Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of nearly 20,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Unlock the Edge+ Experience: Labor Day Sale

Before we get to the newsletter, we have huge news!!

Have you been eyeing the Stock Investor’s Edge+ community but hesitated due to the cost? Now's your chance to join the Edge+ club at an unbeatable price!

For a limited time, our 4th of July Sale offers you a whopping 30% off on an annual subscription. Don’t miss out—this incredible deal ends Tuesday, July 8th. Take advantage of this amazing deal and take your investing to the next level!

Edge+ members get expert market analysis straight to their inbox as well as access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

Market Talk

The major indexes are all lower to start the week as markets await the all important Nvidia earnings report.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

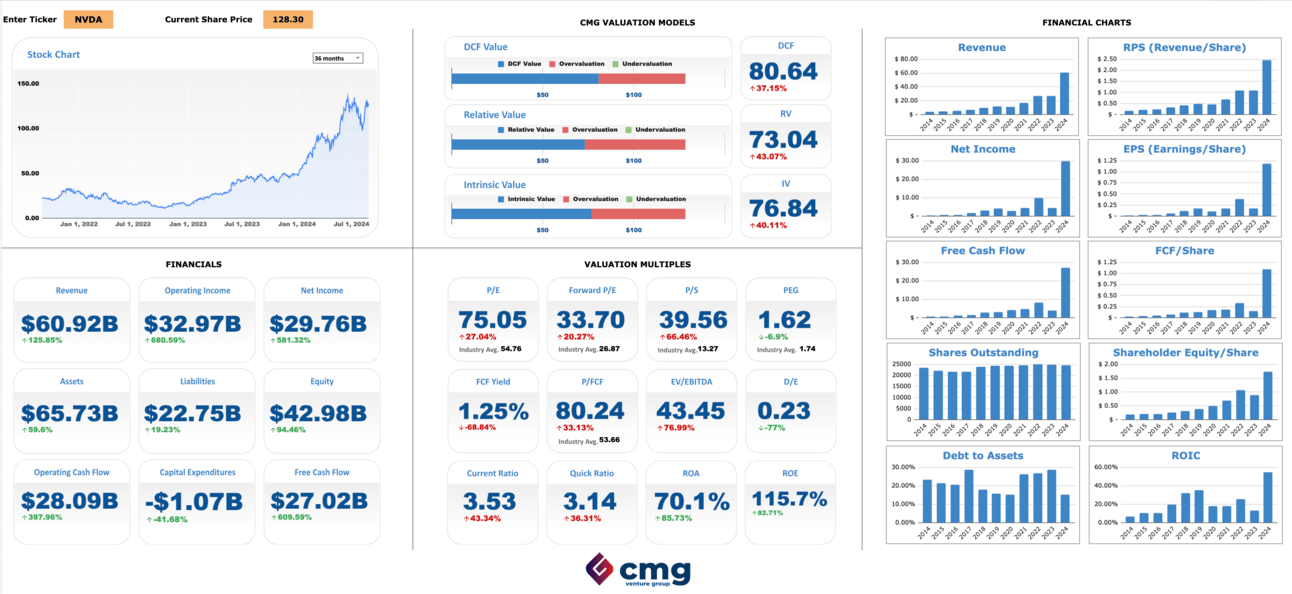

Nvidia reports earnings after the bell, here’s what to expect

Screener typically reserved for Edge+ members - a little gift for everyone 🎁

Nvidia is set to report its second fiscal-quarter earnings, with Wall Street expecting adjusted earnings per share of 64 cents and revenue of $28.7 billion.

Nvidia has greatly benefited from the ongoing AI boom, with its market value increasing more than ninefold since the end of 2022.

Investors are watching for signs that AI demand remains strong, although growth is expected to slow over the next seven quarters. Nvidia's forecast for the October quarter is crucial to justify its stock price, with analysts projecting 71 cents in earnings per share and 77% annual revenue growth.

Investors will also seek updates on the launch of Nvidia's next-generation Blackwell AI chips, which may be delayed, potentially shifting revenue into future quarters while boosting sales of current-generation Hopper chips.

👉 EDGE ALERT: Like seeing the screener? We’re working on some cool things behind the scenes but it’s going to be reserved for Edge+ members only…take advantage of our Labor Day Sale and upgrade to Edge+ for 30% off today and get full access once we roll out the screener, valuation tools and much more.

Buffett’s Berkshire Hathaway hits $1 trillion market value, first U.S. company outside of tech to do so

Warren Buffett's Berkshire Hathaway has reached a $1 trillion market capitalization, becoming the first non-technology company in the U.S. to do so.

The company's stock has surged over 28% in 2024, outperforming the S&P 500's 18% gain.

Buffett, who is nearing his 94th birthday, has recently shifted to a more defensive strategy, selling off significant assets, including half of his Apple stake, and raising Berkshire’s cash reserves to a record $277 billion by June.

Berkshire has invested heavily in short-term Treasury bills, holding $234.6 billion worth, more than the U.S. Federal Reserve.

Additionally, Berkshire has sold over $5 billion in Bank of America stock, a company Buffett supported during the 2011 financial crisis.

📚 EDGE-UCATION: Who is Warren Buffett?

Warren Buffett is one of the most renowned and successful investors in the world. Known as the "Oracle of Omaha," he is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company. Buffett is famous for his value investing strategy, which focuses on buying stocks that appear undervalued compared to their intrinsic worth. He has a long-term approach to investing, often holding onto stocks for years, even decades.

Buffett's success in the stock market has made him one of the wealthiest individuals globally, with a net worth frequently ranking among the top billionaires. Despite his immense wealth, he is known for his frugality and modest lifestyle. He still lives in the same house in Omaha, Nebraska, that he purchased in 1958.

Buffett is also a philanthropist, pledging to give away the majority of his wealth through the Giving Pledge, an initiative he co-founded with Bill and Melinda Gates. This commitment includes significant donations to the Bill & Melinda Gates Foundation and other charitable organizations.

Buffett’s influence extends beyond investing; his annual letters to Berkshire Hathaway shareholders are widely read for their insights into markets and business strategies. His wisdom, straightforward communication style, and remarkable track record have made him a mentor figure in the world of finance.

A word from our sponsor - 1440 Media

All your news. None of the bias.

Be the smartest person in the room by reading 1440! Dive into 1440, where 3.5 million readers find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight.

Shares of Super Micro Computer dropped over 23% after the company announced a delay in filing its annual report with the SEC, citing the need for more time to assess its internal controls over financial reporting.

Super Micro, which produces computers used as servers and in AI applications, has major clients like Nvidia, AMD, and Intel.

Despite being up over 47% year-to-date, investor confidence was shaken when Hindenburg Research disclosed a short position in the company, alleging evidence of accounting manipulation.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

The Second Half

While there are several earnings and economic reports left this week, Nvidia’s earnings and the PCE report are the two major catalysts everyone will be watching, including us.

Earnings Reports

There are still some major earnings this week. At the Investor’s Edge we will be watching Nvidia, Salesforce, CrowdStrike, Lululemon, and Ulta Beauty.

Here is the calendar of earnings releases scheduled for the rest of the week:

Economic Reports

Here is the calendar of events scheduled for the remainder of the week:

The PCE inflation report will be the main focus as we close the week, though there will also be the latest GDP data, initial jobless claims, consumer sentiment and pending home sales.

The Investor’s Edge Discord is here!

Before you go, don’t forget to join our Discord server.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.