Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 25,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

Stocks are trying to stage a rally this morning after getting off to a rough start this week, but the major indexes are still lower overall.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

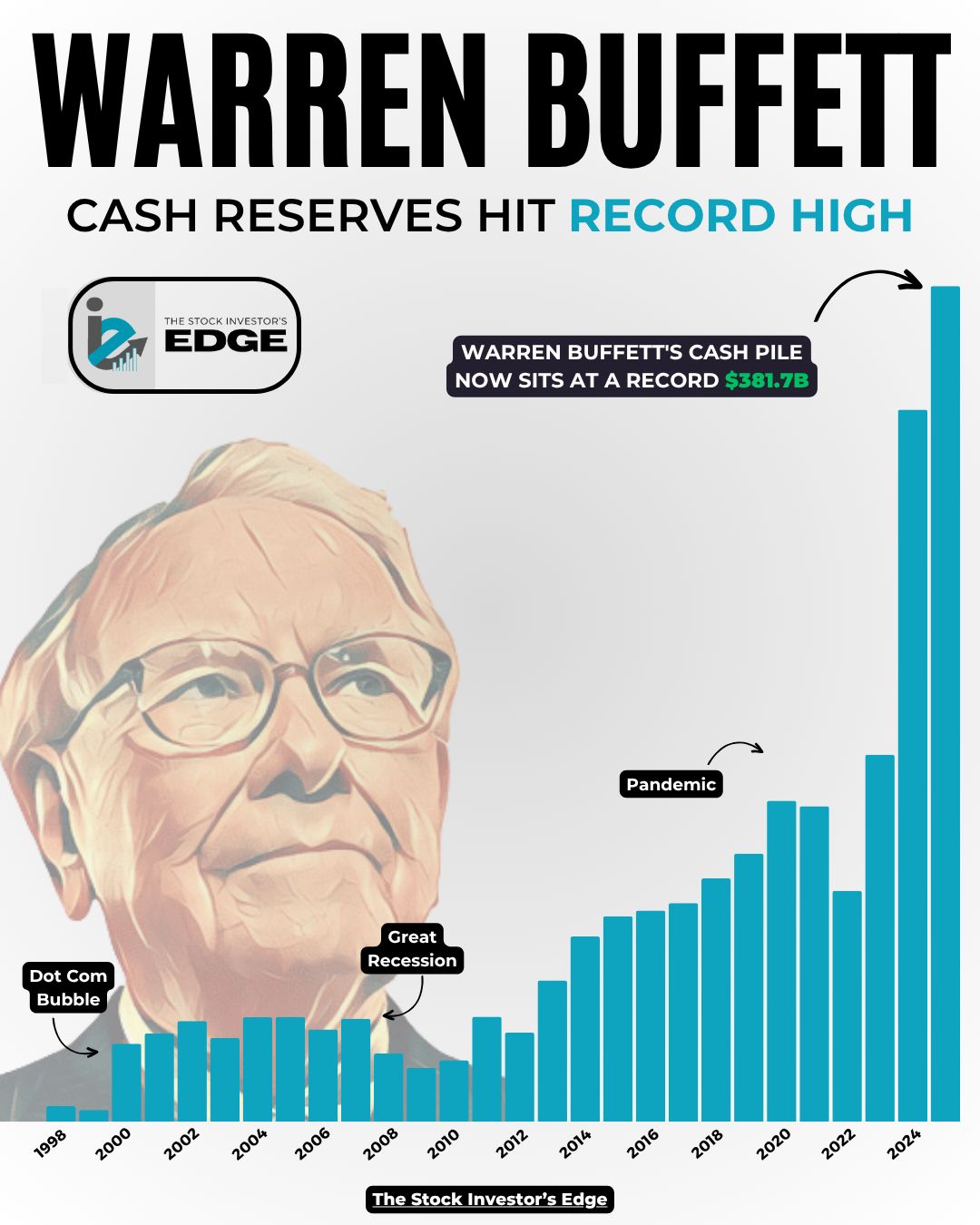

Berkshire’s Profit Surges as Buffett Hoards Record $382B in Cash

Berkshire Hathaway $BRK.B ( ▲ 0.25% ) posted a strong Q3 2025, with operating profit up 34% to $13.5 billion on a surge in insurance underwriting. Management refrained from buybacks despite a double digit pullback in the shares, allowing cash and equivalents to reach a record $381.6 billion. Berkshire also net sold equities, recognizing a $10.4 billion taxable gain, as deal activity remained notably muted.

🔑 Key Points

Operating strength: Operating profit jumped 34% to $13.5B on stronger insurance results.

Net income: Rose 17% to $30.8B, including investment gains from public holdings.

Cash record: Cash and equivalents reached an all-time high of $381.6B.

No buybacks: Berkshire had no share repurchases for the 12th straight quarter.

Equity activity: Net equity sales produced a $10.4B taxable gain, showing limited new opportunities.

👀 What You Need to Know

Buffett’s growing cash reserve with no buybacks reflects deep caution toward valuations and the broader deal environment. While the quarter showed renewed strength in core operations, the absence of repurchases highlights an exceptionally high hurdle for capital use. Investors now look to Abel’s coming tenure to gauge whether Berkshire’s hallmark patience evolves into a more active deployment strategy once market conditions improve.

🔐 Edge Takeaway: Berkshire’s quarter told a simple story: insurance strength, cash discipline, and patience that borders on defiance. The cash pile…upgrade to Edge+ to read the full Edge Takeaway.

Kimberly-Clark to Buy Kenvue in $48.7B Deal, Creating a Consumer-Health Giant

Kimberly-Clark $KMB ( ▲ 0.31% ) announced plans to acquire Kenvue $KVUE ( ▲ 0.32% ) in a $48.7 billion cash-and-stock deal that merges household staples like Huggies and Kleenex with health brands such as Tylenol and Band-Aid. The combined company will generate about $32 billion in annual sales. The deal, expected to close in late 2026, marks one of the largest consumer-goods mergers in recent years.

🔑 Key Points

Big merger: The $48.7B cash-and-stock deal values Kenvue at roughly $21 per share.

Market reaction: Kenvue jumped 12% while Kimberly-Clark fell 14%,, reflecting optimism on scale but concern over valuation.

Brand scale: The merged company will oversee ten billion-dollar brands and roughly $32 B in annual global revenue.

Cost savings: Companies expect about $1.9 billion in synergies within three years.

Next step: Deal follows Kimberly-Clark’s recent pivot toward higher-margin categories.

👀 What You Need to Know

This move reshapes the consumer-health landscape, combining two portfolios built on everyday essentials. It also highlights how traditional staples companies are leaning on acquisitions to find growth as shoppers trade down and input costs stay high. The deal could boost pricing power and distribution reach globally, but execution will matter, especially integrating brands and cultures as large as these.

🔐 Edge Takeaway: Kimberly-Clark’s $48.7B deal for Kenvue is its biggest swing in decades, paying ~$21 a share, and the new company should…upgrade to Edge+ to read the full Edge Takeaway, including the Edge score and CMG Strength Ratio.

📚 Edge-ucation: Mergers and Acquisitions (M&A)

Mergers and acquisitions happen when one company buys another to get bigger, grow faster, or cut costs. They tend to move in waves that line up with where we are in the business cycle.

When activity peaks: Big deals usually pile up late in an expansion when companies have strong profits and cheap financing.

Why it happens: Growth slows, so management starts buying it instead — using cash or expensive stock to stay relevant.

When it cools off: Once rates rise or markets turn, confidence fades and deal flow dries up fast.

What it tells us: When the headlines fill with megadeals, it usually means the cycle is closer to the top than the bottom.

M&A tells you how confident CEOs really are. When everyone’s buying, it’s often the last stage before things tighten up.

Sponsored by Polymarket

Is the AI Bubble About to Burst? (95.2% Accurate Forecast)

NVIDIA officially reports earnings November 19, but you can get a sneak peek right now.

Not just for NVIDIA, but for dozens of public companies.

On Polymarket, the world's largest prediction market (with verified 95.2% accuracy), you can see what top forecasters believe will happen.

Our new Earnings Markets let you:

See real-time odds of NVIDIA beating estimates

Predict what executives will say on earnings calls

Profit directly from being right, regardless of stock price movement

Trade simple Yes/No outcomes instead of complex options

Will Jensen stun Wall Street again?

Or is the AI trade finally cooling off?

Top forecasters are already positioning.

Q3 Earnings Season: This Week’s Roundup

AI execution, platform scale, and spending resilience drove this week’s reports from Palantir, AMD, McDonald’s, Uber, and Shopify. Results were broadly strong across AI infrastructure and consumer platforms, with Palantir and AMD setting the pace on enterprise demand, while McDonald’s, Uber, and Shopify showed solid pricing power and steady user growth heading into year-end.

Palantir $PLTR ( ▲ 0.26% ) delivered a clear beat and raise on surging AIP demand and accelerating U.S. commercial momentum.

EPS: $0.21 adj vs $0.17 est.

Revenue: $1.18B vs $1.09B est.

Highlights: Revenue +63% YoY, U.S. commercial +121% YoY, FY25 revenue guide raised to ~$4.40B, Q4 guide $1.327–$1.331B above consensus.

AMD $AMD ( ▼ 1.58% ) posted a strong beat on data center momentum and guided Q4 above Street expectations.

EPS: $1.20 adj vs $1.17 est.

Revenue: $9.25B vs $8.76B est.

Highlights: Data center $4.3B +22% YoY, client PC a record, Q4 revenue outlook $9.3B–$9.9B above Street.

McDonald’s $MCD ( ▲ 0.65% ) reported solid comps and steady revenue, but EPS came in light versus consensus.

EPS: $3.22 adj vs $3.33 est.

Revenue: $7.08B vs $7.08B est.

Highlights: Global comps +3.6% vs +3.5% est, U.S. comps +2.4% vs +1.9% est, value platforms supporting average check, steady top-line despite traffic sensitivity.

Uber $UBER ( ▲ 1.26% ) delivered a strong top-line and headline EPS beat, aided by a large tax valuation benefit and healthy bookings growth.

EPS: $3.11 vs $0.69 est.

Revenue: $13.47B vs $13.28B est.

Highlights: Gross bookings $49.7B +21% YoY, trips +22% YoY, Q4 bookings guide above Street, adjusted EBITDA guide slightly below, EPS inflated by ~$4.9B tax valuation release.

Shopify $SHOP ( ▲ 1.94% ) delivered a revenue beat but missed on EPS, as investment marks weighed despite strong GMV and demand trends.

EPS: $0.34 vs $0.34 est.

Revenue: $2.84B vs $2.75B est.

Highlights: GMV $92B +32% YoY above est, gross margin 48.9% a touch light, operating income +53% YoY, Q4 revenue growth guided mid- to high-20s.

*Note - we will be breaking down these earnings reports more in detail in Friday’s Earnings Recap.

🔐 Edge Takeaway: Palantir’s quarter was strong, no doubt, but valuations are starting to matter as the stock trades at roughly…upgrade to Edge+ to read the full Edge Takeaway.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

With the Fed interest rate decision announced, the focus for the rest of the week is earnings, with a number of major companies scheduled to report.

Earnings Reports

The major earnings this week start tonight with 3 of the MAG7 names expected to report, followed by 2 more MAG7 names reporting tomorrow. On top of that, we get a number of other major earnings. Here are the list of names we will be watching:

Wednesday 11/5: Qualcomm

Thursday 11/6: Airbnb, Block, and The Trade Desk

Friday 11/7: Enbridge

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

Due to the government shutdown we are still only receiving limited economic data, but we will get the UMich consumer sentiment survey on Friday.

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.