If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Koyin is a great platform with reliable data for investors who are looking to gain an edge in the stock market. You can setup custom dashboards based on what is important to you when researching a stock. Check out what all the hype is around Koyfin.

Try out Koyfin today, CLICK HERE.

*This is sponsored advertising content.

Market Talk ⏪

We always begin with 5 important topics from the week prior and/or related to the week ahead for investors to be mindful of.

Fed hikes interest rates, as anticipated: As expected by the wide majority of investors and analysts, the Federal Reserve increased the Fed Funds rate by an additional 25 basis points at a meeting held on July 26, 2023. It was the Fed’s eleventh interest rate hike in its last twelve meetings and the increase has rates at the highest level in 22 years. Chairman Powell in his press conference was hesitant to call this the final hike and instead alluded to the committee taking a data driven approach “meeting by meeting.”

US GDP accelerates by 2.4% in Q2: Despite high inflation and hiking interest rates, the US economy defied the fears of recession with better-than-expected growth in the second quarter of 2023. Q2 GDP grew by 2.4%, which was higher than analyst expectations and higher than the 2.0% GDP growth in the first quarter of 2023. A strong labor market, descending rates of inflation, and robust consumer spending have supported the US GDP growth.

Pending home sales grow for the first time in four months: The housing recession in the US seems to be nearing its end, according to the monthly pending home sales index released by the National Association of Realtors. In addition, many US homebuilders have found their stocks trading near fresh 52-week highs. The sale of pending homes is still lower by 15.6% year-over-year; however, it went up by 0.3% in June 2023, giving some positive signals. Low inventory combined with high mortgage rates have proved to be difficult buying conditions, especially for first-time homebuyers.

The Dow Jones Industrial ended its 13-day winning streak: The 13-day winning streak was the longest winning streak since 1980 and had that streak extended one more day, it would have broken the streak record set back in 1897. The DJIA rose more than 5% during the winning streak and was aided by a widening rally as well as some key components reporting strong quarterly earnings. In the week following 10 or more consecutive days of gains, stocks have previously held on to their profits, staying flat on average.

The July Jobs Report is due out on Friday. Fed Chair Jerome Powell continues to mention how the committee will be data dependent, when it comes to monetary policy moving forward. The July jobs report, although it is a lagging report, is a key piece of data that the committee will digest when deciding whether they choose to continue to raise interest rates moving forward, or choose to pause. In June, we saw nonfarm payrolls increase 209K with the unemployment rate at 3.6%. Another month of slowing job growth and an increase in unemployment could cause the Fed to hit the pause button.

Deep Dive 📰

Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Valuation Dashboard

Subscriber only content

Premium subscribers received our latest DEEP DIVE covering Microsoft Corporation (MSFT) and they will be receiving another DEEP DIVE today.

Go PREMIUM today!

US Markets 🇺🇸

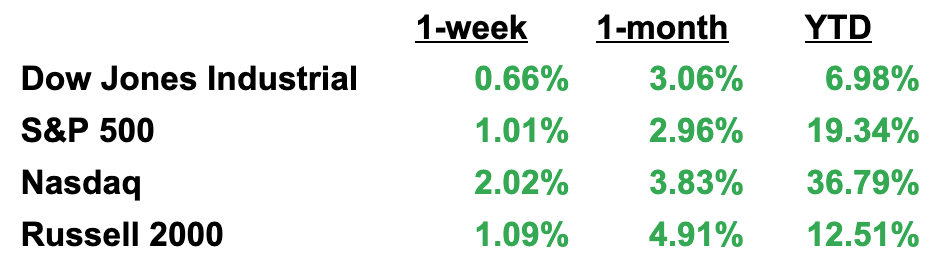

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

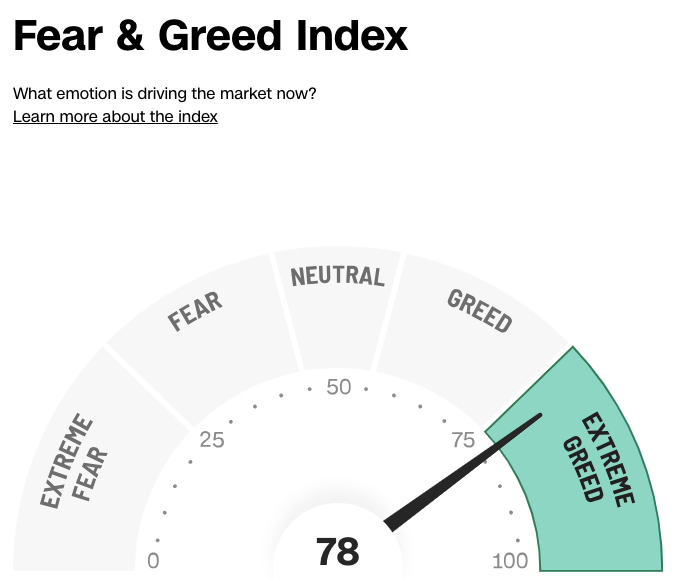

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

In the last week, the Fear & Greed Index went down slightly but remained in the Extreme Greed territory, which gives me some pause as an investor in the near-term. Currently, the index has a reading of 78, which is slightly lower than the prior week’s reading of 82.

Earnings on Deck 💰

Q2 earnings season is officially in full swing with yet another busy week of earnings due out. Here are the companies reporting this week:

Dividend News 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Piper downgrades American Express to underweight from neutral

Piper Sandler upgrades Walmart to overweight from neutral

Morgan Stanley downgrades Progressive to underweight from equal weight

Bank of America downgrades Tractor Supply to neutral from buy

Citi downgrades Goldman Sachs to neutral from buy

Raymond James downgrades Target to market perform from strong buy

Morgan Stanley downgrades RTX to equal weight from overweight

Atlantic Equities downgrades Union Pacific to neutral from overweight

Bank of America downgrades RTX to neutral from buy

Wells Fargo downgrades Enphase Energy to equal weight from overweight

Economic Data This Week 📆

Monday

Chicago PMI SA (July)

Dallas Fed index (July)

Tuesday

Markit PMI Manufacturing SA final (July)

Construction Spending SA M/M (June)

ISM Manufacturing SA (July)

JOLTS Job Openings (June)

Wednesday

ADP Employment Survey SA (July)

Thursday

Continuing Jobless Claims SA (7/22)

Initial claims SA (7/29)

PMI Composite SA (Final)

Markit PMI Services SA final (July)

Durable Orders SA M/M final (June)

Factory Orders SA M/M (June)

ISM Services PMI SA (July)

Friday

Hourly Earnings SA preliminary (July)

Average Workweek SA preliminary (July)

Manufacturing Payrolls SA (July)

Nonfarm Payrolls SA (July)

Private Nonfarm Payrolls SA (July)

Unemployment Rate (July)

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of more than 30,000 like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: 5 Forever Dividend Stocks To Build A Portfolio With:

Here is another video I put out last week: 2 REITs With Long-Term Upside:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark