If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Have you ever wanted to invest in an ETF, but wish a particular stock was NOT included? Well today I am here to tell you that Pebble allows you to create your own ETF. All of this can be done through the use of their AI tools as well.

Click HERE to give Pebbly a try.

Market Talk ⏪

Welcome to the Monday Morning Edge Report, where we breakdown some of the top stories going on in the stock market and put it is an easy to understand report.

This week is likely going to bring some added volatility as the Federal Reserve is expected to give their next decision on interest rates and discuss further plans. The Fed’s dot plot is something investors will have their eyes on, as it predicts where Fed members believe interest rates will be in future meetings. The Federal Reserve is likely going to pause and keep rates unchanged this week, but the conference call is where investors are going to learn about the committee’s future plans.

Let me discuss some of those in more details within our Top 5 Stories:

The Federal Reserve will be conducting their two-day meeting beginning on Tuesday. The Fed will then provide a decision on whether to hike interest rates or keep them at the same levels. Given the sticky inflation data we have seen in recent weeks, I would not be surprised to hear some commentary about potential future hikes before the end of the year, although I believe rates will remain unchanged this month.

ARM Holdings has a successful first day of trading after going IPO. ARM Holdings was the largest IPO of the year, in what could reignite the IPO market. THis week, Instacart is expected to begin trading on the stock market as well. ARM opened up with a valuation near $60 billion, as the stock climbed nearly 25% on the first day of public trading. ARM is a chip design company with 90% ownership being held by Soft Bank.

Inflation data remains hot with CPI and PPI data coming in high. As I mentioned above, inflation has remained sticky of late, which could lead to the Federal Reserve choosing to hike rates yet again prior to the end of the year. CPI showed 0.6% YoY growth and PPI MoM growth of 0.7% compared to 0.4% expected.

Auto Union workers at odds with automakers and on strike: Union workers for the auto makers are at odds over pay, with a union of 400,000+ union workers going on strike. General Motors, Stellantis, and Ford Motor Company has all offered upwards of 20% raises, which have not been accepted by the union’s leader, Shawn Fain yet. With this, the automakers have actually announced some layoffs, to which they say is not related to the work stoppage.

Apple announced their new iPhone 15 a long with a new Apple Watch. Last week, Apple unveiled their latest edition on the iPhone, the iPhone 15, which came with a stronger camera, a new outlet. Apple swapped out its proprietary Lightning connector for a new USB-C connection, which was part of the agreement they had with the European Trade Commission. The iPhone 15 also surprisingly did not come with a price hike.

Join today because PREMIUM just got better! Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Earnings Recaps (NEW ADDITION)

Valuation Dashboard

Subscriber only content

Over the weekend, I published the Earnings Recap, which highlighted Oracle (ORCL). I left this report free for everyone to see, so they can get an idea of what we publish in term sof Earnings Recaps. For those on the cusp, we are currently running a sale through the end of the week, give PREMIUM a try.

Go PREMIUM today!

US Markets 🇺🇸

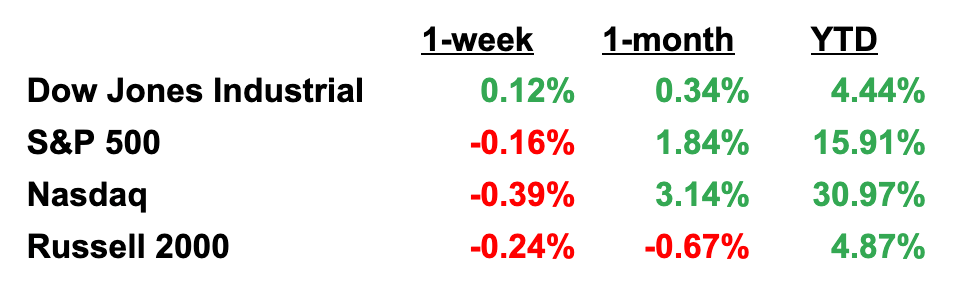

Here is a performance summary for US Equities:

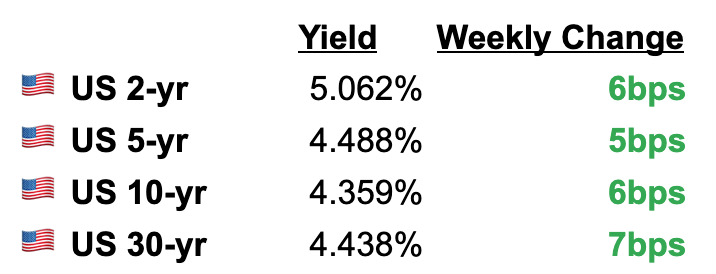

Here is a look at US Treasuries:

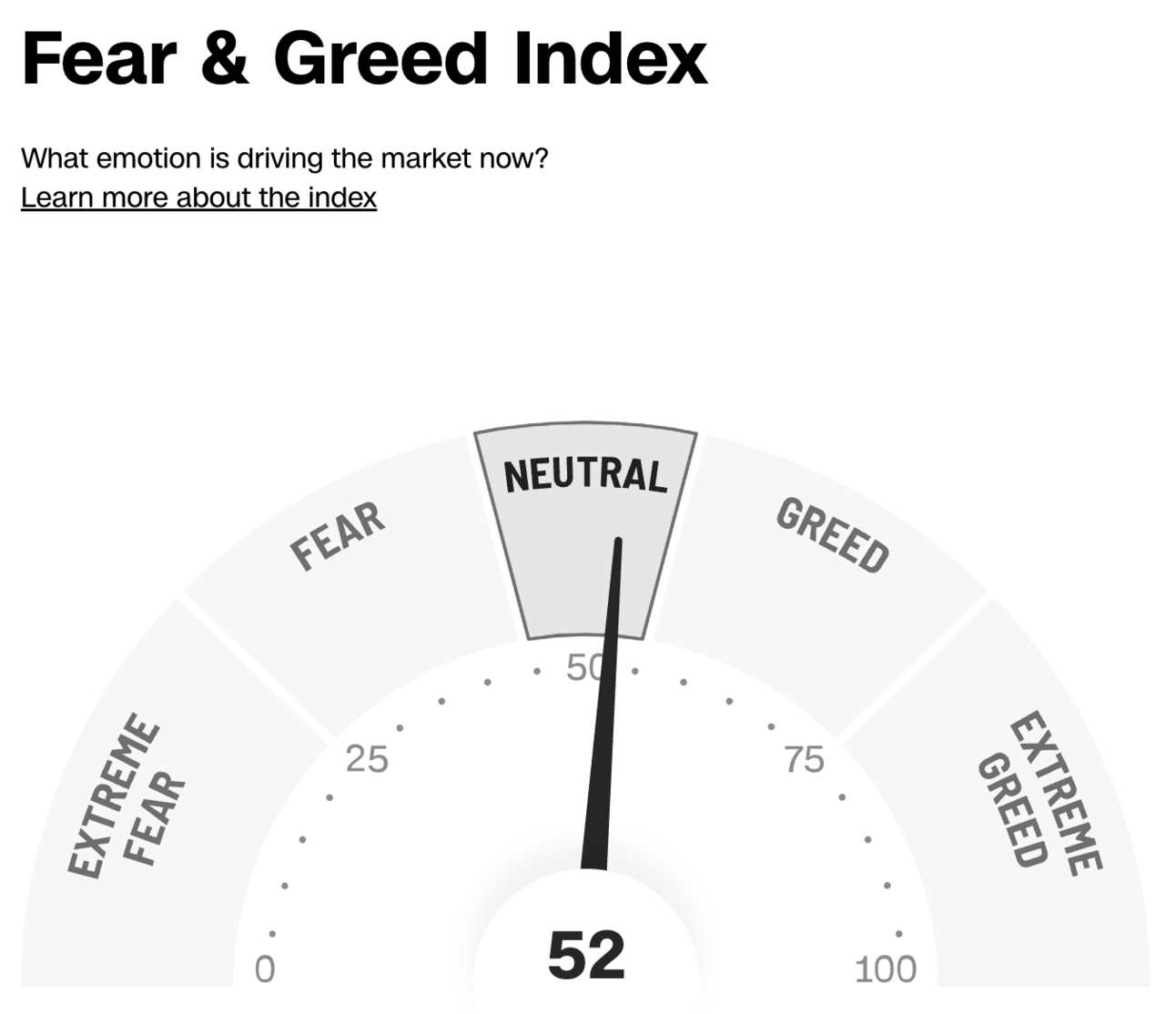

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

With stocks largely unchanged to finish the week off, the Fear & Greed Index was little changed as well. As we enter Fed week, we could see some movement within the index by this time next week. Currently, the index has a neutral reading of 52, which is slightly higher than the prior week’s reading of 51.

Earnings on Deck 💰

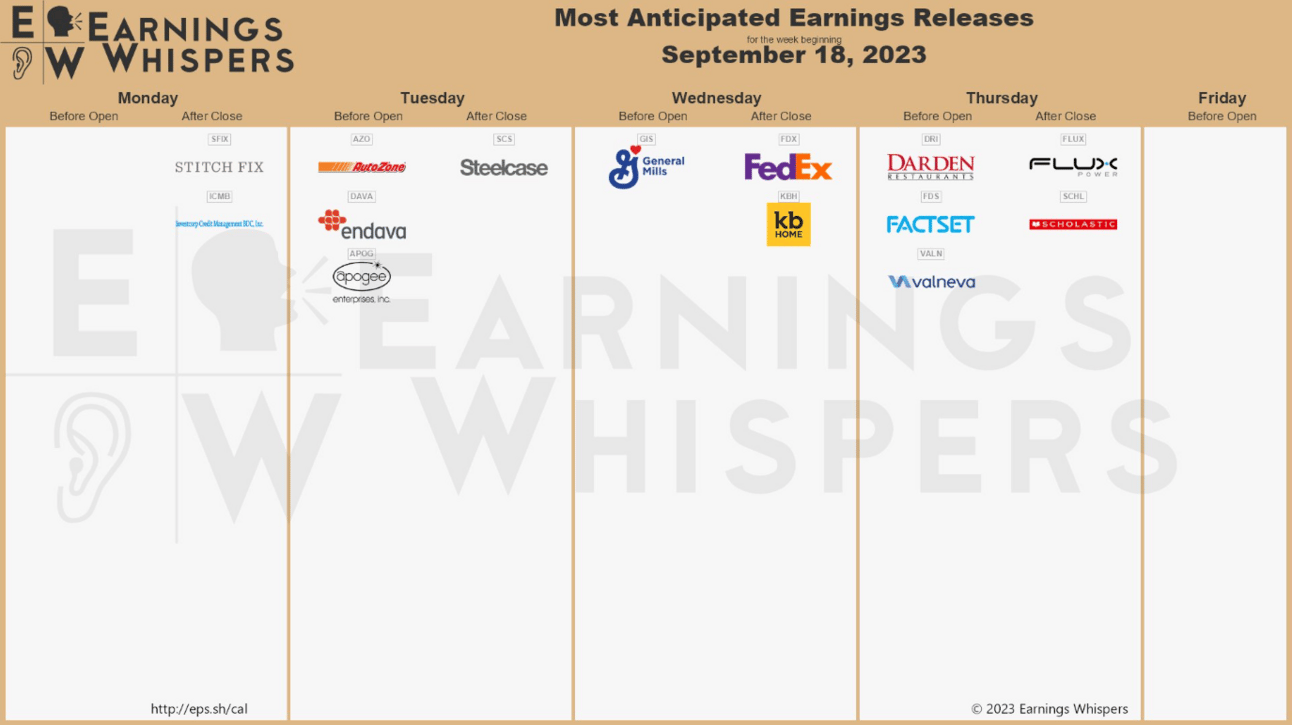

We have entered a dead period as it pertains to earnings season, with only a few companies reporting this week. The companies I will be watching this week include: AutoZone (AZO), General Mills (GS), and FedEx (FDX). Here are the companies reporting earnings this week:

Analyst Upgrades/Downgrades 📝

In this section we will highlight any recent notable analyst upgrades or downgrades.

Bank of America upgrades CSX to buy from neutral

Deutsche Bank upgrades Kenvue to buy from hold

Citi adds a positive catalyst watch on Microsoft

Monness Crespi Hardt downgrades Oracle to neutral from buy

Wolfe upgrades CVS to outperform from peer perform

JPMorgan downgrades Oracle to neutral from overweight

TD Cowen initiates Hershey as outperform

Bank of America downgrades J.M. Smucker to neutral from buy

HSBC initiates Deere as buy

Economic Data This Week 📆

Monday

NAHB Housing Market Index (September)

Tuesday

Building Permits preliminary (August)

Housing Starts (August)

Wednesday

FOMC Meeting

Fed Funds Target Upper Bound

Thursday

Current Account (Q2)

Continuing Jobless Claims

Initial Claims

Philadelphia Fed Index (September)

Existing Home Sales (August)

Leading Indicators (August)

Friday

Fed Governor Lisa Cook gives speech for Keynote Address at the National Bureau of Economic Research Economics of Artificial Intelligence Conference, Fall 2023, Toronto, Canada

PMI Composite SA preliminary (September)

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of 35,000+ like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: Ranking 5 ETFs From BEST to WORST:

Here is another video I put out last week: I Am Beginning To Like This ETF MORE Than SCHD:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark