Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

The major indexes all ended the week at record highs despite the government shutdown.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Shutdown Headlines Fail to Dent Market Momentum

The government shutdown has entered its third day with no sign of progress, but equity markets haven’t blinked. The S&P 500 and Nasdaq are pressing fresh all-time highs, reflecting investor confidence that the economic drag from lost wages and frozen projects will be modest compared to the tailwinds from easing policy and resilient earnings. For now, markets are treating the shutdown as political noise rather than a market driver.

🔑 Key Points

Markets Unfazed: S&P 500 and Nasdaq closed at record levels even as federal agencies began winding down operations.

Consumer Drag Limited: While 750,000 workers face furloughs, history shows most shutdowns have had negligible effects on GDP once back pay is restored.

Infrastructure Freeze: Billions in federal project funding are delayed, but industrials and contractors have so far traded with the broader market strength.

Sector Lens: Retail and travel stocks show little sign of weakness despite the risk of temporarily reduced paychecks for government employees.

Historical Context: Past shutdowns have rarely driven lasting equity moves, and investors are leaning on that precedent as policy volatility increases.

👀 What You Need to Know

With equities making new highs, liquidity flows and earnings resilience are dominating sentiment, while shutdown risks are being discounted as temporary, not a macro shock. The real focus remains on monetary policy, consumer spending trends, and Q4 earnings season. Unless this drags on for months, the shutdown story is unlikely to derail the current rally.

🔐 Edge Takeaway: History says not to overreact as shutdowns have little impact on markets. The swing factor this time, however, is duration. Betting markets like Kalshi and Polymarket are pricing toward…upgrade to Edge+ to read the Full Edge Takeaway.

EV Sales Hit Records in Q3 Before Incentives Expired

Tesla, GM, and Ford each posted record-breaking EV sales in the third quarter as buyers rushed to capture the final round of $7,500 federal credits before they expired at the end of September. Industry-wide EV deliveries surpassed 1 million through nine months and reached a 10.5% U.S. share in Q3. With subsidies gone, Q4 will test whether demand proves resilient or collapses.

🔑 Key Points

Tesla record: Delivered 497,009 vehicles in Q3, maintaining ~43% U.S. EV market share.

Ford surge: Sold 85,789 EVs in Q3, up 19.8% YoY; Mustang Mach-E +50.7% YoY, Lightning 10,005 units.

GM milestone: 66,501 EVs sold in Q3, more than all of 2024, with Equinox EV leading non-Tesla sales.

Startups lagging: Rivian delivered 13,201 EVs; Lucid remains under 1% share with muted sales.

Cliff ahead: With federal credits gone, EV demand could slide from 10–12% market share in Q3 back toward 5% in Q4.

👀 What You Need to Know

The Q3 spike in EV sales was a clear tax-credit pull-forward, masking the sector’s underlying demand softness. Tesla still dominates in scale, but GM and Ford posted genuine record quarters, showing momentum in pickups and crossovers. Without subsidies, affordability becomes a major issue, and unless OEMs cut costs toward $30k price points, Chinese entrants could be the next competitive threat in the U.S. market.

🔐 Edge Takeaway: The end of the $7,500 federal EV credit sets up a brutal reality check for these automakers. Tesla…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: What was the EV Tax Credit?

The federal EV tax credit was designed to accelerate electric vehicle adoption by lowering the effective purchase price for consumers. It provided up to $7,500 per qualifying vehicle, but came with rules on income, vehicle type, and sourcing that shaped both consumer behavior and automaker strategy.

Amount: Buyers could receive up to $7,500 in tax relief depending on the battery size and sourcing requirements.

Eligibility: Income limits applied to households, and vehicle MSRP caps excluded many luxury EVs from qualifying.

Sourcing rules: To qualify, automakers had to meet North American final assembly and increasingly strict battery material sourcing standards.

Industry impact: The credit supported EV demand and allowed automakers to price less aggressively, but also created cycles of pull-forward sales ahead of policy changes.

The EV credit mattered because it artificially propped up affordability and margins, and its removal leaves automakers to prove EV demand can survive without government support.

Berkshire Strikes $9.7B Deal for OxyChem

Warren Buffett’s Berkshire Hathaway $BRK.B ( ▼ 0.44% ) agreed to buy Occidental Petroleum’s $OXY ( ▼ 0.8% ) petrochemical unit, OxyChem, for $9.7 billion in cash, marking its biggest deal since the Alleghany purchase in 2022. The acquisition deepens Berkshire’s footprint in chemicals while helping Occidental reduce debt by $6.5 billion and restart share buybacks. Both companies expect the deal to close in Q4.

🔑 Key Points

Largest deal since 2022: The $9.7B OxyChem buyout follows the $11.6B Alleghany deal and could be Buffett’s final major swing.

Debt reduction focus: Occidental will apply $6.5B to cut net debt below $15B, trimming $350M in annual interest and reopening share buybacks.

Buffett’s backing: Berkshire owns ~28% of OXY and has supported Hollub since 2019, including a $10B preferred stake that funded Anadarko.

Sharper energy pivot: Selling chemicals frees Occidental to double down on core oil and gas properties in West Texas and Wyoming.

Chemicals precedent: The deal echoes Berkshire’s 2011 $10B Lubrizol buyout, underscoring Buffett’s preference for stable, cash-rich chemical businesses.

👀 What You Need to Know

This deal underscores two key shifts: Berkshire is reinforcing its portfolio with another durable cash-flowing chemical business, while Occidental clears a major debt overhang and can finally restart shareholder returns. Selling OxyChem also signals a sharper pivot to oil and gas, where Hollub believes OXY can generate higher long-term returns, but selling OxyChem into a weak petrochemical cycle may leave value on the table.

🔐 Edge Takeaway: Berkshire just bought a cash machine at the bottom of the cycle, while Occidental needed the relief. The math is interesting for this deal as…upgrade to Edge+ to read the Full Edge Takeaway.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming jobs reports, the looming government shutdown, as well as earnings from Nike. See the latest full report here:

Weekly Options Recap

This report is a breakdown of every options trade we made this week—what we opened, what we closed, and how our open trades are performing. Each edition gives you full transparency on our strategy, including entry points, premiums collected or paid, trade rationale, and risk/reward setups. See this week’s recap:

Stock Deep Dive - Home Depot

Our Deep Dive focused on Home Depot this week. We not only broke down the financials of this leader in the home improvement space, but we also shared our valuation models, price targets for 2025, and put the stock through our Edge Scoring System. You can see the full analysis here:

The Week Ahead

The government shutdown throws a wrench in data being released, which adds to uncertainty around the next potential rate cut, although markets continue to price in another cut while equities make all-time highs. No data is bullish apparently. On the earnings front, we get earnings from two economic bellwether names, which should give us some insights into the state of the consumer and economy overall.

Earnings Reports

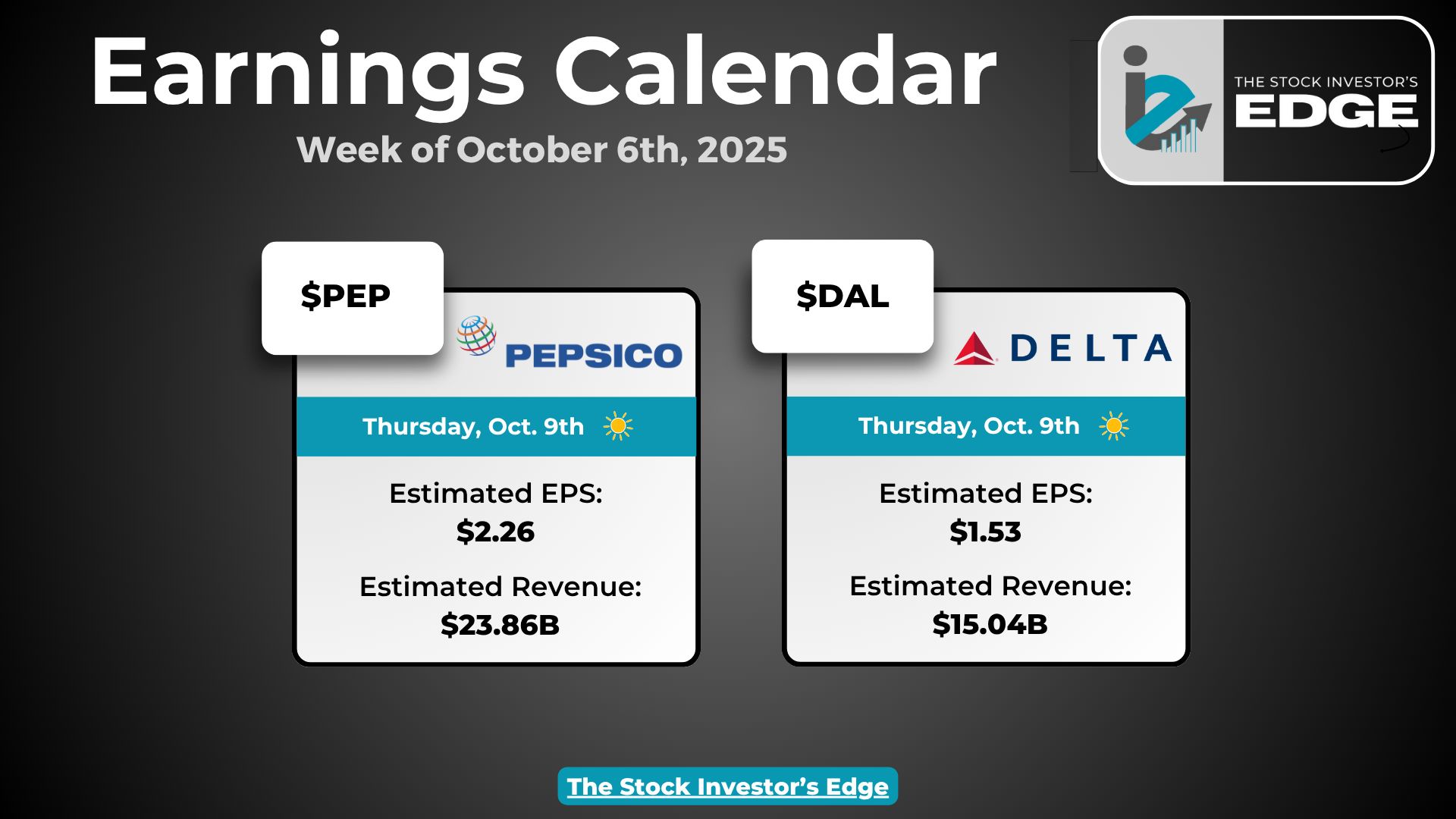

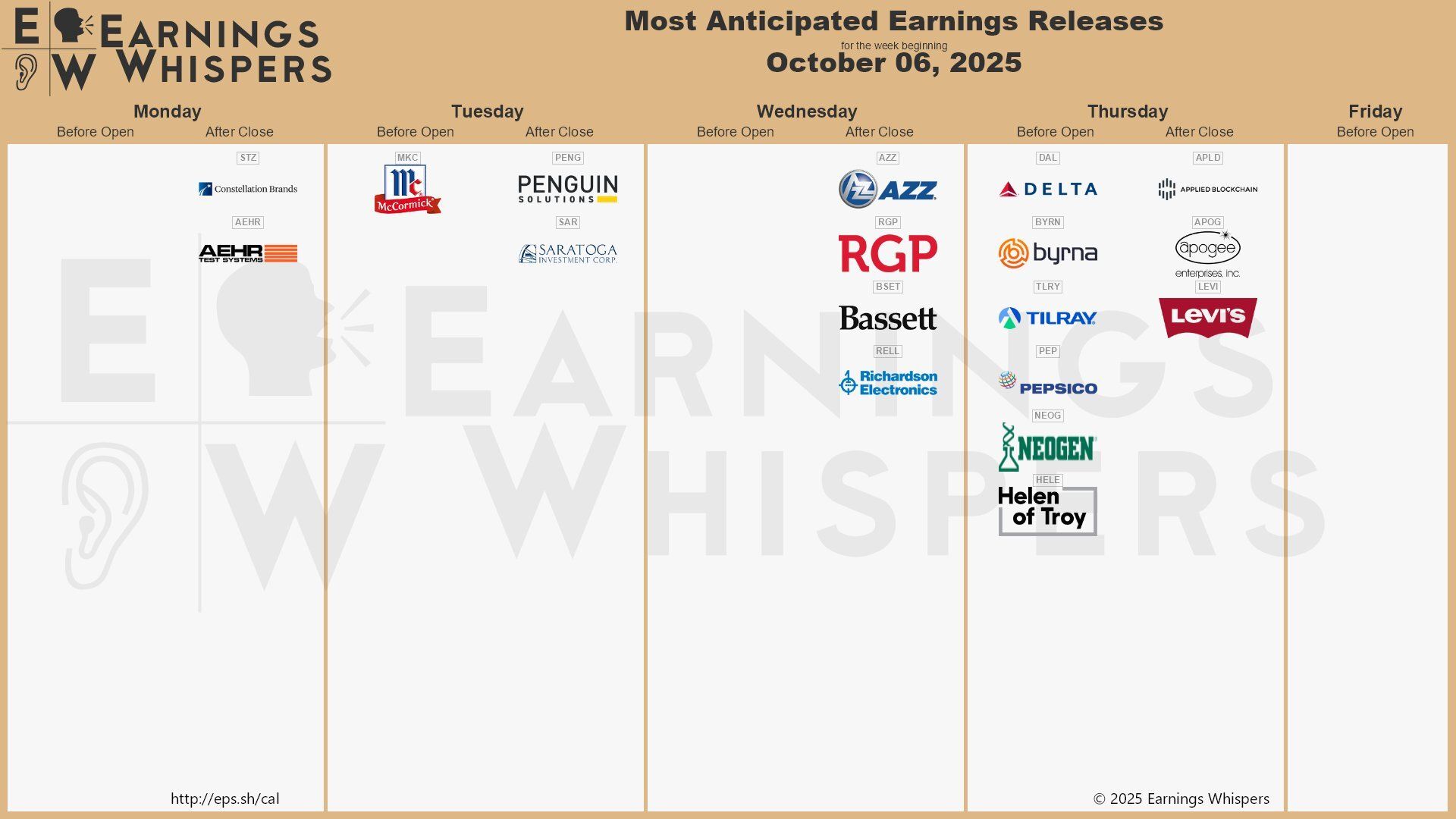

Two names we cover are scheduled to report earnings next Thursday morning, Pepsico and Delta Airlines.

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

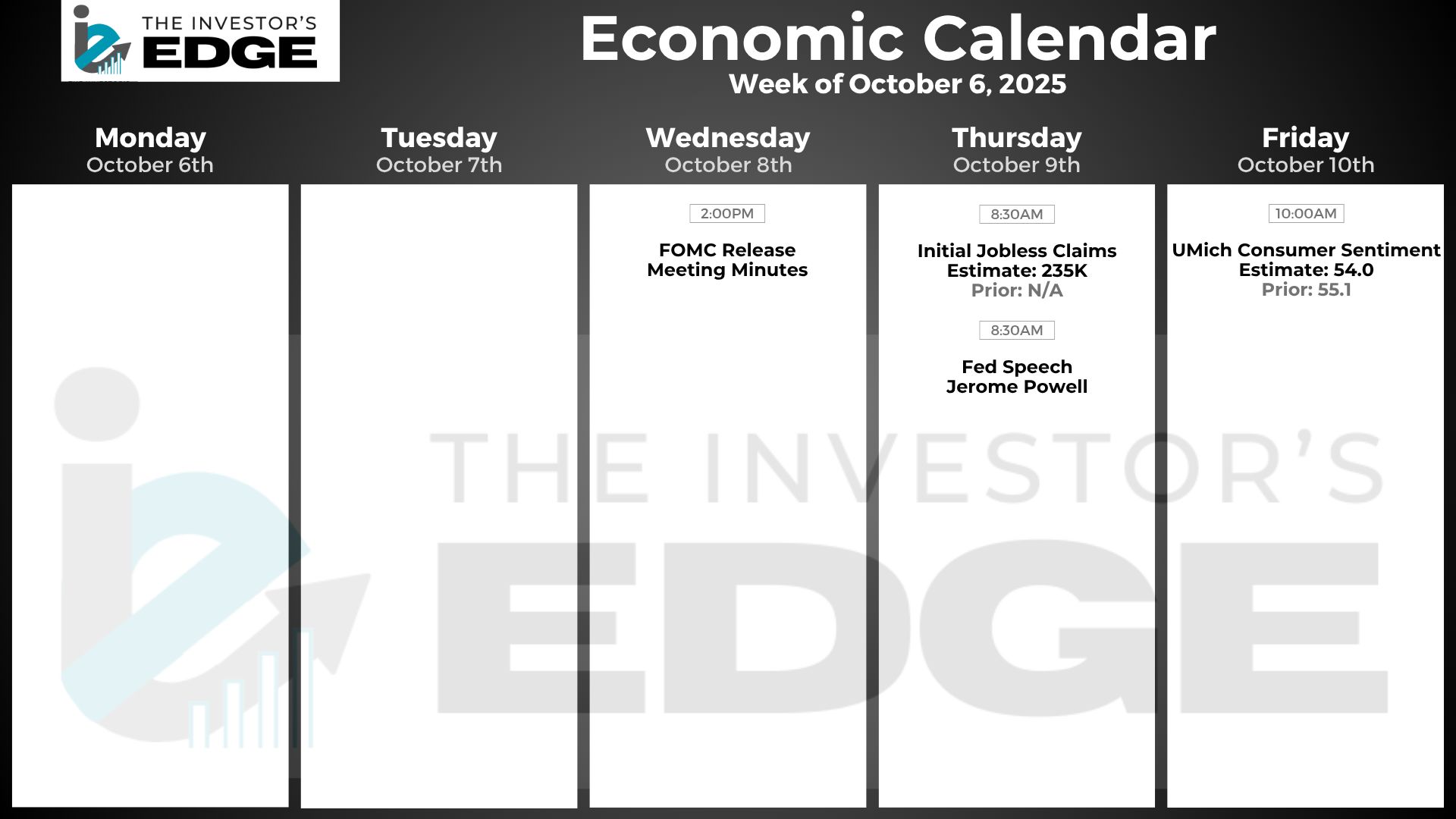

Economic Reports

Next week’s economic reports remain up in the air as long as the shutdown is in effect. We should still get the UMich consumer survey on Friday, but initial jobless claims will be held once again if the shutdown continues.

On the Fed side, we get the latest FOMC meeting minutes, as well as several speeches from Fed members throughout the week. With minimal economic data expected, Jerome Powell’s speech on Thursday morning is a must listen for investors.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.