Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 22,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Edge Announcement

🚨 ONE WEEK LEFT TO LOCK IN OUR CURRENT PRICES 🚨

Time’s almost up. In just 7 days, prices are going up for the very first time.

Over the past few years, we’ve built something special—a thriving community of retail investors focused on one mission: building wealth together. Over that time, we’ve packed more and more value into The Stock Investor’s Edge—exclusive insights, deeper analysis, new offerings—all without touching our prices. But starting April 1 at 11:59pm, that changes.

This is your last chance to secure the current rate before the hike.

💡 Pro Tip: If you’re on a monthly plan, upgrading to annual not only locks in today’s pricing for the next 12 months—it also saves you money.

New Pricing (Starting April 2):

Edge+ Monthly → $40/month

Edge+ Annual → $400/year

Options Edge+ Monthly → $60/month

Options Edge+ Annual → $600/year

Don’t wait until the deadline hits—lock in your rate today and keep building with us 👇

Market Talk

The major indexes all green to start the week, despite some weakness today. Treasury yields, oil and Bitcoin are also higher.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

Trump’s tariffs—here’s where they stand currently as White House continues to adjust its strategy

President Trump's tariffs are overhauling decades of U.S. free-trade policy, targeting both allies and rivals. By April 2—dubbed "Liberation Day"—he may impose retaliatory tariffs on all trade partners. Here’s the latest:

A 25% steel and aluminum tariff took effect March 12. The EU responded with counter-tariffs on $28 billion in U.S. goods, though some—like a 50% whiskey duty—were delayed, prompting Trump to threaten a 200% tariff on European spirits.

Canada and Mexico were hit with the same metal tariffs on March 4, but USMCA-compliant goods are exempt until April 2. Canada retaliated with tariffs on $20 billion of U.S. goods, and talks are ongoing.

Trump raised tariffs on China by another 20%, leading China to impose up to 15% duties on U.S. farm goods from March 10.

This week, he also announced a 25% "secondary tariff" on countries trading with Venezuela if they buy its oil or gas, effective April 2.

👉 EDGE TAKEAWAY: Tariffs remain a persistent source of market volatility, not just because of their economic impact, but because of…upgrade to Edge+ to read the full Edge Alert.

Apple is about to spend $1 billion on NVIDIA servers for AI

After sitting out the AI data center arms race, Apple $AAPL ( ▲ 1.54% ) is finally making a major move.

According to Loop Capital, Apple is ordering around $1 billion worth of Nvidia’s high-end GB300 NVL72 systems—roughly 250 servers—to build a large-scale generative AI cluster. The company is partnering with Dell and Super Micro Computer to support its efforts.

This shift comes amid internal struggles to launch AI-enabled features like a revamped Siri, which has been delayed indefinitely despite being heavily promoted.

Reports suggest Apple has reshuffled its executive team after setbacks that insiders described as “ugly” and “embarrassing.”

AAPL is +2.6% this week following the news.

📚 EDGE-UCATION: What is an AI server cluster?

An AI server cluster is a group of high-performance servers networked together to work as a single system, specifically designed to handle the massive computing demands of artificial intelligence tasks—especially training and running large language models (LLMs) like ChatGPT or image recognition systems.

Each server in the cluster typically includes powerful GPUs (graphics processing units), like Nvidia’s, because they’re far better than CPUs at the parallel processing required for AI workloads. By combining many of these servers, companies can dramatically increase their compute power, enabling them to train more advanced models, process huge datasets, or deliver faster AI-driven services.

Think of it as the AI equivalent of a sports team: each server is a strong individual player, but together in a tightly coordinated group, they can tackle far bigger challenges than one machine alone.

Sponsored by RYSE

Apple's New Smart Display Confirms What This Startup Knew All Along

Apple has entered the smart home race with its new Smart Display, firing a $158B signal that connected homes are the future.

When Apple moves in, it doesn’t just join the market — it transforms it.

One company has been quietly preparing for this moment.

Their smart shade technology already works across every major platform, perfectly positioned to capture the wave of new consumers Apple will bring.

While others scramble to catch up, this startup is already shifting production from China to its new facility in the Philippines — built for speed and ready to meet surging demand as Apple’s marketing machine drives mass adoption.

With 200% year-over-year growth and distribution in over 120 Best Buy locations, this company isn’t just ready for Apple’s push — they’re set to thrive from it.

Shares in this tech company are open at just $1.90.

Apple’s move is accelerating the entire sector. Don’t miss this window.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Tesla's grip on the European EV market is slipping fast.

In February, its sales fell 42.6% year-over-year, even as overall battery-electric vehicle (BEV) registrations in Europe rose 26.1%. Tesla's share of the BEV market plunged from 21.6% to 10.3%, and its total market share dropped to just 1.8%.

The company sold fewer than 17,000 vehicles across the EU, UK, and EFTA countries—down from over 28,000 a year ago. With an aging lineup and growing competition from traditional automakers and aggressive Chinese entrants, Tesla is under increasing pressure ahead of its delayed Model Y refresh.

Adding to the company’s challenges, Canada has frozen all current Tesla EV rebate payments and banned the automaker from participating in future programs pending individual investigations into its claims.

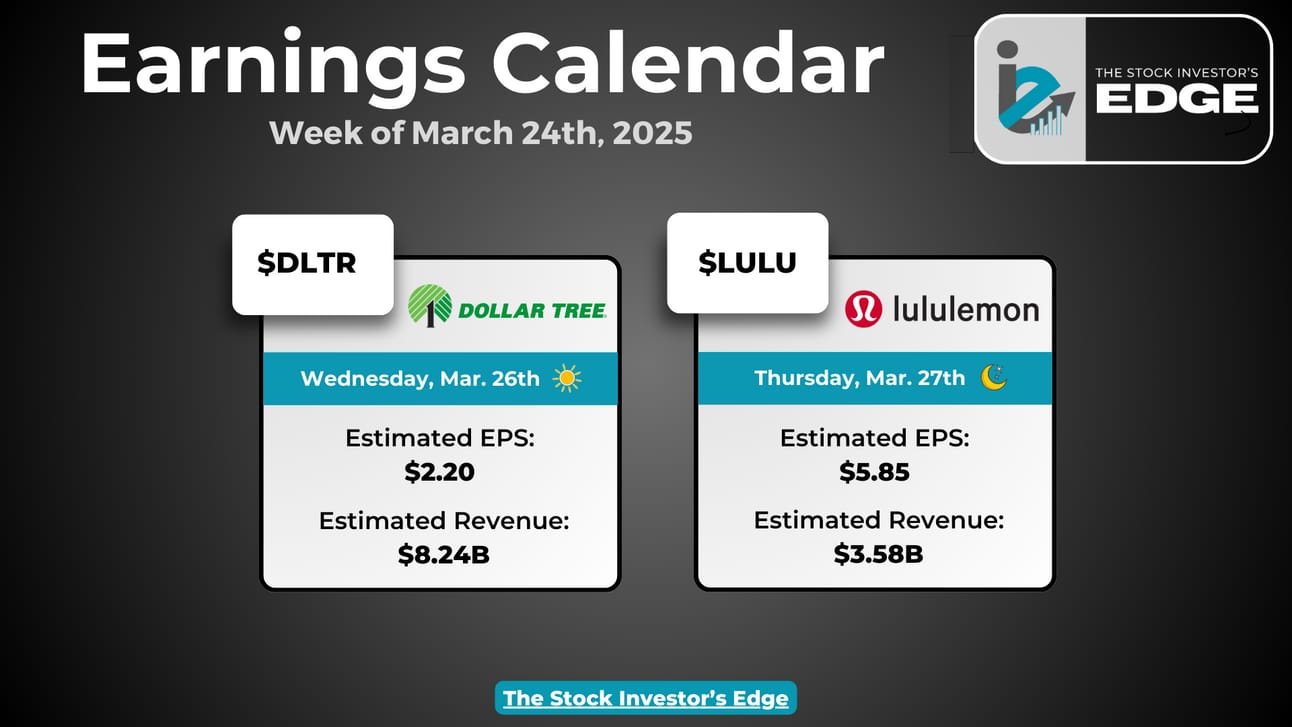

Earnings Recap

With only two names reporting this week, we thought we would just include the breakdowns and our takeaways in the wrap-up as opposed to a separate email.

Dollar Tree (DLTR)

Dollar Tree $DLTR ( ▲ 0.7% ) reported mixed fourth-quarter results, with a modest revenue increase but sharply lower profits as higher operating costs and strategic review expenses weighed on margins—and a major announcement to divest its struggling Family Dollar business.

The company posted Q4 revenue of $5.00 billion, up 0.7% year-over-year, while net income from continuing operations declined 24.9% to $400.2 million. Adjusted EPS from continuing operations was $2.11, and total adjusted EPS including discontinued operations came in at $2.29, beating estimates by 4%.

Same-store sales at Dollar Tree rose 2.0%, driven by a 0.7% increase in traffic and a 1.3% rise in average ticket. However, operating income dropped 26.5% to $533.6 million as operating expenses rose 12% to $1.4 billion. Free cash flow for the year declined 26% to $893 million, though the company repurchased $403.6 million worth of shares. Dollar Tree ended the year with 8,881 stores, including 2,900 in the higher-priced Dollar Tree 3.0 format.

In a major strategic move, Dollar Tree announced it has entered into a definitive agreement to sell Family Dollar to Brigade Capital and Macellum Capital for $1.01 billion, with expected pre-tax proceeds of $804 million and roughly $350 million in tax benefits. The sale, expected to close in mid-2025, will allow the company to fully focus on optimizing the core Dollar Tree brand.

Looking ahead, Dollar Tree guided for full-year fiscal 2025 revenue of $18.5 billion to $19.1 billion (+~5% YoY) and adjusted EPS between $5.00 and $5.50. For Q1 2025, the company expects revenue between $4.5 billion and $4.6 billion, and EPS of $1.10 to $1.25.

👉 EDGE TAKEAWAY: Dollar Tree’s decision to offload Family Dollar is more than just a restructuring—it's the long-overdue undoing of a failed 2015 acquisition that never delivered. For years,…upgrade to Edge+ to read the full Edge Alert.

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

The entire market is waiting for Friday’s PCE report, hence why we’ve seen flat trading since Monday’s relief rally. Nothing else really matters right now.

Earnings Reports

There’s only one name left to watch this week - Lululemon reports on Thursday. Here’s what we are expecting:

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

Economic Reports

We get initial jobless claims, GDP, pending home sales and consumer sentiment to end the week, but the major catalyst will be that key inflation report on Friday - all eyes will be on that release.

Here is the full calendar of events scheduled for the remainder of the week:

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.