Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of more than 16,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

Tech and mega caps are weighing on the S&P 500 and Nasdaq, while the Dow Jones continues to make all-time highs.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

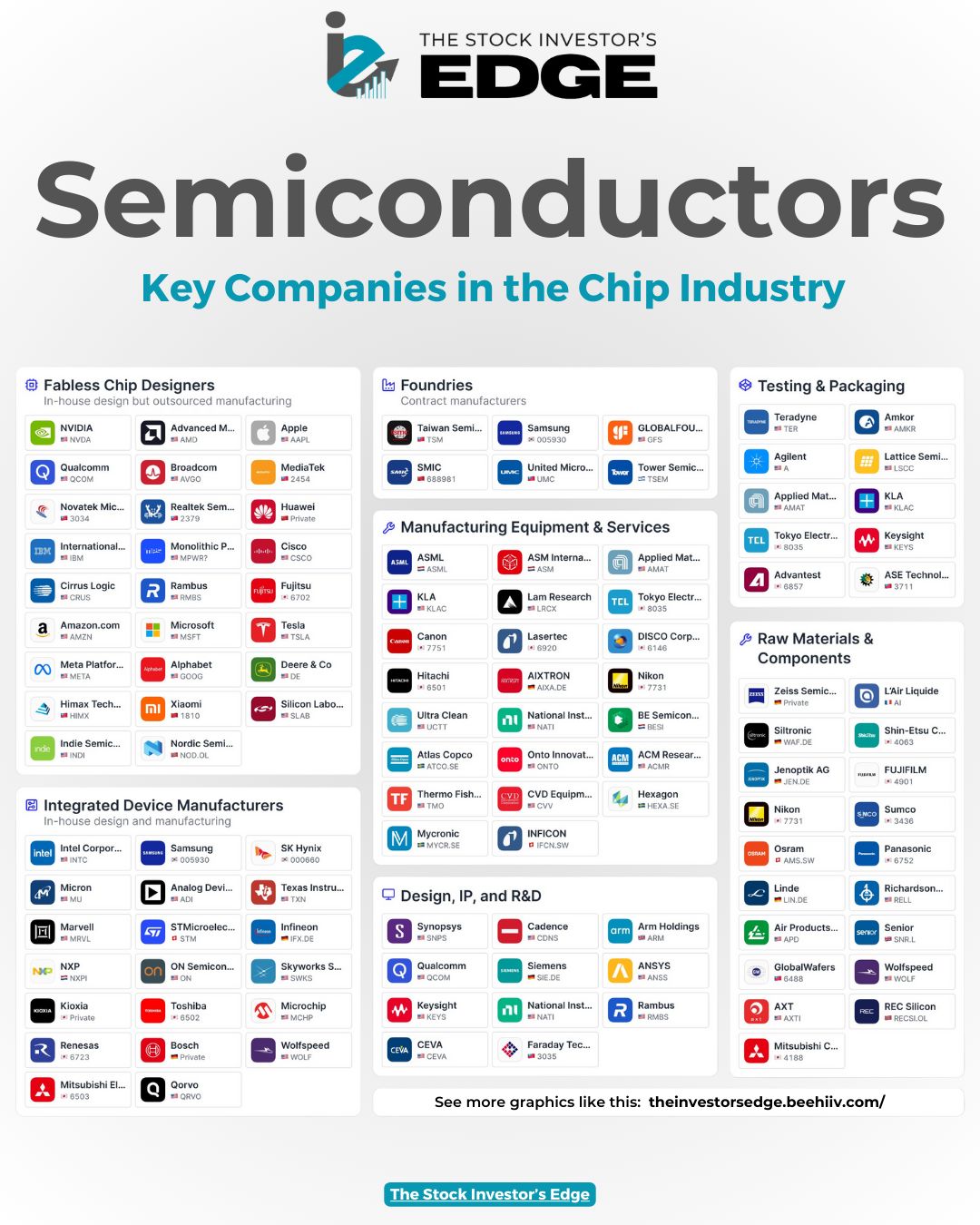

Global chip stocks from Nvidia to ASML fall on geopolitics

Global chip stocks fell sharply due to reports of tighter U.S. export restrictions and geopolitical tensions.

The Biden administration is considering stricter rules on exporting chipmaking equipment to China, affecting companies like ASML, which relies heavily on Chinese sales.

Comments from former President Trump about Taiwan added to the negative sentiment.

Taiwan Semiconductor Manufacturing Co.'s shares dropped, and U.S. chip stocks, including Nvidia and Applied Materials, also suffered losses, dragging the entire market lower with them.

👉 EDGE ALERT: The market has been heavily concentrated in Mag7 and tech stocks. However, as we've noted recently,…upgrade to Edge+ to read the Full Edge Alert.

Google in advanced talks to acquire cyber startup Wiz for $23 billion, its largest-ever deal

Google is in advanced talks to acquire cybersecurity firm Wiz for $23 billion, with a deal expected to close soon.

Founded in 2020, Wiz rapidly grew under CEO Assaf Rappaport, achieving a $12 billion valuation by May.

This acquisition would be Google's largest ever, emphasizing its focus on cybersecurity amid increasing threats from nation-state and criminal actors. Google previously acquired cybersecurity firm Mandiant for $5.4 billion.

Despite facing significant antitrust scrutiny and ongoing litigation, Google's interest in Wiz signals a renewed appetite for mergers and acquisitions.

Talks to acquire sales software maker Hubspot reportedly cooled.

📚 EDGE-UCATION: What is Wiz?

Wiz is a cybersecurity company founded in 2020 by Assaf Rappaport, along with his co-founders Ami Luttwak, Yinon Costica, and Roy Reznik.

The company focuses on cloud security, providing tools and services that help businesses protect their cloud infrastructure and detect vulnerabilities, threats, and misconfigurations.

Wiz's platform offers real-time visibility into cloud environments, enabling organizations to identify and address security issues quickly.

The company has grown rapidly since its inception, attracting significant investment and achieving a high valuation. Wiz's innovative approach to cloud security and its ability to scale quickly have made it a notable player in the cybersecurity industry.

U.S. mortgage rates fall to 6.87%, lowest level since early March

U.S. mortgage rates fell to their lowest level since early March, offering relief to potential homebuyers and the housing industry.

The 30-year fixed mortgage rate dropped 13 basis points to 6.87%, and the 15-year rate fell to 6.49%, according to the Mortgage Bankers Association.

This decline mirrors a drop in Treasury yields due to cooling inflation, increasing the likelihood of Federal Reserve interest rate cuts.

Despite a 2.7% seasonally adjusted drop in mortgage applications, unadjusted purchase applications surged 22%. The overall index of mortgage applications rose 3.9%, with refinancing applications up 15.2%.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these reports, but they also get expert market analysis straight to their inbox daily as well as access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

The Second Half

It’s been a busy week so far from every perspective - earnings, economic reports and market volatility. Don’t expect that to change because the second half of the week has much more its up sleeve.

Earnings Reports

There are still some major earnings this week. At the Investor’s Edge we will be watching Taiwan Semiconductor, Netflix, Abbott Labs, and Domino’s Pizza.

Here is the calendar of earnings releases scheduled for the rest of the week:

Economic Reports

Here is the calendar of events scheduled for the remainder of the week:

The week of Fed commentary continues as several members of the Federal Reserve are scheduled to speak for the last time before the blackout period prior to this month’s rate hike decision. We also get initial jobless claims which should give us a better view of the recent trend of increasing claims.

The Investor’s Edge Discord is here!

Before you go, don’t forget to join our Discord server.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.