Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 10,000 subscribers striving to be better investors with an edge in the market.

Every weekend we publish “The Weekly Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

If you haven’t done so already, subscribe and hit that LIKE button to show your appreciation and help us grow!

Grab your coffee and let’s dive in.

Market Talk

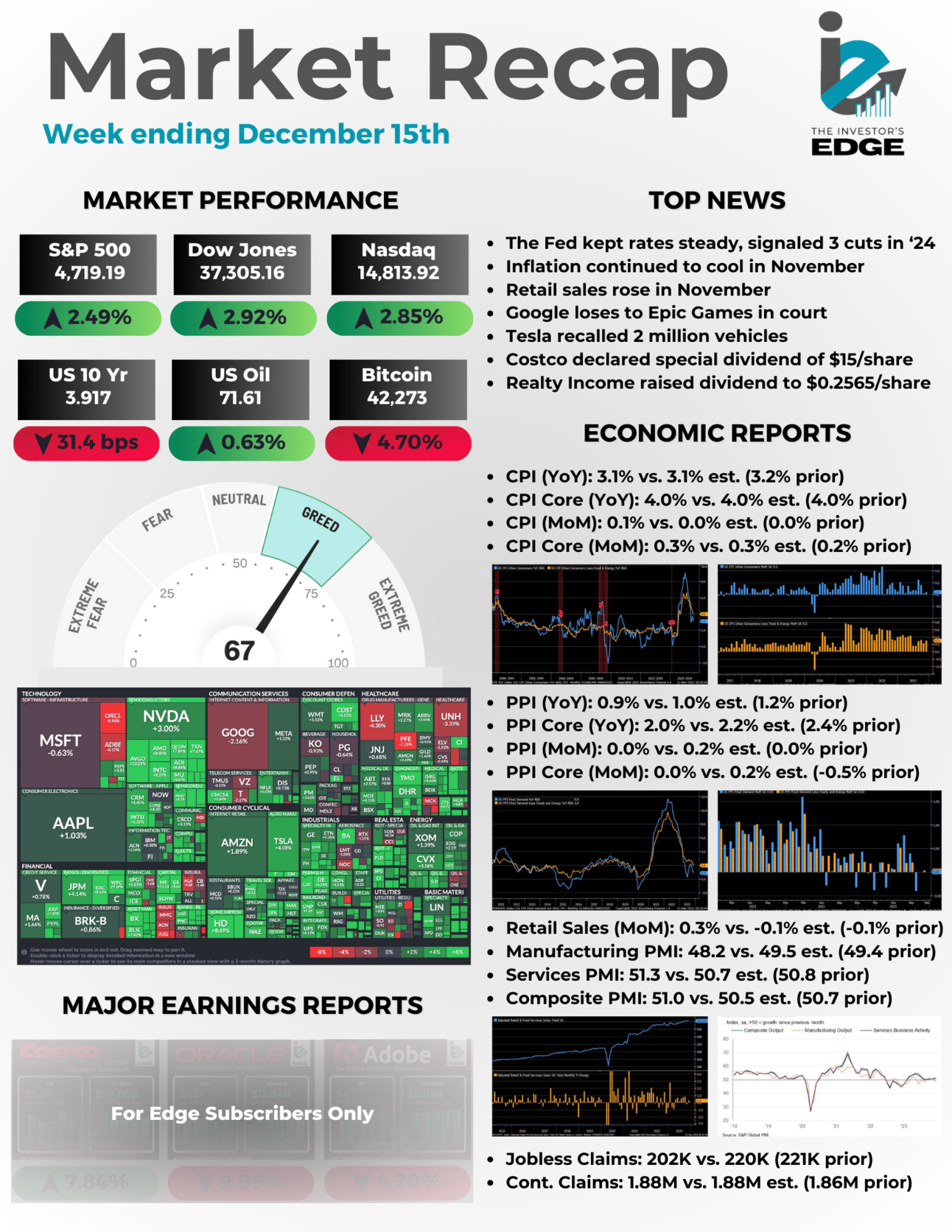

The major indexes continued their march higher last week after the Fed’s rate hike decision and cooling inflation added more fuel to the Santa Rally.

*Note - premium subscribers received our “Earnings Recap” this morning. Become a member of the IE community today to get your edge.

5 Stories Moving the Market

These are the biggest stories from the past week that had an influence on market action.

The Fed’s Rate Hike Decision

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. With the inflation rate easing and the economy continuing to hold up, policymakers on the Federal Open Market Committee voted unanimously to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%. Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than market pricing of four, but more aggressive than what officials had previously indicated.

Sectors that will benefit from declining interest rates

As rates are expected to decline moving forward, with the Federal Reserve predicting multiple rate cuts in 2024, two sectors that are expected to see the most relief are utilities and real estate. Both sectors are very sensitive to interest rates, hence how the two have underperformed the great stock market in 2023 in a high rate environment. Additionally, stocks in capital-intensive sectors like technology would also benefit from lower loan rates and financing costs.

In the last month, the 10 year treasury yield has fallen from 4.7% to 3.9%. In that time, Vanguard’s real estate ETF () is up 18%, SPDR’s utilities ETF () is up 9% and Vanguard’s information technology ETF () is up 12%.

Inflation Continues to Cool

Both consumer and producer prices declined overall in November. The consumer price index, a closely watched inflation gauge, increased 0.1% in November, and was up 3.1% from a year ago. While the monthly rate indicated a pickup from the flat CPI reading in October, the annual rate showed another decline after hitting 3.2% a month earlier. Excluding volatile food and energy prices, the core CPI increased 0.3% on the month and 4% from a year ago. On the producer side, the PPI was flat for the second straight month, while the annual rate fell to 0.9% compared to 1.2% in October.

Both reports strengthened optimism that overall inflation would continue to subside and allow the Federal Reserve to start cutting interest rates next year.

Costco announces special dividend of $15 per share

Costco announced on Thursday it would pay a special cash dividend of $15 per share on Jan. 12, 2024 to shareholders of record as of the close of business on Dec. 28. This, of course, is on top of the quarterly dividend the company has already committed to. This will be Costco's fifth-ever special dividend. Previous special dividends were paid in 2012, 2015, 2017, and 2020 in the amounts of $7, $5, $7, and $10, respectively. This makes the company's 2024 special dividend of $15 its largest, by far.

Realty Income Rewards Investors With 123rd Dividend Hike

Realty Income , “The Monthly Dividend Company®”, announced an increase in the company's common stock monthly cash dividend to $0.2565 per share from $0.2560 per share. The dividend is payable on January 12, 2024, to stockholders of record as of January 2, 2024. This is the 123rd dividend increase since Realty Income's listing on the NYSE in 1994. The new monthly dividend represents an annualized dividend amount of $3.078 per share, resulting in a dividend yield of 5.32%.

Looking for more of an Edge? Join the IE Club today!

Like the content you have seen so far? This is only the tip of the iceberg when it comes to the Investor Edge community.

Join the IE club today and take your investing to the next level. Subscribers get access to all of the following premium benefits:

Monthly Portfolio Updates

The Weekly Edge Report

1 Stock Deep Dive Per Week

Weekly Earnings Recaps

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the club today!

The Week Ahead

While the earnings calendar is relatively quiet, a key inflation report is set to be released this week. With the market sitting at a critical level and investors looking to book profits into year end, things could get interesting.

We tend to see some tax loss harvesting take place towards the end of the year, which could result in a slight pullback in the markets before we move higher as part of the traditional “Santa Claus rally” to close out the year.

Earnings Reports

Even though there are only two weeks left in the year, there are still some big names left to report. Companies like Nike, FedEx, General Mills, and Micron all report this week.

Here is the full calendar of earnings:

Economic Reports

The report everyone will be watching will be the PCE report on Friday. Not only is this the key inflation data the Fed pays the closest attention to, it’s the final inflation report of the year.

On top of the PCE report, there is also the GDP report as well as several housing reports that will give investors an updated look into the state of the housing market.

Poll of the Week 📊

Want even more from us? Check out our other resources

If you haven’t done so, check out the social media pages of our collaborators and give them a follow:

Mark Roussin (Dividend Seeker)

Chris Guillou (CMG Venture)

Thank you for reading this edition of the Weekly Wrap-Up.

If you enjoyed this newsletter, be sure to subscribe, leave a like and comment your thoughts below!

And remember - sharing is caring. If you found this edition of the Weekly Wrap-Up informative and valuable, please consider sharing it with your friends and family. Your support is the cornerstone of our growth and the more people that see this the better. Thank you all!

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.