Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 20,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

The major indexes, treasury yields, oil and Bitcoin are all surging higher following the election results.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Stock market surges as Trump defeats Harris

Stocks surged as Donald Trump won the 2024 presidential election, sparking a strong rally driven by expectations of pro-growth and deregulation policies. The Dow Jones jumped 2.9%, while the S&P 500 and Nasdaq 100 gained 2.1% and 1.7%, respectively.

Key sectors expected to benefit under a Trump presidency saw major gains: Tesla shares surged 13%, and major banks like JPMorgan and Bank of America rose over 6%. Small-cap stocks in the Russell 2000 soared 6%, with investors anticipating benefits from Trump's tax cuts and protectionist stance.

Bitcoin reached an all-time high of $75,000, and the dollar index climbed on expectations of Trump’s tariffs boosting the greenback. The 10-year Treasury yield spiked to 4.43% amid forecasts of economic growth from proposed tax cuts, though concerns about inflation and a widening deficit remain.

With NBC projecting a Republican Senate win and a potential GOP House takeover, markets anticipate major policy shifts, tax changes, and increased M&A activity.

Trump Media & Technology Group also surged 37% today.

👉 EDGE ALERT: Regardless of personal views, as investors, our responsibility is to remain objective and respond strategically to the political and economic landscape. With Trump back in office, we’re likely to see…upgrade to Edge+ to read the full Edge Alert.

Palantir posted a solid Q3 earnings report, beating revenue and EPS estimates on strong demand across U.S. commercial and government sectors.

The company reported net income of $143.5 million, up 101% YoY, with revenue reaching $725.5 million, a 30% increase from the previous year, outperforming the $705.1 million revenue estimate.

Notable highlights include U.S. government revenue of $320 million (up 40% YoY) and U.S. commercial revenue of $179 million (up 54% YoY). Operating income surged 183% YoY to $113.1 million, while operating cash flow grew by 215% YoY to $419.8 million, with free cash flow reaching $434.5 million, marking a 209% increase YoY. Palantir’s customer count also grew by 39% YoY, with 104 deals closed valued over $1 million.

For full-year 2024, Palantir raised its revenue guidance to $2.805-$2.809 billion and anticipates free cash flow above $1 billion, with Q4 revenue projected between $767-$771 million.

📊 EDGE SCORE: We are giving our Edge members a front row seat as we build out the Edge Score Dashboard. This feature will be available for Edge+ members very soon.

Join today and be one of the first to get access:

Let us know what you think and if you’d like to see any additional information in the dashboard.

Here’s a look at Palantir’s Edge Score - valuations are stretched despite the impressive growth score:

A word from our sponsor - Mode Mobile

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Boeing machinists end strike after approving labor contract with 38% raises

Boeing machinists ended a seven-week strike by approving a new labor contract with a 59% vote in favor, which provides a 38% wage increase over four years and improved retirement benefits.

This agreement is a relief for Boeing CEO Kelly Ortberg, who took over in August amid the company’s financial and operational challenges, including a recent $20 billion share sale and plans to cut 10% of its workforce.

The end of the strike will allow Boeing to resume aircraft production, critical to its recovery as payments are tied to aircraft deliveries. However, returning to pre-strike production rates, especially for the cash-generating 737 Max, will take time due to potential retraining needs for some workers.

President Joe Biden praised the contract, highlighting its importance for Boeing’s future in the U.S. aerospace sector. The union acknowledged this as a significant win for workers, with machinists' pay expected to average $119,309 by the contract’s end, but warned that further improvements were unlikely in future negotiations.

📚 EDGE-UCATION: How did the Boeing strike affect aircraft production and the company’s financials?

The Boeing strike significantly impacted aircraft production, halting most of the company’s output for seven weeks.

With machinists off the job, Boeing couldn’t progress on building or finishing planes, delaying the assembly lines for key models like the 737 Max, the 777, and the 767.

Since Boeing receives the bulk of payment only upon delivery, the production stoppage exacerbated its cash flow issues and mounting financial losses. Although the strike's end allows production to resume, returning to target production rates will take time, as some workers may require retraining to get back up to speed.

This delay in ramping back up could prolong Boeing’s recovery timeline and slow its ability to meet customer demands.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Edge+ members also get access to all of the following benefits:

As we like to say, price is what you pay value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Join the Edge+ club today!

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

The Second Half

With the election in the rear view, the focus now shifts to the Federal Reserve and its latest interest rate decision. There’s also several key earnings reports to watch..

Earnings Reports

There are still some major earnings this week. We will be watching Qualcomm, Mercado Libre, AirBnB, the Trade Desk, Block, and Hershey.

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

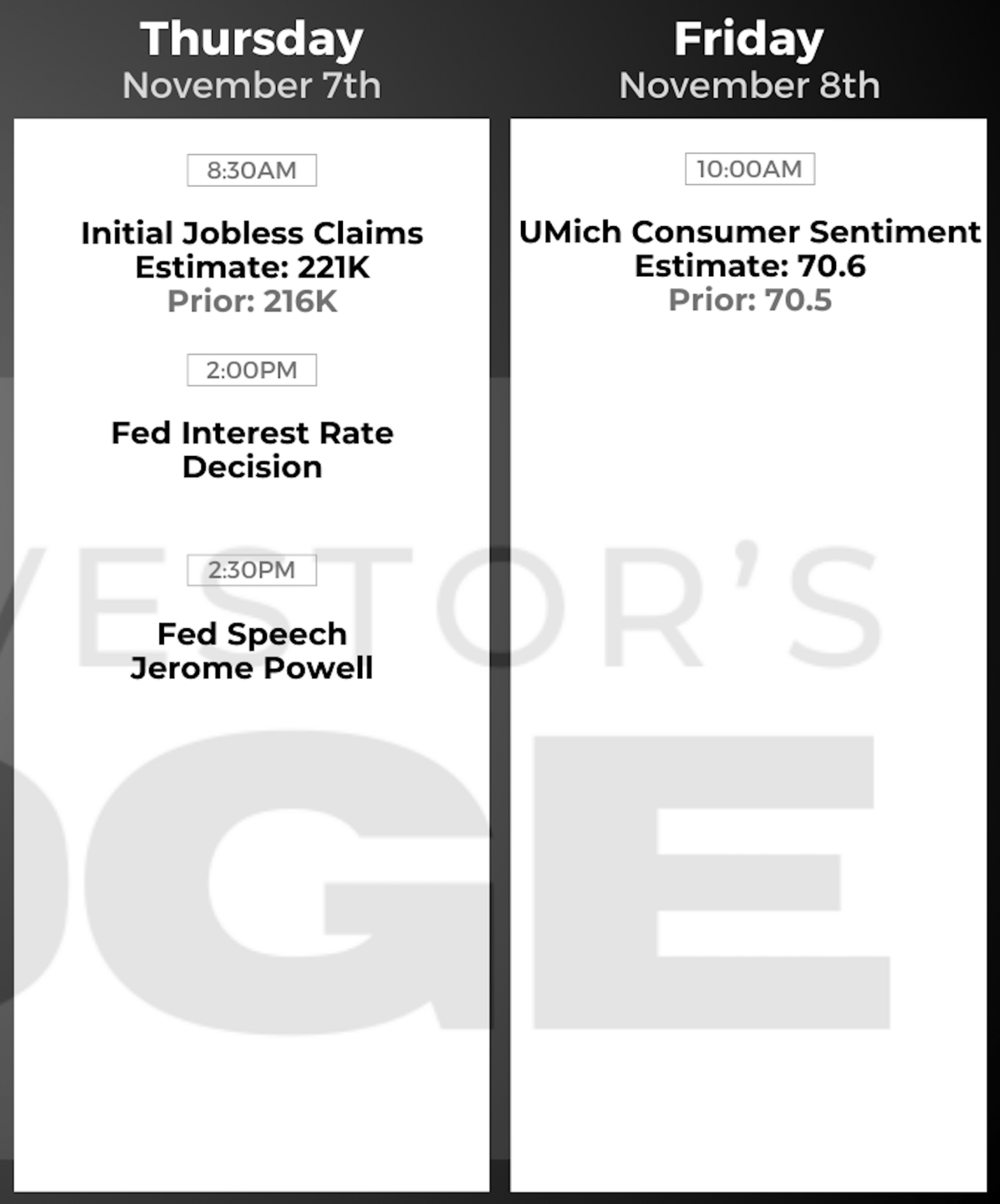

The Fed’s interest rate decision and Powell’s speech afterwards now take center stage to end the week. There will also be the latest initial jobless claims data and consumer sentiment data.

Here is the full calendar of events scheduled for the remainder of the week:

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.