Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 26,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

Stocks are rallying this week as the longest government shutdown in US history looks to finally be coming to an end.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Shutdown deal nears, tariff rebate talk collides with Supreme Court scrutiny

House members will return from a 53-day recess to vote on a compromise that would end the 42-day shutdown, restore agency funding, and keep the government running through January 30. Travel chaos lingers, with roughly 1,200 flights canceled and several days needed for operations to normalize. The deal preserves SNAP through September 30, 2026, while Democrats remain split over expiring ACA subsidies that could see a separate December vote.

🔑 Key Points

The vote: House to vote tonight at 7pm EST with Republican leadership expecting easy passage after the Senate approved the package.

Short runway: Funding extends only to January 30, creating another near-term budget cliff and policy uncertainty.

Tariff checks: Trump’s floated $2,000 tariff “dividend” lacks detail and clear funding sources, and risks inflation.

Household strain: Current tariffs are estimated to cost households about $1,800 in 2025.

Court risk: Supreme Court skepticism raises odds of refunding tariffs to importers, undermining any rebate scheme.

👀 What You Need to Know

The deal ends the record shutdown but provides only a short extension, with another deadline on January 30. Talk of tariff rebate checks remains speculative, lacking details, legal clarity, and confirmed funding. Economists warn such payments could rekindle inflation while offering limited relief from tariff costs. The Supreme Court is weighing tariff legality, and a loss could force refunds to importers. The shutdown’s end brings short-term relief, but persistent gridlock and tariff disputes risk continued economic uncertainty into early next year.

🔐 Edge Takeaway: With the shutdown set to end, the economy avoids deeper self-inflicted damage, but the recovery resumes into a fragile backdrop. Markets now face a three-way test…upgrade to Edge+ to read the full Edge Takeaway.

AMD bets big on AI dominance with ambitious growth roadmap

At its first analyst day since 2022, AMD laid out aggressive multi-year targets fueled by soaring AI demand. CEO Lisa Su said overall company revenue could grow more than 30% annually, led by rapid expansion in its data center segment. The company expects AI-related sales to accelerate sharply as new rack-scale systems and next-generation chips reach customers.

🔑 Key Points

AI surge: Data center AI revenue projected to grow ~80% per year, reaching “tens of billions in revenue” by 2027 and ~$100 billion by 2030.

Revenue momentum: Company targets >35% overall CAGR and >60% data center CAGR over 3-5 years.

Market share goals: Aims for double-digit AI chip share, challenging Nvidia’s roughly 90% dominance.

System expansion: MI400-series chips and rack-scale configurations debut next year to power large AI workloads.

Strategic alliances: Long-term deals with OpenAI, Oracle, and Meta strengthen demand visibility and ecosystem reach.

👀 What You Need to Know

AMD’s plan underscores how fast the AI infrastructure race is scaling, with hyperscalers seeking alternatives to Nvidia’s high-priced GPUs. The company’s growth outlook reflects both surging customer commitments and the belief that diversified AI architectures will define the next wave of data center buildouts. For investors, it’s a story of massive potential balanced by equally high execution risk as AMD works to deliver on its promises at scale.

🔐 Edge Takeaway: AMD just reset expectations with a roadmap that reframed its entire story around execution and scale. Management…upgrade to Edge+ to read the full Edge Takeaway, including the Edge score and CMG Strength Ratio.

Sponsored by Masterworks

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

SoftBank Dumps $5.8B Nvidia Stake to Fuel Massive AI Expansion

SoftBank shares slid sharply after the $5.8B sale of its Nvidia stake underscored Masayoshi Son’s push to reallocate capital toward OpenAI and other high-cost bets. The company is racing to deepen its footprint in AI hardware and robotics through major acquisitions and loans that could strain its balance sheet.

🔑 Key Points

Funding drive: Proceeds will help finance follow-on investments in OpenAI, Ampere Computing, and ABB Robotics.

Capital strain: Analysts estimate SoftBank’s new commitments exceed $41 billion, testing liquidity limits with just $27.9 billion in cash reserves.

Debt support: SoftBank has taken out loans totaling $15 billion and issued over $8 billion in multi-currency bonds to bridge gaps.

AI concentration: The $22.5 billion OpenAI commitment and $6.5 billion Ampere deal center exposure in one high-risk theme.

Execution test: Success now depends on integrating large AI investments before liquidity tightening hits harder.

👀 What You Need to Know

SoftBank is repositioning itself from a tech-holding conglomerate into a leveraged AI operator, rotating out of legacy stakes and into direct infrastructure exposure. The strategy banks on sustained AI growth to cover near-term funding needs, leaving little room for error if markets cool or credit costs rise. While Son’s conviction fuels optimism about OpenAI’s potential, investors remain wary of liquidity pressure, execution risk, and whether SoftBank can turn bold vision into disciplined returns.

🔐 Edge Takeaway: SoftBank’s $5.8B Nvidia sale looks less like strategic discipline and more like a classic late-cycle tell, as…upgrade to Edge+ to read the full Edge Takeaway.

📚 Edge-ucation: Spotting Late-Cycle Behavior

When money is cheap, borrowing fuels fast growth. When money tightens, debt gets painful and weaker players get exposed.

Bond market tell: A jump in corporate bond sales is a warning that firms are scrambling for cash.

Asset rotation clue: Selling big winners to fund new projects often marks a late-stage market.

Narrative shift: Earnings calls that pivot from “demand” to “how we’ll finance it” signal rising strain.

Cash strength: Companies that fund growth from steady free cash flow usually outlast debt-heavy peers.

When financing gets harder, stick with low-debt, cash-generating businesses and be skeptical of stories that need constant new money.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

The government shutdown should end tonight which could be a major catalyst to the end of the week.

Earnings Reports

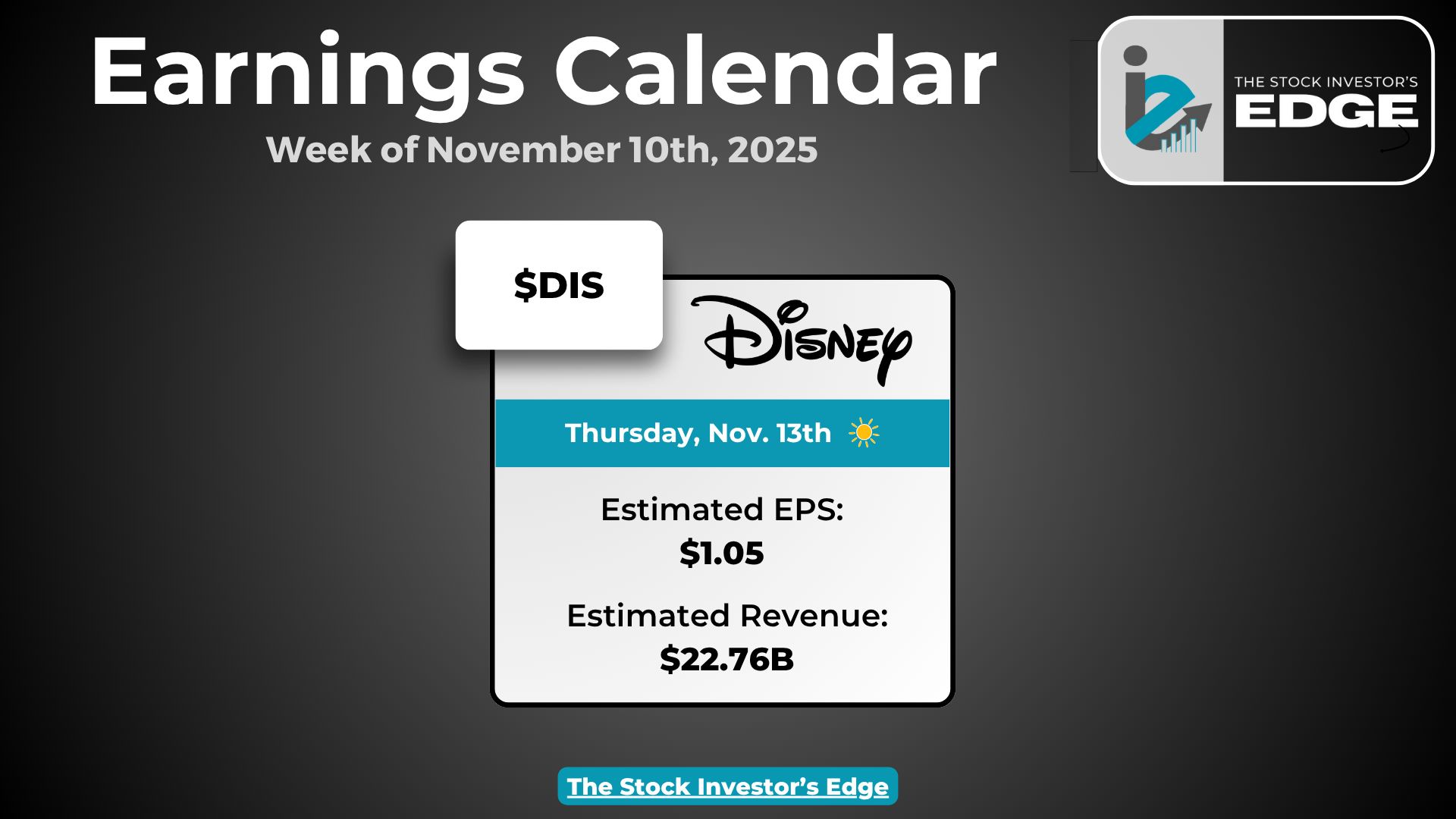

The only name on our coverage list that reports this week is Disney, which reports Thursday morning. Here are the list of names we will be watching:

Wednesday 11/12: --

Thursday 11/13: Disney

Friday 11/14: --

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

Economic reports have been limited due to the government shutdown, and that will carry on into week end despite tonight’s vote to end the closure. There are no reports expected this week.

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.