If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Tired of letting your money sit idle? Learn how you can become your own money manager and put your money to work to build GENERATIONAL WEALTH. Inquire about my 6-week Investing Accelerator course where you get the opportunity to work with me 1 on 1 throughout the entirety of the course.

Click HERE to to book your FREE 15-minute Investing Evaluation and join our waiting list.

Market Talk ⏪

Welcome to the Monday Morning Edge Report, where we try and breakdown everything going on in the stock market and put it is an easy to understand report.

As I discussed in last weeks report, September is historically the worst month for the stock market and its not close. The first full week of September went about as expected with every major US index down, with the Russell 2000 falling by 3.6%.

This week, all eyes will be focused on an update with regards to inflation. Let me discuss some of those in more details within our Top 5 Stories:

August Inflation update on deck with CPI due Wednesday: he Bureau of Labor Statistics will be releasing the August CPI report on Wednesday, which will give investors as well as the Federal Reserve an update as to how rising interest rates are impacting inflation. Inflation came in at 3.2% in July and analysts are expecting the year over year growth to remain the same for the month of August. This report will weight heavily on the direction the Federal Reserve takes moving forward.

Apple expected to announce a NEW iPhone this week: On Tuesday September 12th, Apple is expected to announce their Apple iPhone 15. There is not any major updates expected to the new iPhone except for some camera updates as well as a new charging port. Apple is also expected to announce their latest edition of the Apple Watch Series 9. Apple stock has been going through a small correction over the past few weeks, down more than 10% off their recent highs.

China bans iPhone usage for Government employees: Continuing on the Apple theme, part of the pressures on the stock later in the week was due to a report that came out in regards to China banning its government officials from using Apple iPhones. This could expand to state and local employees as well, which is not ideal given that the company is announcing a new iPhone this week.

Tight Labor Market adds fuel to the inflation story: Last week, the initial jobless claims data fell 13,000 to 216,000 in the week ended Sept. 2 from a revised 229,000 in the prior week. Meanwhile, those continuing to receive jobless benefits fell by 40,000 to 1.679 million in the week ended Aug. 26 from a revised 1.719 million a week earlier. These low levels have not been seen since February.

Service sector sees growth in the month of August: ISM non-manufacturing PMI jumped to 54.5% in August compared to 52.7% in the month prior. Economists were expecting the index to slip to 52.5%. This is the 8th straight reading above the 50% threshold that indicates expansion in the economy. Another sign that inflation could remain sticky in the near-term.

Join today because PREMIUM just got better! Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Earnings Recaps (NEW ADDITION)

Valuation Dashboard

Subscriber only content

Over the weekend, we posted my Monthly Portfolio Update. If you haven’t seen, the update has a questionnaire about how you want Portfolio Updates to look moving forward, so if you haven’t answered that yet, please check it out.

Go PREMIUM today!

US Markets 🇺🇸

Here is a performance summary for US Equities:

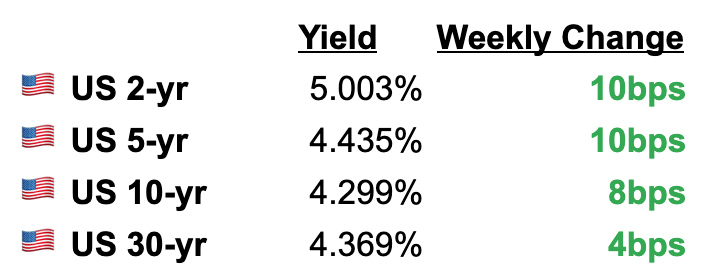

Here is a look at US Treasuries:

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

Stocks got off to a weak start to begin the worst month for the stock market, which resulted in the Fear & Greed Index falling into Neutral territory. Currently, the index has a reading of 51, which is slightly higher than the prior week’s reading of 56.

Earnings on Deck 💰

We have entered a dead period as it pertains to earnings season, with only a few companies reporting this week. The one company I am watching this week is Oracle (ORCL) which will be included in our Earnings Recap for this week. Here are the companies reporting earnings this week:

Analyst Upgrades/Downgrades 📝

In this section we will highlight any recent notable analyst upgrades or downgrades.

TD Cowen upgrades Domino’s to outperform from market perform

RBC upgrades American Express to outperform from sector perform

Barclays upgrades Oracle to overweight from equal weight

Bernstein upgrades Lowe’s to outperform from market perform

Wells Fargo upgrades McDonald’s to overweight from equal weight

Barclays downgrades Dell to underweight from equal weight

Stifel initiates Lowe’s as buy

Economic Data This Week 📆

Monday

None

Tuesday

NFIB Small Business Index (August)

Wednesday

Consumer Price Index (August)

Hourly Earnings final (August)

Average Workweek final (August)

Treasury Budget (August)

Thursday

Continuing Jobless Claims (09/02)

Initial Claims (09/09)

Producer Price Index (August)

Retail Sales (August)

Business Inventories (July)

Friday

Export Price Index (August)

Import Price Index (August)

Empire State Index (September)

Capacity Utilization (August)

Industrial Production (August)

Manufacturing Production (August)

Michigan Sentiment preliminary (September)

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of ~35,000 like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: If I Could Only Own 3 REITs, It Would Be These 3:

Here is another video I put out last week: 3 Dividend ETFs To Compound Your Wealth:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark