Good morning investors!

Every weekend we publish our “Earnings Recap” — an in-depth summary of the earnings reports for stocks that we cover.

Earnings season was in full force this week as thirteen of the stocks we cover reported quarterly results this week — here is the list of companies we focused on:

Tesla, Coca-Cola, IBM, Verizon, Union Pacific, Lockheed Martin, UPS, Lam Research, 3M, General Motors, Tractor Supply, L3Harris, and Alexandria Real Estate

Let’s dive in.

Tesla (TSLA)

Tesla reported third-quarter earnings that beat analysts’ expectations on earnings per share, though revenue slightly missed estimates.

The company posted revenue of $25.18 billion, an 8% increase year-over-year, but missed estimates by 1.14%. Net income rose to $2.2 billion, or $0.72 per share, up 17% year-over-year, surpassing expectations.

Automotive revenue increasing by 2% to $20 billion, while energy revenue surged 52% to $2.4 billion.

Operating cash flow soared 89% to $6.3 billion, reflecting strong liquidity. Operating income also jumped 54% year-over-year to $2.7 billion.

Total vehicle deliveries grew 6% year-over-year to 462,890.

Looking ahead, Tesla expects vehicle deliveries to experience slight growth in 2024 despite macroeconomic pressures. Energy storage deployments are forecasted to more than double next year, and CEO Elon Musk anticipates vehicle growth of 20% to 30% in 2025, with advancements in autonomy and lower-cost models contributing to that expansion.

TSLA shares are +2.1% so far this week.

👉 EDGE TAKEAWAY: While Tesla's Q3 earnings beat expectations on EPS, the revenue miss should not be overlooked. The company…upgrade to Edge+ to read the Full Edge Takeaway.

Coca-Cola (KO)

Coca-Cola reported strong quarterly earnings and revenue, exceeding analysts' expectations due to higher prices that compensated for weakening demand.

The company posted net income of $2.85 billion, or $0.77 per share, down from $3.09 billion a year ago, but adjusted net sales were flat at $11.95 billion. Organic revenue rose 9%, despite a 1% drop in unit case volume, reflecting lower demand in some international markets.

In North America, volume was flat as declines in water, sports drinks, coffee, and tea were balanced by growth in soda, juice, and plant-based beverages. However, unit case volume fell 2% in regions like Europe, the Middle East, Africa, and Asia Pacific, particularly in China and Turkey.

Globally, Coke’s sparkling soft drinks and soda volumes were flat, while other segments, such as juice and water, saw declines. Coca-Cola raised prices by 10%, with inflation in markets like Argentina contributing 4% of that increase.

For 2024, the company expects organic revenue growth of around 10%, with earnings per share projected to rise 5% to 6%.

KO shares are -4.3% so far this week.

👉 EDGE TAKEAWAY: While Coca-Cola beat earnings expectations, the underlying picture is…upgrade to Edge+ to read the Full Edge Takeaway.

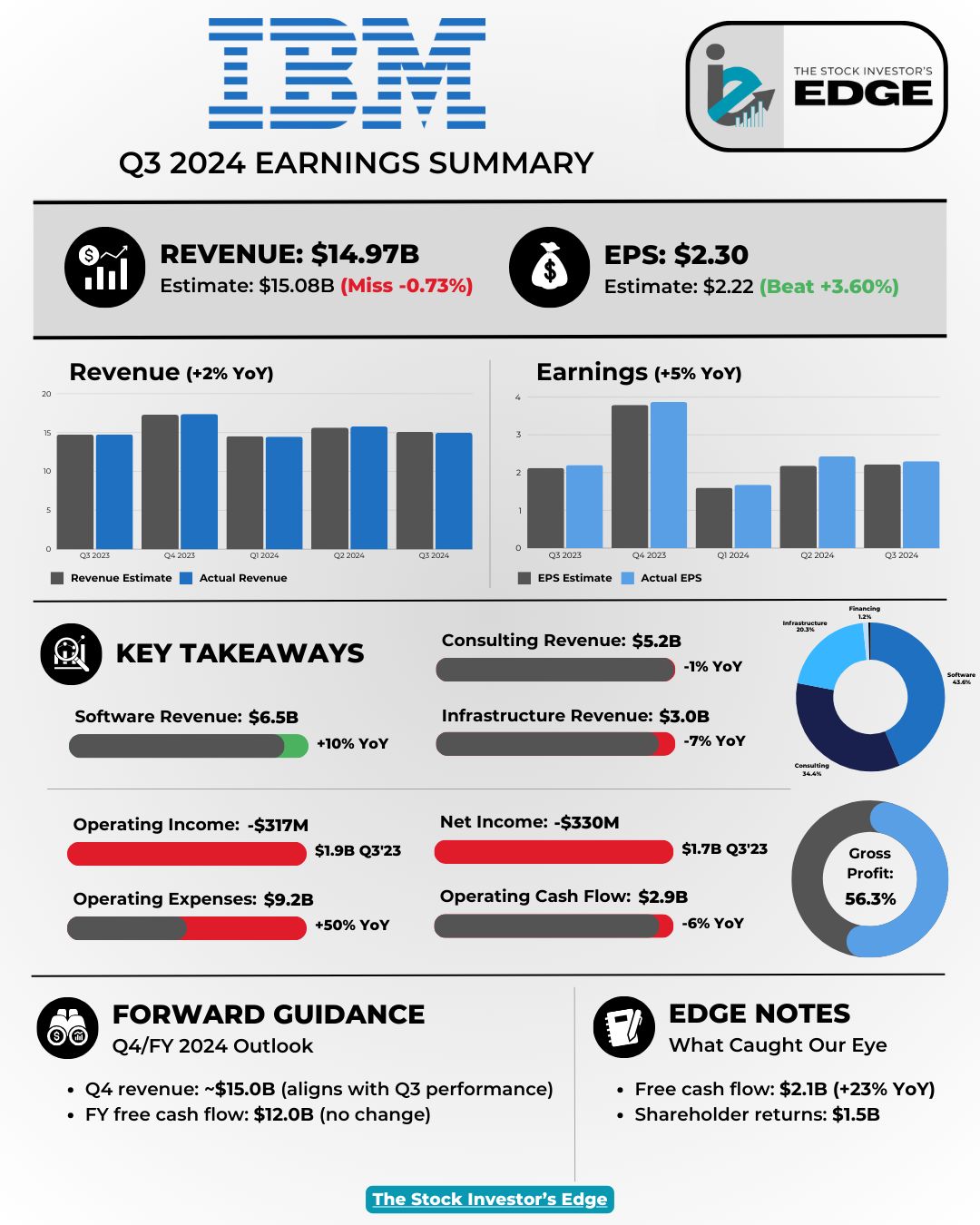

IBM (IBM)

IBM reported third-quarter earnings that beat EPS estimates, but revenue came in slightly below expectations, causing shares to drop in extended trading.

The company posted revenue of $14.97 billion, a 1.5% year-over-year increase, but missed Wall Street’s estimate of $15.08 billion. IBM recorded a net loss of $330 million due to a one-time pension settlement charge, compared to a net income of $1.70 billion in the same period last year.

Software revenue grew 10% year-over-year to $6.5 billion, supported by Red Hat’s 14% growth. However, consulting revenue of $5.2 billion declined by 1%, and infrastructure revenue fell 7% to $3 billion. Operating expenses surged 50% year-over-year to $9.2 billion, driven by non-operational costs.

IBM's forward guidance suggests Q4 revenue to remain flat, aligning with Q3 performance at around $15 billion, while the company maintains its $12 billion free cash flow target for 2024.

IBM shares are -6.3% so far this week.

👉 EDGE TAKEAWAY: IBM’s Q3 results highlight a tough quarter for the company, despite the EPS beat. The…upgrade to Edge+ to read the Full Edge Takeaway.

A word from our sponsor - The Oxford Club

Man Who Called Nvidia at $1.10 Says Buy This Now...

In 2004, one man called Nvidia before just about anyone knew it existed. Now, he says a new company could become the next to soar like Nvidia. The biggest tech firms are loading up on shares. Nvidia, Apple, Google, AMD, Intel, and Samsung are all invested in this company. It also signed a MAJOR deal with Apple to get its AI tech into the iPhone and iMac. And its tech is also found in products from Samsung and Google.

Verizon (VZ)

Verizon's Q3 2024 results were mixed, with earnings slightly beating expectations but revenue falling just short.

The company reported revenue of $33.33 billion, flat year-over-year, but missing estimates by 0.33%. Adjusted earnings per share came in at $1.19, down 2% year-over-year, though it narrowly beat estimates of $1.18. Wireless service revenue rose 2.7% to $19.8 billion, but growth slowed compared to the prior quarter.

Business revenue declined by 2% year-over-year, while consumer revenue remained flat at $25.4 billion. Operating income fell by 21%, with net income dropping by 30% to $3.4 billion, reflecting rising operating expenses which increased by 6% year-over-year.

Verizon added 239,000 wireless postpaid phone subscribers, surpassing estimates and marking the first positive consumer subscriber growth since 2021.

Looking ahead, Verizon maintained its guidance for FY 2024, forecasting wireless revenue growth between 2% to 3.5% and EPS between $4.50 and $4.70, with capital spending projected to rise in 2025.

VZ shares are -4.6% so far this week.

👉 EDGE TAKEAWAY: Verizon’s Q3 report was weighed down by a notable drop in wireless equipment revenue, which…upgrade to Edge+ to read the Full Edge Takeaway.

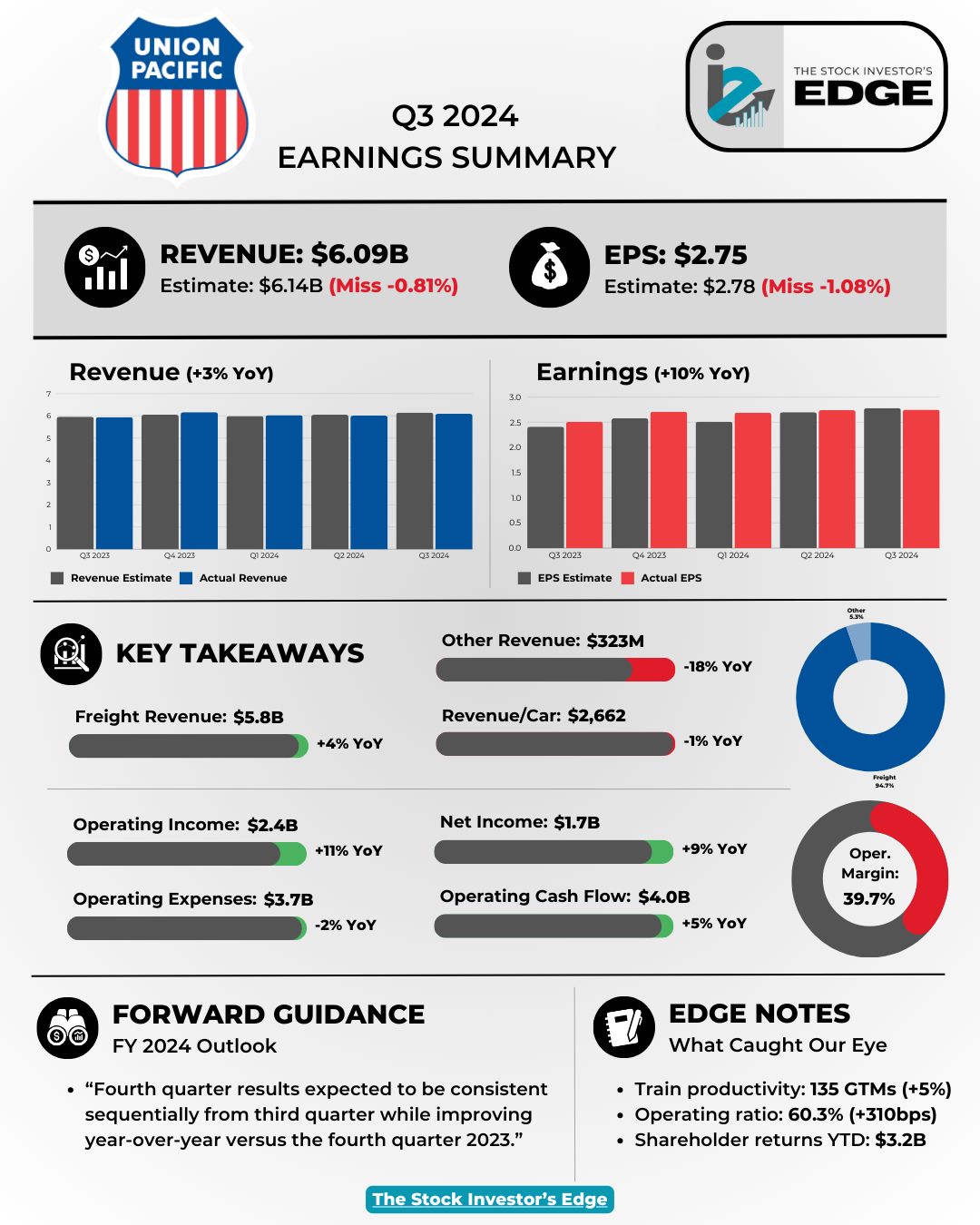

Union Pacific (UNP)

Union Pacific reported third-quarter results that missed Wall Street's expectations for both revenue and profit, as a less favorable business mix and lower fuel surcharge revenue overshadowed shipment growth and price increases.

The company posted revenue of $6.09 billion, up 3% year-over-year, but below estimates of $6.14 billion. Earnings per share came in at $2.75, missing expectations of $2.78.

Freight revenue rose 4% to $5.8 billion, while operating income increased by 11% year-over-year to $2.4 billion.

Key highlights include a 17% decline in coal and renewables freight revenue, driven by reduced demand for domestic coal, while grain and intermodal segments saw gains due to a strong harvest and increased imports. The operating ratio improved to 60.3%, reflecting better cost control, although other revenue sources were down 18% year-over-year.

Looking forward, Union Pacific expects Q4 results to remain consistent with the third quarter, while showing improvement compared to the same period last year.

UNP shares are -5.3% so far this week.

👉 EDGE TAKEAWAY: UNP shares sold off rather hard after reporting an earnings miss, but…upgrade to Edge+ to read the Full Edge Takeaway.

Lockheed Martin (LMT)

Lockheed Martin posted mixed Q3 2024 results, with earnings beating estimates but revenue falling short of expectations, leading to a drop in its stock price.

The company reported revenue of $17.1 billion, up 1% year-over-year but missing Wall Street’s $17.38 billion estimate by 1.6%. Earnings per share came in at $6.80, surpassing estimates by 4.6%. Net income dropped to $1.6 billion, down 4% year-over-year, as operating income rose 5% to $2.1 billion.

Key highlights include a 6% growth in its Rotary and Mission Systems revenue to $4.4 billion, and an 8% increase in Missiles and Fire Control revenue to $3.2 billion. However, Aeronautics revenue declined by 3% due to delays in the F-35 contract, which may continue to weigh on results until resolved.

Operating expenses also rose by 1%, while operating cash flow decreased by 16% year-over-year.

Despite the revenue miss, Lockheed Martin raised its FY 2024 guidance, now expecting $71.25 billion in annual revenue and EPS of $26.65, up from its prior outlook. It also approved $3 billion in share buybacks and increased its dividend to $3.30 per share.

LMT shares are -7.5% so far this week.

👉 EDGE TAKEAWAY: It has been clear over the past two years that demand has been high, however the company…upgrade to Edge+ to read the Full Edge Takeaway.

United Parcel Service (UPS)

UPS reported strong Q3 results, beating both earnings and revenue estimates as the company benefited from rebounding volumes and effective cost management ahead of the holiday season.

The company posted revenue of $22.20 billion, up 5% year-over-year and slightly above the estimate of $22.10 billion. Adjusted earnings per share came in at $1.76, surpassing analysts' expectations of $1.63, reflecting a 12% year-over-year increase. Operating income rose 48% to $2.0 billion, while net income surged 37% to $1.5 billion.

UPS reported a 6% increase in domestic revenue to $14.5 billion and 8% growth in supply chain revenue to $3.4 billion. International revenue also grew by 3%, contributing to the overall performance.

However, operating expenses were reduced by 16%, highlighting UPS’s focus on cost efficiency. Despite this, operating cash flow fell 13% to $6.8 billion.

Looking ahead, UPS raised its full-year operating margin forecast to 9.6%, up from the 9.4% previously guided in July, but reduced its revenue outlook to $91.1 billion due to a shift toward lower-margin ground services like SurePost, driven by the rise of e-commerce players like Shein and Temu.

UPS shares are +1.9% so far this week.

👉 EDGE TAKEAWAY: UPS delivered a strong Q3 performance, marking a significant turnaround after recent challenges. The…upgrade to Edge+ to read the Full Edge Takeaway.

Lam Research (LRCX)

Lam Research reported a strong Q3 2024, exceeding expectations on both revenue and earnings, driven by solid demand in its semiconductor equipment segment.

The company posted revenue of $4.17 billion, up 20% year-over-year and beating estimates by 2.7%. Earnings per share came in at $0.86, surpassing estimates by 6.17%.

Operating income rose 24% to $1.3 billion, while operating cash flow surged 82% year-over-year to $1.6 billion, reflecting improved efficiency and liquidity.

Lam reported a 16% year-over-year increase in systems revenue to $2.4 billion and a 25% jump in support revenue to $1.8 billion. However, China revenue declined 8% year-over-year to $1.5 billion, though it still accounted for 37% of total revenue.

Gross profit remained solid at 46.9%, while inventories declined to $4.2 billion, showing better inventory management.

For Q4 2024, Lam projects revenue between $4.0 billion and $4.6 billion and EPS in the range of $0.77 to $0.97, both above analyst expectations.

LRCX shares are +5.6% so far this week.

👉 EDGE TAKEAWAY: This was a great quarter for LRCX after weaker than expected results from ASML…upgrade to Edge+ to read the Full Edge Takeaway.

3M (MMM)

3M reported stronger-than-expected Q3 2024 results, beating both earnings and revenue estimates despite ongoing challenges in some segments.

The company posted revenue of $6.29 billion, a 0.4% year-over-year increase, surpassing estimates by 3.8%. Earnings per share came in at $1.98, beating expectations by 4.21%.

Operating income rose to $1.3 billion from a loss of $3.1 billion in the same period last year, while organic sales showed modest growth of 0.7%.

Operating expenses were down 47%, showing strong cost discipline, though operating cash flow decreased 36% year-over-year to $1.8 billion. The gross profit margin improved to 42.1%.

Revenue in the Industrial segment was flat at $2.8 billion, while Transportation and Electronics revenue declined by 1% to $2.1 billion.

Looking ahead, 3M updated its full-year 2024 guidance, now expecting 1% revenue growth and adjusted EPS between $7.20 and $7.30, reflecting the company’s efforts to stabilize performance in a challenging macro environment.

MMM shares are -6.4% so far this week.

👉 EDGE TAKEAWAY: 3M reported better than expected earnings and revenues, but that was not enough for investors, as shares fell…upgrade to Edge+ to read the Full Edge Takeaway.

General Motors (GM)

General Motors delivered a standout Q3 2024 performance, exceeding expectations on both revenue and earnings, which led to a significant rise in its stock.

The company posted revenue of $48.76 billion, a 10.5% year-over-year increase, and beat estimates by 9.16%. Earnings per share came in at $2.96, significantly surpassing estimates by 24.37%. GM’s net income was $3.0 billion, up slightly year-over-year,

Operating income rose 21% to $3.7 billion. Despite rising operating expenses, GM maintained a healthy adjusted EBIT margin of 8.4%.

Automotive revenue increased 10% to $44.7 billion and GM Financial’s revenue grew 11% to $4.0 billion. However, GM’s operations in China continue to struggle, posting a $137 million loss. The Cruise autonomous vehicle unit also reported a substantial loss of $383 million in Q3, contributing to $1.3 billion in losses year-to-date.

Looking ahead, GM raised its 2024 guidance, now expecting net income between $10.4 billion and $11.1 billion and increasing its automotive free cash flow forecast to $12.5 billion to $13.5 billion, reflecting confidence in its core business despite international headwinds.

GM shares are +7.3% so far this week.

👉 EDGE TAKEAWAY: As we have seen with other financials with trading revenues…upgrade to Edge+ to read the Full Edge Takeaway.

Tractor Supply (TSCO)

Tractor Supply reported mixed Q3 results, with earnings meeting expectations but revenue slightly missing the mark.

The company posted revenue of $3.48 billion, a 2% year-over-year increase, but fell short of estimates by 0.29%. Earnings per share were in line with expectations at $2.24.

Despite the modest revenue miss, Tractor Supply saw its gross profit rise 3.2% to $1.29 billion, and its gross margin improved to 37.2%, driven by lower transportation costs and disciplined product cost management. However, same-store sales slipped by 0.2%, while new store sales grew by 2%.

Tractor Supply did report a 5% year-over-year decline in operating income to $324.6 million and a 4% decline in operating cash flow to $903.6 million, reflecting rising costs and soft comparable store sales.

The company continues its expansion, adding 3% more stores year-over-year to a total of 2,475 locations.

Looking ahead, Tractor Supply raised the lower end of its full-year guidance, now expecting FY 2024 revenue between $14.85 billion and $15 billion and EPS in the range of $10.10 to $10.40, slightly above prior estimates. While same-store sales growth remains a challenge, Tractor Supply's strong cost management and margin expansion help balance the softness in comparable sales.

TSCO shares are -7.3% so far this week.

👉 EDGE TAKEAWAY: Tractor Supply is due to benefit from…upgrade to Edge+ to read the Full Edge Takeaway.

L3Harris (LHX)

L3Harris reported a strong Q3 2024, beating both revenue and earnings expectations, while raising its full-year guidance.

The company posted revenue of $5.29 billion, an 8% year-over-year increase, slightly above estimates by 0.19%. Non-GAAP earnings per share came in at $3.34, exceeding expectations by 2.77%.

Operating income increased 3% to $495 million, and operating cash flow surged 44% year-over-year to $780 million, underscoring improved cash generation. However, operating expenses rose 8% to $4.8 billion, reflecting rising costs.

Key highlights include a strong book-to-bill ratio of 1.4x, with orders totaling $7.2 billion. Mission Systems revenue grew 7%, while Communication Systems revenue increased 10%, both supporting the company’s top-line growth. Space and Airborne revenue remained flat at $1.7 billion. L3Harris also delivered an adjusted operating margin of 15.7%, reflecting efficiency gains.

Looking ahead, L3Harris raised its FY 2024 revenue guidance to $21.1 billion to $21.3 billion, with EPS now expected to range between $12.95 and $13.15. The company is on track to achieve at least $600 million in cost savings this year, surpassing its earlier $400 million target. With a growing pipeline and efficiency initiatives, L3Harris is well-positioned to continue its momentum into 2025.

LHX shares are +2.5% so far this week.

👉 EDGE TAKEAWAY: The company’s strong book-to-bill ratio of 1.4x and $7.2 billion in orders demonstrate…upgrade to Edge+ to read the Full Edge Takeaway.

Alexandria Real Estate (ARE)

Alexandria Real Estate Equities reported a solid Q3 2024 performance, with revenue and earnings exceeding expectations despite a slight miss on funds from operations (FFO).

The company posted revenue of $791.6 million, a 12% year-over-year increase, beating estimates by 3.21%. Net income surged 653% to $164.7 million. FFO came in at $2.37 per share, narrowly missing the estimate of $2.38 by 0.42%.

Rental revenue rose 10% to $775.7 million, and other income jumped by 153% to $15.9 million. Operating expenses grew by 10% year-over-year to $620.5 million, but the company maintained a strong operating margin of 71%.

Alexandria reported a 48% increase in leasing volume to 1.5 million rentable square feet (RSF), reflecting strong demand. The company continues to maintain high occupancy, with an average of 94.7%.

Looking ahead, Alexandria updated its FY 2024 guidance, with FFO expected to range between $9.45 and $9.49 per share, and occupancy levels anticipated to stay in the 94.6% to 95.6% range. Despite the FFO miss, Alexandria's revenue growth and solid leasing activity demonstrate the company’s strong position in the market.

ARE shares are -4.1% so far this week.

👉 EDGE TAKEAWAY: Alexandria Real Estate just reported a mixed quarter which gave me as an investor…upgrade to Edge+ to read the Full Edge Takeaway.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out!

Before you go, don’t forget to join our our Discord server!

If you are only reading the newsletter, you are only getting a fraction of the benefits of being an Edge subscriber. Here’s what you’re missing in the Discord:

🗨️ Chat rooms: Connect with fellow investors, swap ideas, and engage in lively discussions about stocks and market trends—all while rubbing virtual elbows with both Mark and Chris.

📊 Earnings / Economic reports: No more waiting for our newsletters to hit your inboxes - see earnings results and economic data as they are released. And more importantly, get our reactions and insights immediately.

🚨Trade Alerts (Edge+ members): Get exclusive, behind-the-scenes access to our trades as they happen. It's like having a front-row seat to our investment decisions!

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this week’s Earnings Recap.

If you enjoyed this newsletter, be sure to give this a LIKE and LEAVE US A COMMENT. You can share your thoughts on the earnings, let us know that you appreciate the content or even just say hello.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.