Good morning investors!

Our goal is to provide high quality content that gives our IE+ members an EDGE in the market. We strive to not only adapt, but refine, perfect, and elevate our content week after week.

Last month we introduced our latest addition to the Investor’s Edge catalog: a monthly “Top Stocks to Watch” report. In this exclusive article we will break down 10 stocks that we are watching in the upcoming month and beyond so you can be prepared for what lies ahead.

Grab your coffee and let’s dive in.

Watchlist Performance - April 2024

First, let’s take a look at how our top stocks to watch in April performed:

By comparison, here is how the major indexes performed in April:

Outside of Schlumberger, our stocks did outperform the major indexes. However, SLB does affect the overall monthly return of these 10 stocks but it is important to understand that this is a WATCHLIST and not a BUY NOW list. These are stocks we like, just not at the current valuations.

You can see why we were watching these stocks and what we expected to happen here:

Top 10 Stocks to Watch - May 2024

Here is our May watchlist along with several key valuation metrics that we like to use for our stock analysis:

Alphabet

Alphabet Inc. is a major American multinational technology conglomerate based in Mountain View, California. Formed on October 2, 2015, through a restructuring of Google, Alphabet serves as the parent company to Google and various former Google subsidiaries. The company is recognized as one of the Big Five American information technology firms, alongside Amazon, Apple, Meta (formerly Facebook), and Microsoft. The creation of Alphabet aimed to streamline and enhance accountability within Google's core business, while providing more autonomy to its diverse range of subsidiaries.

Alphabet is up +19.6% this year and is currently the fourth largest company by market cap, behind only Apple, Microsoft and Nvidia.

Alphabet reported first quarter 2024 earnings on April 25, 2024. The company reported revenue of $80.54 billion, a 15% increase from one year ago, and a notable 57% jump in net income to $23.66 billion, or $1.89 per share.

Google's advertising business, a major revenue driver, grew 13% to $61.66 billion, indicating a rebound from challenges faced in 2022 and 2023 due to economic factors.

Additionally, Google's cloud division showed remarkable progress, with operating income more than quadrupling, signaling substantial profitability after years of investment to compete with rivals like Amazon Web Services and Microsoft Azure.

Alphabet's also reiterated its commitment to innovation, particularly in artificial intelligence, with enhancements to search and other services aimed at retaining user engagement.

Alphabet did not provide guidance for the current quarter.

Over the last 5 years, Alphabet’s EPS CAGR is 20.8%. Alphabet’s forecasted EPS growth rate for 2024 is 17.2% and analysts estimate an 19.3% CAGR over the next 5 years.

Alphabet has not paid a dividend yet but the company announced its first-ever dividend of 20 cents per share. The board also authorized a $70 billion share repurchase program, both of which demonstrate confidence in its financial position and commitment to returning value to shareholders.

Over the last 5 years, Alphabet has repurchased $225 billion shares, bringing the company’s 5 year total return CAGR to 20.6%.

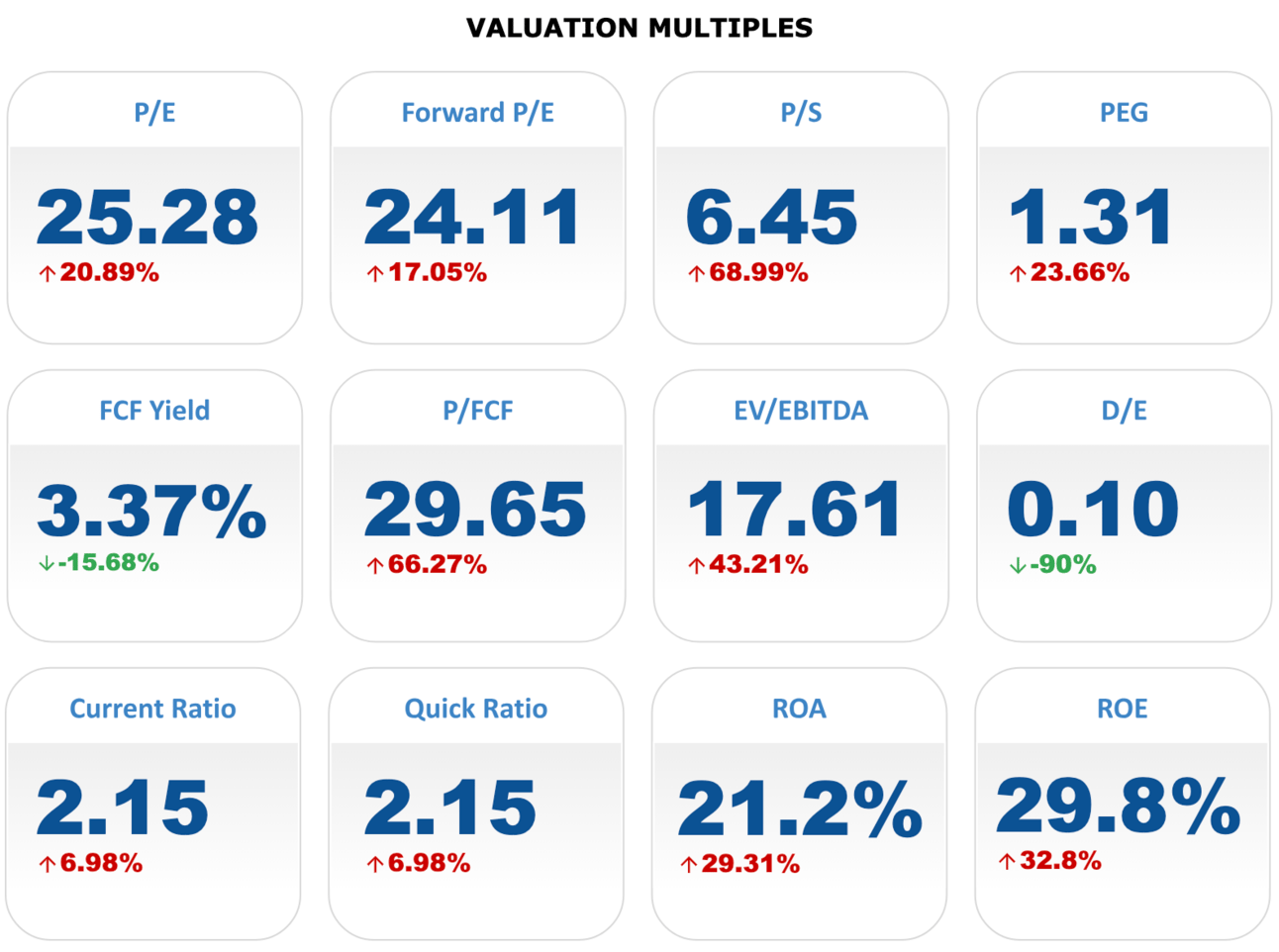

Alphabet continues to grow at an impressive rate, but valuations are slightly stretched at these levels. Alphabet is currently trading at a P/E ratio of 25.5x, which is above both its historical average P/E of 24.6x as well as the industry average of 19.1x. When accounting for future growth, the forward P/E ratio is 24.1x.

Over the last 12 months, Alphabet has generated $69.12B in free cash flow, or $5.96 per share, resulting in a P/FCF of 30.0x. That is slightly higher than its 10 year historical average of 24.6x but well above the industry average of 15.7x.

When we combine both our DCF and relative value models, Alphabet has an intrinsic value of 121.08. With GOOGL shares currently trading at 165.79, that means there is a 33% premium for the price.

Alphabet shares have been on a tear since early March, rising +26.2% off the recent lows. Now that the market has digested the latest report and dividend announcement, Alphabet’s stock may be running out of steam.

From a technical standpoint, after making a double top a few weeks back, Alphabet’s stock broke out to new all time highs. RSI remains near overbought levels and momentum may be slowing here.

Remember, this is a watchlist, not necessarily a buy list.