Good morning investors!

Our goal is to provide high quality content that gives our Edge+ members an EDGE in the market. We strive to not only adapt, but refine, perfect, and elevate our content week after week.

Last month we introduced our latest addition to the Investor’s Edge catalog: a monthly “Top Stocks to Watch” report. In this exclusive article we will break down 10 stocks that we are watching in the upcoming month and beyond so you can be prepared for what lies ahead.

Grab your coffee and let’s dive in.

Top 10 Stocks to Watch - October 2024

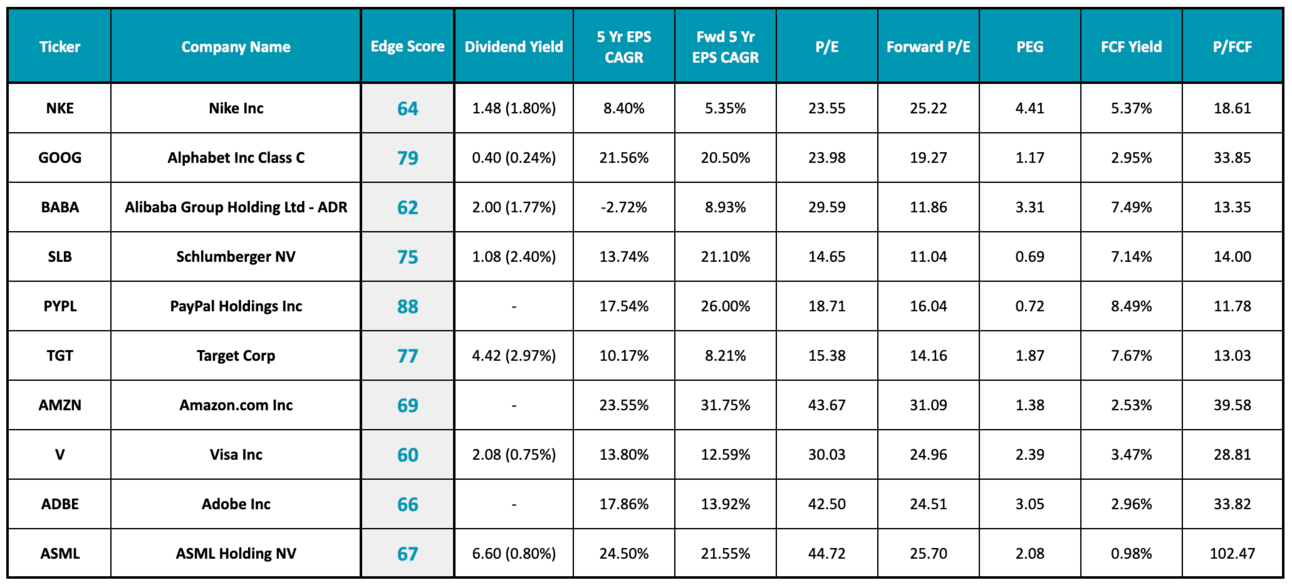

Here is our October watchlist along with several key valuation metrics that we like to use for our stock analysis:

Alibaba

Alibaba, a leading Chinese multinational technology company founded in 1999, dominates the global landscape with its diverse portfolio spanning e-commerce, retail, internet, and technology. Recognized as one of the world's largest retailers and e-commerce companies, Alibaba also holds significant positions in artificial intelligence, venture capital, and financial services through its Fintech arm Ant Group. The company operates the world's largest marketplaces for business-to-business (Alibaba.com), consumer-to-consumer (Taobao), and business-to-consumer (Tmall) transactions, solidifying its impact across various business sectors.

Alibaba was down over -78% from its all time highs in October 2020 up until very recently. The company was hit hard after the CCP forced the company to shelve its Ant Financial IPO. The IPO was flagged by regulators after CEO Jack Ma made a speech railing against financial regulation, saying that it was outdated, and claiming technology companies should not be subject to regulation.

On top of the IPO issues, China’s economy has been slowing which has put pressure on the consumer and Alibaba’s business overall. And last quarter, the company announced it was shelving the spin-off of its Cloud Intelligent Unit. Despite the bad news, the e-commerce company has performed well as of late, meeting muted earnings and revenue estimates the past few quarters.

China recently announced a stimulus package for the economy and Alibaba has benefited greatly. The stock is up +52.5% since its last earnings report.

Alibaba reported first quarter 2025 earnings on August 15, 2023. The company’s revenue grew by 4% year-on-year to $33.5 billion, but net income fell 27% to $3.3 billion, or $2.26 per share, primarily due to decreased income from operations and increased impairment from investments.

Sales in Alibaba's China e-commerce segment, which includes Taobao and Tmall, declined by 1% year-on-year, though the company noted "double-digit" growth in gross merchandise value, indicating continued usage of its platforms by shoppers.

On a positive note, Alibaba's international e-commerce businesses, such as Lazada and Aliexpress, saw a 32% year-on-year sales increase, providing a bright spot for the company.

Additionally, revenue from Alibaba's cloud computing division grew by 6% year-on-year, marking its fastest growth since mid-2022, with profitability in the cloud division significantly improving as EBITA rose 155% year-on-year.

Alibaba did not provide guidance.

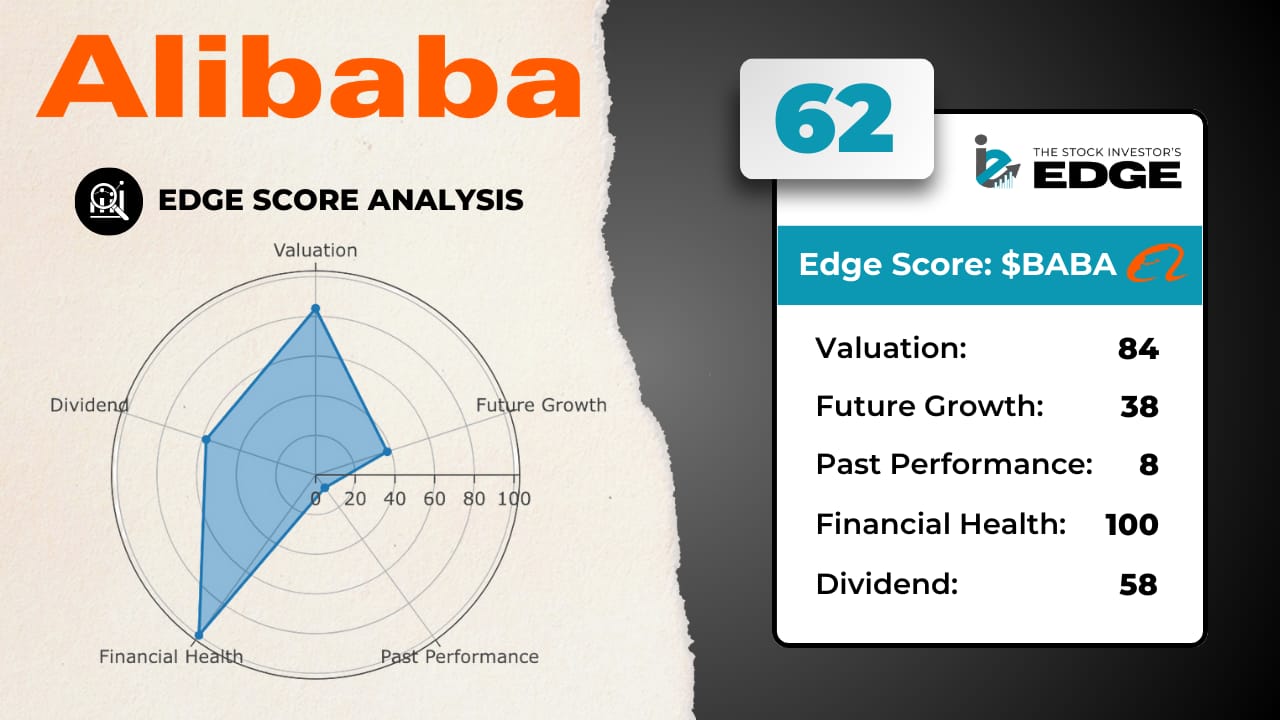

While Alibaba’s EPS was cut in half in 2022, the company is trying to get back on track. Alibaba’s forecasted EPS growth rate is 17% this year and analysts estimate an 11.3% CAGR over the next 5 years.

Alibaba began paying a dividend in 2023 and has continued that trend into 2024. The company’s dividend yield is currently 0.85%.

When taking this into account, valuations look very enticing at these prices. Alibaba is currently trading at a P/E ratio of 29.6x, which is below the industry average of 36.0x. When accounting for future growth, the forward P/E ratio is 11.9x.

Over the last 12 months, Alibaba has generated $23.8B in free cash flow, or $8.45 per share, resulting in a P/FCF of 13.4x. That is below the industry average of 35.9x.

When we combine both our DCF and relative value models, Alibaba has an intrinsic value of 184.64. With BABA shares currently trading at 113.24, that means there is a 63% upside for the price.

We started buying Alibaba in February after saying the following:

With the company returning to its pre-pandemic growth trajectory, there is a lot of potential upside for the stock. You’d have to be willing to endure some volatility and potential political and economical risks, but risk-reward wise, this is an interesting stock.

Well, that risk-reward has certainly paid off. While the recent run has been impressive, we we wouldn’t be surprised if the stock took a breather as investors book some profits. We will be using any pullbacks as an opportunity to add more to our positions this month.