If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Tired of letting your money sit idle? Learn how you can become your own money manager and put your money to work to build GENERATIONAL WEALTH. Inquire about my 6-week Investing Accelerator course where you get the opportunity to work with me 1 on 1 throughout the entirety of the course.

After today, we will be CLOSING the sign ups for my September cohort so sign up for a FREE 15 minute Investing Evaluation to learn more.

Click HERE to to book your FREE 15-minute Investing Evaluation.

Market Talk ⏪

Welcome to the Monday Morning Edge Report, even though its Tuesday because of the holiday, where we discuss key events and stories within the stock market.

Now we move into our first full week of September, which has easily been the WORST month of the year for the stock market dating back to 1945. This week was cut short by the Labor Day holiday, and there’s not much economic or earnings news, so I do expect a rather quiet week.

Last week we got some key economic data, which was more positive than negative. Let me discuss some of those in more details within our Top 5 Stories:

Labor Market starting to show some weakness: To close the week last week, we got an update on the latest jobs report. Analysts were looking for nonfarm payroll additions of 170,000 in the month of August, yet the report came in at 187,000, exceeding expectations. However, on the flip side, although more jobs were added we finally saw the unemployment rate tick higher from 3.5% to 3.8%, which was the highest level since February 2022. Earlier in the week the JOLTS report, which shows job openings, came in at 8.83 million, which was below the 9.5 million estimate. Another odd update from the government was the adjustment to the July jobs report, which initially showed 187,000 jobs added during the month, but that was later reduced by 30,000.

Hourly Earnings beginning to slow: In addition to the jobs report last week, we also got an update as to average hourly earnings. In the month of August, average hourly earnings increased 4.3% year over year, which was a tick below the 4.4% estimated. Growth is still positive, but this is the slowest growth we have seen in the US since before 2022. Signs are pointing to a once hot labor market coming back to normalization.

Fed’s preferred inflation gauge ticks higher: Last week we got a new reading on PCE, which is a preferred inflation gauge for the Federal Reserve. The Core Personal Consumption Expenditures (PCE) Index, which excludes both the cost of food and energy, rose 4.2% over the prior year in July, in line with estimates, but increasing from the 4.1% in June. The Fed’s goal is to bring PCE down to 2%.

S&P 500 Earnings continue to fall: Q2 earnings were expected to be weak, but many investors are predicting things to turn around in Q3 and Q4 and beyond. Are analysts getting too comfortable with their turnaround predictions? S&P 500 earnings fell 4% on average during Q2, which was the 4th straight quarter of declining profits and also one of the biggest year over year earnings drops. Analysts are expecting a turnaround in 2024 with earnings expected to grow by more than 12%, according to FactSet.

China continues to be an area of concern for investors: China is not a region I invest in directly. I have some open option plays with Alibaba, but that is about it. The country reported an update to its services activity, which showed expansion at the slowest pace in eight months, as they continue to run into demand issues. The Caixin purchasing managers index for August came in at 51.8, down from 54.1 in July. China has tried to spark some economic activity with various types of stimulus thus far, but it has not yet turned things around at all. Companies with large exposure to the region could be weighed down for the foreseeable future.

Join today because PREMIUM just got better! Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Earnings Recaps (NEW ADDITION)

Valuation Dashboard

Subscriber only content

Last week, premium subscribers received TWO deep dives and this week will be jam packed as well. I will be submitting my MONTHLY Portfolio Review as well as a new feature being added for premium subscribers, which will be an earnings summary recap, related to dividend stocks I follow in my coverage.

Go PREMIUM today!

US Markets 🇺🇸

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

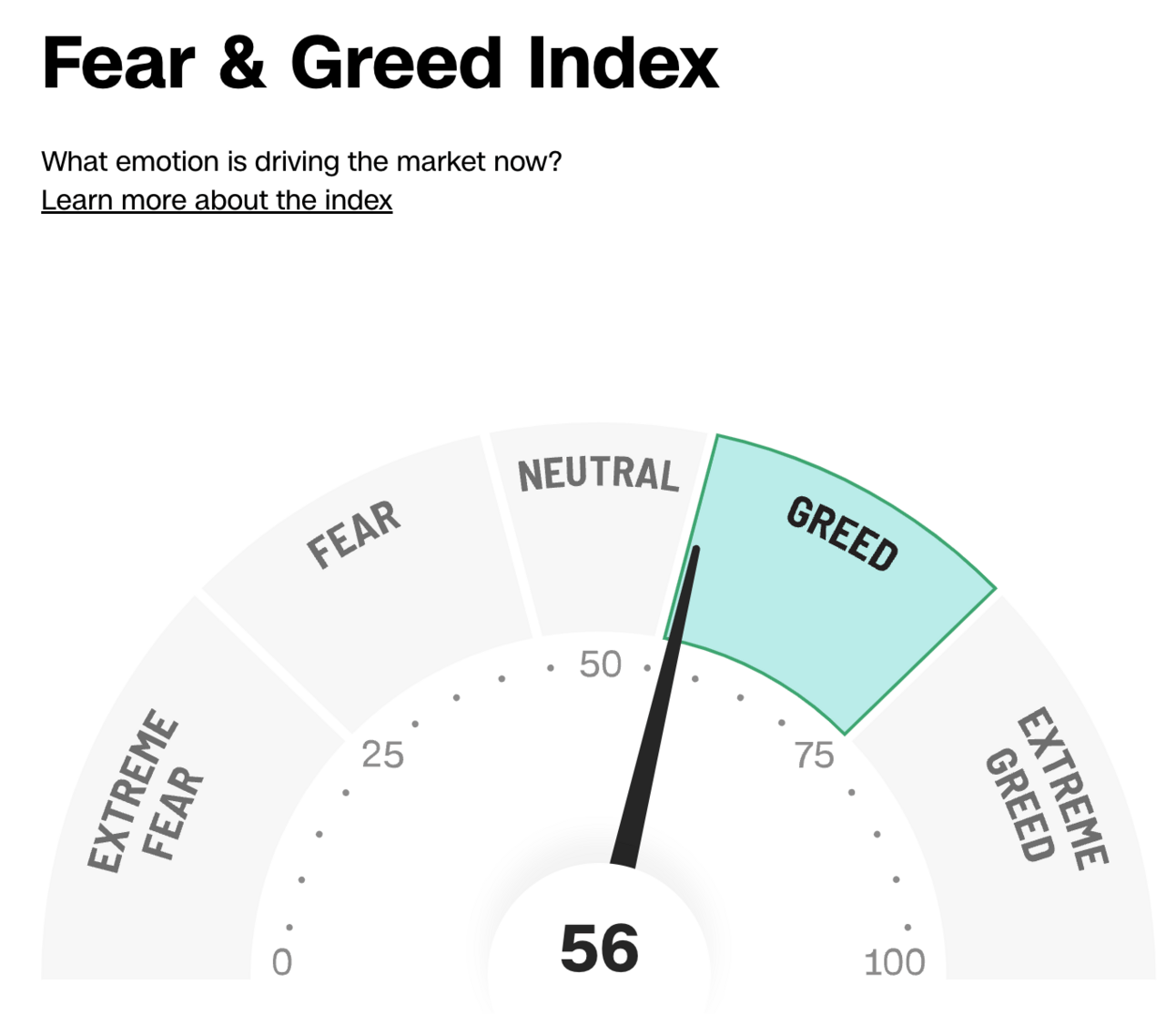

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

With every major US index moving higher last week, it should come at no surprise that the Fear & Greed Index moved higher from neutral to a Greed status to start this week. Currently, the index has a reading of 56, which is slightly higher than the prior week’s reading of 48.

Earnings on Deck 💰

With earnings season in the rearview mirror, not much this week in terms of notable earnings reports being released. Here are the companies reporting earnings this week:

Analyst Upgrades/Downgrades 📝

In this section we will highlight any recent notable analyst upgrades or downgrades.

Bernstein downgrades L3Harris to market perform from outperform

UBS upgrades Oracle to buy from neutral

Citi upgrades Verizon and AT&T to buy from neutral

Morgan Stanley upgrades 3M to equal weight from underweight

Redburn Atlantic upgrades Exxon to neutral from sell

Loop downgrades Dollar General to hold from buy

Wedbush upgrades Papa John’s to outperform from neutral

Economic Data This Week 📆

Monday

LABOR DAY

Tuesday

Total vehicle sales

Factory orders

Wednesday

Mortgage Applications

Imports/Exports

S&P Global Composite PMI

ISM Non-Manufacturing

Beige Book

Thursday

Initial jobless claims

Continuing jobless claims

Fed Balance Sheet

Friday

NONE

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of more than 34,000 like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: 5 Top Dividend Stocks For September 2023:

Here is another video I put out last week: 2 Dividend Stocks I Am Avoiding:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark