Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

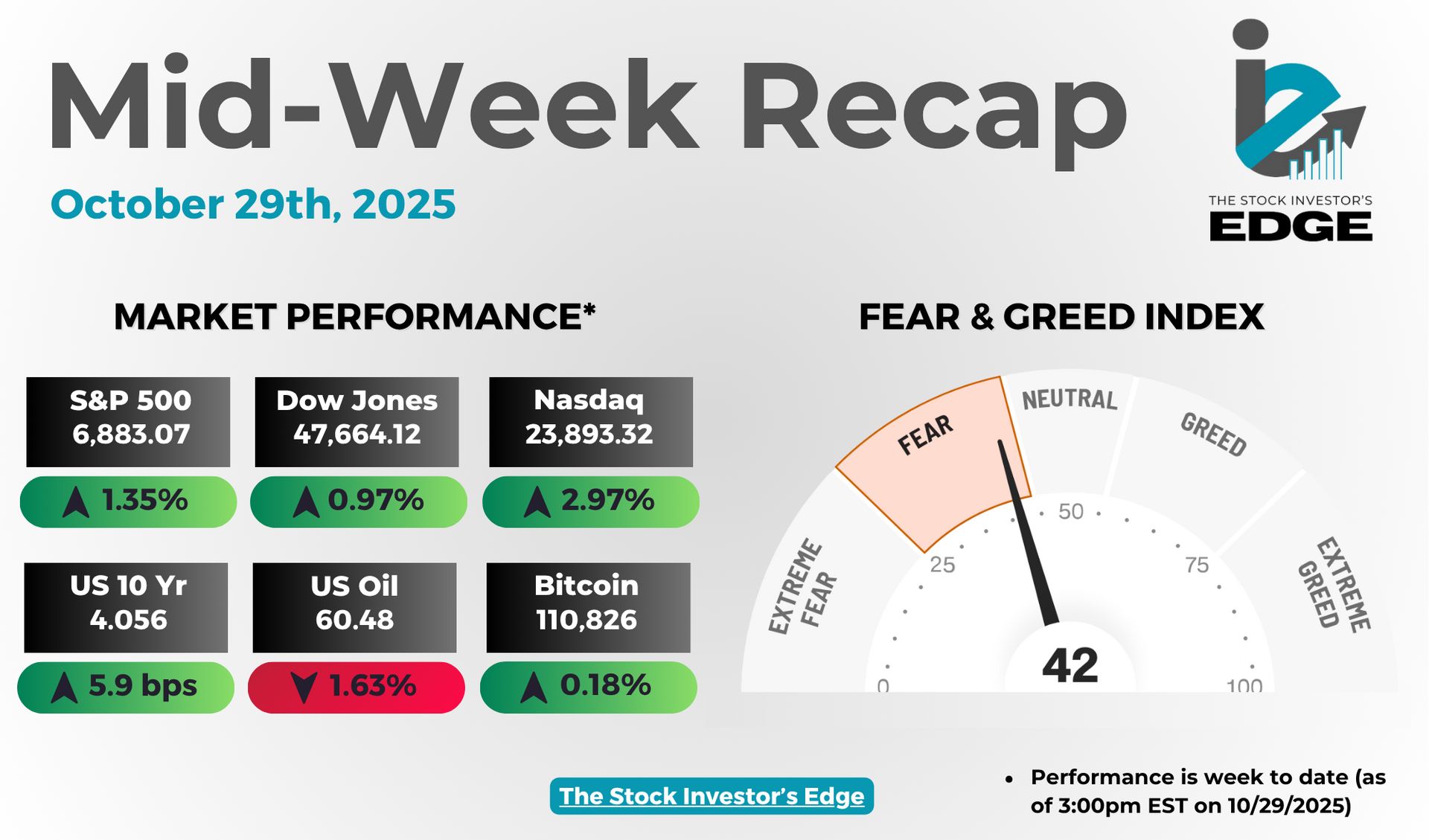

The major indexes all made record highs this week, though we have seen a bit of a cooldown today following the Fed’s interest rate decision.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Fed Cuts Rates Again Amid Data Blackout and Growing Labor Market Risks

The Fed delivered a second straight cut, lowering the funds rate to 3.75% to 4.00% by a 10 to 2 vote despite limited data from the shutdown. Policymakers also ended quantitative tightening effective December 1 and will roll maturities into shorter bills, signaling caution on liquidity and portfolio duration. Dissent split both ways, with Stephen Miran favoring a larger half-point move and Jeffrey Schmid preferring no cut.

🔑 Key Points

Split Decision: Miran pushed for a half-point cut while Schmid opposed any cut, underscoring internal policy tension.

QT Halted: The Fed will stop balance sheet runoff and reinvest in shorter-term bills starting December 1.

Data Void: With payrolls and retail data frozen by the shutdown, policymakers acted with limited visibility.

Labor Concerns: The FOMC flagged “downside risks to employment” despite stable unemployment rates through August.

Inflation Pressure: CPI remains near 3%, lifted by energy costs and tariffs, keeping real progress elusive.

👀 What You Need to Know

This was a defensive cut that reflects uncertainty rather than conviction. The Fed is signaling caution as it navigates a murky economy without reliable data and a labor market that’s losing momentum. Ending QT reduces liquidity strain but also hints at concern over short-term funding markets. Investors see easier policy as supportive for risk assets, but another misread on inflation could force a reversal just as quickly.

🔐 Edge Takeaway: Powell’s remarks reinforced that today’s decision was…upgrade to Edge+ to read the full Edge Takeaway.

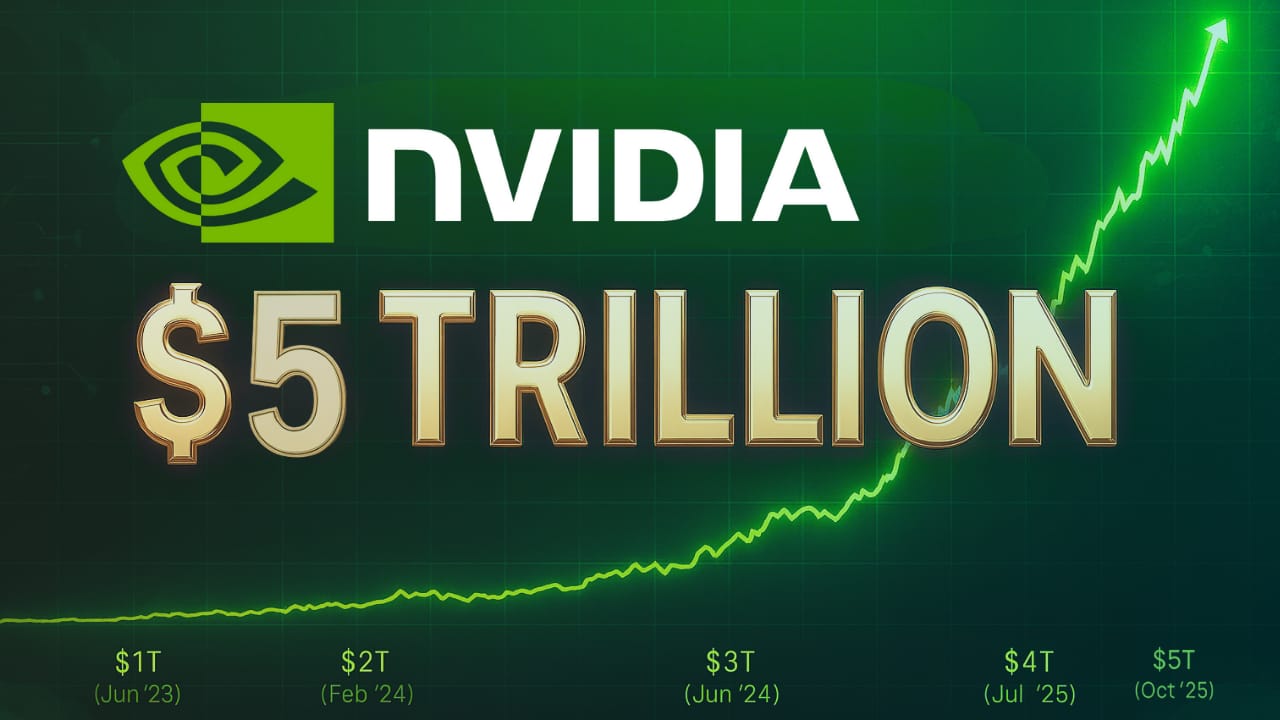

Nvidia becomes first $5 trillion company as Huang unveils $500 billion AI chip roadmap

Nvidia $NVDA ( ▲ 1.02% ) has surged this week to become the first company ever worth $5 trillion. The milestone capped an extraordinary run fueled by CEO Jensen Huang’s forecast of $500 billion in AI chip orders and a sweeping set of new partnerships unveiled in Washington. The company also announced a $1 billion stake in Nokia to co-develop 6G infrastructure and plans to build seven U.S. supercomputers, deepening its dominance in AI hardware.

🔑 Key Points

Historic valuation: Nvidia crossed $5 trillion in market cap, up 50% year-to-date and extending its lead in global equities.

$500B order book: CEO Jensen Huang projected half-a-trillion dollars in AI chip demand driven by Blackwell and Rubin architectures.

Major partnerships: Deals include Palantir, CrowdStrike, Uber, Lucid, and Eli Lilly, plus a $1 billion investment in Nokia for 6G.

Government push: Nvidia will build seven supercomputers for the U.S., part of a broader AI-infrastructure strategy aligned with domestic policy.

Competitive backdrop: Huang dismissed bubble fears even as AMD, Broadcom, and Qualcomm ramp efforts to challenge Nvidia’s AI dominance.

👀 What You Need to Know

Nvidia’s $5 trillion mark cements it as the defining winner of the AI era, yet Huang’s tone suggests a company still in expansion mode rather than celebration. His $500 billion order forecast reframed expectations for how long AI spending can stay elevated, while the Nokia and government supercomputer deals highlight efforts to diversify beyond hyperscalers. Investors embraced the vision, seeing Nvidia’s surge as proof that AI spending is still accelerating and has yet to hit its ceiling.

🔐 Edge Takeaway: Huang’s $500 billion order forecast is the loudest signal yet that AI infrastructure spending…upgrade to Edge+ to read the full Edge Takeaway, including the Edge score and CMG Strength Ratio.

📚 Edge-ucation: What Are Hyperscalers?

Hyperscalers are the tech giants that build and run massive cloud networks powering the modern internet. They provide the computing backbone for AI training, streaming, and cloud services, spending hundreds of billions each year on servers, chips, and data centers to keep global systems online.

Who they are: Amazon, Microsoft, Google, and Meta dominate global hyperscale infrastructure.

How they grow: They scale horizontally, adding thousands of servers to expand computing power efficiently.

Why they matter: Their capex drives semiconductor demand, networking growth, and energy consumption worldwide.

Market impact: A shift in hyperscaler budgets can ripple through the entire tech sector almost instantly.

Overall, hyperscalers set the tempo for global tech investment, and every AI cycle starts and ends with their spending.

Sponsored by AltIndex

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Q3 Earnings Season: This Week’s Roundup

Several heavyweights across payments, healthcare, logistics, telecom, and fintech posted results this week, with most topping EPS and delivering investor-friendly updates. Trends were solid overall, especially for consumer spend, and many names raised or reiterated their full-year outlooks.

Visa $V ( ▲ 0.63% ) delivered another clean beat on resilient card spend and healthy cross-border.

EPS: $2.98 vs $2.97 est.

Revenue: $10.72B vs $10.61B est.

Highlights: Payments volume +9% constant dollar, cross-border +12%, processed transactions +10%, FY26 outlook low double-digit growth.

UnitedHealth $UNH ( ▲ 0.02% ) beat EPS and nudged guidance higher as utilization tracked in line and the MCR stabilized.

EPS: $2.92 vs $2.80 est.

Revenue: $113.16B vs. $113.03B est.

Highlights: Medical care ratio 89.9% in line, Optum Health margin compression persists, FY25 adjusted EPS raised to ≥$16.25, 2026 setup improving.

UPS $UPS ( ▲ 1.03% ) topped on EPS and revenue as mix and pricing offset softer volumes, with early progress on the turnaround.

EPS: $1.74 adj vs $1.29 est.

Revenue: $21.40B vs $20.84B est.

Highlights: Avg daily volume +4.8%, international revenue +5.9%, supply chain operating profit up, cash flow pressure eased in Q3.

Verizon $VZ ( ▲ 1.25% ) beat on EPS and postpaid adds, missed on revenue, and reiterated full-year targets.

EPS: $1.21 adj vs $1.19 est.

Revenue: $33.8B vs $34.28B est.

Highlights: Postpaid phone adds 44k vs 19k est, broadband cross-sell rising, FCF outlook about $19.5B to $20.5B, capex within plan.

PayPal $PYPL ( ▼ 0.19% ) beat on EPS and revenue, raised guidance, and announced a strategic ChatGPT wallet integration.

EPS: $1.34 vs $1.20 est.

Revenue: $8.40B vs $8.24B est.

Highlights: Net revenue +7%, TPV $458.1B +7% FX-neutral, first dividend, FY25 EPS guide raised, AI commerce partnership with OpenAI.

🔐 Edge Takeaway: Q3 earnings season has been one of the strongest in years, with…upgrade to Edge+ to read the full Edge Takeaway.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

With the Fed interest rate decision announced, the focus for the rest of the week is earnings, with a number of major companies scheduled to report.

Earnings Reports

The major earnings this week start tonight with 3 of the MAG7 names expected to report, followed by 2 more MAG7 names reporting tomorrow. On top of that, we get a number of other major earnings. Here are the list of names we will be watching:

Wednesday 10/29: Microsoft, Alphabet, Meta, Starbucks, and Chipotle

Thursday 10/30: Apple, Amazon, Eli Lilly, Mastercard, Merck, Coinbase, L3Harris, and VICI

Friday 10/31: Exxon Mobil, AbbVie, and Chevron

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

Due to the government shutdown, there are no more economic reports scheduled for the rest of the week.

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.