Good morning investors!

During the ever important earnings season, we publish our “Earnings Recap” — an in-depth summary of the earnings reports for stocks that we cover on a regular basis.

This earnings season is mostly in the rear-view mirror but there were still a couple of big names that we cover that reported this week.

Let’s dive in.

Micron Technology (MU)

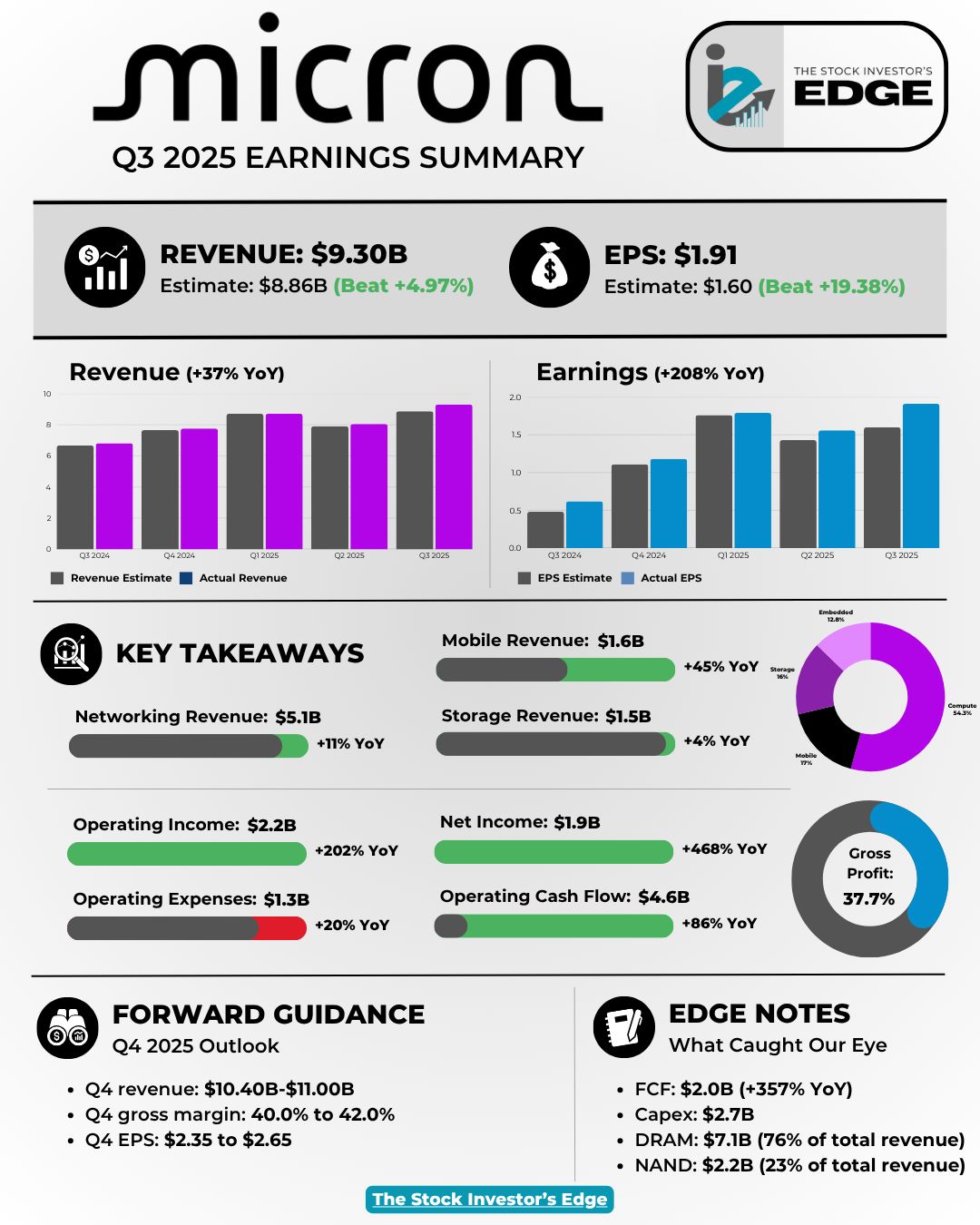

Micron $MU ( ▼ 1.68% ) delivered record results in Q3 FY2025, fueled by explosive growth in AI-related memory demand. Revenue and earnings smashed Wall Street expectations, as HBM and DRAM drove a surge in data center and mobile sales. With free cash flow up nearly 4x and Q4 guidance pointing to further strength, Micron is reasserting its leadership in the semiconductor cycle.

🔑 Key Points

Record Data Center Revenue: AI-driven memory demand sent data center revenue to a new record, more than doubling YoY.

Strong Mobile and Storage Growth: Mobile revenue rose +45% YoY to $1.6B, while storage revenue climbed +4% to $1.5B.

DRAM Powers the Quarter: DRAM contributed $7.1B (76% of total revenue), with HBM revenue up nearly 50% QoQ.

Margins and Cash Flow Surge: Gross margin reached 39%, while free cash flow hit $2.0B, up +357% YoY.

Bullish Q4 Outlook: Management sees Q4 revenue at $10.7B, gross margin of 42%, and EPS between $2.35–$2.65.

👀 What You Need to Know

This was a blowout quarter across the board for Micron. With DRAM/HBM strength showing no signs of slowing, MU is firmly positioned as a critical supplier in the AI infrastructure boom. The Q4 guidance confirms continued operating leverage, as gross margin expansion and tight capex discipline fuel higher earnings quality. While shares have run hard in 2025, this report adds conviction that Micron is executing on its expectations.

MU shares are +0.9% so far this week.

🔐 Edge Takeaway: Micron is no longer just riding the memory cycle, it’s becoming a core pillar of AI infrastructure. With…upgrade to Edge+ to read the Full Edge Takeaway.

Sponsored by AIR Insider

Expert investment picks that have returned 200%+

AIR Insiders get picks from expert investors and industry leaders sent straight to their inbox every week. Picks like:

Jason Calacanis recommending Uber at $25/share (200%+ return)

Anthony Scaramucci recommending Bitcoin at $29,863 (200%+ return)

Sim Desai recommending OpenAI at an $86 billion market cap (200%+ return)

Looking to invest in real estate, private credit, pre-IPO ventures or crypto? Just sign up for our 2-week free trial so you can experience all the benefits of being an AIR Insider.

Nike (NKE)

Nike $NKE ( ▼ 3.53% ) posted a 12% revenue drop and an 86% plunge in net income in Q4 FY2025, marking one of its toughest quarters in recent memory. However, both revenue and EPS beat analyst expectations, and management struck a confident tone on the call, noting that Q4 represented the “largest financial impact” from its restructuring efforts. With a renewed focus on core sports categories and easing inventory pressures, the company outlined a clearer path forward.

🔑 Key Points

EPS & Revenue Beat: EPS of $0.14 beat by 7.7%, while revenue of $11.1B topped estimates by 3.4% despite falling YoY.

Margins Hit Hard: Gross margin fell 440 bps to 40.3%, driven by heavy discounting and channel mix pressure.

Digital Weakness: Nike Brand Digital revenue fell 26%, dragging total Direct sales down 14% YoY.

Confidence on Call: CFO said headwinds would “moderate from here,” citing traction in restructuring efforts.

Stock Reaction: Shares jumped ~11% post-call as investors viewed Q4 as a bottoming quarter.

👀 What You Need to Know

While sales and earnings were weak, execution is improving, and management’s tone was notably more optimistic. With inventory flat YoY and wholesale declines moderating, Q1 could show early signs of stabilization. The new “sport offense” strategy promises to reignite the brand. Investors also welcomed Nike’s transparency on tariffs, with CFO Matt Friend acknowledging a ~$1B cost hit but outlining mitigation plans.

NKE shares are +18.9% so far this week.

🔐 Edge Takeaway: Nike may have just flipped the script. While the headline numbers were ugly, the…upgrade to Edge+ to read the Full Edge Takeaway.

FedEx (FDX)

FedEx $FDX ( ▼ 1.23% ) topped Q4 earnings expectations with adjusted EPS of $6.07 (+12% YoY), supported by strong cost discipline and a leaner network. Revenue rose just 1% to $22.2B, but margins improved on the back of the DRIVE cost-cutting program. Express segment gains helped offset Freight softness, while overall operating income rose 8% to $2.0B. Despite lower cash flow, FedEx increased shareholder returns and remains on track with its Freight spin-off.

🔑 Key Points

EPS Beats on Margin Strength: Adjusted EPS of $6.07 beat by 4.3%, driven by a 60bps jump in operating margin to 9.1%.

Revenue Grows Modestly: Sales rose 1% YoY to $22.2B, led by Express (+1%) while Freight declined 4%.

Operating Cash Flow Slips: OCF dropped 15% YoY to $7.0B, driven by working capital drag despite better earnings.

Capital Returns Accelerate: FedEx repurchased $3.0B in stock and raised its annual dividend 5% to $5.80/share.

Capex at Historic Low: FY25 capex fell 22% YoY to $4.1B, the lowest level as a % of revenue in company history.

👀 What You Need to Know

FedEx is executing on cost transformation even as macro pressures weigh on top-line growth. The 12% EPS jump shows that margin expansion, not volume, is driving near-term equity value. With full-year guidance withheld, Q1 becomes a key litmus test, especially as Freight volatility lingers. Execution on Network 2.0 and spin-off timing will be crucial into FY26.

FDX shares are -1.2% so far this week.

🔐 Edge Takeaway: FedEx isn’t a macro recovery bet anymore, it’s a cost-efficiency and capital return story. The…upgrade to Edge+ to read the Full Edge Takeaway.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out!

Before we continue with the rest of the earnings recap, please don’t forget to join our our Discord server!

If you want these recaps as soon as the earnings are released, you need to be on the Discord:

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this week’s Earnings Recap.

If you enjoyed this newsletter, be sure to give this a LIKE and LEAVE US A COMMENT. You can share your thoughts on the earnings, let us know that you appreciate the content or even just say hello.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.