Good morning investors!

Every weekend we publish our “Earnings Recap” — an in-depth summary of the earnings reports for stocks that we cover.

Earnings season is winding down but three of the stocks we cover reported quarterly results this week — here is the list of companies we focused on:

Alphabet, Tesla, Visa, Coca-Cola, Verizon, UPS, Lockheed Martin, General Motors, and Alexandria Real Estate

Let’s dive in.

Alphabet (GOOG)

Google parent company Alphabet exceeded earnings and revenue estimates, although YouTube ad revenue fell short.

Alphabet reported a net income of $23.6 billion, or $1.89 per share, a 29% increase from last year. Revenue was $84.74 billion, surpassing the $84.21 billion estimate and marking a 14% year-over-year rise.

The revenue growth was driven by search and cloud services, with cloud revenue exceeding $10 billion and achieving $1 billion in operating profit for the first time.

Ad revenue grew to $64.62 billion, up from $58.14 billion last year, indicating recovery in Google's advertising business. YouTube ad revenue increased to $8.66 billion from $7.66 billion but missed estimates, as the platform faces competition from social video sites like TikTok.

The "Other Bets" unit, including Waymo, generated $365 million, up from $285 million a year ago.

Alphabet did not provide future guidance.

GOOG shares -1.4% so far this week.

👉 EDGE TAKEAWAY: Alphabet has fumbled its AI delivery in the past, but the company is starting to…upgrade to Edge+ to read the Full Edge Takeaway.

There’s a FREE 7 day trial if you want to test the waters first. Dive in, explore, and decide for yourself — all without spending a penny upfront.

Tesla (TSLA)

Tesla reported weaker-than-expected earnings for the second quarter as automotive sales declined for the second consecutive period.

Net income fell by 45% to $1.48 billion, or 42 cents per share, down from $2.7 billion, or 78 cents per share, a year earlier. Revenue increased by 2% to $24.93 billion.

Automotive sales dropped by 7% to $19.9 billion from $21.27 billion in the same quarter last year, including $890 million in regulatory credits, more than three times the figure from the previous year.

Despite better-than-expected deliveries earlier this month, deliveries were still down year-over-year for the second straight period.

However, Tesla’s energy generation and storage business nearly doubled its revenue to just over $3 billion, with record deployments of its Megapack and Powerwall products. Tesla opted not to provide guidance.

TSLA shares are -5.6% so far this week.

👉 EDGE TAKEAWAY: Tesla remains the leading seller of EVs in the U.S., but it is…upgrade to Edge+ to read the Full Edge Takeaway.

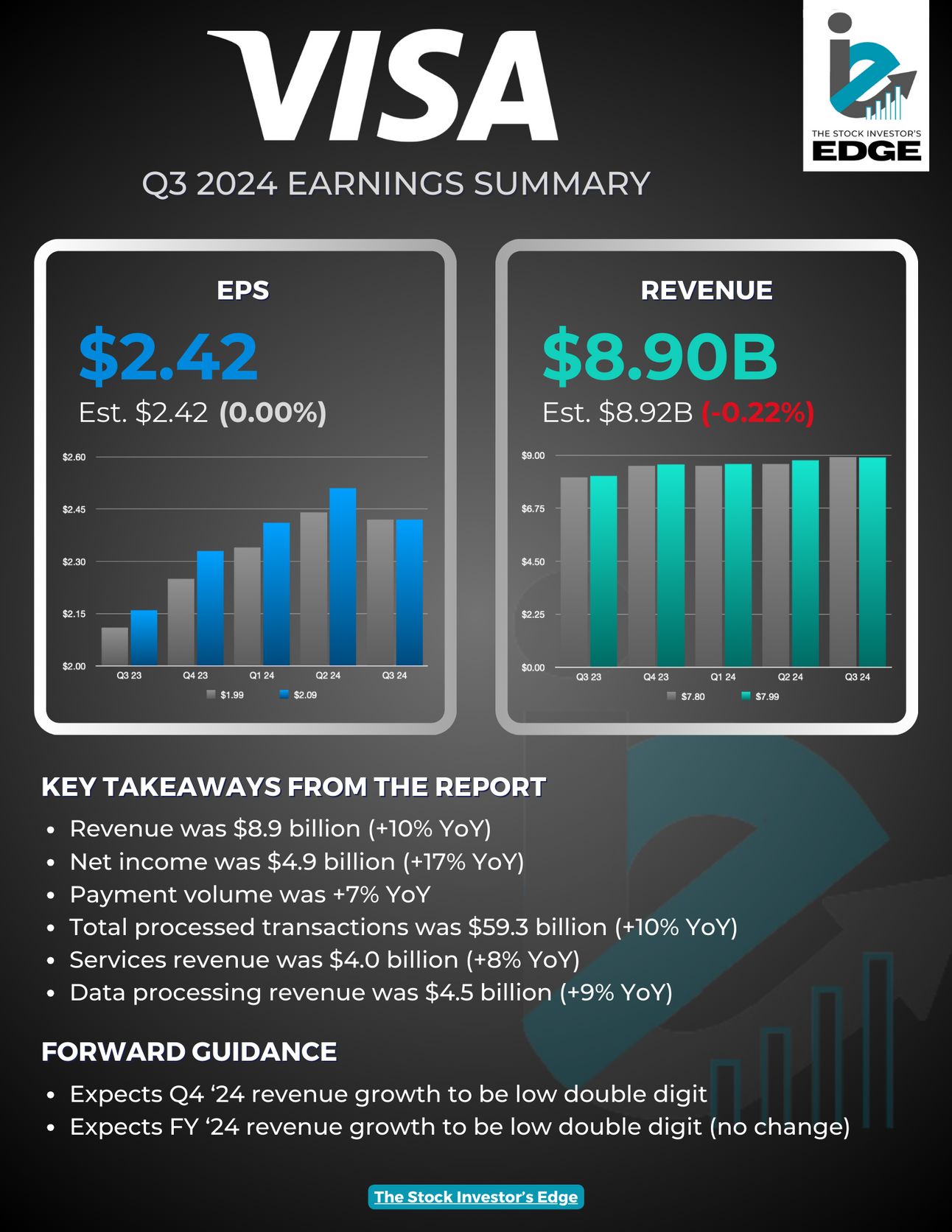

Visa (V)

Visa reported mixed fiscal Q3 results, with earnings matching Wall Street expectations but revenue falling slightly short.

The company reported an EPS of $2.42, up from $2.16 a year ago, and revenue of $8.90 billion, which was below the $8.92 billion consensus but 10% higher than last year's $8.12 billion.

Visa's total payment volume was $3.95 trillion, surpassing the $3.42 trillion estimate and compared to $3.81 trillion a year earlier. Payment volume increased by 7% year-over-year in constant dollars, cross-border volume grew by 14%, and processed transactions rose by 10%.

Operating expenses were $2.96 billion, down from $3.42 billion in Q2 and $3.10 billion a year ago.

For fiscal Q4, Visa expects EPS growth at the high end of low double digits, net revenue growth in the low double digits, and operating expense growth in the high single digits.

For fiscal 2024, the company anticipates annual operating expense growth in the high single-digit to low double-digit percent range, compared to the prior forecast of low double digits. It reiterated guidance for low double-digit net revenue growth and low teens percent EPS growth.

V shares are -3.8% so far this week.

👉 EDGE TAKEAWAY: There are not too many companies out there with the unique insight to the global consumer like Visa has. As such, after this latest quarter I believe we are…upgrade to Edge+ to read the Full Edge Takeaway.

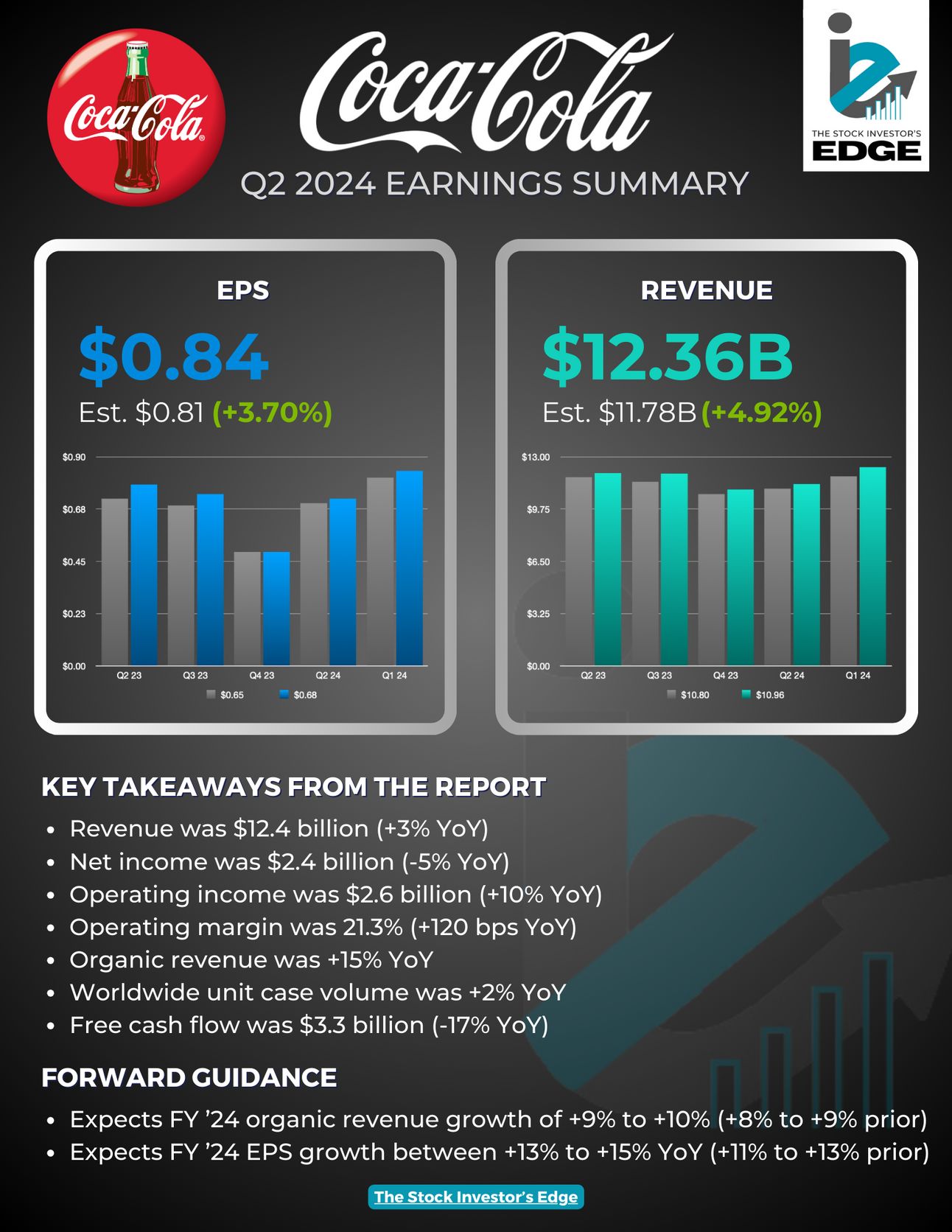

Coca-Cola (KO)

Coca-Cola exceeded earnings and revenue expectations for the second quarter and raised its full-year outlook due to increased global demand.

The company reported a net income of $2.41 billion, or 56 cents per share, down from $2.55 billion, or 59 cents per share, the previous year. Excluding certain costs, earnings were 84 cents per share. Net sales increased by 3% to $12.36 billion, with organic revenue rising 15%.

Global unit case volume grew by 2%, driven by international markets, although North American volume fell by 1%. Sparkling soft drinks saw a 3% global volume increase, while juice, dairy, and plant-based beverages grew by 2%, and water, sports, coffee, and tea remained flat.

Prices increased by 9%, partly due to hyperinflation in markets like Argentina.

For 2024, Coca-Cola expects organic revenue growth of 9% to 10% and raised its comparable earnings growth outlook to 5% to 6%.

KO shares are -0.4% so far this week.

👉 EDGE TAKEAWAY: Coca-Cola is a stock that paid the price when the GLP-1 drugs were front and center, but during that time I mentioned that the sell-off in stocks like KO were overdone. Looking back, that was the right call, but now…upgrade to Edge+ to read the Full Edge Takeaway.

Verizon (VZ)

Verizon Communications missed quarterly revenue estimates due to slow phone upgrades in the U.S.

The company reported second-quarter revenue of $32.8 billion, below the expected $33.06 billion. Net income was $4.7 billion, or $1.15 per share, meeting expectations.

Verizon added 148,000 net monthly bill-paying wireless phone subscribers, exceeding the estimated 127,870 additions, after losing 68,000 subscribers in the prior quarter.

The consumer business saw a net loss of 8,000 wireless retail postpaid phone subscribers, an improvement from 136,000 losses a year earlier.

Verizon reiterated its full-year outlook.

VZ shares are -6.3% so far this week.

👉 EDGE TAKEAWAY: Verizon has been attempting to right the ship after seeing shares decline…upgrade to Edge+ to read the Full Edge Takeaway.

United Parcel Service (UPS)

United Parcel Service reported lower-than-expected profit and revenue for the second quarter and reduced its 2024 revenue forecast.

UPS’s net income for the quarter was $1.41 billion, or $1.65 per share, down from $2.08 billion, or $2.42 per share, a year earlier. Adjusted earnings were $1.79 per share. Revenue fell to $21.82 billion from $22.06 billion, mainly due to declines in domestic and international segments.

Operating profit decreased to $1.94 billion from $2.78 billion a year earlier.

The U.S. operation's revenue declined by 1.9% due to changes in product mix, and the international segment's revenue fell by 1% due to a 2.9% drop in average daily volume. The supply chain solutions segment saw a 2.6% revenue increase, driven by growth in logistics, including healthcare.

UPS now expects 2024 revenue to be approximately $93 billion, down from a previous forecast of up to $94.5 billion, and full-year capital expenditures to be around $4 billion, down from $4.5 billion. The company also plans to target around $500 million in share repurchases in 2024.

UPS shares are -12.0% so far this week.

👉 EDGE TAKEAWAY: Investors were looking to UPS earnings to gauge demand improvements. This report highlights…upgrade to Edge+ to read the Full Edge Takeaway.

Lockheed Martin (LMT)

Lockheed Martin raised its annual sales target following the resumption of F-35 aircraft deliveries by the Pentagon.

In the second quarter, Lockheed's net income was $7.11 per share, exceeding estimates of $6.46 per share. Quarterly sales increased by 9% to $18.12 billion, easily surpassing the estimated $17.04 billion.

The U.S. resumed taking F-35 deliveries after a pause due to software upgrade delays. Lockheed's Technology Refresh 3 (TR-3) program is enhancing the jets' displays and processing power.

Despite the resumed deliveries, the Pentagon will withhold some payments until all upgrades are complete. The F-35 program, contributing about 30% of Lockheed's revenue, is the world's largest defense program.

Lockheed now expects 2024 sales to be between $70.5 billion and $71.5 billion, up from the previous forecast of $68.5 billion to $70 billion.

LMT shares are +5.9% so far this week.

👉 EDGE TAKEAWAY: Lockheed Martin is one of those stocks that has benefited from the “Trump Trade” …upgrade to Edge+ to read the Full Edge Takeaway.

General Motors (GM)

General Motors raised key financial targets for 2024 after surpassing Wall Street's earnings expectations for the second quarter.

GM's net income attributable to stockholders increased by 14.3% to $2.93 billion, with earnings per share rising to $3.06 from $1.91 a year earlier. Adjusted earnings before interest and taxes (EBIT) grew by 37.2% to $4.44 billion. GM's revenue set a quarterly record, increasing by 7.2% to $44.75 billion.

The strong performance was driven largely by GM's North American operations, particularly truck sales. The average transaction price was around $50,000, with incentives below the industry average. The North America division's adjusted earnings rose nearly 40% to $4.43 billion, with a profit margin of 10.9%, up 2.3 percentage points from the previous year.

GM aims to produce and wholesale 200,000 to 250,000 all-electric vehicles (EVs) in North America, despite slower-than-expected adoption. EV deliveries rose 40% year-over-year to 21,930 units, but EVs accounted for only 3.2% of total U.S. sales in the quarter.

GM now forecasts full-year adjusted EBIT of $13 billion to $15 billion, up from $12.5 billion to $14.5 billion. The adjusted automotive free cash flow forecast was also raised, while the net income attributable to stockholders was slightly lowered by less than 1%.

GM shares are -5.4% so far this week.

👉 EDGE TAKEAWAY: Despite strong financial results, GM shares fell due to investor concerns over…upgrade to Edge+ to read the Full Edge Takeaway.

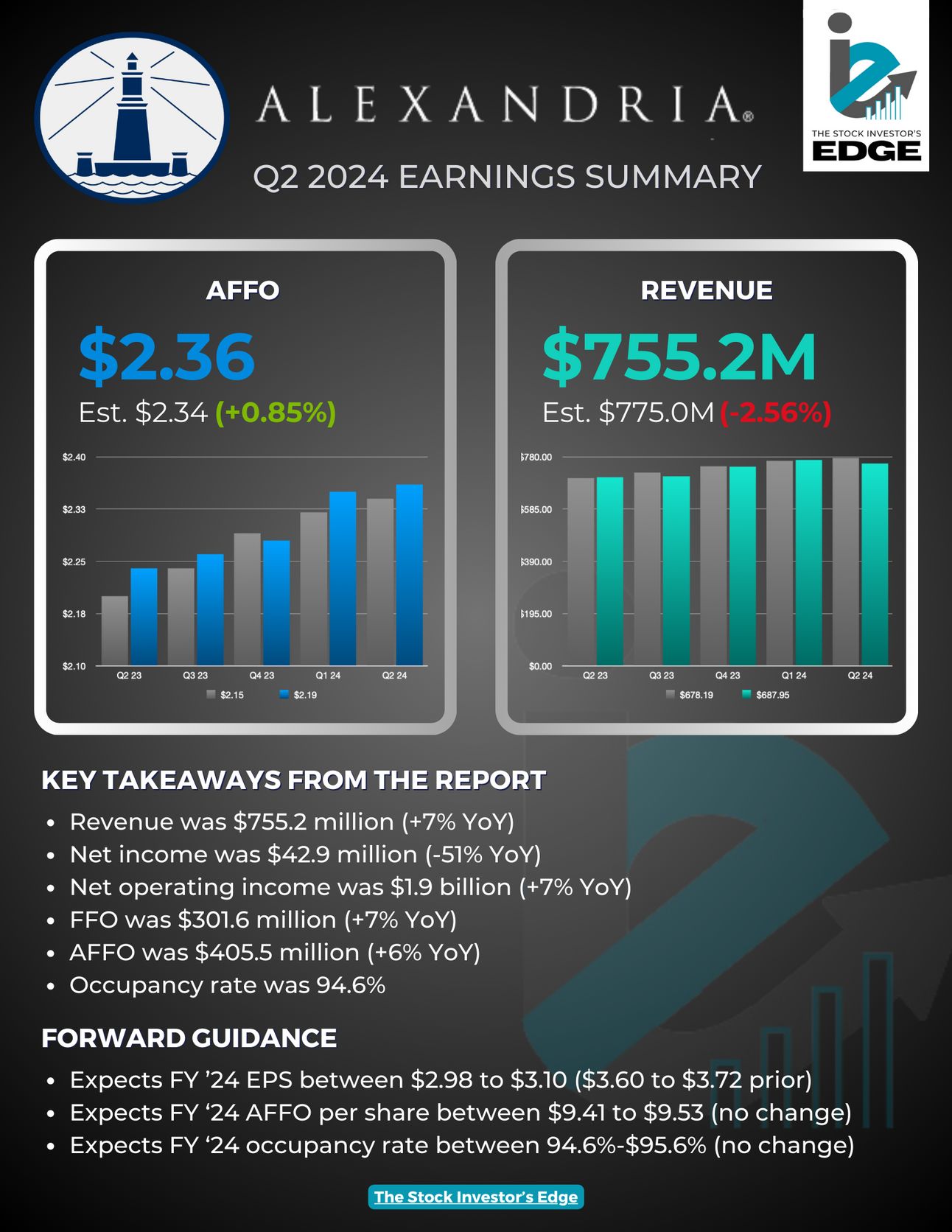

Alexandria Real Estate (ARE)

Alexandria Real Estate Equities exceeded expectations for funds from operations (FFO) but fell short on revenue estimates.

The REIT reported quarterly FFO of $2.36 per share, surpassing the estimated $2.34 per share and up from $2.24 per share a year ago. Revenues were $766.73 million, below the estimated $775.0 million but higher than the $713.9 million reported a year ago.

Total expenses increased to $629.2 million from $593.8 million in Q1 but decreased from $716.9 million in Q2 2023.

Occupancy of operating properties in North America was steady at 94.6% as of June 30, 2024. Same-property net operating income (NOI) grew 1.5% year-over-year, improving from Q1's 1.0% gain, with cash basis NOI rising 3.9% compared to 4.2% in Q1.

Approximately 96% of leases included contractual annual rent escalations of about 3%.

Alexandria maintained its 2024 guidance for adjusted FFO per share at $9.41-$9.53, aligning with the $9.48 consensus estimate.

ARE shares are -3.2% so far this week.

👉 EDGE TAKEAWAY: Alexandria reported a mixed bag of earnings, but we believe the REIT should…upgrade to Edge+ to read the Full Edge Takeaway.

The Investor’s Edge Discord is growing!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber.

Our Discord server is tailor-made for investors like you who want to dive deeper into stocks, share insights, and engage directly with us.

Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Investors have been on top of the earnings this week, with several members sharing great insights.

🚨 Trade Alerts: Chris and Mark shared several trades, including additions to the portfolio and trades that set up their portfolios for the week.

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this week’s Earnings Recap.

If you enjoyed this newsletter, be sure to give this a LIKE and LEAVE US A COMMENT. You can share your thoughts on the earnings, let us know that you appreciate the content or even just say hello.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.