If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Are you ready to LEARN how to add $1000s in monthly income by utilizing options. Within this discord you can get the support of a community and track the teachers trades, which are posted in the TRADE ALERTS section. Come join Cash Flow University TODAY!

I have a SPECIAL PROMO code that will get you 33% of your first month or an annual subscription. Use promo code “DIVEDGE33” to get your discount.

Click HERE to check out CFU.

*This is sponsored advertising content.

Market Talk ⏪

We always begin with 5 important topics from the week prior and/or related to the week ahead for investors to be mindful of.

U.S. Retail Sales beat expectations: The Commerce Department reported July retail sales data within the U.S. that showed an increase of 0.7% in the month of July 2023. The rise in retail sales is higher than the 0.4% expectations of the experts and indicates the continued expansion of the economy as well as the strength of the US consumer, who continues to spend. We have seen credit card debt levels continue to increase, which makes sense as consumers continue to spend and they are likely spending those dollars and putting them on a credit card. The positive data continues to have investors baking in the likelihood of a soft landing.

Jackson Hole comes into the spotlight: Jackson Hole over the years has become more and more popular for investors more recently, as the Fed CHair tends to discuss strategy at times. On Friday, Fed Chair Jerome Powell will hold his annual summit. Monetary policy plans are often discussed and in prior years we have seen some sizable market moves. If you are playing options, have Friday on your calendar, as volatility could creep higher to close the week.

Industrial production grew in July but declined year-over-year: U.S. Industrial Production is reported to have grown by 1.0% in July but fell 0.2% year-over-year. The rise in industrial production for the month of July is mainly attributable to a 5.2% increase in motor vehicles and parts production; however, it may soon get reversed as the industrial sector is expected to face multiple challenges in the coming months. Also, the July growth comes after two consecutive months of U.S. industrial production decline in May and June. Industrial production measures the output of the companies in the industrial sector, including manufacturing, mining, and utilities.

10-Year Treasury Hits Highest Level Since 2007: The 10-year US Treasury touch a high of 4.32% late last week, which was the highest level since 2007, a mere 16 years ago. Investors continue to digest the possibility of further rate hikes in order to bring CPI down to the Fed’s stated goal of 2%. A continued sharp rise could put further pressure on yields, with the short-term outlook not looking as rosy as investors once thought.

Initial Jobless Claims decline compared to the previous week: According to the reports filed by the U.S. Department of Labor, the number of new Americans filing for unemployment benefits declined by 11,000 this week to 239,000, compared to 250,000 in the previous week. This decrease essential wipes away the prior week increase we saw. The number of jobless claims this week is in line with the expected number of 240,000. The slight decline further strengthens that the U.S. labor market is softening compared to its tight levels at the beginning of the year.Deep Dive 📰

Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Valuation Dashboard

Subscriber only content

Premium subscribers will soon be receiving their first Deep Dive of the month, so stay tuned!

Go PREMIUM today!

US Markets 🇺🇸

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

In the last week, the Fear & Greed Index went down a significant amount from Greed to Neutral. As you can see from the chart below, we are close to moving into Fear territory. As such, I fully expect a volatile week of trading this week. Currently, the index has a reading of 45, which is slightly lower than the prior week’s reading of 66.

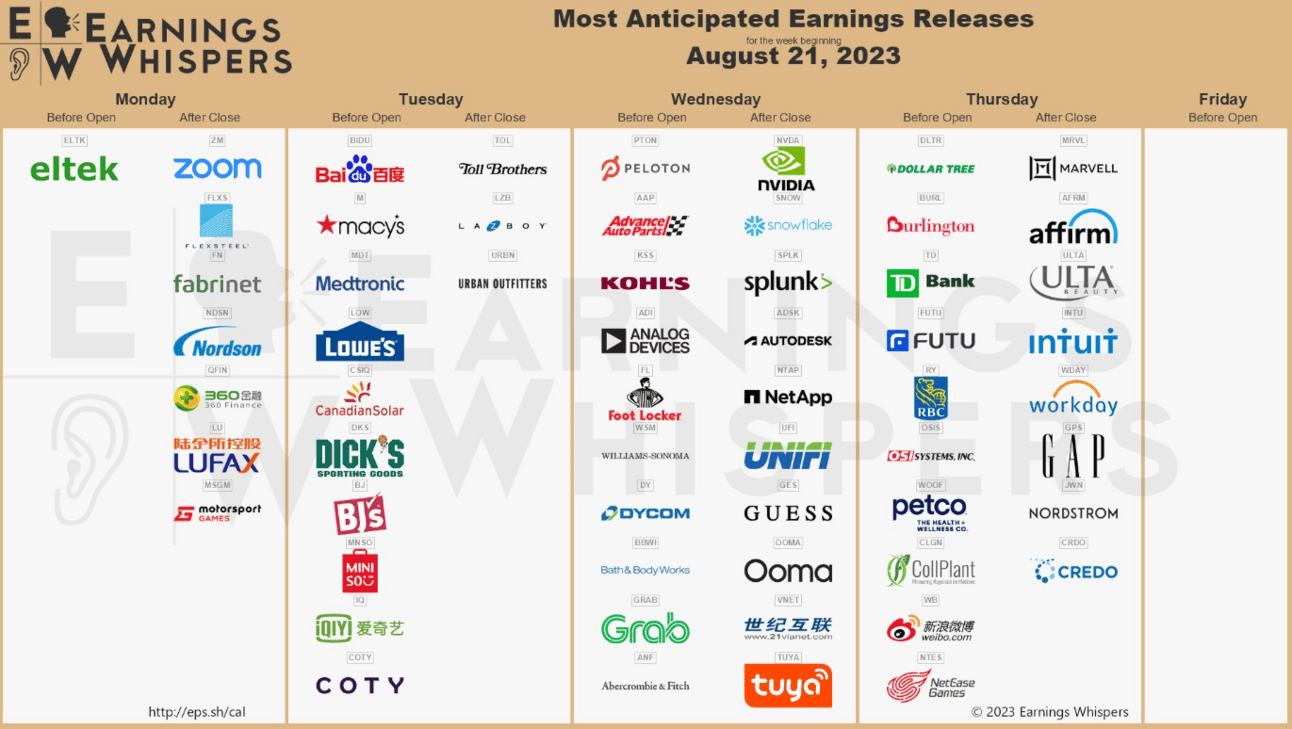

Earnings on Deck 💰

Earnings season is slowly coming to an end, but we still have another week of some larger retailers set to report. Here is a look at the company’s reporting earnings this week:

Analyst Upgrades/Downgrades 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Evercore ISI adds a tactical outperform on Walmart

Bank of America downgrades Phillips 66 and Marathon Petroleum to neutral from buy

Mizuho upgrades Chevron to buy from neutral

Wells Fargo upgrades GE HealthCare to overweight from equal weight

BMO downgrades SL Green to market perform from outperform

Edward Jones downgrades CVS to hold from buy

Economic Data This Week 📆

Monday

None

Tuesday

Existing home sales (July)

Richmond Fed Index (August)

Fed Governor Bowman at the Fed Listens event hosted by the Federal Reserve Bank of Chicago

Wednesday

Building Permits (Final)

PMI Composite Preliminary (August)

Markit PMI Manufacturing Preliminary (August)

Markit PMI Services Preliminary (August)

New Home Sales (July)

Thursday

Chicago Fed National Activity Index (July)

Continuing Jobless Claims (8/12)

Durable Goods Orders 8:30 a.m. Initial Claims (8/19)

Kansas City Fed Manufacturing Index (August) Jackson Hole symposium starts.

Friday

Michigan Sentiment Final (August)

Federal Reserve Chairman Jerome Powell scheduled to speak at Jackson Hole, Wyoming

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of roughly ~33,000 like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: 2 INSANELY Cheap REITs to Buy & 1 To Avoid (Check out this video and see how I nailed the REIT to avoid):

Here is another video I put out last week: 4 Future Dividend Aristocrats To Buy:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark