Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 22,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

Markets were doing well this week, then Friday happened and all three major indexes ended the week much lower.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

UnitedHealth’s rough stretch continues, with buyouts, a reported DOJ probe and a 23% drop in three months

UnitedHealthcare is under investigation by the DOJ for alleged fraudulent Medicare billing practices. The probe examines whether the company made questionable diagnoses to receive extra payments for its Medicare Advantage plans. UnitedHealth denies the allegations, calling them “misinformation.”

The company is also cutting costs through employee buyouts and potential layoffs, while dealing with the fallout from a cyberattack on its subsidiary, Change Healthcare, which exposed the health information of 190 million people.

Additionally, UnitedHealthcare faced public criticism from investor Bill Ackman, who accused the company of overstating profitability by denying necessary medical procedures, though he later retracted his comments.

Despite these challenges, UnitedHealth Group remains the largest U.S. healthcare conglomerate by revenue, though they have led to a 23% drop in UnitedHealth Group's stock over the past three months.

👉 EDGE TAKEAWAY: UnitedHealth Group has faced a series of challenges recently, leading to a significant -26% stock sell-off. Despite these headwinds, the…upgrade to Edge+ to read the Full Edge Takeaway.

Palantir’s stock fell over 18% this week after CEO Alex Karp disclosed plans to sell up to $1.23 billion worth of his shares and news emerged that the Pentagon is considering defense budget cuts over the next five years.

The planned sale involves up to 48.9 million shares, as disclosed in a recent filing with the Securities and Exchange Commission. This sizable sell-off from Karp has raised concerns among investors about insider sentiment and its potential impact on the stock price.

Adding to investor anxiety, the Pentagon is reportedly considering budget cuts over the next five years, as Defense Secretary Pete Hegseth has asked senior military officials to draft a cost-cutting plan

Despite these developments, some analysts believe the budget cuts could benefit Palantir by driving demand for cost-efficient defense software solutions.

📚 EDGE-UCATION: What does Palantir do?

Palantir Technologies is a data analytics and software company that helps organizations integrate and analyze massive amounts of data to make informed decisions. It primarily serves government agencies, defense organizations, and large enterprises.

Key Products:

Gotham: Used by defense and intelligence agencies for counterterrorism, intelligence analysis, and military logistics.

Foundry: Serves commercial clients in healthcare, finance, energy, and manufacturing for supply chain optimization, risk management, and customer analytics.

Apollo: A deployment system that updates software across various environments, supporting both Gotham and Foundry.

Main Use Cases:

Government & Defense: Intelligence gathering, counterterrorism, and logistics.

Healthcare: Clinical trials and patient analytics.

Finance: Fraud detection and risk management.

Supply Chain: Optimization and demand forecasting.

Strategic Position:

Palantir has strong ties to U.S. government agencies but is expanding rapidly into commercial sectors. It focuses on artificial intelligence and machine learning to provide advanced data analytics and operational intelligence solutions.

Sponsored by Morning Brew

The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

Earnings: Walmart, Alibaba, Mercado Libre and more report results

Earnings season is off to a strong start. Here’s how some of the major companies that reported this week have performed:

Walmart shares fell despite beating earnings and revenue expectations as the company provided a much weaker than expected full year outlook. Here are the key numbers from the report:

Earnings per share: $0.66 vs. $0.65 expected

Revenue: $180.55 billion vs. $180.07 billion expected

Alibaba shares surged last week after beating earnings and revenue expectations. Here are the key numbers from the report:

Earnings per share: $2.93 vs. $2.67 expected

Revenue: $38.38 billion vs. $38.14 billion expected

Mercado Libre shares surged after topping earnings and revenue estimates and showing continued strength and growth. Here are the key numbers from the report:

Earnings per share: $12.61 vs. $7.90 expected

Revenue: $6.06 billion vs. $5.88 billion expected

Block shares plunged after missing earnings and revenue expectations and providing guidance that was softer than expected. Here are the key numbers from the report:

Earnings per share: $0.71 vs. $0.88 expected

Revenue: $6.03 billion vs. $6.29 billion expected

*Note - our full breakdown of these reports, as well as several others, was sent out in Friday’s Earnings Recap.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the earnings ahead, the impacts of tariffs, and the potential for new record highs. See the latest full report here:

The Options Edge Report

This week, we dropped the latest Edge Options Report for our members—packed with actionable insights and options strategies. This week we discussed a trade to capitalize on Amazon’s recent sell-off. See the latest report here:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Walmart, Alibaba, Mercado Libre, and many more. See this week’s recap:

The Week Ahead

Earnings season carries on with several major companies reporting, including Nvidia, and the Fed’s preferred inflation metric is set to be released.

Earnings Reports

Can Nvidia save the day again? The semiconductor company will be in focus next week, as will several retail names. Here is the list of names we will be covering:

Monday 2/24: Domino’s Pizza and Realty Income

Tuesday 2/25: Home Depot and American Tower

Wednesday 2/26: Nvidia, Salesforce, and Lowe’s

Thursday 2/27: --

Friday 2/28: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

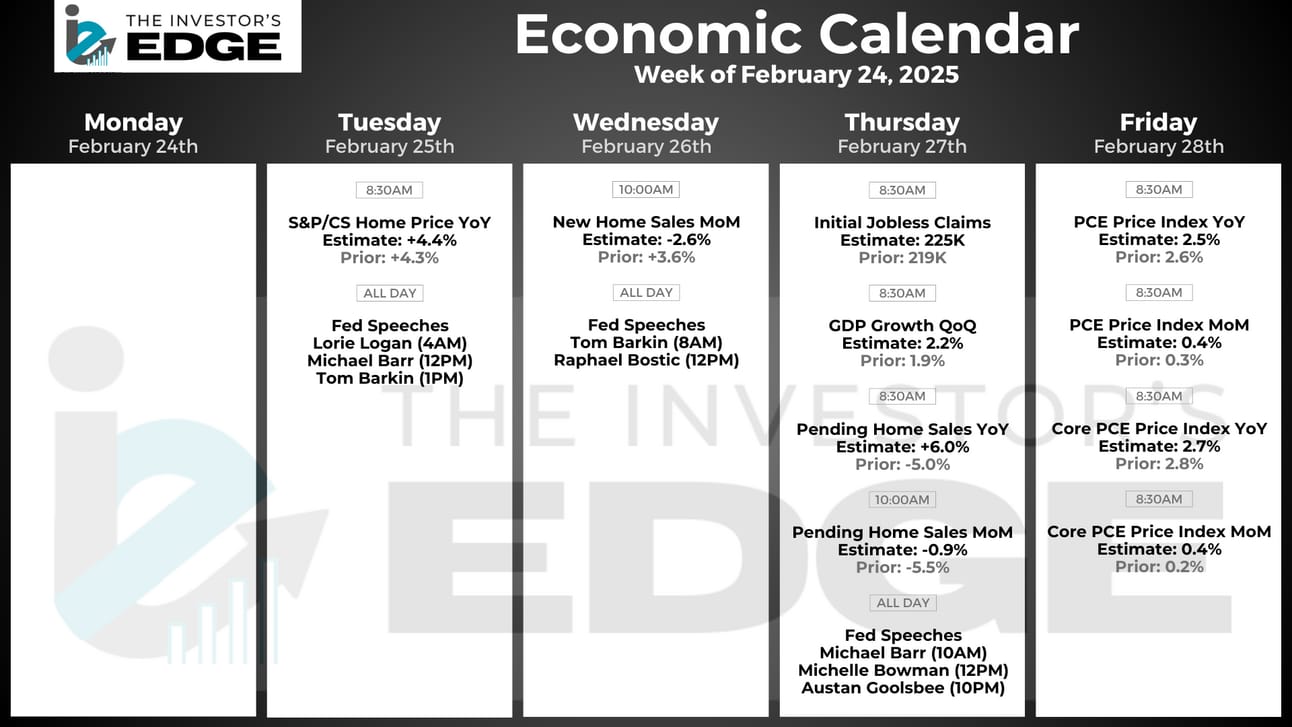

Next week’s PCE inflation report will be the main catalyst on the economic news front.

We also get initial jobless claims, GDP, housing data, and several Fed speeches.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.