Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 23,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

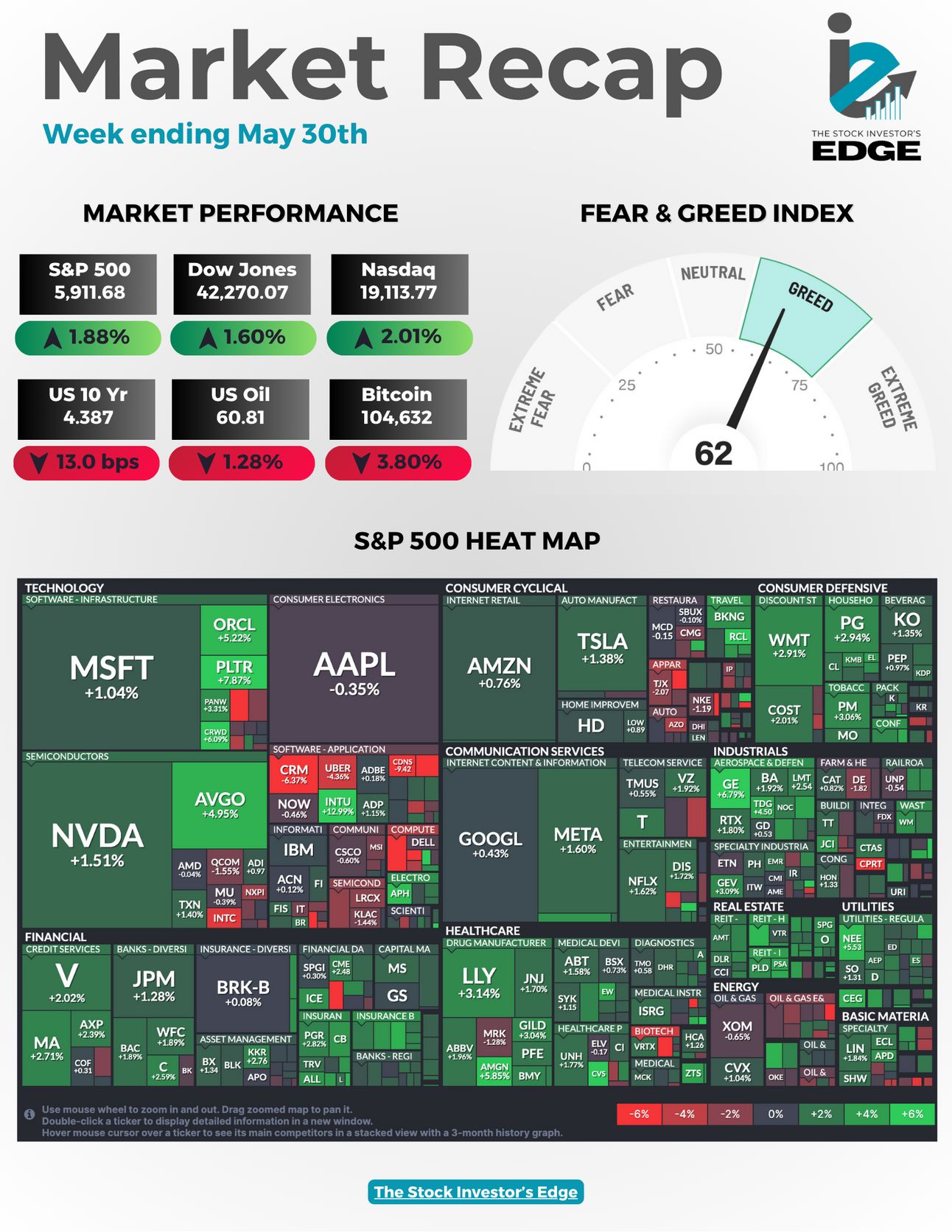

The major indexes all ended the week higher despite all the back on forth on tariff news.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Trade truce at risk: tariff tensions roar back

President Trump reignited trade tensions this week, accusing China of violating the May 12 tariff truce and threatening retaliation. U.S. officials echoed these concerns, citing stalled negotiations and China's failure to ease restrictions on rare earth exports. The situation intensified as a federal court ruled that Trump's sweeping tariffs exceeded his authority, casting doubt on the administration's trade strategy, though an appeals court has temporarily paused the ruling.

🔑 Key Points

Trump accuses China of breaching the May 12 tariff truce, threatening renewed trade penalties.

U.S. officials report stalled negotiations and China's failure to ease rare earth export restrictions.

Visa restrictions on Chinese students add fuel to the geopolitical fire.

A federal court ruled that Trump's sweeping tariffs exceeded his authority, though an appeals court has temporarily paused the lower court ruling.

The "TACO trade (“Trump Always Chickens Out”) gains traction on Wall Street, reflecting a pattern of market dips on tariff threats and rebounds when Trump retreats.

👀 What You Need to Know

Markets are bracing for renewed volatility as U.S.-China trade tensions escalate. While the "TACO trade" pattern has provided short-term gains for some investors, the underlying uncertainty in trade policy poses risks to global supply chains and economic stability. Investors should stay informed and consider diversifying portfolios to mitigate potential disruptions.

🔐 Edge Takeaway: All of this tariff drama is exhausting from an investor’s standpoint. Just when…upgrade to Edge+ to read the Full Edge Takeaway.

Nvidia beats Q1 expectations but faces China headwinds

Nvidia delivered another strong quarter, with Q1 revenue surging 69% YoY to $44.06B and EPS jumping 33% to $0.81, both beating reduced Wall Street estimates. Data center revenue hit a staggering $39.1B (+73% YoY), fueled by explosive demand from cloud giants for Nvidia’s new Blackwell chips. Management did reveal $2.5B in lost revenue due to U.S. export restrictions on China, and warned that Q2 is expected to be ~$8B lighter due to the same issue.

🔑 Key Points

Revenue of $44.06B (+69% YoY) beat estimates by 1.76%; EPS of $0.81 beat by 10.96%.

Data center revenue grew to $39.1B (+73%), with Blackwell GPUs making up ~70%.

U.S. chip export restrictions cost ~$2.5B in Q1 sales and will shave ~$8B from Q2.

Operating cash flow reached $27.4B (+79% YoY), free cash flow hit $26.1B.

Nvidia repurchased $14.1B in shares; H20 chips face $4.5B in regulatory charges.

👀 What You Need to Know

Nvidia is firing on all cylinders operationally, with record data center growth and robust demand for its latest AI chips, but the export drama with China is becoming a real drag on future growth. Q2 guidance of $45B in revenue is solid, but still shadowed by $8B in sales Nvidia would have seen from China. CEO Jensen Huang was blunt saying China represents a $50B opportunity that’s slipping away. As Nvidia leans into inference workloads and rolls out Blackwell Ultra, the core AI thesis remains strong, but geopolitical clarity will be key to unlocking its full potential.

📊 Edge Tools: Here’s a look at Nvidia’s Edge Score - the growth projections continue to impress even with the China impacts, though the stock does trade at a premium:

Nvidia’s Strength Indicator shows big money has been selling into strength with the recent rally.

Want access to these tools? Join the Edge+ community today!

Sponsored by Pacaso

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Inflation stalls, but tariff risks remain

April's PCE data showed inflation essentially flat, with both headline and core rising just 0.1% month-over-month, right in line with expectations. On a yearly basis, headline cooled to 2.1% while core dipped to 2.5%, the lowest in months. Consumer spending slowed to +0.2% and savings rose, reflecting a more cautious mood. While markets welcomed the print, economists are warning that the real inflation story may be delayed, as Trump’s latest round of tariffs has yet to work its way into prices.

🔑 Key Points

Headline PCE: +0.1% MoM (vs. +0.1% est.); +2.1% YoY (vs. +2.2% est.)

Core PCE: +0.1% MoM (in line); +2.5% YoY (vs. 2.6% prior)

Personal income jumped 0.8%; spending slowed to +0.2% from 0.7%

Food prices -0.3%, energy +0.5%, shelter +0.4% (still sticky)

Personal savings rate climbed to 4.9%, signaling more cautious consumers

👀 What You Need to Know

Inflation may be trending in the right direction, but the market can’t fully relax. The muted April print hasn’t yet absorbed the potential price pressure from Trump’s latest tariffs, especially on core goods, and if passed through, that could reverse recent progress. Add in slowing consumer momentum and the Fed finds itself stuck between weak demand and rising costs. Until there’s clarity on trade policy and inflation stickiness, rate cut hopes should remain tempered.

📚 Edge-ucation: Why does the Fed prefer PCE over CPI?

The Fed favors the Personal Consumption Expenditures (PCE) index over the Consumer Price Index (CPI) for one key reason: it gives a more complete and flexible view of consumer behavior.

Unlike CPI, which uses a fixed basket of goods, PCE adjusts over time to reflect how consumers actually shift their spending, like switching from steak to chicken when meat prices rise.

It also captures a broader range of expenditures, including healthcare costs paid by employers or the government, making it more reflective of the overall economy.

PCE also tends to run slightly lower and smoother than CPI, which helps the Fed avoid overreacting to short-term price swings.

Bottom line: PCE offers a more nuanced and policy-relevant snapshot of inflation trends, which is why it’s the Fed’s go-to gauge.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed Nvidia’s earnings, the upcoming inflation report, and the return of tariff headlines. See the latest full report here:

The Options Edge Report

This week we dropped the latest Edge Options Report for our members—packed with actionable insights and options strategies. We broke down a play on LLY following its recent weakness. See the latest report here:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Nvidia, Costco, Salesforce, Ulta Beauty and Dick’s Sporting Goods. See this week’s recap:

The Week Ahead

The labor market will be in focus next week and both the Fed and market will be watching the data closely as the next interest rate decision approaches. We also get a number of earnings reports that will give us further insights into the consumer and potential tariff impacts.

Earnings Reports

Earnings season may be winding down but there are still several names we cover here at Edge on the calendar next week, including three retailers, a major chip company and a leading cybersecurity stock. Here is the list of names we will be covering:

Monday 6/2: --

Tuesday 6/3: CrowdStrike and Dollar General

Wednesday 6/4: Dollar Tree

Thursday 6/5: Broadcom and Lululemon

Friday 6/6: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week is all about the labor market as nonfarm payrolls, unemployment, JOLTs, ADP employment and initial jobless claims are all on the calendar. We will also get manufacturing and services PMI.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.