Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

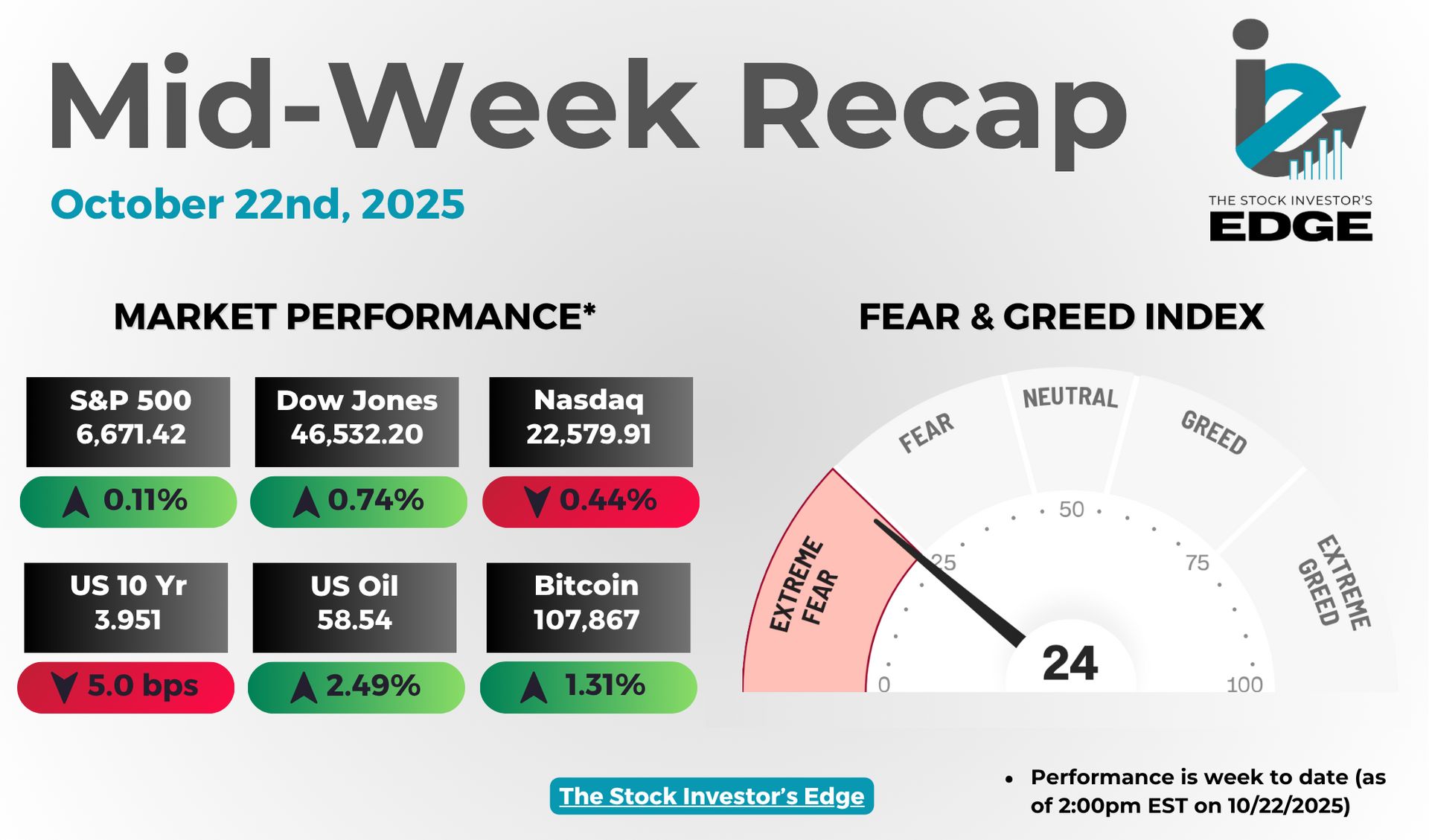

The major indexes are mixed to start the week despite the strong rally to start the week and after today’s sell-off.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Amazon’s AWS Glitch Takes Down Half the Internet

A routine software update to Amazon’s $AMZN ( ▲ 2.56% ) cloud network AWS triggered a massive internet outage across the US, disrupting airlines, banks, and countless online services. A faulty DNS entry crippled AWS’s DynamoDB early Monday, leaving Alexa, Slack, Venmo, and others offline for hours. Amazon restored most services by late afternoon, exposing how dependent modern connectivity has become on a single cloud provider.

🔑 Key Points

DNS misfire: A routine update to AWS’s DNS mislabeled DynamoDB routes, severing machine-to-machine communication.

Widespread fallout: Flights, e-commerce, financial transactions, and educational systems were knocked offline across the East Coast.

Critical dependency: Over 140 AWS products failed, crippling even firms attempting to migrate to other regions.

Economic losses: Early estimates suggest tens of millions in losses as businesses, banks, and crypto exchanges stalled.

Cloud rethink: The event reignited calls for diversification across multiple cloud providers to prevent systemic single-point failures.

👀 What You Need to Know

This outage highlights the concentration risk built into the modern internet, where Amazon controls roughly one-third of global cloud infrastructure. Even a minor technical glitch cascaded into a national disruption, proving that scale alone doesn’t guarantee resilience. Expect renewed pressure on regulators and CIOs to pursue multi-cloud strategies. For investors, the disruption underscored that AWS’s long-term value depends as much on reliability as it does on expanding its reach.

🔐 Edge Takeaway: The recent outage at Amazon Web Services, responsible for nearly 30% of the global cloud infrastructure market and running at about a $124B annual revenue run rate, raises a subtle but material red flag for Amazon. The…upgrade to Edge+ to read the full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

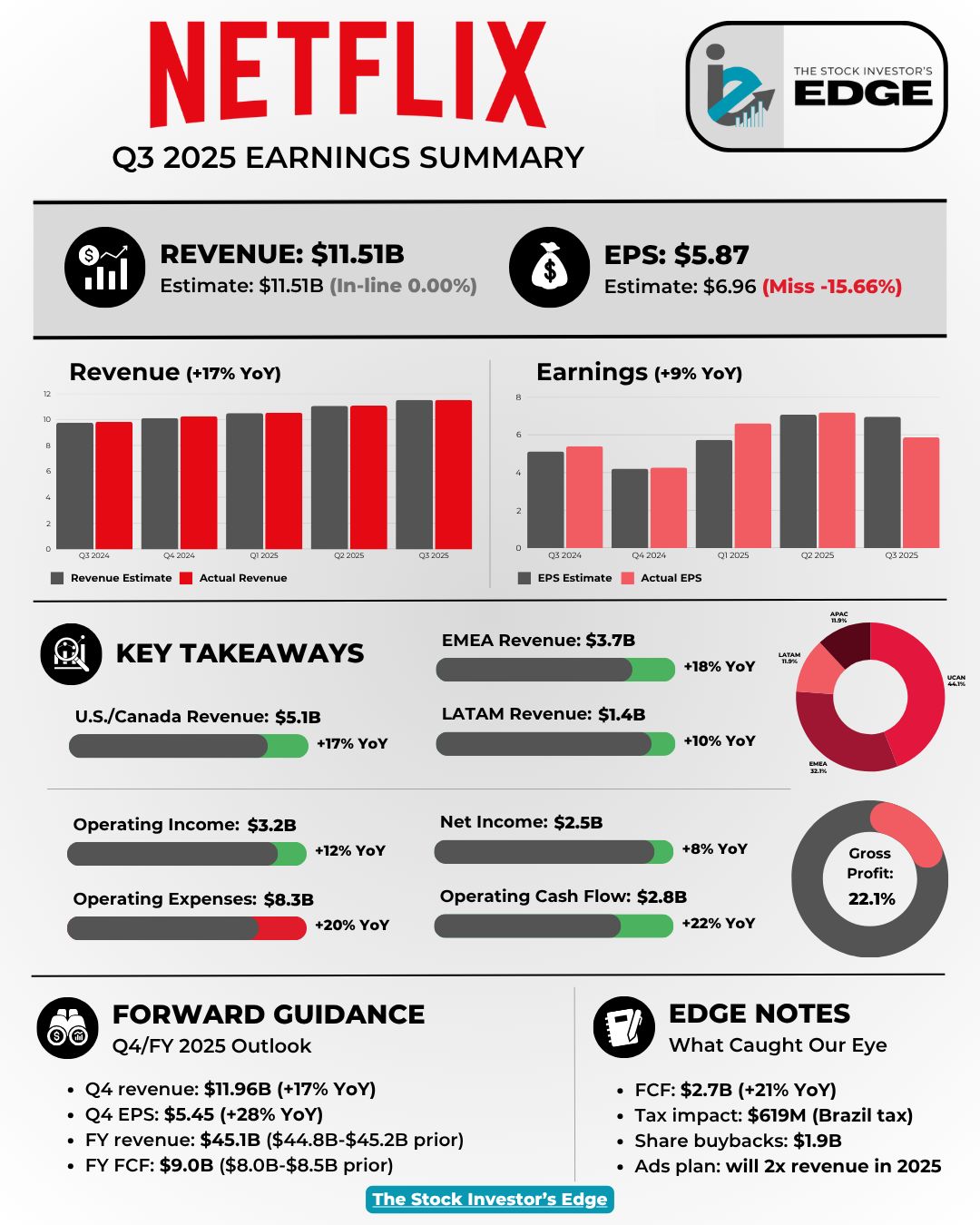

Netflix Shares Drop on Earnings Miss, as Brazil Tax Hit Offsets Record Ad Growth

Netflix $NFLX ( ▲ 2.17% ) missed profit expectations as a $619M Brazilian tax charge offset strong ad and revenue growth. The stock is -7% so far this week.

EPS: $5.87 vs $6.96 est.

Revenue: $11.51B vs $11.51B est.

Tax impact: $619M Brazil charge cut operating margin by ~5 points to 28%.

Ad momentum: Record quarter with U.S. upfront commitments doubling YoY.

Cash flow: Free cash flow +21% YoY to $2.7B on lower content spend.

Buybacks: $1.9B repurchased with $10.1B authorization remaining.

Guidance: Q4 revenue +17% YoY to $11.96B, EPS +28% to $5.45, margin 23.9%.

🔐 Edge Takeaway: The 10% post-earnings drop is the market telling you Netflix’s…upgrade to Edge+ to read the full Edge Takeaway, including the Edge score and CMG Strength Ratio. Take advantage of our Earnings Season sale and get 15% off today!

📚 Edge-ucation: Top Line vs Bottom Line

In earnings season, you’ll often hear analysts talk about the “top line” and “bottom line.” These aren’t just accounting terms, they tell you whether growth is coming from scale or efficiency. The top line shows how fast a company is expanding, while the bottom line reveals how much of that growth actually turns into profit.

Top line = revenue, the total sales before expenses.

Bottom line = net income, profit after taxes, interest, and costs.

Top-line beats show demand strength, but may mask weak margins.

Bottom-line beats signal real operating leverage and shareholder value creation.

Understanding the difference helps investors spot whether a company’s growth is sustainable or just cosmetic.

Sponsored by Masterworks

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Q3 Earnings Season: This Week’s Roundup

Several major names across consumer, industrial, defense, and medtech sectors reported third-quarter earnings this week, with results broadly resilient. Pricing power, cost discipline, and backlog strength helped most companies top expectations, and guidance remained steady or improved across the board.

Coca-Cola $KO ( ▲ 1.18% ) delivered solid top-line growth and margin expansion, reaffirming full-year guidance.

EPS: $0.82 vs $0.78 est.

Revenue: $12.5B vs $12.41B est.

Highlights: Organic revenue +6%; unit cases +1%; operating margin 32%; CCBA stake sale; FY25 organic growth 5–6%.

General Motors $GM ( ▲ 0.05% ) posted a strong beat and lifted its full-year outlook despite EV production adjustments.

EPS: $2.80 vs $2.31 est.

Revenue: $48.6B vs $45.0B est.

Highlights: FY EPS & FCF raised +10%; U.S. share 16.3% (best since 2017); China EBIT margin 7%; EV realignment charge $0.4B.

Lockheed Martin $LMT ( ▼ 1.24% ) beat expectations and raised full-year guidance on broad segment strength.

EPS: $6.95 vs $6.38 est.

Revenue: $18.61B vs $18.2B est.

Highlights: Aeronautics +12%; Missiles & Fire Control +14%; Space +9%; FY EPS & sales guide raised.

GE Aerospace $GE ( ▲ 2.53% ) delivered another beat led by commercial services and defense, with guidance raised across metrics.

EPS: $1.66 vs $1.47 est.

Revenue: $12.2B vs $10.9B est.

Highlights: Commercial services +28%; record LEAP deliveries; Defense +26%; FCF $2.4B; guidance raised.

Intuitive Surgical $ISRG ( ▲ 0.91% ) reported strong procedure growth and da Vinci 5 momentum, with FY outlook lifted.

EPS: $2.40 vs $1.99 est.

Revenue: $2.51B vs $2.41B est.

Highlights: Procedures +20%; 427 placements; installed base +13%; da Vinci 5 uptake; FY procedure growth raised.

🔐 Edge Takeaway: Q3 earnings are unfolding stronger than expected, with S&P 500 blended EPS growth approaching…upgrade to Edge+ to read the full Edge Takeaway. Take advantage of our Earnings Season sale and get 15% off today!

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

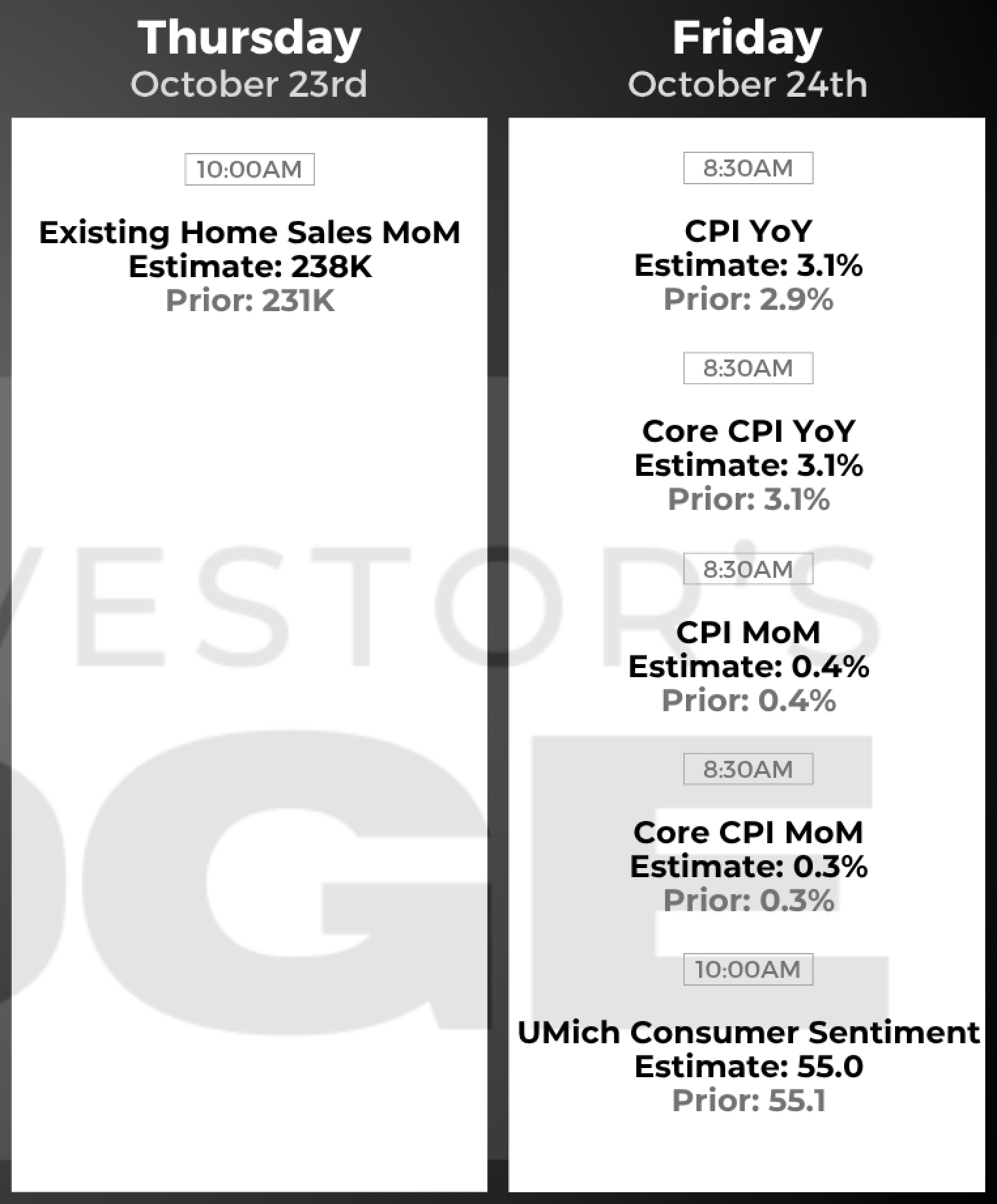

The Second Half

While there are several major earnings reports, including Tesla, all eyes will be on Friday’s CPI report.

Earnings Reports

There are still several companies we cover that are scheduled to report this week. Here are the list of names:

Wednesday 10/22: Tesla, IBM, and Lam Research

Thursday 10/23: Intel

Friday 10/24: Procter & Gamble

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

We finally get some economic data this week with the key report being Friday’s CPI data. This is the last inflation print ahead of the Fed’s next interest rate decision, and being one of the only data points in October it will have be a major catalyst to end the week.

We also get consumer sentiment and existing home sales data.

Here is the full calendar of events scheduled for the remainder of the week:

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.