Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

Markets are higher to start the week on the heels of the PPI report and Oracle’s huge earnings report.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Oracle’s AI-fueled cloud forecast stuns Wall Street, stock soars

Oracle $ORCL ( ▼ 5.4% ) delivered one of the most jaw-dropping outlooks in recent memory, sending its stock to the biggest single-day rally since the dot-com era. Despite missing on both earnings and revenue, investors zeroed in on the company’s bold cloud trajectory, powered by blockbuster AI contracts and surging demand for data center capacity.

🔑 Key Points

Historic stock move: Shares surged over 30%, marking Oracle’s sharpest rally since 1999 and pushing its market cap above $870B.

RPO surge: Remaining performance obligations rocketed 359% YoY to $455B, reflecting four new multibillion-dollar AI contracts.

Cloud growth path: Oracle projects cloud infrastructure revenue climbing from $18B in FY26 to $144B in FY30, a tenfold increase over five years.

AI integration: OpenAI will develop 4.5 GW of U.S. data center capacity with Oracle, while GPT-5 and Gemini AI models are being embedded into its platform.

Capex expansion: Management raised capital expenditures by 65% to $35B to support the massive build-out of cloud infrastructure.

👀 What You Need to Know

Oracle reset expectations with a multi-year cloud roadmap that projects revenue climbing to $144B by FY30. The $455B backlog provides rare visibility into future demand and positions Oracle alongside Microsoft and Amazon as a major hyperscaler player. The key investor question is whether the company can execute and deliver this unprecedented growth path without margin erosion as capex accelerates.

🔐 Edge Takeaway: Oracle missed on revenue and EPS, but the market ignored that and re-rated the stock on cloud projections that put the company in…upgrade to Edge+ to read the full Edge Takeaway, including the Edge score and CMG Strength Ratio.

Wholesale Prices Surprise with Deflationary Turn in August

Wholesale prices unexpectedly declined in August, offering the Federal Reserve additional breathing room to move forward with its first rate cut of the year. The drop was driven by softer services costs, particularly in trade margins, while goods prices showed only marginal strength. With inflation worries still lingering from earlier months and another CPI print due tomorrow, the data gives the Fed short-term cover to begin cutting rates but doesn’t resolve the larger debate over price stability.

🔑 Key Points

Headline miss: PPI fell 0.1% vs. estimates for a 0.3% increase, the third deflationary print this year.

Core weakness: Core PPI also dropped 0.1%, though core minus trade services advanced 0.3%.

Services drag: Services prices, a critical Fed focus, fell 0.2%, driven by a 3.9% plunge in wholesale margins.

Market reaction: Stocks ticked higher and Treasury yields slipped modestly, as traders await Thursday’s CPI release.

Rate cut odds: Futures markets now price a 100% chance of a 25bp cut and ~10% chance of 50bp next week.

👀 What You Need to Know

The PPI decline gives the Fed some flexibility, but it doesn’t erase last month’s hotter inflation signals or broader price risks tied to tariffs and wages. Services deflation matters because it drives most of GDP, yet goods costs still edged higher, showing underlying stickiness. Investors are waiting for CPI to confirm whether easing momentum is real or temporary. With labor market revisions showing cracks, this release adds to the case for a September cut but doesn’t guarantee a smooth disinflation path ahead.

🔐 Edge Takeaway: Markets ripped higher on the PPI miss, but the real story is…upgrade to Edge+ to read the full Edge Alert.

📚 Edge-ucation: What the PPI matters?

The Producer Price Index (PPI) tracks wholesale prices that businesses pay for goods and services before they reach consumers. Think of it as an early warning system for inflation pressures building in the pipeline. Because it measures input costs, it can sometimes signal where consumer prices (CPI) are headed next.

Pipeline inflation: Rising PPI suggests companies may eventually pass higher costs to consumers, pushing up CPI.

Fed’s lens: While the Fed prefers PCE, it watches PPI as a cross-check on inflation trends.

Sector signals: Services vs. goods splits in PPI reveal where inflation is sticky and where it’s easing.

Market impact: Surprises in PPI can jolt bonds, stocks, and rate expectations since traders see it as a clue for policy direction.

Understanding PPI helps investors anticipate shifts in Fed policy and market reaction before they fully show up in consumer inflation data.

Apple unveils iPhone 17 series and ultra-thin iPhone Air

Apple $AAPL ( ▲ 1.54% ) introduced the iPhone 17 lineup and a new iPhone Air at its annual event, marking the company’s biggest hardware refresh since the iPhone X. The Air, priced at $999, replaces the Plus model and sets the stage for a foldable device expected next year. Apple also updated the Watch and AirPods lines, though AI software progress remains absent.

🔑 Key Points

iPhone Air: At 5.6mm thick with a 6.6-inch display, the Air debuts at $999 and replaces the Plus model.

iPhone 17: Base model remains $799 with 256GB storage, while Pro starts at $1,099, reflecting Apple’s pricing discipline.

Design plateau: New rear “plateau” houses hotter chips and cameras, balancing thinner devices with AI-ready performance.

Supply chain: Most U.S. shipments now come from India, but Pro units still rely heavily on Chinese production.

Wearables and audio: Watch Ultra 3 gains satellite connectivity, and AirPods Pro 3 add heart-rate monitoring and translation.

👀 What You Need to Know

Apple is leveraging thinner designs and storage shifts to lift iPhone margins, but risks remain tied to execution. The iPhone Air positions Apple for a foldable release while highlighting design trade-offs like weaker battery life. Meanwhile, AI delays keep Apple lagging rivals, leaving hardware as the primary revenue driver. For investors, pricing strength and tariff insulation support near-term sales, but long-term growth hinges on AI delivery.

🔐 Edge Takeaway: Apple just raised the iPhone price floor, which is a positive, but the stock dropped because…upgrade to Edge+ to read the full Edge Alert.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

All eyes are on Thursday’s CPI report, which will be the main catalyst to whether markets push to all-time highs to end the week, or if we see a pullback.

Earnings Reports

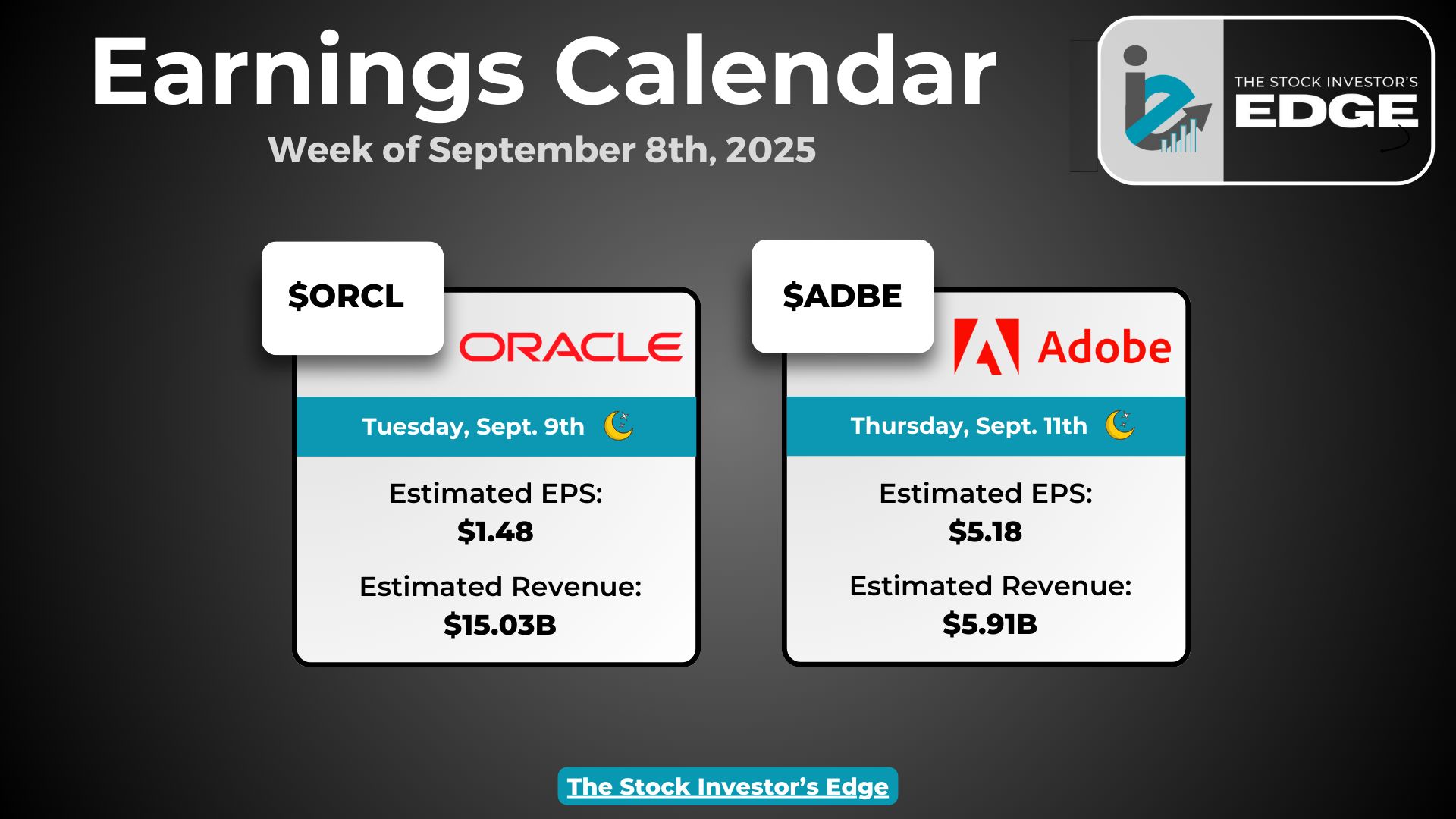

There’s only one stock we cover left to report this week, Adobe, which reports on Thursday after the bell:

Here is the full calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

CPI will be the main focus to end the week, but we also get initial jobless claims and consumer sentiment.

Here is the full calendar of events scheduled for the remainder of the week:

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.