Good morning investors!

If this is your first time reading, welcome to The Investor’s Edge — a thriving community of over 23,000 subscribers striving to be better investors with an edge in the market.

Every Wednesday we publish “The Mid-Week Wrap-Up” — your ticket to being well informed and staying ahead in the investment game!

This report is designed to help investors of all skill levels break down important stories/topics within the stock market. And best of all, we cut through all of the BS and give you exactly what you need to know in easy to digest, bite sized pieces of content.

This article is designed to truly give you that EDGE in the day ahead!

Grab your afternoon pick me up and let’s dive in.

Market Talk

The major indexes are pushing towards all-time highs following today’s CPI report and China deal.

3 Stories Moving the Market

These are some of the biggest stories so far this week that are having an influence on market action.

U.S.-China reach deal to ease export curbs, keep tariff truce alive

U.S. and Chinese negotiators have reached a handshake framework to implement the Geneva trade pact agreed last month, aiming to restore their fragile truce after renewed tensions. The deal, still pending approval from Presidents Trump and Xi, includes mutual concessions: China will expedite rare earth exports while the U.S. rolls back certain tech restrictions and allows Chinese student visas. While framed as progress, this is largely an attempt to salvage the previously agreed deal.

🔑 Key Points

Framework, Not Breakthrough: The deal simply implements the earlier Geneva pact, not a new agreement.

Mutual Concessions: China will expedite rare earth exports while the U.S. will ease tech restrictions and allow student visas.

Pending Leader Approval: Trump and Xi must formally approve the framework before actions begin.

Few Concrete Details: Lack of specifics leaves questions about enforcement and durability.

Cautious Market Reaction: Chinese equities saw slight gains, while U.S. stock dipped on the news, reflecting investor skepticism.

👀 What You Need to Know

This agreement is less about resolution and more about managing optics while both sides recalibrate. Rare earths gave Beijing fresh leverage, and Washington blinked, easing tech restrictions in return. The framework kicks the can down the road again, offering a pause but not a pivot. Until there’s a signed, enforceable deal with teeth, investors should treat this as a temporary ceasefire, not a true peace. Expect volatility to persist.

🔐 Edge Takeaway: The London talks didn’t produce a breakthrough, they simply outlined a framework to implement what was already agreed during the Geneva agreement. From an investor standpoint, this…upgrade to Edge+ to read the full Edge Alert.

U.S. inflation rises less than expected in May

Consumer prices rose just 0.1% in May, coming in below expectations as the Trump administration’s sweeping tariffs have yet to meaningfully ripple through to headline inflation. Core CPI also increased just 0.1%, softening concerns of an imminent price spike. While energy prices dropped and key goods like vehicles and apparel actually declined, shelter and food kept overall CPI slightly positive.

🔑 Key Points

Soft CPI Print: Both headline and core CPI rose just 0.1% in May, easing inflation fears and missing forecasts.

Tariff Impact Delayed: Prices for vehicles and apparel fell, suggesting tariffs haven’t hit yet due to inventory cushioning.

Fed Pressure Mounts: Weak inflation and steady wage growth (+0.3%) fueled new political pressure to lower rates.

Energy Relief: A 2.6% drop in gasoline and 1% decline in overall energy prices helped counteract gains in shelter and food.

Data Reliability Risks: BLS data collection cutbacks and increased reliance on imputation raise concerns about the reliability and consistency of CPI readings.

👀 What You Need to Know

May’s CPI report suggests inflation pressures remain contained for now, easing immediate concerns for the Fed and supporting a wait-and-see stance on rates. Markets reacted positively, but the report also underscores just how much recent inflation softness is being driven by transitory categories.

📚 Edge-ucation: CPI vs. PPI – What’s the Difference?

Understanding the difference between the Consumer Price Index (CPI) and the Producer Price Index (PPI) is critical for investors tracking inflation trends:

CPI (Consumer Price Index):

Measures the change in prices paid by consumers for a basket of goods and services, i.e. rent, groceries, clothing, and medical care. It reflects retail-level inflation and is the most widely followed gauge by the public and policymakers. The Fed focuses heavily on core CPI (which excludes food and energy) when assessing long-term inflation trends.PPI (Producer Price Index):

Tracks the change in prices producers receive for their goods and services. It captures inflation upstream in the supply chain (before it hits consumers) and includes items like raw materials, intermediate goods, and finished wholesale products.

Why it matters:

PPI often serves as a leading indicator for CPI. If producers face rising input costs and successfully pass them on, CPI typically follows with a lag. However, if companies absorb those costs or if demand weakens, CPI may stay lower even as PPI rises. For investors, watching both helps assess margin pressures, pricing power, and how inflation might flow through earnings reports.

Sponsored by Wallstreet Prep

Turn AI Hype Into Business Impact

AI is more than just using ChatGPT.

It’s about understanding how the technology works—and applying it in practical ways to solve real business problems.

The AI for Business & Finance Certificate Program from Wall Street Prep + Columbia Business School Exec Ed helps you move beyond the hype.

You’ll demystify today’s most important tools and learn just enough Python to streamline workflows, automate tasks, and make smarter decisions.

No coding experience needed—you’ll get step-by-step guidance from world-class faculty.

👉 Save $300 with code SAVE300.

Apple unveils Liquid Glass and iOS 26 at WWDC 2025

Apple’s $AAPL ( ▲ 1.54% ) WWDC 2025 keynote showcased sweeping updates across its ecosystem, with the spotlight on a fresh design language called Liquid Glass and a unified versioning jump across all operating systems, including iOS 26, iPadOS 26, macOS Tahoe, and more. Alongside design tweaks, iOS 26 brings major updates to core apps like Phone and Messages, introduces a dedicated Games app, and debuts real-time language translation baked across apps.

🔑 Key Points

Liquid Glass UI: A full visual refresh across platforms with glass-like buttons, curved corners, and fluid animations inspired by visionOS.

OS Naming Reset: Apple ditches version numbers in favor of year-based names, iOS 26, macOS Tahoe, creating a cleaner, unified ecosystem.

iOS 26 Features: New Phone app layout, group chat polls in Messages, live voice translation using on-device AI, and a dedicated Games app.

AI Integration: ChatGPT now powers Genmoji creation and screenshot analysis, but Apple Intelligence remains on hold, with no release date.

Investor Response: Shares fell -1.2% post-keynote with analysts calling the AI updates “incremental” and flagged growing pressure to compete with rivals.

👀 What You Need to Know

Apple’s design refresh signals a push toward long-term software unity, but it’s not the breakthrough investors were hoping for. With Apple Intelligence still delayed and little progress on Siri, Apple risks falling behind in AI leadership, especially as competitors advance rapidly.

📊 Edge Score: Apple’s Edge Score clocks in at 69, supported by strong past performance and capital returns. While free cash flow remains robust at $98B, valuation looks stretched, with shares trading 6–20% above modeled fair values.

💪 CMG Strength: The CMG Strength Ratio has steadily drifted lower and now sits near the lower end of its historical range, below the midpoint and approaching cautionary territory. This suggests waning accumulation and a lack of strong institutional demand in recent weeks.

Want access to these Edge Tools? Upgrade to Edge+ today!

In Other News

In this section we'll be curating a selection of news headlines we think you'll find interesting. If a topic catches your eye, click the provided links to read more about it.

Unlock the Edge+ Experience

Like the content you have seen so far? Edge+ members not only get additional content in these recaps, but they also get expert market analysis straight to their inbox multiple times per week.

Upgrade Options:

Ultimate Edge - our latest addition to the Stock Investor’s Edge

Get access to all premium tiers with one subscription

Edge+

Comprehensive market insights and analysis delivered multiple times weekly.

Exclusive deep dives into earnings reports, stock performance, and macro trends.

Access to our expertly managed portfolios and live webinars.

Member-only Discord: Stay connected with the team and community in real-time.

Options Edge+

Weekly Options Edge Report: Top-tier options trade ideas, including covered calls, cash-secured puts, and spreads with detailed risk-reward analysis.

Options Education Hub: A growing library of primers and strategies to boost your confidence.

Live Trade Alerts: Never miss an opportunity to act on key trades.

Market Sentiment Analysis: Stay ahead with insights on volatility trends and strategy adjustments.

Member-Exclusive Discord: Connect with experts and like-minded traders in real-time.

Quick Picks — The Affordable Option

Still not sure if the Edge+ club is for you? We’ve launched Edge Quick Picks, a cost-effective tier that delivers actionable insights and recommendations at just $10 per month or $99 per year.

With Edge Quick Picks, you’ll get:

5 stock or ETF picks each month: High-conviction ideas at current valuations.

Edge Scores: A snapshot ranking of each pick based on key metrics.

Exclusive Discord Room: Updates on picks and strategy throughout the month.

Our goal with Edge Quick Picks is to offer a streamlined, actionable option for investors who want high-quality recommendations without breaking the bank. We’re confident this new tier will help you build long-term wealth while gaining an edge in the market.

As we like to say, price is what you pay, value is what you get. Trust us when we say you’re not getting this much value for the price anywhere else on the Internet. Choose the tier that fits your goals and join the Edge community today!

The Second Half

The CPI report may be behind us, but earnings from two large cap names and a key inflation report are sure to have effects on the overall market.

Earnings Reports

Earnings season is essentially over, but there are two large cap stocks set to report this week. Here are the names we will be watching to end the week:

Wednesday 6/11: Oracle

Thursday 6/12: Adobe

Friday 6/13: --

Here is the calendar of earnings releases scheduled for the rest of the week:

Source: Earnings Whisper

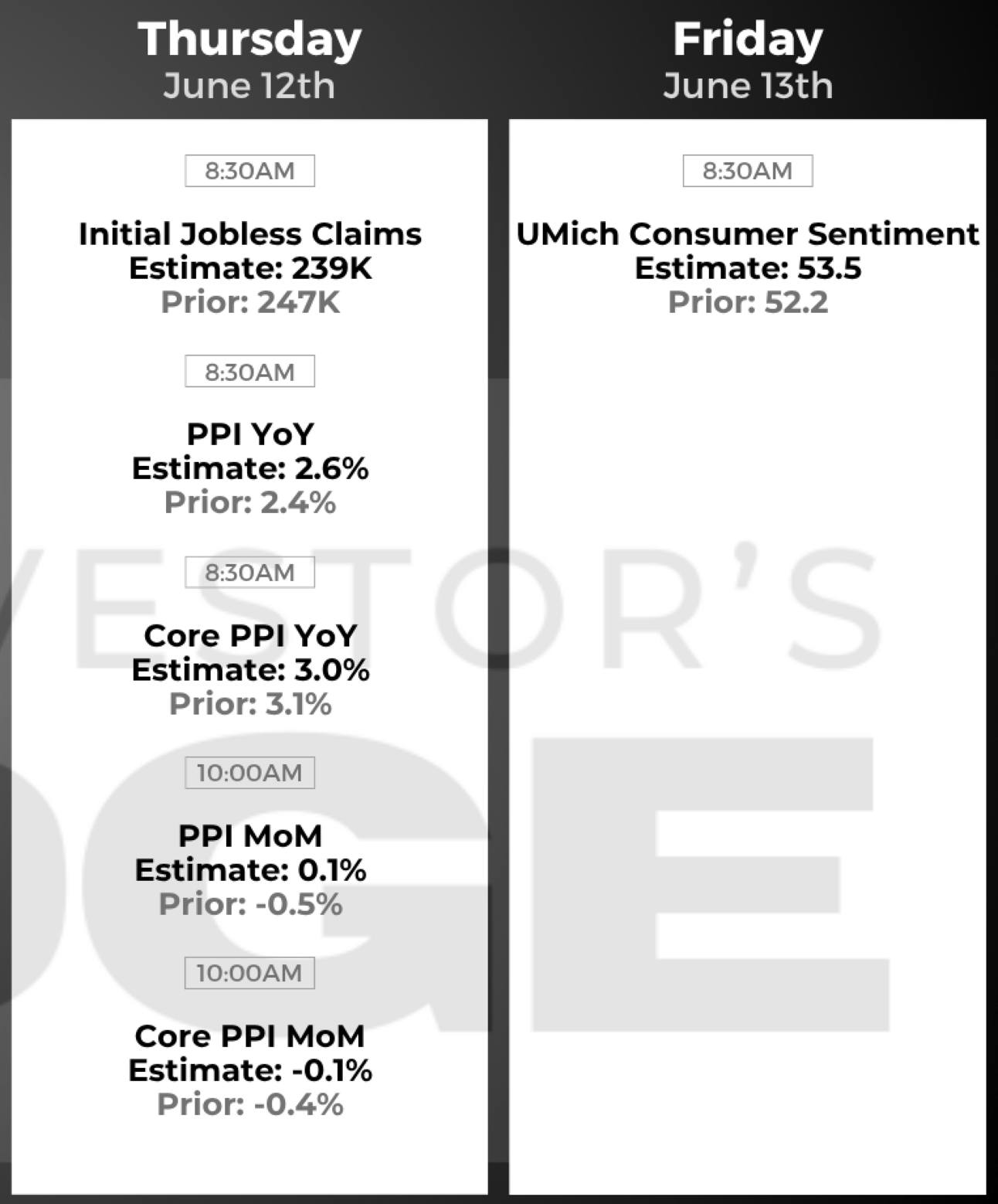

Economic Reports

The CPI may have been the main event this week, but tomorrow’s PPI report will be closely watched for rising input costs. Meanwhile, jobless claims and consumer sentiment are also due later this week.

Here is the full calendar of events scheduled for the remainder of the week:

The Investor’s Edge Discord is the place to be!

Before you go, don’t forget to join our Discord server. Members this week got a first row seat to some great trades and a sneak-peek of our Edge Scoring Dashboard.

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

🚨Trade Alerts: Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this edition of the Mid-Week Wrap-Up.

Until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.