Welcome to the +247 new subscribers who joined our Dividend Investor’s Edge community this past week. If this is your first time reading, but you have not yet subscribed, join our fast growing investing community of ~7.1K investors.

Cash Flow University is an online community focused on building passive income and stable wealth. Learn about building passive income through: Options Selling, Short-Term Rentals, Amazon/eBay Flipping, and More. There are a number of rooms lead by leaders within the space both showing how they are building passive income and educating community members. The Cash Flow University community has grown to well over 320 members.

Click HERE to give CFU a try today!

*This is sponsored advertising content.

Market Talk ⏪

We have not heard from the majority of companies within the S&P 500 and it has been mostly a mixed bags. OK earnings results with poor guidance has been the norm.

Now we embark on a week in which we get an update on inflation, as the January CPI data will be released on Tuesday. As such, I expect a stagnant market until we get that data and then volatility will most likely ratchet higher.

CPI comes in higher than expected, we could get a sell off as interest rates will likely need to go higher for longer. CPI comes in light, we may get an earlier end to the hiking cycle than anticipated and the markets could shoot higher. It is anyone’s guess, but the Fed is data dependent and this is our next piece of major economic data. In Fed Chair Jerome Powell speech last week he stated that “there is still a long way to go” in terms of fighting inflation.

Last week, all the major indexes ended the week in the red which was a rarity considering the way the markets have shot higher at the start of the new year.

Alphabet was a major drag on the S&P 500 and the Nasdaq as they had an AI day to introduce Bard, their new AI bot, which underwhelmed investors and sent shares tumbling. Investors were spooked that Microsoft has the clear lead in the AI space and that ChatGPT could take market share from Google's search dominance. Shares of GOOGL fell 9% on the week.

Seeking Alpha

There is not a lot of nuances to this week, it is really just boiling down to inflation. Once we know where that data stands, the market will make its move. Many economists still do not believe this rally we have seen to start the year is real. This could be the deciding week to determine that.

In international news, there was a giant earthquake in Turkey that has caused more than 20,000 people to lose their life. My thoughts and prayers are with the families impacted.

Deep Dive 📰

Become a premium subscriber today for ONLY $1 PER DAY. Premium subscribers receive the following:

Monthly Portfolio Updates

Earnings Recaps

2 Individual Stock Deep Dives Per Month

And More

We are wrapping up our latest Deep Dive which should be out for premium subscribers this week. If you didn’t see the latest report on Intel, you can see that HERE.

Go PREMIUM today!

If there is a specific stock you would like me to consider for a future Deep Dive, then send me an email at [email protected] and I would be happy to consider it.

US Markets 🇺🇸

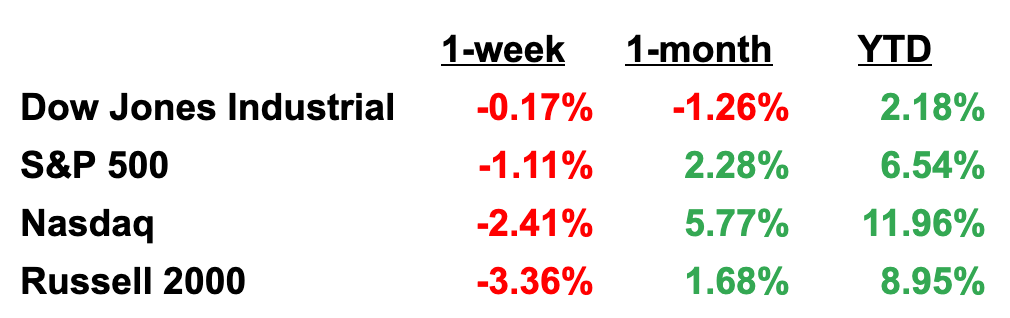

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

When it comes to the Fear and Greed Index, the stock market is off to a fast start, however, the market took a bit of a small breather last week, which resulted in a little movement within this index. Given the move in the market, we dropped from Extreme Greed back into the Greed level. Currently, the index has a reading of 70, which is slightly below the prior week reading of 76.

Earnings on Deck 💰

The earnings reports keep coming fast a furious with another jam packed week of important earnings reports.

Notable Analyst Updates 📝

Cowen initiates Dick’s Sporting Goods as outperform

Credit Suisse upgrades Lockheed Martin as outperform

Cowen rates Home Depot as outperform

KBW downgrades Bank of America to underperform

SVB upgrades AbbVie to market perform from underperform

This Week 📆

Monday

No economic data

Tuesday

NFIB Small Business Index

Consumer price index

Philadelphia Fed President Patrick Harker speaks

Wednesday

Empire State Index

Retail sales

Industrial production

Business inventories

NAHB Housing Market Index

Thursday

Housing starts and building permits

Jobless claims

Philadelphia Fed index

Producer price index

Friday

Import and export prices

Leading indicator

Other Resources 📺

If you have not done so yet, definitely check out my growing YouTube community where I publish weekly videos on Dividend Stocks I am looking at.

Here is a look at my latest video: Time To Buy This Dividend Achiever At A Discount:

I also recently published a video discussing 5 Top Dividend ETFs For 2023:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Subscribed

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark