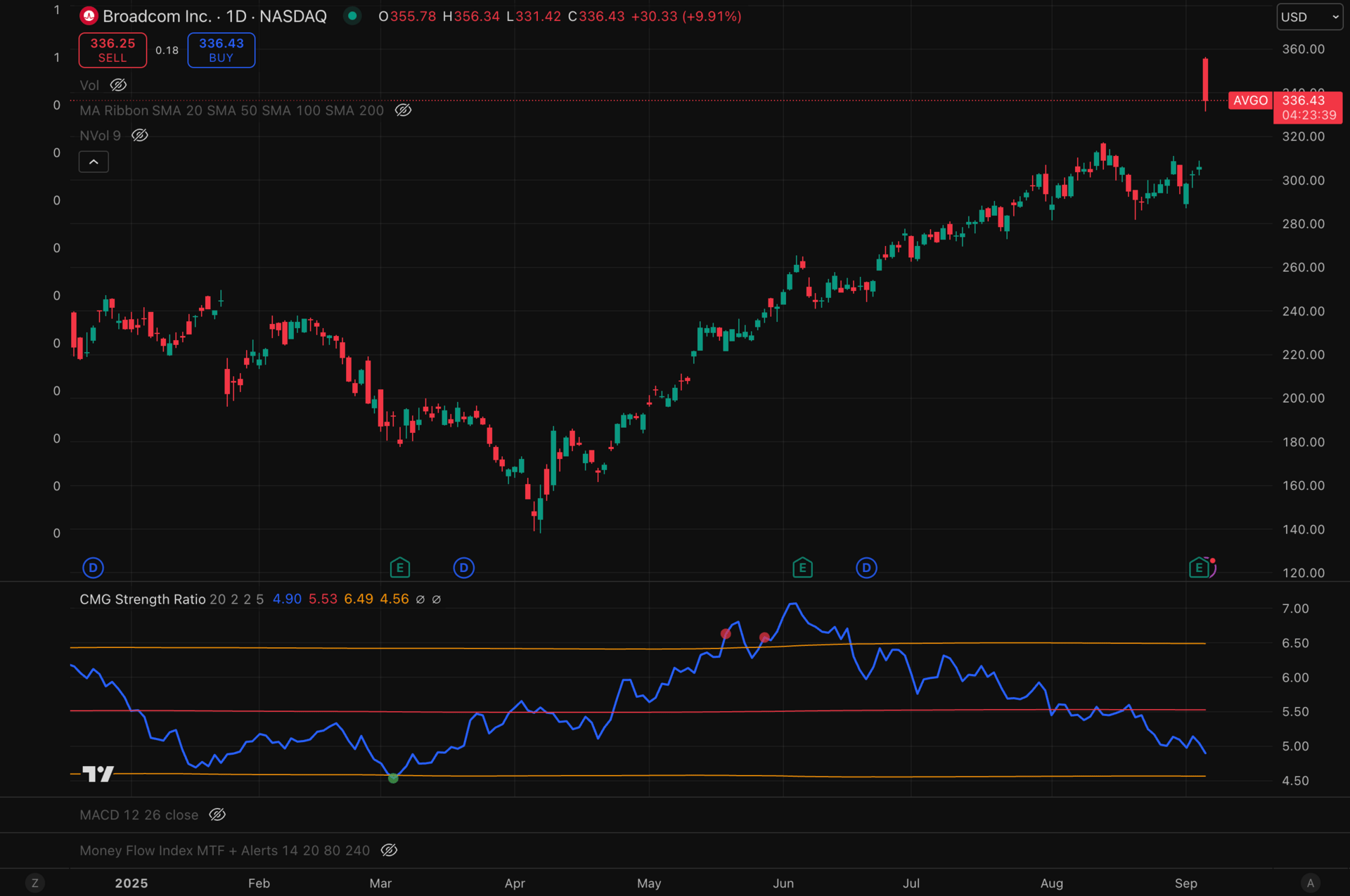

💪 CMG Strength: The ratio has been rolling over since June highs, signaling fading institutional participation despite the strong post-earnings price surge.

Want access to these Edge Tools? Upgrade to Edge+ today!

Sponsored by Uniswap

Swap, Bridge, and Track Tokens Across 14+ Chains

The Uniswap web app lets you seamlessly trade tokens across 14+ chains with transparent pricing.

Built on audited smart contracts and protected by real-time token warnings, Uniswap helps you avoid scams and stay in control of your assets.

Whether you're discovering new tokens, bridging between chains, or monitoring your portfolio, do it all in one place — fast, secure, and onchain.

Alphabet avoids breakup, can keep Chrome as judge limits antitrust remedies

Alphabet $GOOGL ( ▼ 0.16% ) shares surged this week after a favorable antitrust ruling spared it from the harshest remedies. Judge Amit Mehta blocked DOJ efforts to force divestitures of Chrome or Android, saying such measures would harm consumers. Instead, the court banned exclusive contracts, required limited data sharing with rivals, and extended oversight to Google’s GenAI products.

🔑 Key Points

Minimal breakup risk: Google avoids forced divestitures of Chrome or Android, removing a major overhang for investors.

Exclusive deals curbed: Court banned “compelled syndication” but still allows Google to pay for default placement, preserving its Apple partnership.

Search data access: Google must share parts of its search index and click data with rivals, but advertising data remains protected.

GenAI oversight: Remedies extend to Google’s AI products, preventing replication of anticompetitive tactics in new markets.

Market reaction: Alphabet rose 8% and Apple 4% on the news, reflecting relief across both companies.

👀 What You Need to Know

This ruling is a clear win for Alphabet, removing the threat of a breakup while preserving its key Apple and Android distribution channels. Limits on exclusivity and mandated data sharing will pressure Google’s edge but stop short of structural change. Regulators also extended remedies to GenAI, signaling future battles in emerging markets. Overall, Alphabet retains its ad machine intact, easing investor concerns.

🔐 Edge Takeaway: Alphabet’s antitrust relief removes the overhang of a potential breakup, giving the stock…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: What is Antitrust (and why it mattered for Google)?

Antitrust laws are designed to prevent companies from stifling competition, protecting both consumers and markets from monopolistic behavior. In the U.S., they trace back to the Sherman Act of 1890, which outlawed monopolies and unfair restraints of trade. Regulators use these tools when a single company grows so dominant that it can control prices, limit rivals’ access to markets, or restrict innovation.

Market Power: Google controlled over 90% of U.S. search queries, making it the clearest monopoly test in decades.

Exclusive Deals: Paying Apple and others to keep Google Search the default raised red flags about locking out rivals.

Data Advantage: Control of search and click-stream data gave Google a near-insurmountable edge in ads and AI.

Consumer Harm: Regulators argued that less choice in search ultimately reduced competition, innovation, and user privacy.

For investors, the concern was that regulators might force Google to sell off Chrome or Android, moves that could have broken its ecosystem and destroyed the cash-flow engine driving Alphabet’s ad dominance.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the the upcoming jobs reports, as well as our expectations for key earnings. See the latest full report here:

Weekly Options Recap

This report is a breakdown of every options trade we made this week—what we opened, what we closed, and how our open trades are performing. Each edition gives you full transparency on our strategy, including entry points, premiums collected or paid, trade rationale, and risk/reward setups. Here is how our trades did in the month of August:

See this week’s recap:

The Week Ahead

Next week will be pivotal as investors watch whether inflation data shifts expectations for a Fed rate cut later this month.

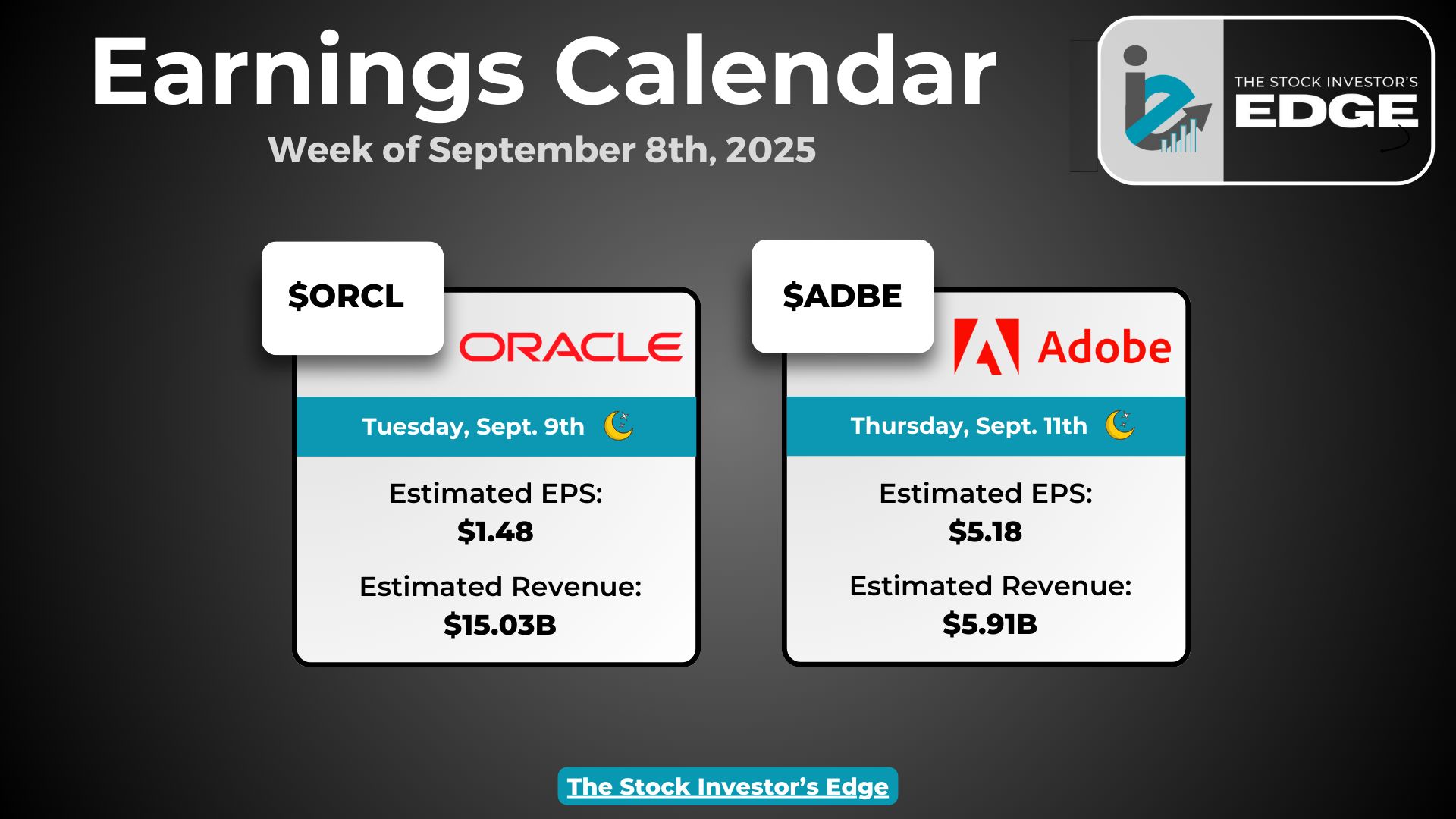

Earnings Reports

Earnings season is coming to an end but there are two companies that we cover left reporting next week. Here is the list of names we will be covering next week:

Monday 9/8: --

Tuesday 9/9: Oracle

Wednesday 9/10: --

Thursday 9/11: Adobe

Friday 9/12: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

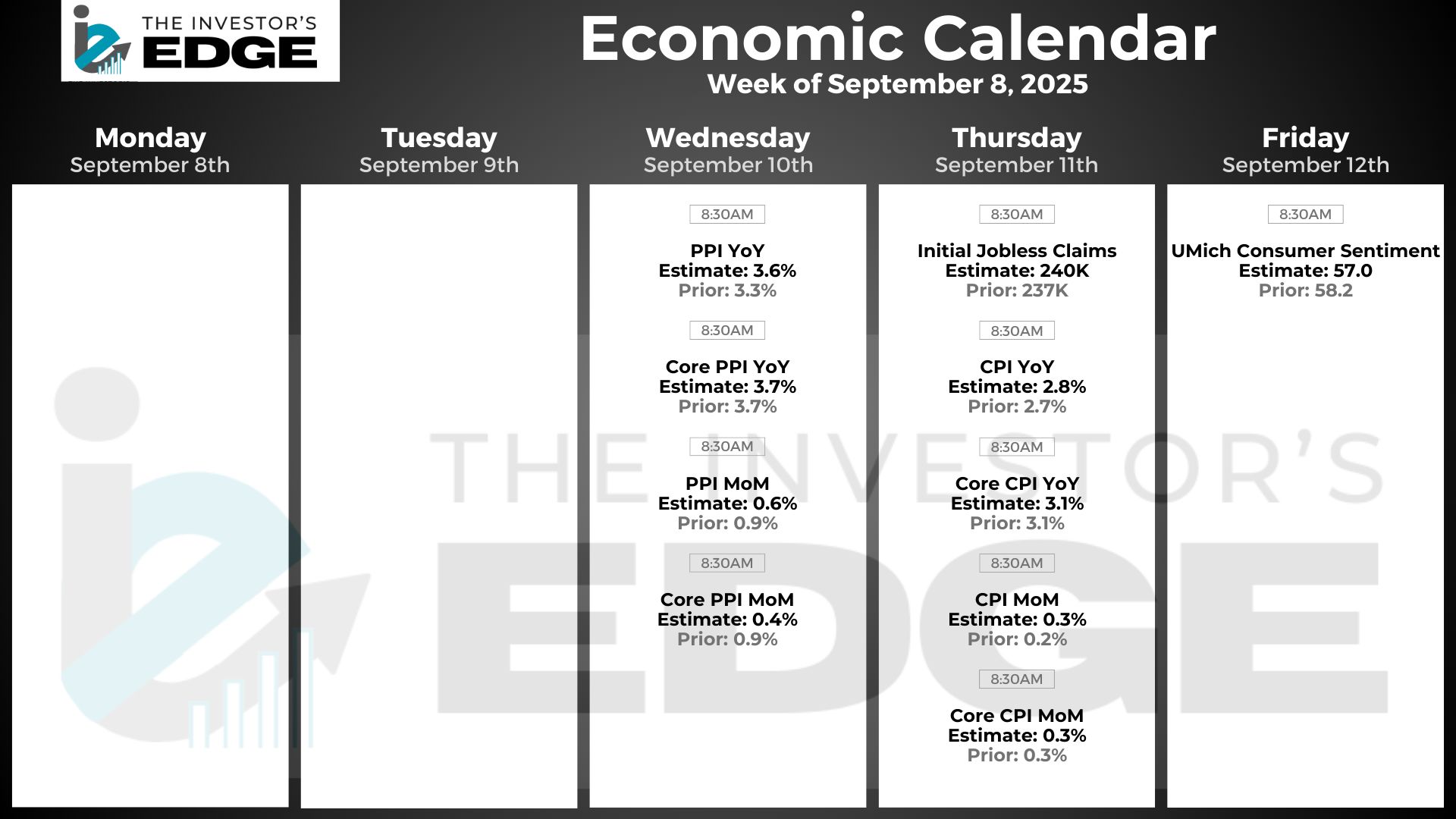

Economic Reports

Next week is another big week on the economic front as we get the latest inflation data ahead of the Fed’s next interest rate meeting. We also get initial jobless claims and consumer sentiment.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.