Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of nearly 20,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

It was green across the board for the major indexes, with both the S&P 500 and Dow Jones making new all-time highs again.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

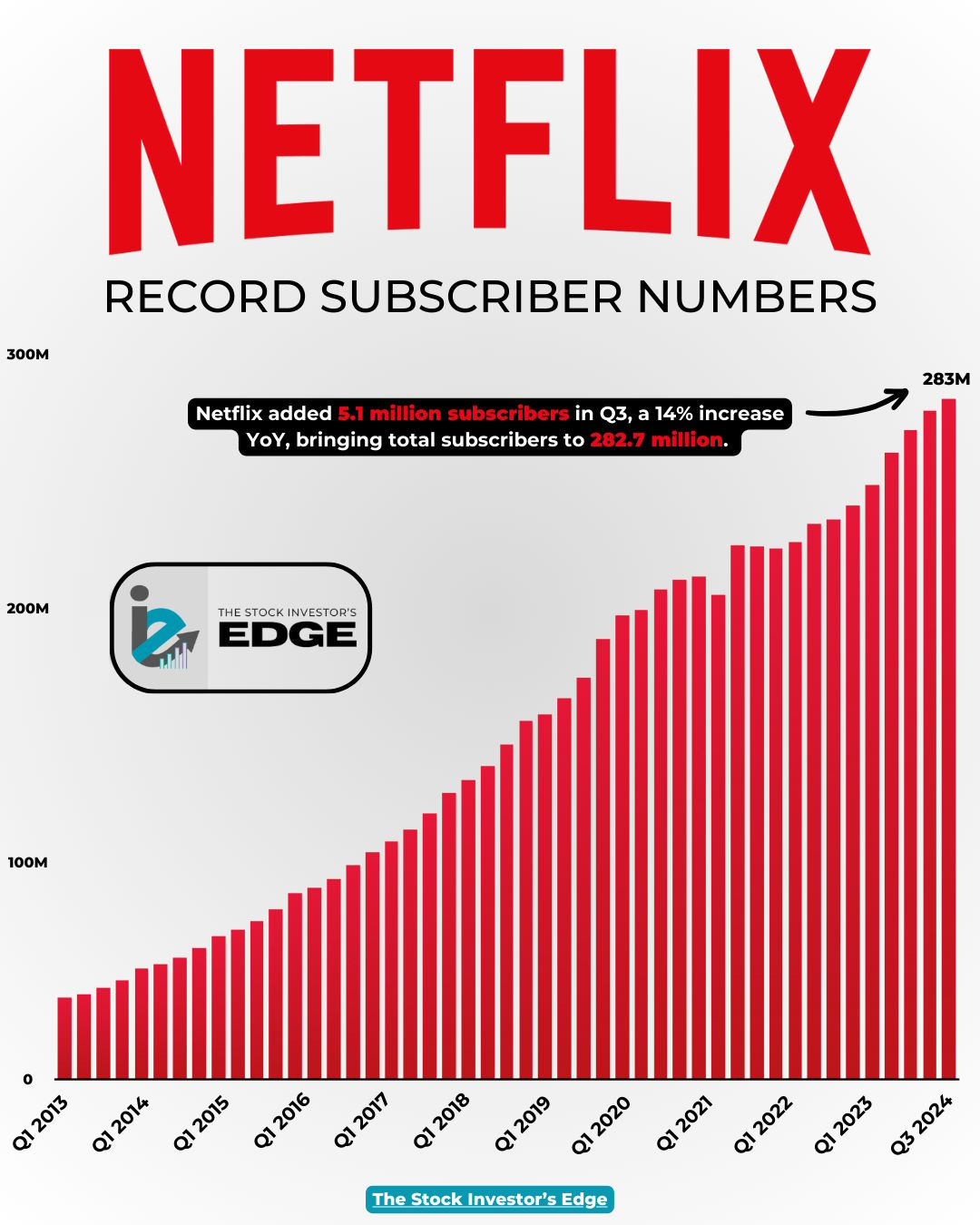

Netflix's Subscriber Growth Is Slowing, but Its Profit and Stock Price Are Still Surging

Netflix ended September with 282.7 million subscribers, significantly more than any other streaming service.

In its earnings release on Thursday, the company reported a profit of $2.36 billion, or $5.40 per share, marking a 41% increase from the previous year. Revenue grew 15% year-over-year to $9.82 billion, with management expecting the same growth rate in the fourth quarter, slightly exceeding analyst expectations.

However, Netflix’s recent subscriber growth was the slowest in over a year, signaling a shift after benefiting from its crackdown on password sharing. Since implementing this policy, Netflix added 57 million subscribers from June 2022 through June 2023.

The company also saw gains from its ad-supported service, which has started contributing to revenue, though it remains a small portion. Netflix is now focusing more on its advertising segment to further drive profits.

Netflix also announced earlier in the year that it will no longer report quarterly membership numbers starting in Q1 2025.

👉 EDGE TAKEAWAY: Netflix's decision to stop reporting subscriber numbers starting in Q1 2025 should be seen as a…upgrade to Edge+ to read the Full Edge Takeaway.

CVS replaces CEO Karen Lynch with exec David Joyner as profits, share price suffers

CVS Health replaced its CEO as it warned of another earnings shortfall, causing shares to drop 7%.

David Joyner has taken over as chief executive, replacing Karen Lynch, as the company faces ongoing challenges, including higher medical costs impacting its Aetna insurance unit and weaker consumer spending in its retail pharmacy business.

CVS had previously lowered its full-year profit outlook for three consecutive quarters and announced $2 billion in cost cuts. For Q3, CVS now expects adjusted earnings of $1.05 to $1.10 per share, with higher-than-expected medical costs.

The company will report its Q3 earnings on November 6.

📚 EDGE-UCATION: What is the "outlook" or "guidance" in earnings reports?

In earnings reports, "outlook" or "guidance" refers to the company's projections or forecasts for its financial performance in upcoming quarters or for the full fiscal year. This includes expected metrics like revenue, earnings per share (EPS), operating expenses, and other key indicators.

Guidance helps investors understand how the company expects to perform in the future, often factoring in market conditions, company initiatives, cost structures, or other external factors.

For example, a company might provide guidance on revenue growth for the next quarter or full year, indicating whether they expect to grow by a certain percentage, maintain current levels, or potentially face a decline.

Investors closely watch this guidance because it provides insight into the company's expectations and future prospects. If guidance is better than anticipated, it can boost investor confidence and push stock prices higher, while weaker guidance can have the opposite effect.

A word from our sponsor: 1440 Media

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

Meta is laying off employees at WhatsApp, Instagram, and more

Meta has begun a new round of layoffs affecting various departments, including WhatsApp, Instagram, and Reality Labs.

These cuts appear to be smaller and more targeted, coinciding with team reorganizations rather than a large companywide layoff.

According to a company spokesperson, the changes are part of Meta's strategy to align resources with long-term goals, with efforts to find new roles for impacted employees.

This follows earlier layoffs in Reality Labs and larger cuts in 2022 and 2023, as Meta continues its "year of efficiency" under CEO Mark Zuckerberg.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Edge+ members also get access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

IE+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming earnings reports and how we were preparing for them. See the latest full report here:

Stock Deep Dive - Lam Research

Our Deep Dive focused on Lam Research this week. We not only broke down the financials of the world’s second largest technology company by revenue, but we also shared our valuation models, price targets for 2024, and put the stock through our new Edge Scoring System. You can see the full analysis here:

The Week Ahead

With the S&P 500 still trading right near all-time highs, the earnings reports in the week ahead have the potential to make or break the market.

Earnings Reports

It’s officially earnings season and next week is jam pack full of major earnings. Here is the list of names we will be covering next week:

Monday 10/21: Alexandria Real Estate

Tuesday 10/22: Verizon, Lockheed Martin, 3M, and General Motors

Wednesday 10/23: Tesla, Coca-Cola, IBM, and Lam Research

Thursday 10/24: Union Pacific, UPS, L3Harris, and Tractor Supply

Friday 10/25: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

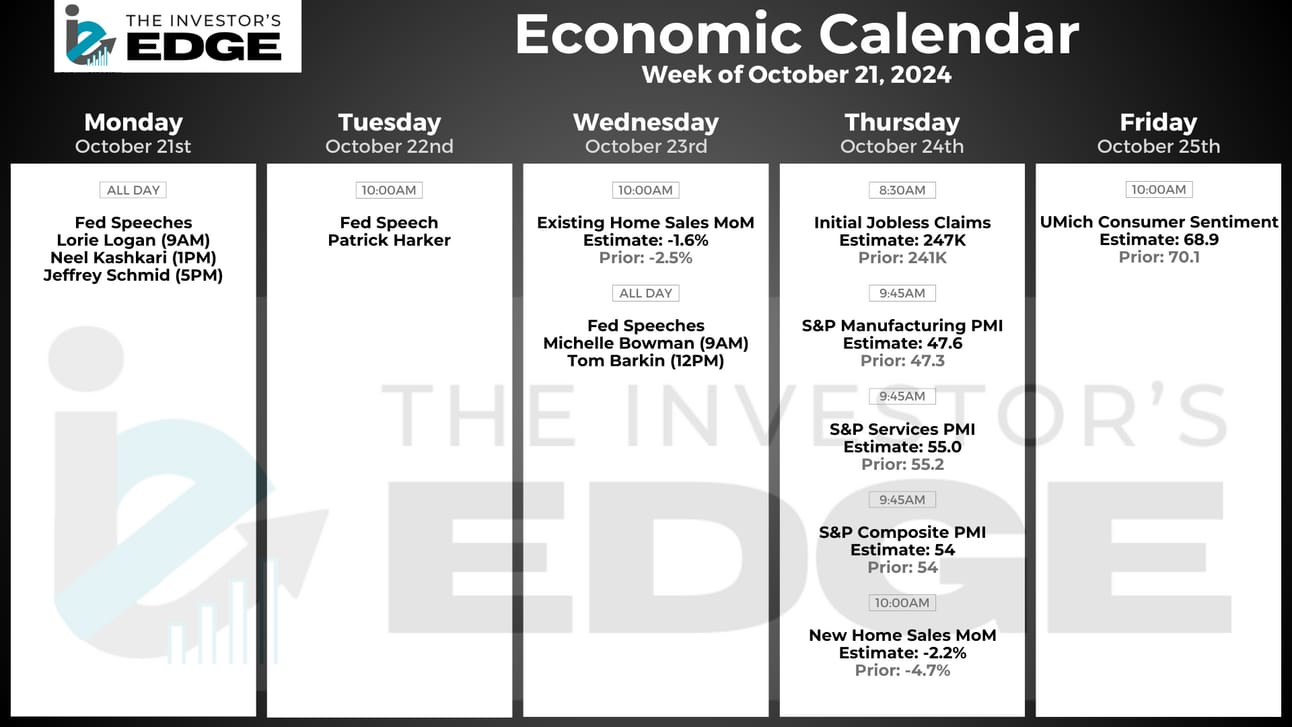

Next week is on the quieter end in terms of economic reports, but there will be initial jobless claims, housing data, consumer sentiment, and a number of speeches from Fed members.

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.