Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

All three major indexes ended the week lower, with tech leading the decline. The market is still in extreme fear, but we did recover into Friday’s close to end on a bit of a stronger note.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

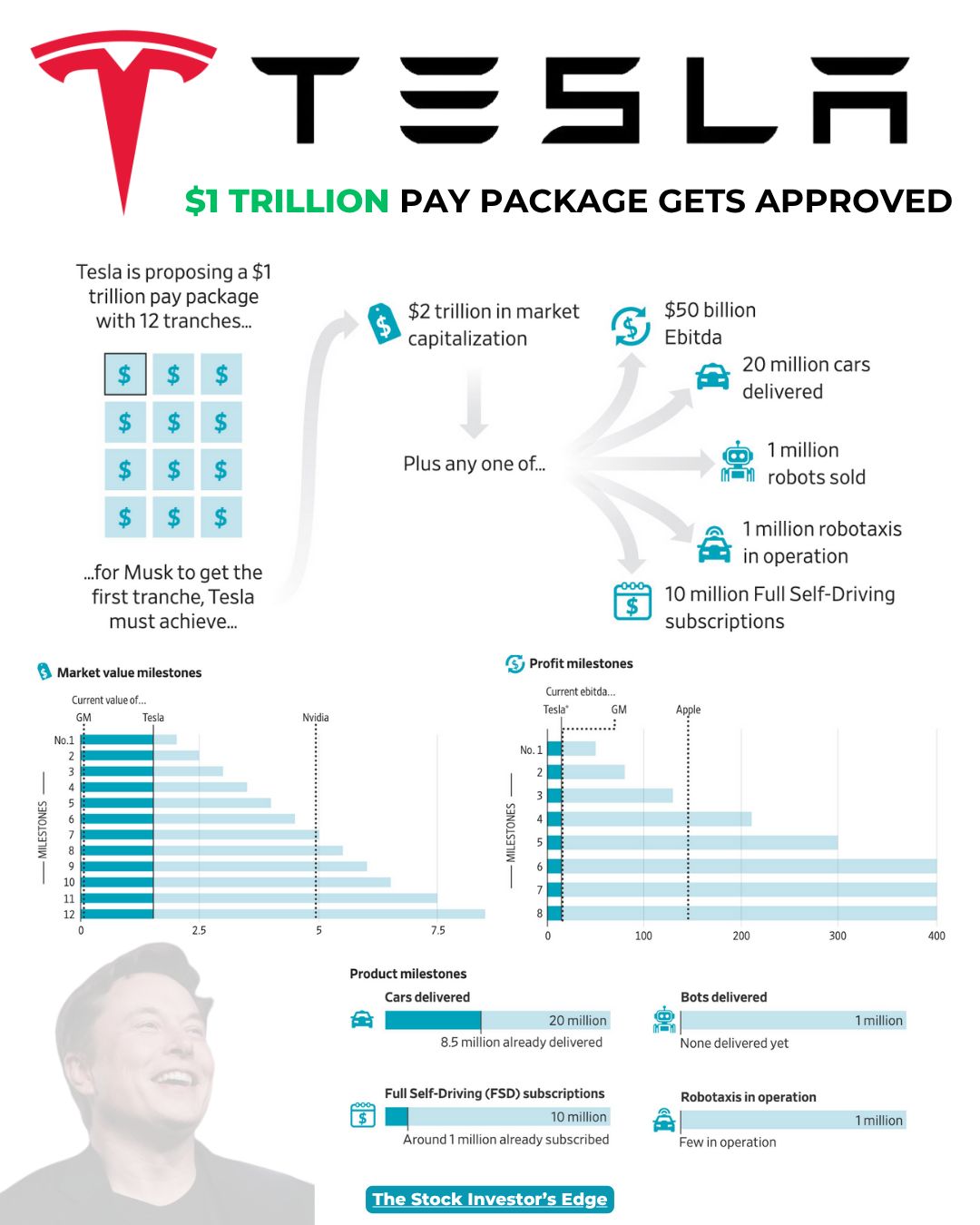

Tesla $TSLA ( ▲ 0.03% ) shareholders voted overwhelmingly to approve CEO Elon Musk’s new compensation plan, granting him potential earnings approaching $1 trillion if ambitious operational and market-cap targets are met. The proposal, endorsed by the board but opposed by top proxy advisers, gives Musk the chance to lift his ownership stake to roughly 25%.

🔑 Key Points

Shareholder approval: Roughly 75% of voting shares backed Musk’s pay package at Tesla’s annual meeting.

Massive performance goals: Payouts require Tesla’s market cap to rise from $1.5T to as high as $8.5T, mostly in $500B increments.

Operational milestones: Targets include 20M vehicle deliveries, 10M FSD subs, and 1M robotaxis and 1M Optimus bots.

Governance challenge: The package could raise Musk’s ownership from 13% to 25%, consolidating corporate control.

Governance and legal: The plan imposes no limits on political activity or minimum time at Tesla, litigation over the 2018 award continues.

👀 What You Need to Know

The record-breaking compensation package cements Musk’s dominance at Tesla while deepening investor reliance on his leadership. Achieving the listed milestones would require extraordinary expansion across manufacturing, autonomy, and robotics. Despite governance worries, shareholders clearly prioritized upside potential over structural checks. The outcome reinforces market confidence that Musk’s vision, from EVs to AI, can continue compounding value and driving Tesla’s next decade of growth.

🔐 Edge Takeaway: Despite shareholders approving the compensation plan with about 75% support, the backdrop should have triggered alarms. Investors bought into Musk’s sales pitch that AI and robotics will fix everything, ignoring the fact that margins are collapsing and growth has stalled. Given…upgrade to Edge+ to read the Full Edge Takeaway.

October layoffs in US spike to highest level in over two decades

Layoff announcements soared last month as companies recalibrated hiring amid the AI boom and slowing growth. Employers announced 153,074 job cuts in October, a 183% jump from September and 175% higher than a year ago. It’s the clearest sign yet that cost pressures and automation are prompting firms to pull back after years of aggressive hiring.

🔑 Key Points

Tech sector: Led all industries with more than 33,000 announced cuts tied to AI restructuring.

Cost discipline: Companies cite cost reduction and automation as primary layoff drivers.

Historical scale: The worst October for job cuts since 2003, tracking over one million this year.

Data blackout: With the shutdown halting official releases, private reports carry added weight.

Fed angle: Mounting layoffs add pressure for another rate cut at the December meeting.

👀 What You Need to Know

October’s spike in planned job cuts signals growing caution from corporate leaders, particularly in tech and consumer sectors adjusting to automation and weaker demand. While announced cuts can overstate near-term impact, they hint at a broader slowdown in hiring momentum heading into winter. The Fed’s recent rate cuts aim to cushion this trend, but if employment softens further, expectations for deeper policy easing will likely intensify.

🔐 Edge Takeaway: The spike to 153,000 announced layoffs in October marks a turning point for both the labor cycle and market psychology. Companies…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: What Is the Challenger Report?

The Challenger Report, published the first week of each month by outplacement firm Challenger, Gray & Christmas, tracks announced job cuts across US companies. It’s one of the earliest reads on corporate confidence and hiring trends, often signaling where the labor market is heading before government data catches up.

Early signal: Measures announced layoffs, giving investors a first look at corporate sentiment each month.

Scope: Breaks down job cuts by sector and reason, including cost control, restructuring, automation, or market slowdown.

Volatility: Data can swing sharply month to month since it captures plans, not actual separations.

Investor relevance: Rising cuts usually point to weaker labor demand, softer spending, and margin pressure ahead.

When job-cut announcements accelerate, it’s often the first crack in economic momentum and an early cue for investors to watch how earnings and policy expectations shift next.

Sponsored by RAD Intel

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

Now open at $0.81/share, allocations limited – price moves on 11/20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Q3 Earnings Season: This Week’s Roundup

Several major names reported this week, with results mixed across the board. While most companies beat on revenue, earnings came in light for several high-growth names as spending, investments, and promotional costs weighed on margins. Guidance was generally cautious, with management teams emphasizing longer-term growth initiatives over near-term profitability.

Airbnb $ABNB ( ▲ 1.65% ) posted a slight EPS miss but beat on revenue with strong booking momentum.

EPS: $2.21 vs $2.31 est.

Revenue: $4.10B vs $4.08B est.

Highlights: GBV $22.9B +14% YoY, Nights and Experiences 133.6M +9% YoY, record adj. EBITDA ~$2.0B at ~50% margin, Q4 revenue guide $2.66-$2.72B.

Robinhood $HOOD ( ▲ 0.61% ) delivered a clean beat on crypto strength and record deposits.

EPS: $0.61 vs $0.54 est.

Revenue: $1.27B vs $1.21B est.

Highlights: Record net deposits $20.4B LTM, Gold subscribers ~3.9M, broad share gains in equities, options, and crypto.

Block $XYZ ( ▲ 0.62% ) missed on both lines but grew gross profit and raised outlook metrics.

EPS: $0.54 vs $0.64 est.

Revenue: $6.11B vs $6.31B est.

Highlights: Gross profit +18% YoY to $2.66B, Cash App gross profit +24% to $1.62B, BNPL GMV $9.7B +17% YoY, FY gross profit guide lifted.

AppLovin $APP ( ▲ 1.62% ) beat across the board with standout AI-driven ad performance.

EPS: $2.45 vs $2.38 est.

Revenue: $1.41B vs $1.34B est.

Highlights: Adj. EBITDA $1.16B, FCF ~$1.05B, buyback authorization raised by $3.2B, Q4 revenue guide $1.57-$1.60B.

DoorDash $DASH ( ▲ 0.06% ) beat on revenue, missed on EPS, and outlined heavier 2026 investment.

EPS: $0.55 vs $0.68 est.

Revenue: $3.45B vs $3.35B

Highlights: Orders +21% to ~776M, GOV +25% to ~$25B, Q4 GOV guide raised, 2026 spend to build unified global tech platform and autonomy, near-term margin pressure.

🔐 Edge Takeaway: Q3 is proving resilient with about 80% of reporting companies beating EPS and roughly 77% topping revenue estimates, yet…upgrade to Edge+ to read the Full Edge Takeaway.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed our thoughts on what to expect in the month of November, as well as the packed week of earnings ahead. See the latest full report here:

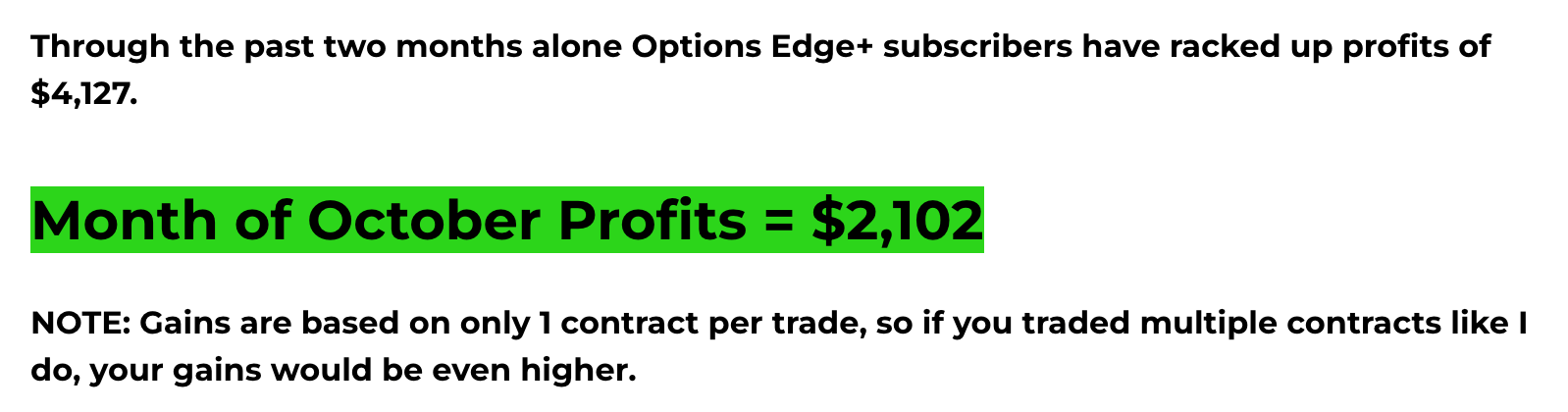

Weekly Options Recap

This report is a breakdown of every options trade we made this week—what we opened, what we closed, and how our open trades are performing. Each edition gives you full transparency on our strategy, including entry points, premiums collected or paid, trade rationale, and risk/reward setups. Here is how we did in October:

See this week’s recap:

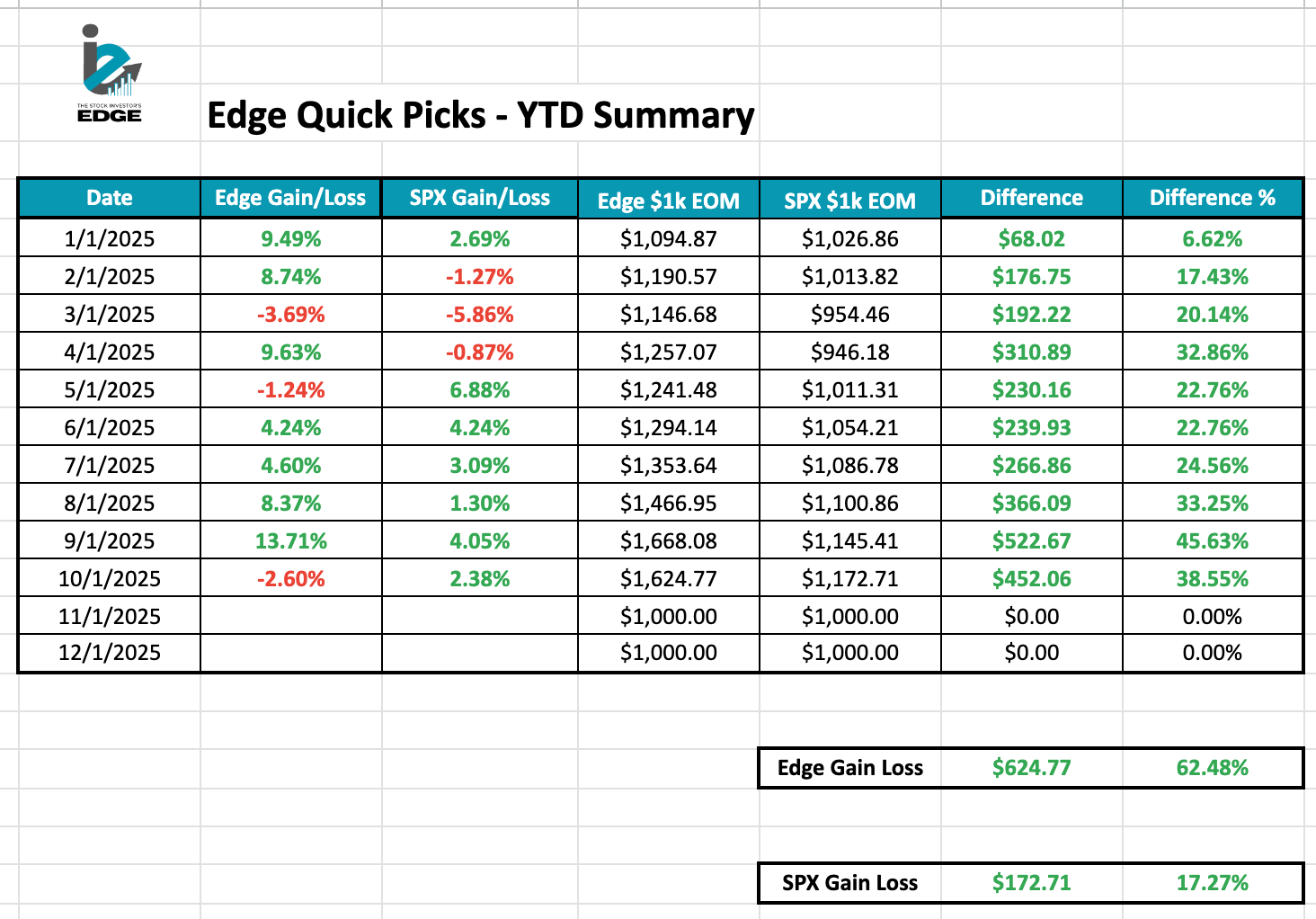

Edge Quick Picks

Every month we break down 5 stocks that we believe are attractive from a valuation perspective right now. Here’s a look at how we’ve performed so far this year:

See the 5 stocks we are buying in November:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Palantir, AMD, Uber, and many more. See this week’s recap:

The Week Ahead

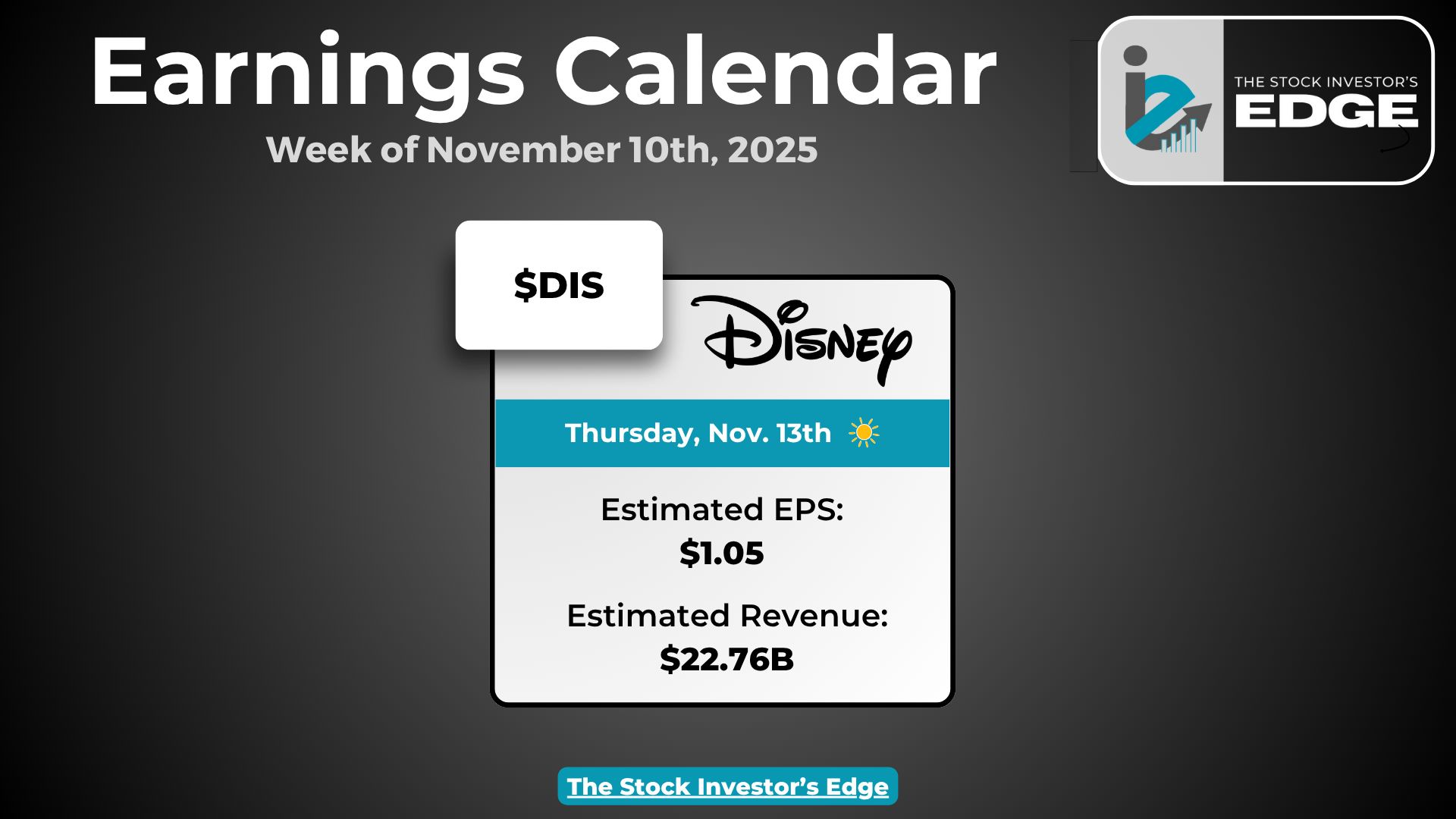

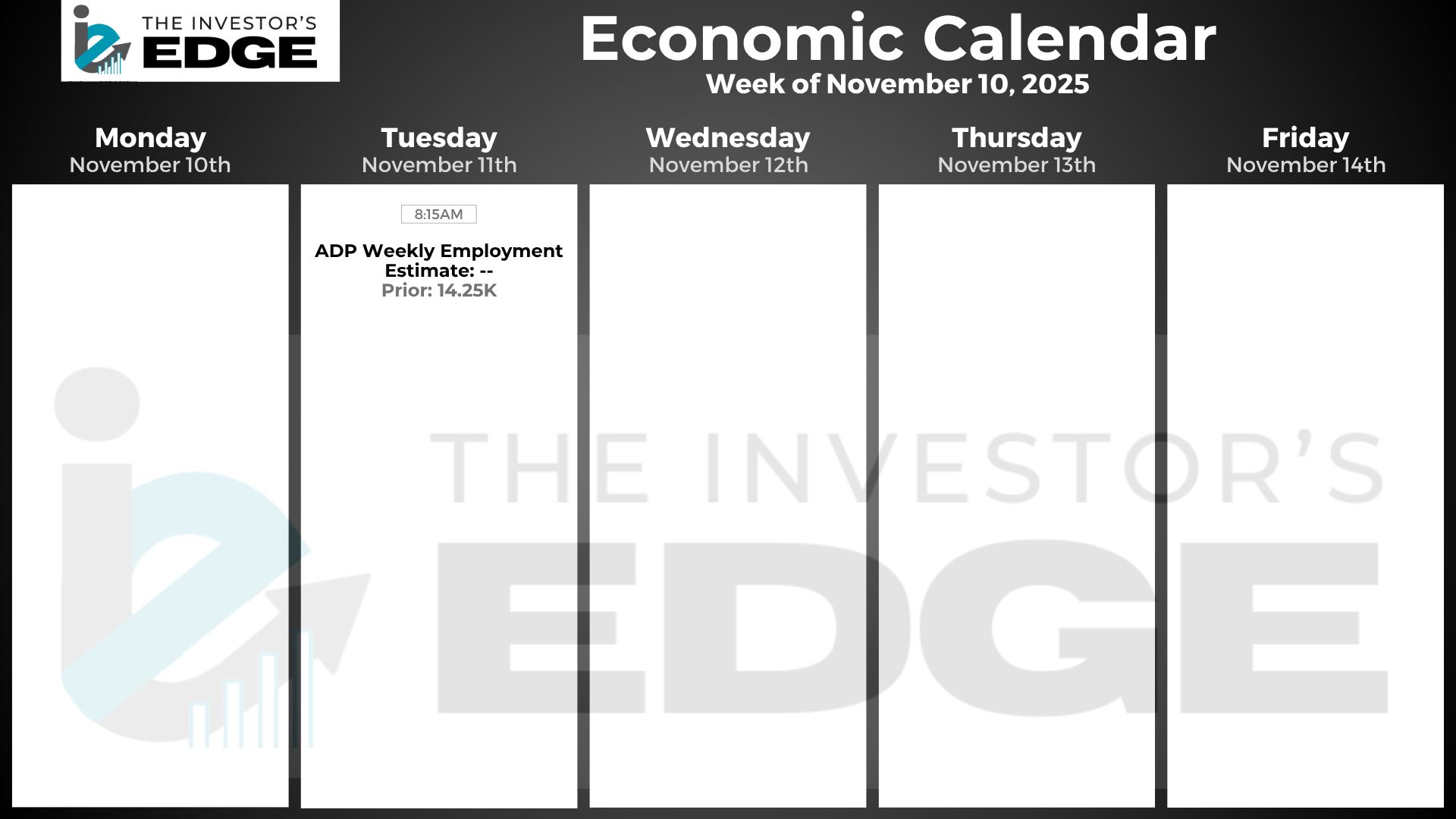

Coming off a volatile week, markets get a brief breather in terms of data with only Disney’s earnings in focus and only the ADP weekly employment report expected amid the shutdown.

Earnings Reports

We get a bit of a break in the earnings season next week with only one company we cover set to report:

Monday 11/10: --

Tuesday 11/11: --

Wednesday 11/12: --

Thursday 11/13: Disney

Friday 11/14: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

As we enter another week of the government shutdown, economic data releases remain limited. ADP has begun publishing a new weekly employment report to fill the gap, and next week will bring its second ever release. But that is the only report on the calendar.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.