Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 22,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

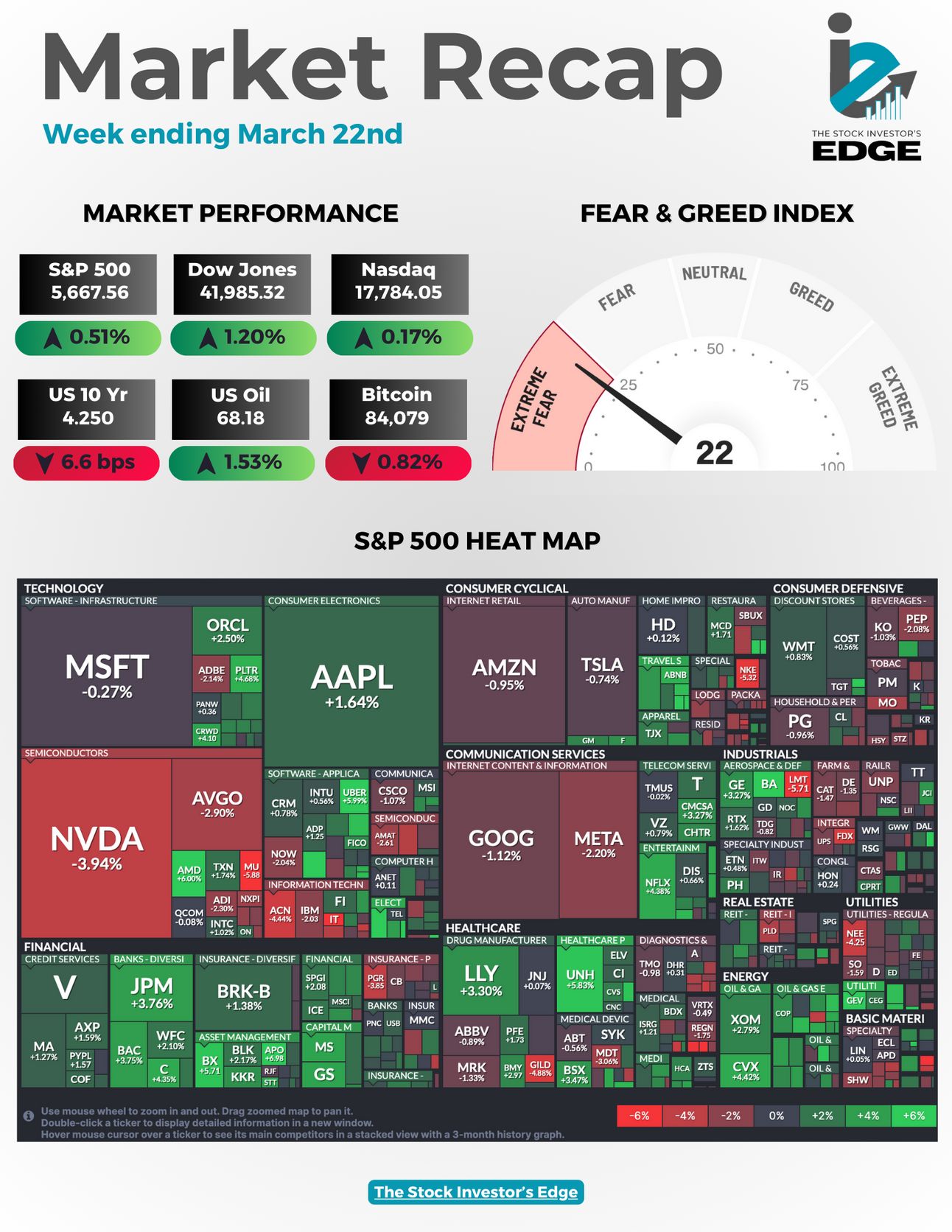

All three major indexes ended the week green even though the MAG7 names continue to underperform the rest of the market.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Wall Street stalls on tariff woes; Micron, Nike and FedEx all slide after bleak forecasts

U.S. markets ended the week flat as tariff concerns and economic uncertainty continued to weigh on investor sentiment.

FedEx slashed its annual outlook, dropping 10.9%, while UPS lost 3.3%, dragging the Dow Jones Transport Index down 2.1%—now over 19% off its November high.

Nike tumbled 8.4% on weaker Q4 revenue guidance due to tariffs, and Micron fell 7.3% after forecasting lower gross margins and warning of potential tariff impacts.

Persistent trade war fears continue to cloud the economic outlook as investors await details on President Trump’s expected tariff measures in April.

See the full earnings summaries our takeaways from these three names in this week’s Earnings Recap.

👉 EDGE TAKEAWAY: Tariffs continue to be a major source of market uncertainty, with a sharp uptick in…upgrade to Edge+ to read the Full Edge Takeaway.

Trump awards Boeing much-needed win with F-47 fighter jet contract

President Trump has awarded Boeing a major $20+ billion contract to build the U.S. Air Force's next-generation fighter jet, the F-47, under the Next Generation Air Dominance (NGAD) program, replacing Lockheed Martin’s F-22.

The F-47 will feature advanced stealth, longer range, and better adaptability to future threats, and could generate hundreds of billions in lifetime orders. This marks a major turnaround for Boeing, whose commercial and defense divisions have struggled with cost overruns, production issues, and regulatory scrutiny.

The victory is a major boost for Boeing’s St. Louis-based fighter jet unit and may help restore confidence after high-profile setbacks like the 737 MAX issues and losses on defense contracts.

Boeing's shares rose nearly 5% on the news, while Lockheed fell nearly 7% after losing the bid.

📚 EDGE-UCATION: What is the F-47?

The F-47 is a newly announced, next-generation fighter jet that will serve as the centerpiece of a future "family of systems" that includes manned aircraft operating alongside drones.

Here’s what’s currently known about the F-47:

Role: 6th-generation crewed fighter jet.

Capabilities (based on Air Force statements):

Advanced stealth technology.

Significantly longer range than current fighters.

Enhanced adaptability to future threats.

Superior sustainability and supportability.

Cost & Scale: The initial engineering and manufacturing development contract is valued at over $20 billion, with lifetime orders potentially worth hundreds of billions of dollars.

Secrecy: Specifics of the design remain classified, but it will likely include cutting-edge sensors, engines, and stealth capabilities.

Strategic Importance: It’s intended to counter threats from China and Russia in future air combat scenarios.

The F-47 marks a significant win for Boeing, especially as it tries to recover from ongoing commercial and defense-sector challenges. The announcement was made by President Trump, who also gave the aircraft its name—F-47, aligning with his status as the 47th U.S. president.

46,000 Cybertrucks recalled for safety issue, Tesla trade ins record high

Tesla is facing a wave of consumer backlash and brand erosion as Elon Musk enters his second month in the White House as head of the Department of Government Efficiency under the Trump administration.

According to Edmunds, Tesla owners are trading in their EVs at record levels, often for rival brands, signaling a sharp decline in brand loyalty. Tesla shopping interest on Edmunds' platform has also plunged to its lowest since 2022.

Protests, vandalism, and growing competition from Ford, Chevrolet, and Volkswagen are compounding the pressure, as Tesla’s U.S. sales drop and public sentiment sours.

Meanwhile, Tesla has recalled over 46,000 Cybertrucks—the eighth recall since January—due to a defect that could cause an exterior panel to detach while driving.

The company’s stock has fallen 42% this year, reversing gains made after Trump’s November victory, as Musk’s controversial political role continues to spark legal challenges and public outrage.

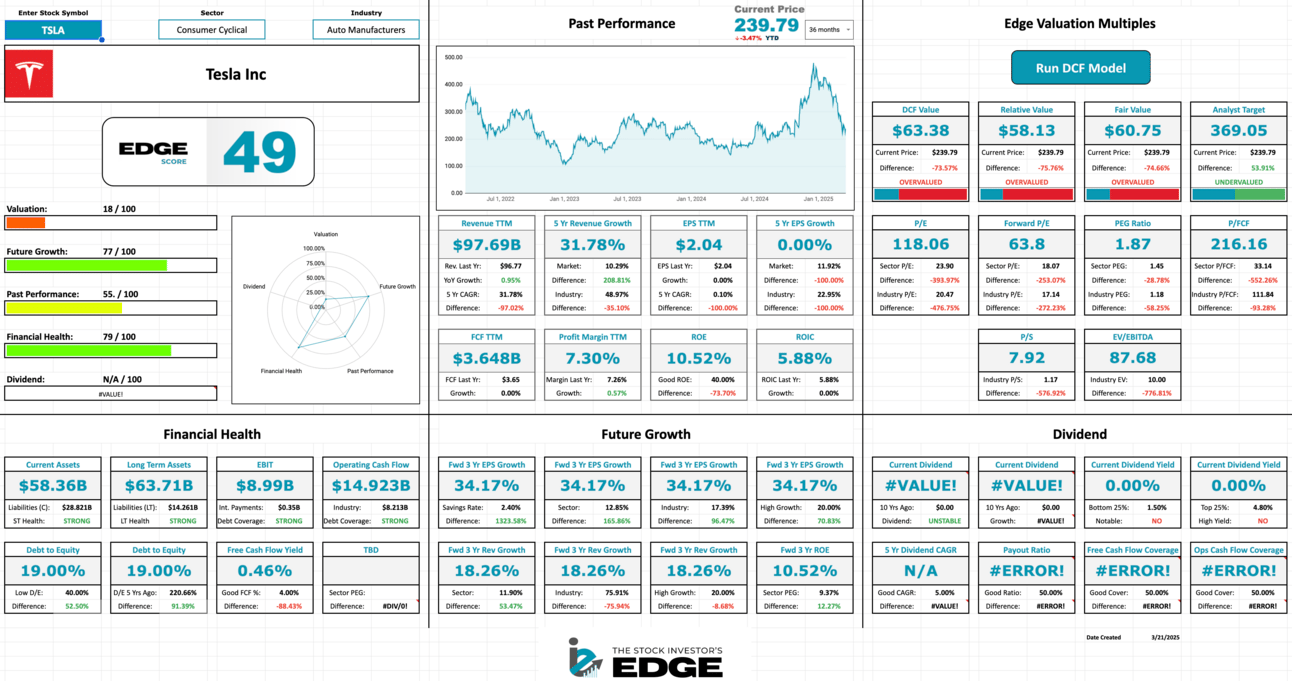

📊 EDGE SCORE: Here’s a look at Tesla’s Edge Score - I (Chris) have been clear on my stance on Musk/Tesla but I will let the numbers speak for themselves:

Want access to your own Edge Scores? Upgrade to Edge+ today!

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the Fed rate decision ahead, as well as the upcoming earnings. See the latest full report here:

The Options Edge Report

This week, we dropped the latest Edge Options Report for our members—packed with actionable insights and options strategies. This week we discussed a trade that focused on Uber. See the latest report here:

Stock Deep Dive - AMD

Our Deep Dive focused on AMD this week. We not only broke down the financials of one of the largest chip companies in the world, but we also shared our valuation models, price targets for 2025, and put the stock through our Edge Scoring System. You can see the full analysis here:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Micron, Nike, and FedEx. See this week’s recap:

The Week Ahead

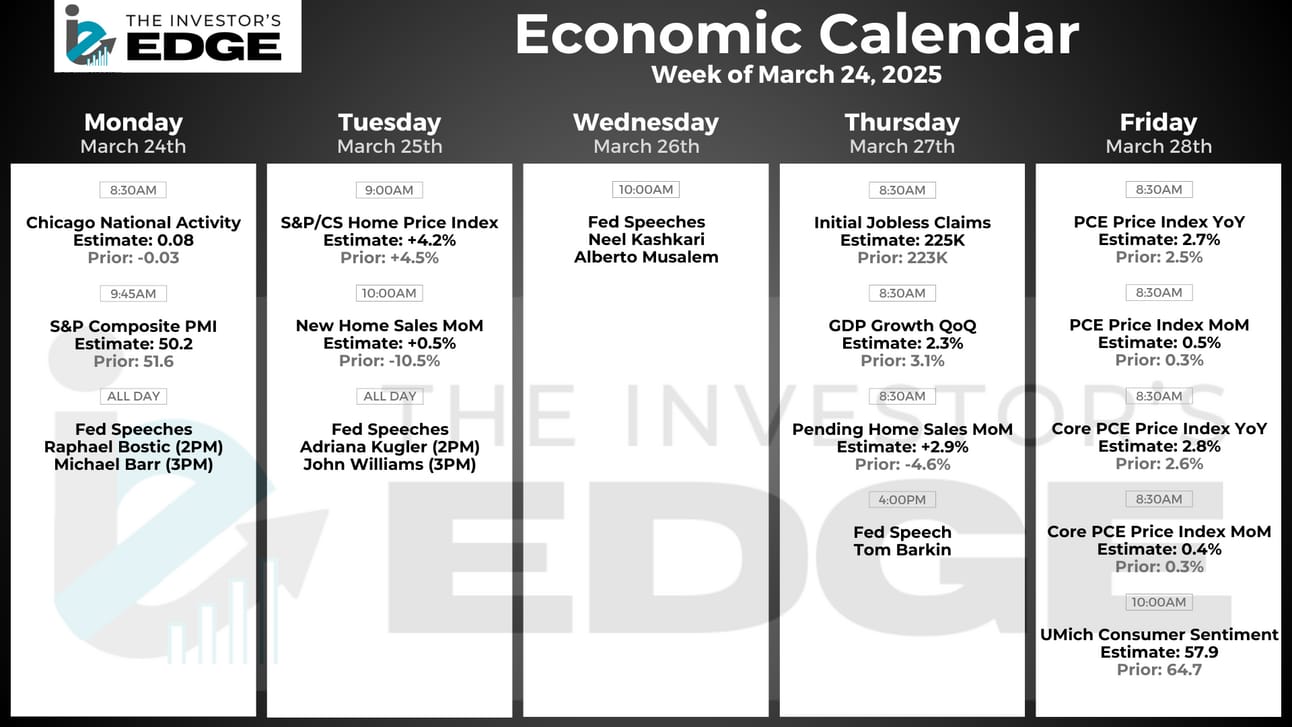

Next week is all about key economic data as it’s a quiet week on the earnings front — the main report being the Fed’s preferred inflation metric on Friday.

Earnings Reports

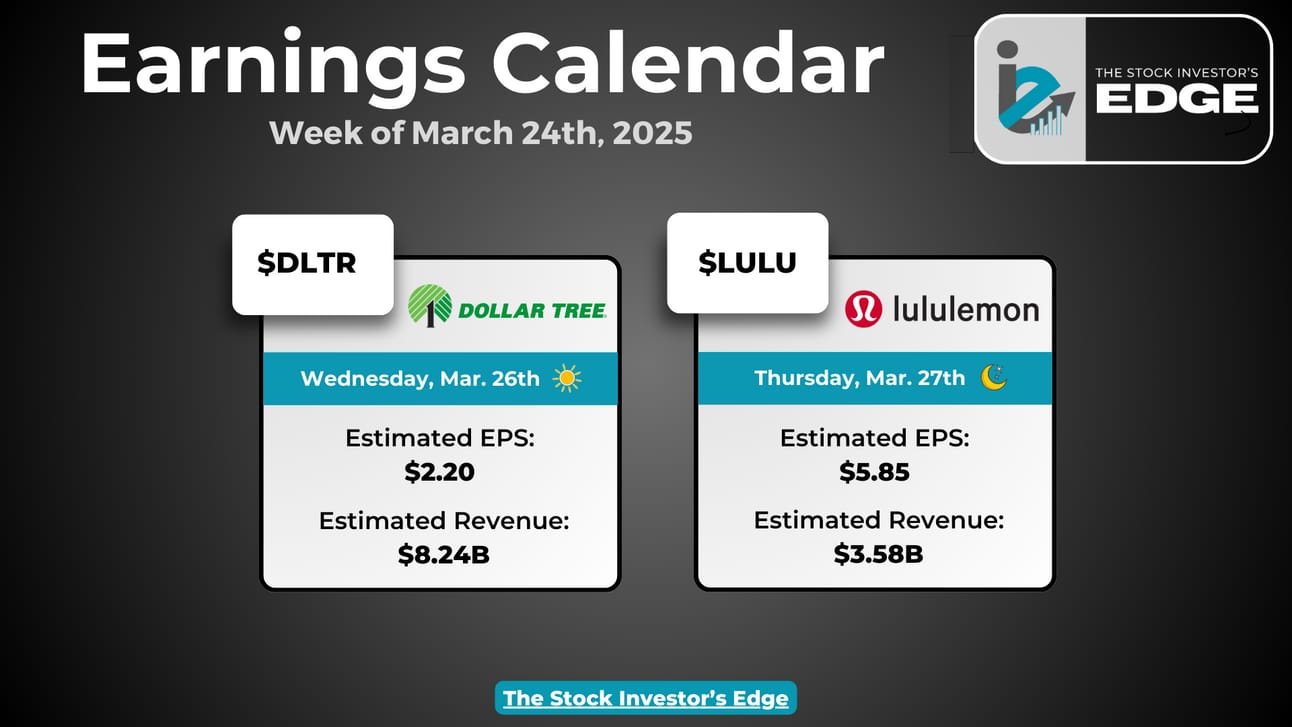

Earnings season is pretty much over, but there are some companies that still need to report. Here is the list of names we will be covering next week:

Monday 3/24: --

Tuesday 3/25: --

Wednesday 3/26: Dollar Tree

Thursday 3/27: Lululemon

Friday 3/28: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week’s PCE inflation report will be the main catalyst on the economic news front.

We also get initial jobless claims, GDP, housing data, and several Fed speeches.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.