Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 26,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

Grab your coffee and let’s dive in.

Market Talk

Another week down, and now there’s only a few more weeks left in 2025. Tech stocks dragged the overall S&P and Nasdaq indexes lower, while the Dow actually ended the week higher.

3 Stories Moving the Market

These are some of the biggest stories from the second half of the week that had an influence on market action.

Broadcom Beats on AI Strength, Shares Slip as Investors Question Margin

Broadcom $AVGO ( ▲ 0.27% ) delivered a strong Q4 beat with record revenue and EPS, yet the stock was down -8% this week on margin concerns and mixed call sentiment.

EPS: $1.95 vs $1.87 est.

Revenue: $18.02B vs $17.47B est.

Record revenue: Revenue +28% YoY, driven by strength across AI semiconductors and infrastructure software.

AI acceleration: AI semiconductor revenue +74% YoY, with management signaling continued outsized demand.

Margin debate: Higher AI mix raised investor concerns about incremental margins despite strong absolute profitability.

Capital returns: Quarterly dividend +10% to $0.65 per share, extending Broadcom’s growth streak.

Guidance: Q1 FY26 revenue guided to ~$19.1B with adjusted EBITDA margin around 67%.

🔐 Edge Takeaway: Broadcom’s quarter was fundamentally strong and the initial reaction was positive, but the earnings call…upgrade to Edge+ to read the Full Edge Takeaway.

Oracle’s AI Backlog Surges, but Q3 Outlook Misses the Bar

Oracle $ORCL ( ▼ 3.54% ) delivered a mixed quarter with a big EPS beat but a slight revenue miss. The stock was -10% this week.

EPS: $2.26 adj vs $1.64 est.

Revenue: $16.1B vs $16.2B est.

RPO surge: Total RPO +438% YoY to $523B, driven by massive AI commitments.

OCI growth: Cloud infrastructure revenue +68% YoY to $4.1B as AI training demand accelerated.

Capex pressure: AI data center build pushed trailing free cash flow deeply negative, FY26 capex outlook lifted to $50B.

Ampere sale: $2.7B pretax gain materially boosted GAAP and adjusted earnings.

Guidance: Q3 adj EPS $1.64-$1.68 and revenue growth 16%-18% YoY, below consensus.

🔐 Edge Takeaway: Oracle’s quarter reinforced that AI and cloud demand is structurally strong, but the stock…upgrade to Edge+ to read the Full Edge Takeaway.

Sponsored by AARE

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Costco Beats Q1 Expectations on Strong Membership and Digital Growth

Costco Wholesale $COST ( ▼ 0.42% ) delivered a clean Q1 beat with strong comps and margins, and the stock is -1.7% this week.

EPS: $4.50 vs $4.27 est.

Revenue: $67.31B vs $67.148B est.

Comparable sales: Total comps +6.4%, driven by +3.1% traffic and +3.2% ticket.

E-commerce: Digitally enabled comps +20.5%, with site traffic +24% and AOV +13%.

Membership income: Membership fees +14.0% YoY, renewal rates at 89.7% globally.

Margins: Gross margin 11.32%, up 4 bps YoY as membership income offset cost pressures.

Capital returns: Operating cash flow $4.7B funded $577M dividends and $210M buybacks.

🔐 Edge Takeaway: Costco’s quarter confirmed the model is still working at this point in the cycle, but…upgrade to Edge+ to read the Full Edge Takeaway.

In Other News

In this section, we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

Edge+ Posts of the Week

We continue to push out more and more content every week to give investors that edge. Here are the posts Investor’s Edge+ subscribers received this week.

The Edge Report

Mondays are for the investors. Every Monday morning we share exactly what we’re watching in the week ahead, how we’re positioning, and even share a sneak peek into our systems and models. This week we discussed the upcoming Fed rate decision and the much anticipated earnings from Broadcom, Oracle, and Costco. See the latest full report here:

Portfolio Update - December

Every month we share a full access look into our portfolios, including holdings, performance, activity and our watchlists for the upcoming month. You can see both of our portfolios and what moves we made in November here:

The Week Ahead

Economic data will be the focus next week as we get a key inflation report and the latest labor data. Both reports will determine market direction not only for next week, but also for the rest of the year.

Earnings Reports

Next week sees another major player in semis and AI report earnings, as well as two companies that will give us crucial insights into the consumer. Overall, 3 of the names we cover are set to report:

Monday 12/15: --

Tuesday 12/16: --

Wednesday 12/17: Micron

Thursday 12/18: Nike and Fedex

Friday 12/19: --

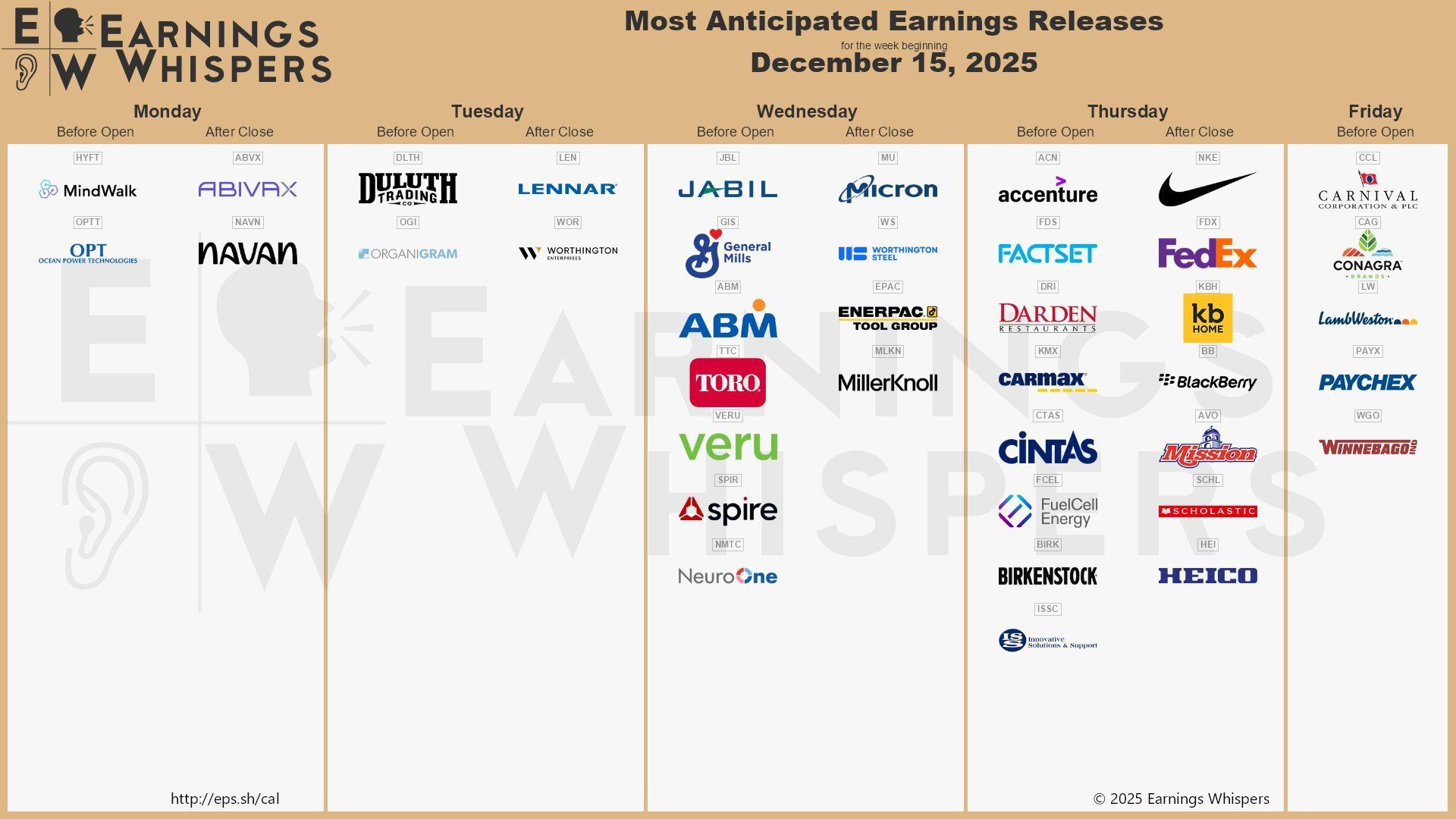

Here is the full calendar of scheduled earnings releases:

Source: Earnings Whispers

Economic Reports

Next week is jam packed with data and we finally get the latest nonfarm payrolls and CPI data after the reports were withheld during the shutdown.

We also get initial jobless claims, PMI data, several housing reports and consumer sentiment.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out, it’s FREE!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us. And it’s completely free!

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors discussed the the huge moves from mega cap tech. Members also dove into the number of jobs reports and shared their views on the overall economy.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Want more? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark (Dividend Seeker)

Chris (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up. Have a great weekend!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.