Good evening investors!

Every month we publish our “Portfolio Update” — Edge+ members get a full access look into our portfolios, including holdings, performance, activity and our watchlists for the upcoming month.

On Saturday February 14 at 11am EST Mark will be hosting our Member’s Only Monthly Meeting. These monthly meetings are for Edge+ & Ultimate Edge members only, where we discuss my portfolio, any changes, market expectations moving forward, and also take your questions. We hope you can join the meeting.

If you are not an Edge+ subscriber yet, you can still join now to get access to the call.

Now let’s dive into our Portfolio Update.

Portfolio Update - Mark

For those new here, IE+ subscribers get full access to my monthly portfolio updates, which includes:

Portfolio Snapshot

Portfolio Performance

Stock Purchases

Stock Sells

Watchlist

*Note - this is the ONLY place where people can find our entire portfolios.

Portfolio Snapshot

As of the end of January 2026, my portfolio contained 50 total positions, the same as the prior month. However, we did close out of 1 position completely and added a new position to the portfolio in January.

You can see all the portfolio activity down below, but first, here is a snapshot of my entire portfolio:

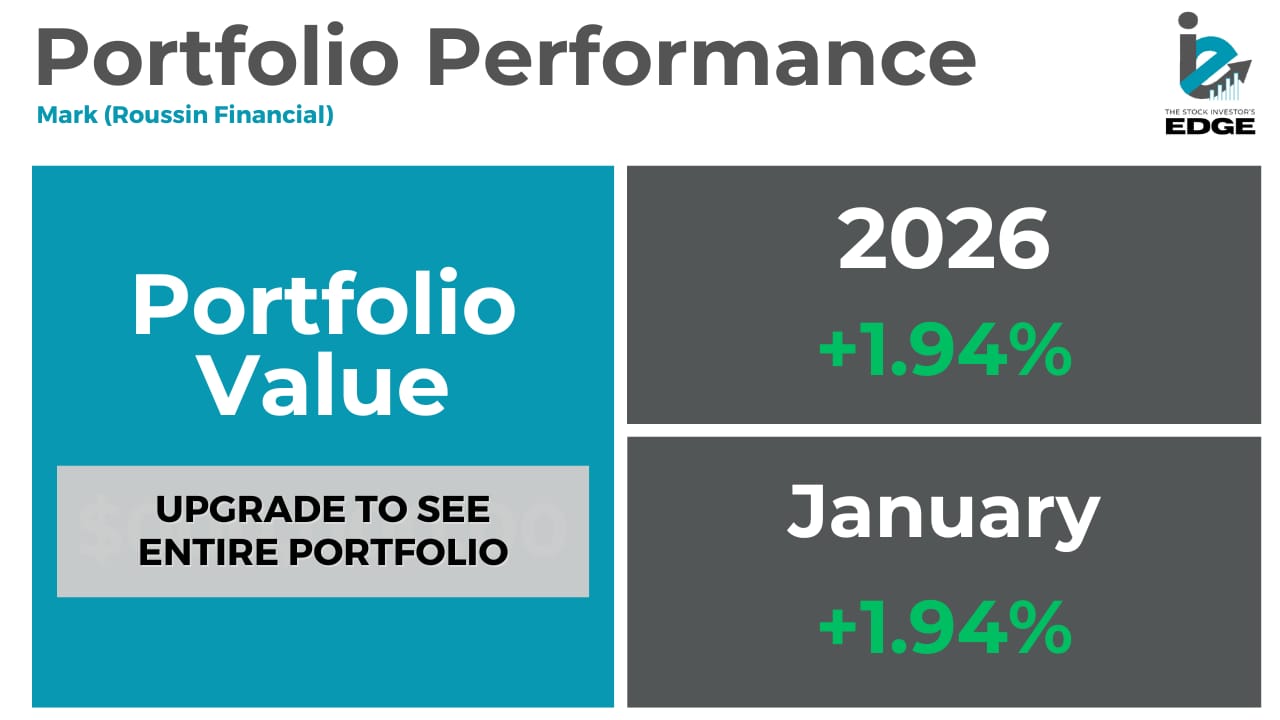

Portfolio Performance

In this section, I will highlight the performance of the portfolio both on a MONTHLY and Year-To-Date basis.

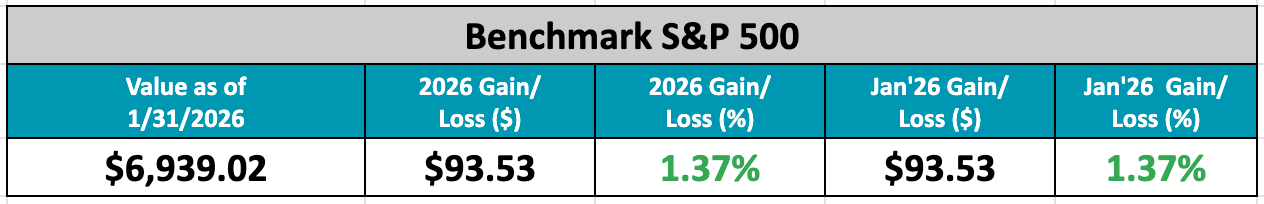

For comparison, here is how the benchmark S&P 500 did during those same time frames:

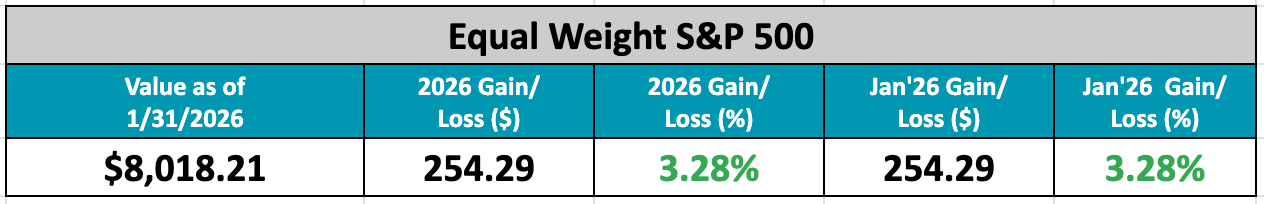

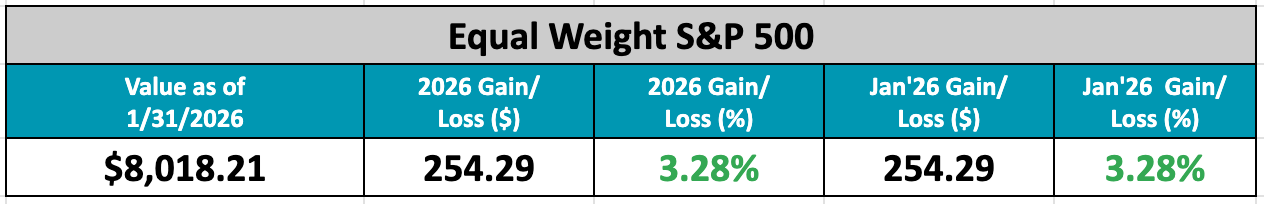

And here is how the equal weighted S&P 500 performed:

Here we are, the start of a new year, and one month under our belts. Although 2026 has started much more volatile than what we have become accustomed to, the rotation we continue to see across AI and many software stocks has been intense. You can verify this when you see the equal weight S&P 500 fund easily outpacing the market weight S&P 500.

During the month of January, my portfolio was just shy of a 2% return, which if we could average 2% per month, that would be fantastic, but as we know, its not always smooth sailing.

However, I was very happy with how the portfolio performed in the face of all the volatility and we have seen SCHD hold things together as it has shot to a new record high, and its a top 10 holding of mine.

I expect the volatility to continue, as February is historically one of the poorer months for stocks, but the economy remains on solid footing as well as inflation seems under control. The key for investors to focus on will be jobs, as that is the one area that can really tip things on its head.

As you will see below, we did a lot more buying during the month than selling, but did close 1 position and enter a brand new position, both in fact related to the AI story in some shape or form.

Cheers to another successful year in 2026.

Stay tuned within our discord where Edge+ members get TRADE ALERTS, being notified of any changes I make to my portfolio in real time.

Monthly Activity

In this section, I detail out any transactions that were made within the portfolio during the month.

The year has started off a little volatile, but in the face of volatility and fear, I have been a net buyer adding…upgrade to Edge+ to see Mark’s entire portfolio and the moves made during the month.

Portfolio Update - Chris

Every month, Investor’s Edge+ members get updates to my individual brokerage portfolio, which includes:

Portfolio Snapshot

Portfolio Performance

Stock Purchases

Stock Sells

Watchlist

*Note - this update ONLY includes my brokerage portfolio. Retirement accounts, cryptocurrency, real estate and cash/cash equivalents outside of the brokerage are excluded from this update.

Portfolio Snapshot

As of the end of January 2026, my brokerage portfolio contained 60 total positions — 60 stock holdings and 0 options contract.

Here is a snapshot of my portfolio:

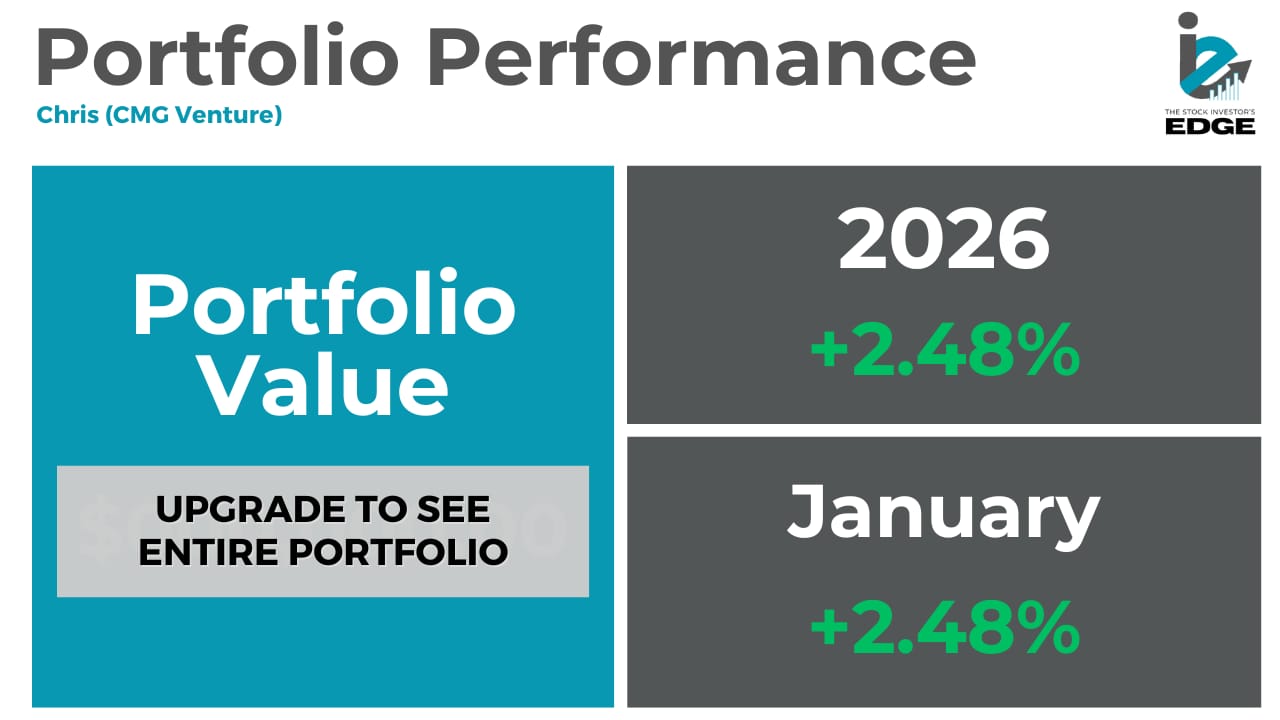

Portfolio Performance

In this section, I will highlight the performance of my portfolio in January as well as for the full year.

For comparison, here is how the benchmark S&P 500 did during those same time frames:

And here is how the equal weighted S&P 500 performed:

January opened the year with a choppier tone, as markets pushed higher at times but rotated quickly between sectors and themes. Instead of a steady trend, the month was defined by volatility, short pullbacks, and sharp rebounds as investors digested shifting macro data and repositioned after a strong 2025 finish.

Against that backdrop, the portfolio held up well and started off on the right foot, extending its relative outperformance over the years. The portfolio gained +2.48% in January, compared with a +1.37% gain for the S&P 500. The Equal Weight S&P 500 performed better than the headline index at +3.28%, reflecting strength across a broader set of names rather than just the largest companies. Even so, the portfolio again finished ahead of the benchmark S&P while remaining competitive with the broader market.

This outperformance came down to structure and positioning. The portfolio remained balanced across core index exposure, growth equities, dividend payers, real assets, and a meaningful cash allocation. That mix helped smooth out some of the month-to-month volatility while still allowing participation in areas of strength. Select hedges and defensive exposure also helped offset pockets of weakness as leadership rotated and sentiment shifted during the month.

Overall, January reinforced the same theme that carried through much of last year: disciplined diversification and risk management continue to matter. While the market environment remains active and sometimes unpredictable, the portfolio’s blend of core holdings, income exposure, and tactical positioning has helped it navigate volatility and maintain a steady edge versus the broader S&P 500 to start the year.

Monthly Activity

In this section, I will go through the transactions that were made within the portfolio during the month.

With volatility picking up and uncertainty around earnings season, I chose patience over action and did not make any stock-specific changes to the portfolio. Where there was activity, it was on the risk management side. I chose…upgrade to Edge+ to see Chris’s entire portfolio and the moves made during the month.

Want Our Portfolio Updates in Real Time?

Then you need to join the Discord! See our trades and portfolio moves as we make them and stay ahead of the market!

In addition, you can join Options Edge+ to see how we generate $1000s per month in income by utilizing our portfolio and stocks we want to buy, just at a lower price. Join today!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Join us on Discord and level up your investing game.

Closing Remarks

2026 kept the momentum we had from 2025, but it was not easy considering the volatility has crept higher to start the year and fear levels have risen a great degree as well. However, for those of you that have followed us for awhile now, you understand our approach is to not overreact and to focus more on the long game.

Take advantage of pullbacks in quality

Cute bait in low quality growth that hasn’t worked

We do not mind taking risks, and in some cases those risks may not work out, but position sizing is key. We do NOT want those high risk positions to be vital parts of the portfolio, instead they need to be positioned correctly.

February has remained shaky, but we are going to continue to search out great entry points in long-term holdings.

Being part of our discord community is vital right now because that is where we post all the up to the minute updates and trades as they are made, so you can choose to follow or not.

I hope you can join on Saturday February 14 at 11am EST for our Member’s Only Monthly Meeting.

Here at The Stock Investor’s Edge, we are laser focused on helping educate investors of all levels, while also giving them full transparency into our personal portfolios.

We will continue to look for new ideas in the market and bring you as much information as we can to give you an EDGE in the markets.

If you enjoyed this Monthly Portfolio Update, then do us a HUGE FAVOR and SHARE THE INVESTOR’S EDGE WITH FRIENDS AND FAMILY. It’s the best way to help us out as it lets us grow and be able to keep bringing you great investment content.

And don’t forget to LEAVE A COMMENT. Let us know your thoughts on our portfolios, share your watchlist for the month or even just let us know that you appreciate the content.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclaimer

This article is intended to be for educational and informational purposes only. The views described in the article are those of the author’s and should not be construed as financial advice. Perform your own due diligence or contact your Financial Advisor before making any financial investment. I have positions in all of the stocks & ETFs mentioned below as of the publish date. This is a disclosure - not a recommendation to buy or sell stocks.