Welcome to the +166 new subscribers who joined our Dividend Investor’s Edge community this past week. If this is your first time reading, but you have not yet subscribed, join our fast growing investing community of ~9.3K investors.

Market Talk ⏪

Here is a look at 5 topics from the week prior and/or related to the week ahead for investors to be mindful of:

Fed Decision week. The Federal Reserve will conclude their next two-day meeting and announce whether they plan to continue hiking rates. Many believe another 25 basis point hike is in store on Wednesday when the decision is announced. The likelihood of this happening stood above 85% as of the end of last week. This is expected to be the FINAL rate hike until we see the Fed pause in June.

How will bank stocks react to another potential rate hike? As we saw in point one, the Fed is likely to hike rates yet again this week, which could add volatility to the financial sector. This will continue to put pressure on banks as investors are not only looking for safe investments, but also being competitive for yield. Whether it is high-yield savings accounts, T-Bills, or money market accounts to name a few.

US GDP rose 1.1% in the first quarter. Gross Domestic Product rose at an annualized pace of 1.1%, which was slower than the 2% economists were expecting. Higher rates and high inflation are finally showing impacts within the economy and labor force to some degree. GDP growth has been slowing for three straight quarters now.

Rough start to the spring selling season. Spring is often the busiest time for the real estate market. However, the start to the spring selling season did not go as planned as signed contracts to buy existing homes in the US unexpectedly dropped in March, the first decline since November 2022. The lack of supply in the market had a lot to do with this drop off in sales. Economists were expecting pending homes sales to grow 0.8% in March, instead the reading was a decline of 5.2%. Lack of supply combined with higher interest rates are proving to be a problem for the sector.

Microsoft’s acquisition of Activision blocked. Microsoft has been going through the antitrust review process in their bid to acquire Activision for $69 billion. Last week, UK’s top competition regulator moved to block the acquisition. Shares of Activision fell nearly 10% after the news broke, but Microsoft states that they plan to appeal the decision. The concern that came up was around the dominance Microsoft would have as it pertains to cloud gaming.

Deep Dive 📰

Become a PREMIUM subscriber today for ONLY $1 PER DAY and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Top 5 Dividend Stocks Newsletter (Coming Soon)

I recently published my latest Deep Dive for premium subscribers to enjoy.

Go PREMIUM today!

US Markets 🇺🇸

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

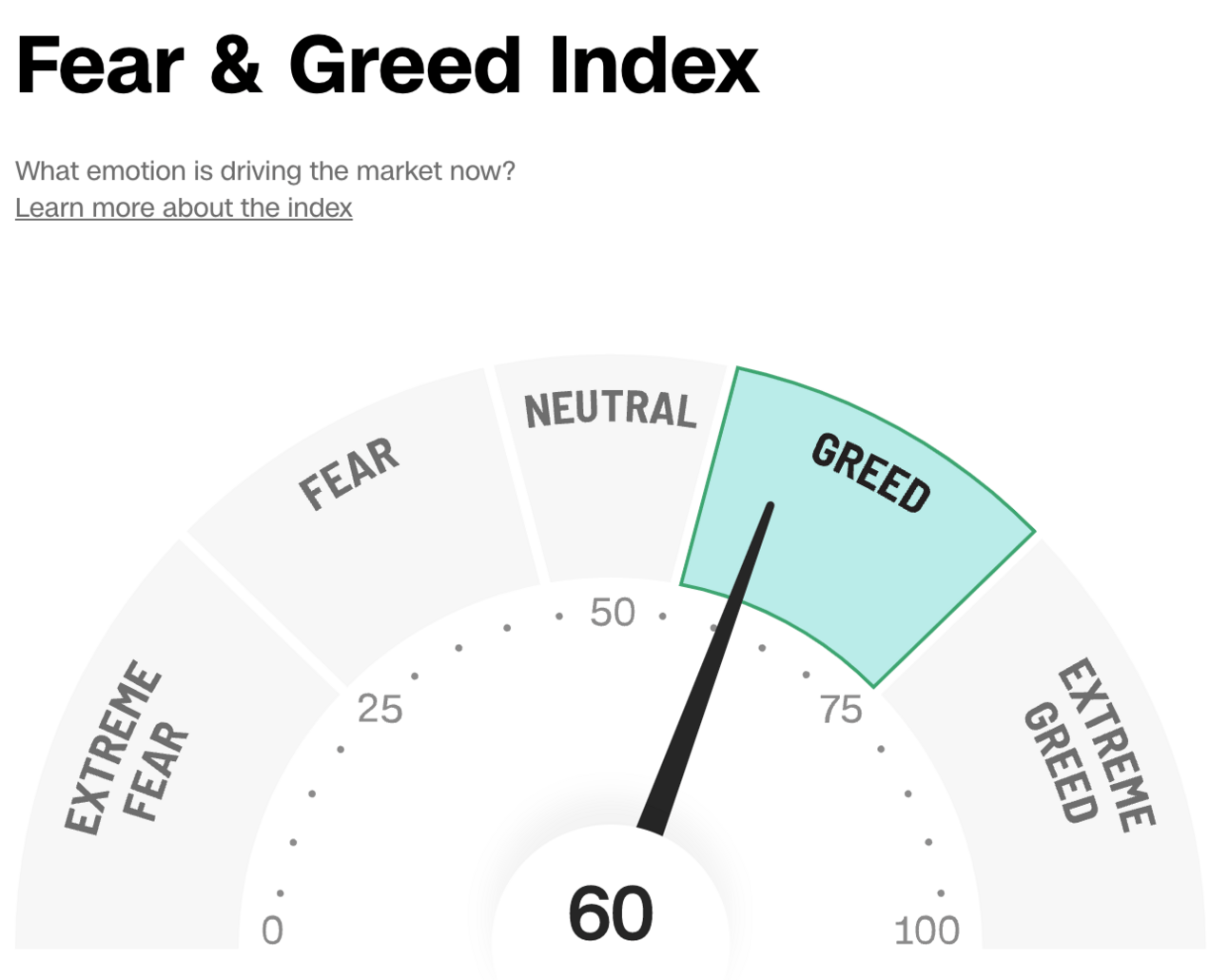

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

When it comes to the Fear and Greed Index, we have seen the markets get a little more volatile, which has the Fear and Greed Index still reading GREED, but the rating has moved a little lower since the past week. Currently, the index has a reading of 60, which is slightly up from the prior week reading of 65.

Earnings on Deck 💰

Another jam packed week of earnings led by Apple. Here is a look at who's reporting this week:

Dividend News 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Bank of America upgrades Ally to neutral from underperform

Wells Fargo upgrades Medtronic to overweight from equal weight

BMO upgrades Microsoft to outperform from market perform

Bank of America upgrades Hasbro to neutral from underperform

Stifel upgrades Waste Management to buy from hold

Benchmark upgrades Intel to buy from hold

This Week 📆

Monday

S&P Global manufacturing PMI (April)

Construction spending (March)

ISM manufacturing index (April)

Tuesday

JOLTS (March)

Factory orders (March)

Durable goods orders (March)

Wednesday

ADP private payrolls report (April)

S&P Global services PMI (April)

ISM services index (April)

Fed decision

Fed Chair Jerome Powell news conference

Thursday

Weekly jobless claims (week ended April 29)

Productivity Q/Q seasonally adjusted annual rate (Q1)

Unit labor costs Q/Q (Q1)

Trade balance (March)

Friday

Nonfarm payrolls (April)

Other Resources 📺

If you have not done so yet, definitely check out my growing YouTube community where I publish weekly videos on Dividend Stocks I am looking at.

Here is a look at my latest video: 5 of the Top Dividend Stocks To Buy In May 2023:

Another video I put out last week:Warren Buffett Loves Dividend Stocks:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark