Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 24,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Edge Announcement

🚨 4TH OF JULY SALE - 25% OFF ALL MEMBERSHIPS 🚨

Independence Day is about freedom — and this week, it’s about financial freedom too.

🔥 25% OFF all Edge premium tiers for a limited time – Ultimate Edge, Edge+, Options Edge+, and Quick Picks. This is your chance to upgrade and get exclusive access to research, trade alerts, earnings breakdowns, and more at the lowest price of the year.

Upgrade to Edge+ now — join today and immediately get access to all of the premium content for a fraction of the price. Your portfolio will thank you. 👇

Market Talk

The S&P 500 and Nasdaq both made new record highs again this week as stocks continue their upward momentum over the last few weeks.

3 Stories Moving the Market

These are some of the biggest stories from this week that had an influence on market action.

U.S. payrolls increased by 147,000 in June, more than expected

The U.S. added 147,000 jobs in June, outpacing expectations as state and local government hiring led the gains. Unemployment dipped to 4.1%, but the drop came from shrinking labor force participation. Wage growth remained soft at 0.2% MoM, reducing inflation pressure. Still, the report was firm enough to push July rate cut odds near zero.

🔑 Key Points

Jobs Beat Forecasts: Nonfarm payrolls rose 147K in June, topping estimates and landing almost exactly in line with the 2024 average of 146K.

Government-Led Gains: Public sector jobs added 73K—half the total—with 40K coming from education; federal employment declined 7K.

Labor Force Shrinks: The participation rate dropped to 62.3% as 329K left the labor force, masking softer underlying job market trends.

Wages Stay Contained: Average hourly earnings rose 0.2% MoM and 3.7% YoY, pointing to minimal wage-driven inflation risk.

Cut Odds Collapse: Fed rate cut odds for July fell from 24% to under 5%, with traders now leaning heavily toward September.

👀 What You Need to Know

Beneath the solid headline, June’s job gains were unusually narrow, driven by government and health care, while participation dropped again. That mix reinforces a labor market that’s steady but fragile. Importantly, it's not weak enough to justify a July cut, and markets swiftly repriced. Unless upcoming CPI surprises, the Fed will most likely stay sidelined until September.

🔐 Edge Takeaway: The Federal Reserve has stuck to its guns and been vindicated. Faced with political heat from Trump, social media posts saying “Too Late Jerome Powell should resign immediately!!!”, Powell and the Fed have…upgrade to Edge+ to read the Full Edge Takeaway.

Apple Eyes Outside AI as China Sales Finally Rebound

Apple $AAPL ( ▼ 0.31% ) is reportedly exploring OpenAI and Anthropic models to power a new Siri, after internal delays and leadership changes derailed its AI push. Meanwhile, iPhone sales in China rose 8% YoY in Q2, the first growth in two years, boosted by aggressive discounts ahead of the 618 shopping festival. Both developments point to a more pragmatic, adaptive Apple under pressure to show progress on key fronts.

🔑 Key Points

Third-Party AI Talks: Apple is in discussions with OpenAI and Anthropic to run their models on Apple’s cloud for a potential Siri overhaul.

Leadership Overhaul: Tim Cook replaced AI lead John Giannandrea with Mike Rockwell after internal delays eroded confidence in Siri’s progress.

Modest WWDC Rollout: Apple stuck to practical AI features like call translation, falling short of the broad generative AI push by rivals.

China Sales Rebound: iPhone sales in China rose 8% YoY in Q2, aided by discounts and trade-ins timed around the 618 shopping festival.

Huawei Still Leads: Huawei maintained top market share, but Apple’s rebound shows it can still compete through pricing and brand loyalty.

👀 What You Need to Know

Apple’s pivot to outside AI models underscores how far behind it’s fallen in the LLM race despite its edge in hardware integration and privacy. Outsourcing core AI to OpenAI or Anthropic would have been unthinkable a year ago but now signals real pressure to catch up. Meanwhile, China iPhone sales are growing again, but the rebound was driven by discounts, not demand. Apple is playing defense on two fronts, and the stakes are only rising.

🔐 Edge Takeaway: Apple’s core growth dynamics have clearly slowed. iPhone revenue is…upgrade to Edge+ to read the Full Edge Takeaway.

📚 Edge-ucation: This section just got an upgrade!

We usually drop a lesson here in the newsletter, but now there’s a whole library.

The new Edge-ucation Hub is live, giving you on-demand access to our full collection of strategy explainers, indicators, and actionable insights.

You’ll still get fresh content in your weekly updates going forward, but now you don’t have to wait.

Microsoft’s AI Outperforms Doctors as Layoffs Underscore the Cost

Microsoft $MSFT ( ▲ 1.07% ) unveiled a major milestone in healthcare AI, announcing that its new Diagnostic Orchestrator, powered by leading LLMs including OpenAI’s GPT-4o, correctly diagnosed 85.5% of complex medical cases, four times the rate of human doctors in the same test. While Microsoft emphasized AI’s role as a complement to clinicians, not a replacement, the timing comes as Microsoft announced layoffs impacting nearly 4% of its workforce.

🔑 Key Points

Diagnostic Milestone: Microsoft’s AI system solved 85.5% of 304 difficult medical cases vs. 20% for experienced doctors.

LLM-Powered Engine: The system worked step-by-step like real clinicians and paired with models from OpenAI, Google, Meta, and Anthropic.

Waste Reduction Claims: Microsoft says the AI reduced unnecessary spending, addressing the 25% of U.S. healthcare waste.

Superintelligence Vision: CEO Mustafa Suleyman called the effort a step toward “medical superintelligence.”

Layoffs in Parallel: Simultaneously, Microsoft laid off thousands to control costs as AI infrastructure spending soars.

👀 What You Need to Know

Microsoft’s breakthrough reinforces the disruptive potential of LLM-driven healthcare tools, but the broader narrative is more complex. The AI’s results are eye-popping, but the doctors in the test were stripped of typical diagnostic aids, making the comparison uneven. Meanwhile, Microsoft’s sweeping job cuts underscore the paradox of this era: radical AI gains paired with ruthless cost control. AI may drive margin expansion long-term, but it’s already forcing painful tradeoffs.

🔐 Edge Takeaway: Microsoft remains one of the rare companies in market history to sustain dominance across multiple tech cycles - operating systems, cloud, enterprise SaaS, and now AI. Its…upgrade to Edge+ to read the Full Edge Takeaway.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the all-time highs in equities, the upcoming jobs reports, and our thoughts on the current state of the market. See the latest full report here:

Weekly Options Recap

This report is a breakdown of every options trade we made this week—what we opened, what we closed, and how our open trades are performing. Each edition gives you full transparency on our strategy, including entry points, premiums collected or paid, trade rationale, and risk/reward setups. See this week’s recap:

The Week Ahead

Next week will be very quiet from a report standpoint as not much is going on. We’ll see if that translates into a calm week in the market.

Earnings Reports

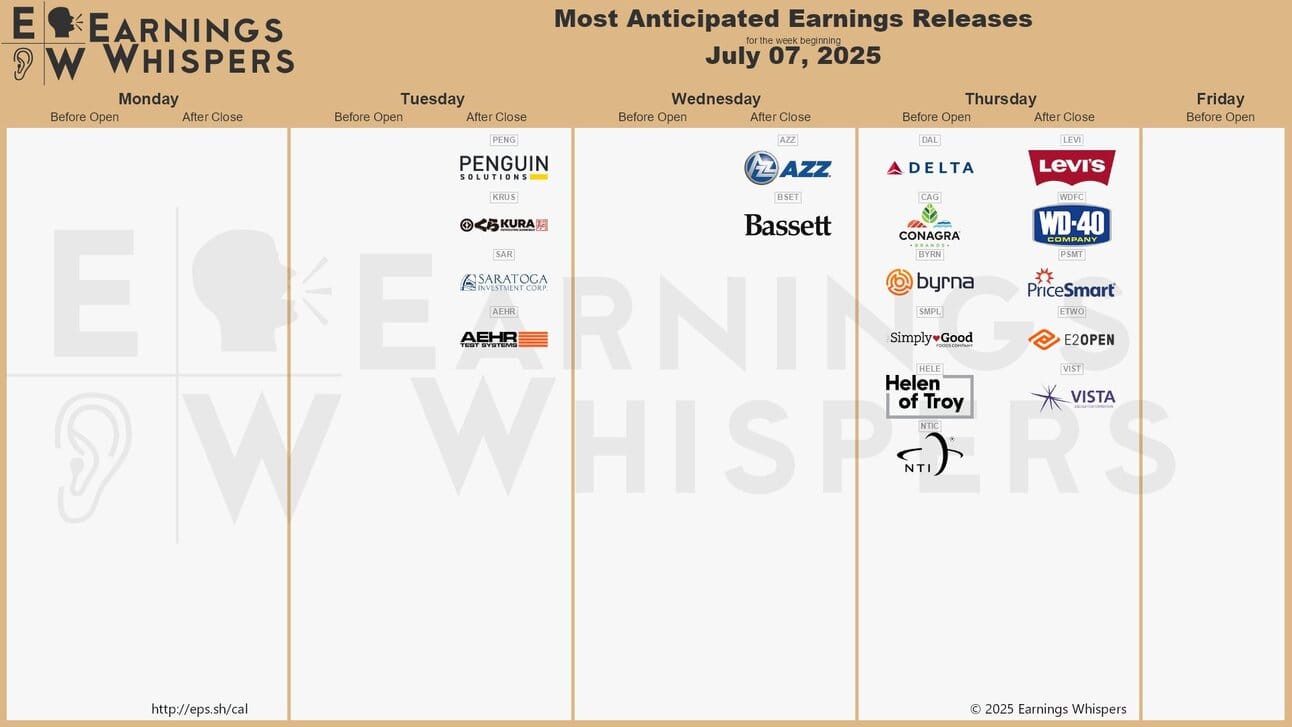

Only one stock we cover is on the earnings calendar next week as Delta reports on Thursday July 10th.

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

It is a very quiet week on the economic news front as we only have the FOMC meeting minutes release and the initial jobless claims report on the calendar.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.