Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of nearly 20,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

🚨 EDGE ALERT: In case you missed it, we announced our newest addition to The Stock Investor’s Edge this: Options Edge+. This a new premium tier designed for investors looking to elevate their strategies and unlock new levels of portfolio growth with options trading.

Market Talk

All three major indexes made all-time highs this week, but the Dow fell slightly to end the week while the S&P and Nasdaq kept rolling.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Payrolls increased 227,000 in November, more than expected; unemployment rate at 4.2%

Job creation rebounded in November, with nonfarm payrolls rising by 227,000, exceeding the Dow Jones estimate of 214,000 and up from October's revised 36,000. September's payrolls were also revised upward to 255,000. October's weaker figure was impacted by Hurricane Milton and a Boeing strike.

The unemployment rate edged up to 4.2%, as expected, due to a lower labor force participation rate and a declining labor force. A broader unemployment measure rose to 7.8%, reflecting discouraged workers and part-time jobs for economic reasons.

Key job gains were seen in health care (54,000), leisure and hospitality (53,000), and government (33,000). Social assistance added 19,000 jobs, while retail trade declined by 28,000, potentially due to a late Thanksgiving delaying seasonal hiring.

Wages grew, with average hourly earnings rising 0.4% month-over-month and 4% year-over-year, both slightly exceeding expectations.

👉 EDGE TAKEAWAY: The stronger-than-expected rise in average hourly earnings suggests…upgrade to Edge+ to read the Full Edge Takeaway.

Bitcoin reaches the $100,000 milestone level for first time ever

Bitcoin briefly surpassed the $100,000 mark late Wednesday, reaching a high of $103,844.05, before pulling back to $101,520 by Friday afternoon amid investor profit-taking.

This historic surge followed President-elect Donald Trump’s announcement to nominate Paul Atkins as the new SEC chair, signaling a potential shift away from the stricter regulatory approach of outgoing chair Gary Gensler.

The rally was also supported by comments earlier Wednesday from Fed Chair Jerome Powell, who stated, “Bitcoin is just like gold, except it’s digital. Bitcoin is used as a speculative asset; it’s a competitor with gold, not the US dollar.”

Longtime bitcoin investors, who have endured volatile cycles and institutional skepticism, viewed the event as a significant milestone for the cryptocurrency's acceptance.

📚 EDGE-UCATION: What is Bitcoin — the simplest explanation?

Bitcoin is a digital currency that lets people send money to each other directly, without needing a bank. It runs on a decentralized network called blockchain, which keeps track of all transactions securely. Think of it as internet money that's not controlled by any government or company.

Digital Currency: Bitcoin exists only online and has no physical form like coins or bills.

Decentralized: It's not controlled by any government, company, or bank; instead, it's run by a global network of computers.

Blockchain Technology: All Bitcoin transactions are recorded on a public ledger called the blockchain, which is secure, transparent, and tamper-proof.

Limited Supply: Only 21 million bitcoins will ever exist, making it scarce and often compared to gold.

Peer-to-Peer Transactions: People can send Bitcoin directly to each other without needing a middleman, like a bank.

Volatility: Its price can change rapidly, making it a high-risk, high-reward asset.

Mining: New bitcoins are created through a process called mining, where powerful computers solve complex math problems.

Anonymity: While transactions are public on the blockchain, users' identities are private unless they choose to reveal them.

Speculative Asset: Many people buy Bitcoin as an investment, hoping its value will increase over time.

Global Use: Bitcoin can be used anywhere in the world, making it useful for cross-border payments or for people in countries with unstable currencies.

A word from our sponsor: Masterworks

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Uber, Lyft Stock Slide As Waymo's Miami Plan Reignites Robotaxi Fears

Shares of Uber (-9.6%) and Lyft (-10.1%) tumbled Thursday after Alphabet's Waymo announced plans to expand its robotaxi service to Miami, with testing starting in 2025 and full service launching in 2026.

Waymo, already operating in cities like San Francisco, Los Angeles, and Phoenix, plans to add Austin and Atlanta to its network next year, heightening investor concerns about rising competition in the rideshare market.

The move highlights ongoing fears that self-driving technology, including Waymo's and Tesla's planned Cybercab, will disrupt traditional ride-hailing models.

While Uber has partnered with Waymo to deploy autonomous vehicles on its platform in 2025, the uncertainty surrounding how the self-driving market will evolve is weighing heavily on investor sentiment, adding to pressure on Uber and Lyft stocks.

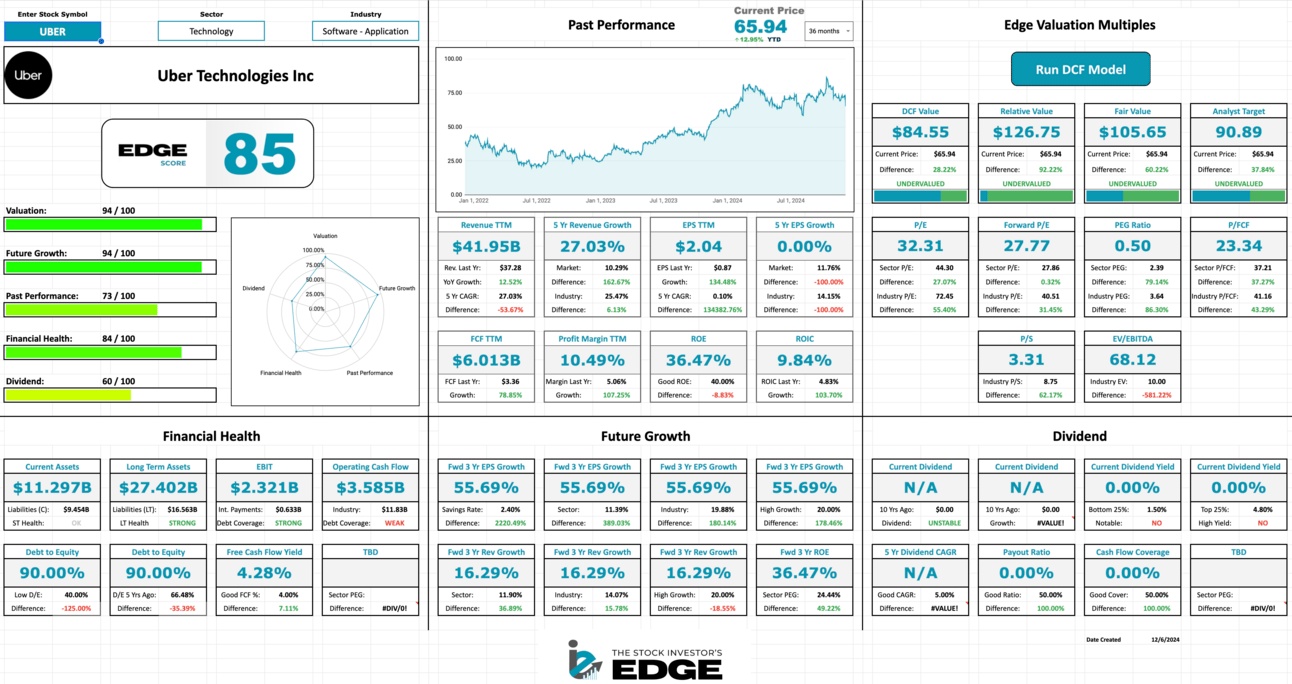

📊 EDGE SCORE: Here’s a look at Uber’s Edge Score - with this week’s price drop, valuations are looking very enticing:

Want access to your own Edge Scores? Upgrade to Edge+ today and be one of the first to use the dashboard:

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Edge+ members also get access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the Edge+ club is for you? We're always listening to your feedback, and many of you have expressed interest in a more affordable option that still delivers actionable insights and recommendations. We just launched a more cost effective tier so you can test the waters - Edge Quick Picks👇

For just $10 per month or $99 per year, Edge Quick Picks will provide you with:

5 stock or ETF picks each month: We believe these are worthy buys at current valuations.

Our new Edge Scores: A quick snapshot of how these picks rank based on key metrics.

Exclusive member-only Discord room: Stay updated on these picks and any changes throughout the month, directly from us.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you continue to build long-term wealth while gaining an edge in the market.

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming earnings reports and how we were preparing for them, as well as the huge week of economic news. See the latest full report here:

Edge Quick Picks

Every month we break down 5 stocks that we believe are attractive from a valuation perspective right now. See the 5 stocks we are buying in December:

Earnings Recap

Every week during earnings season is extremely busy for us here at the Edge as we dive into over 100 reports and provide our members with top tier breakdowns and insights. This week we saw earnings from Salesforce, Lululemon, Ulta Beauty, and more. See this week’s recap:

The Week Ahead

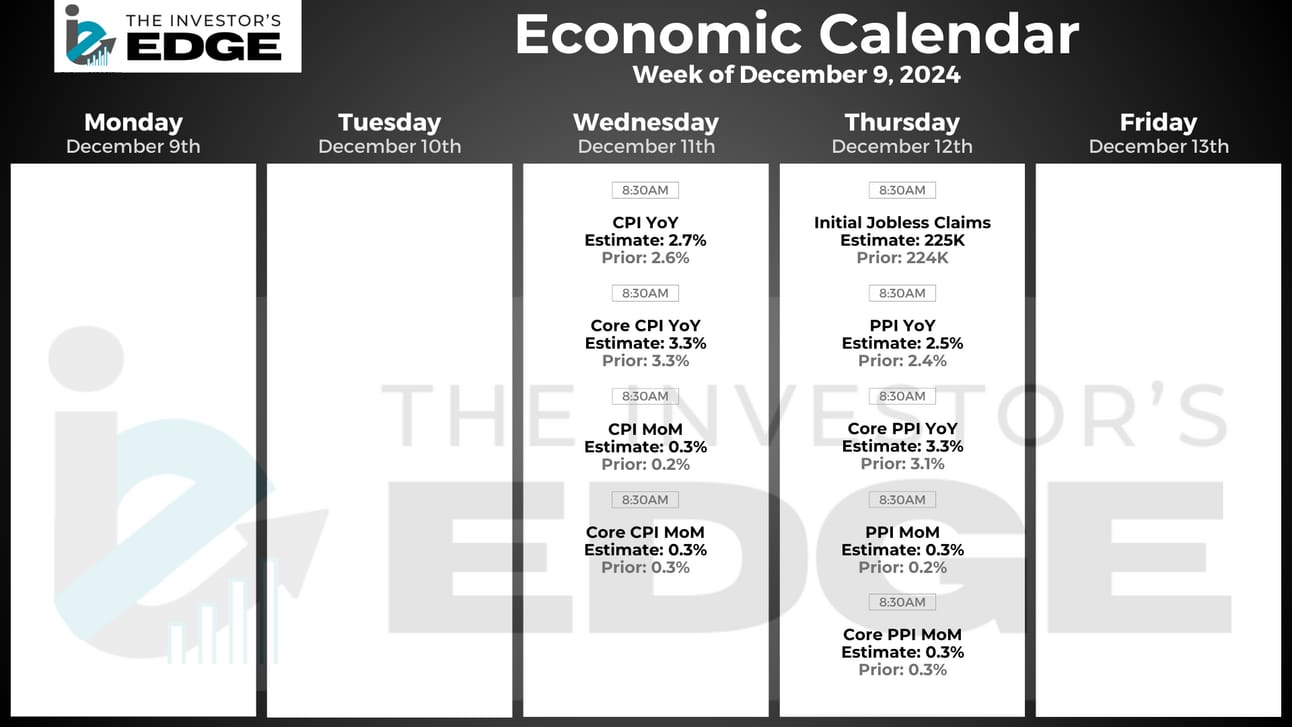

Inflation will be the focus next week as two key reports are on the calendar, though earnings from several major companies also have the power to move markets.

Earnings Reports

Earnings season may be in the rear view but there are still some heavy hitters left to report. Here is the list of names we will be covering next week:

Monday 12/9: Oracle

Tuesday 12/10: AutoZone

Wednesday 12/11: Adobe

Thursday 12/12: Broadcom and Costco

Friday 12/13: --

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week will be all about inflation as we get both the CPI and PPI reports.

There will also be initial jobless claims.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.