Good morning investors!

During the ever important earnings season, we publish our “Earnings Recap” — an in-depth summary of the earnings reports for stocks that we cover on a regular basis.

It was a quieter week on the earnings front, but we did get earnings from Oracle and Adobe, both of which are stocks that we cover. And the earnings did not disappoint.

Let’s dive in.

Oracle (ORCL)

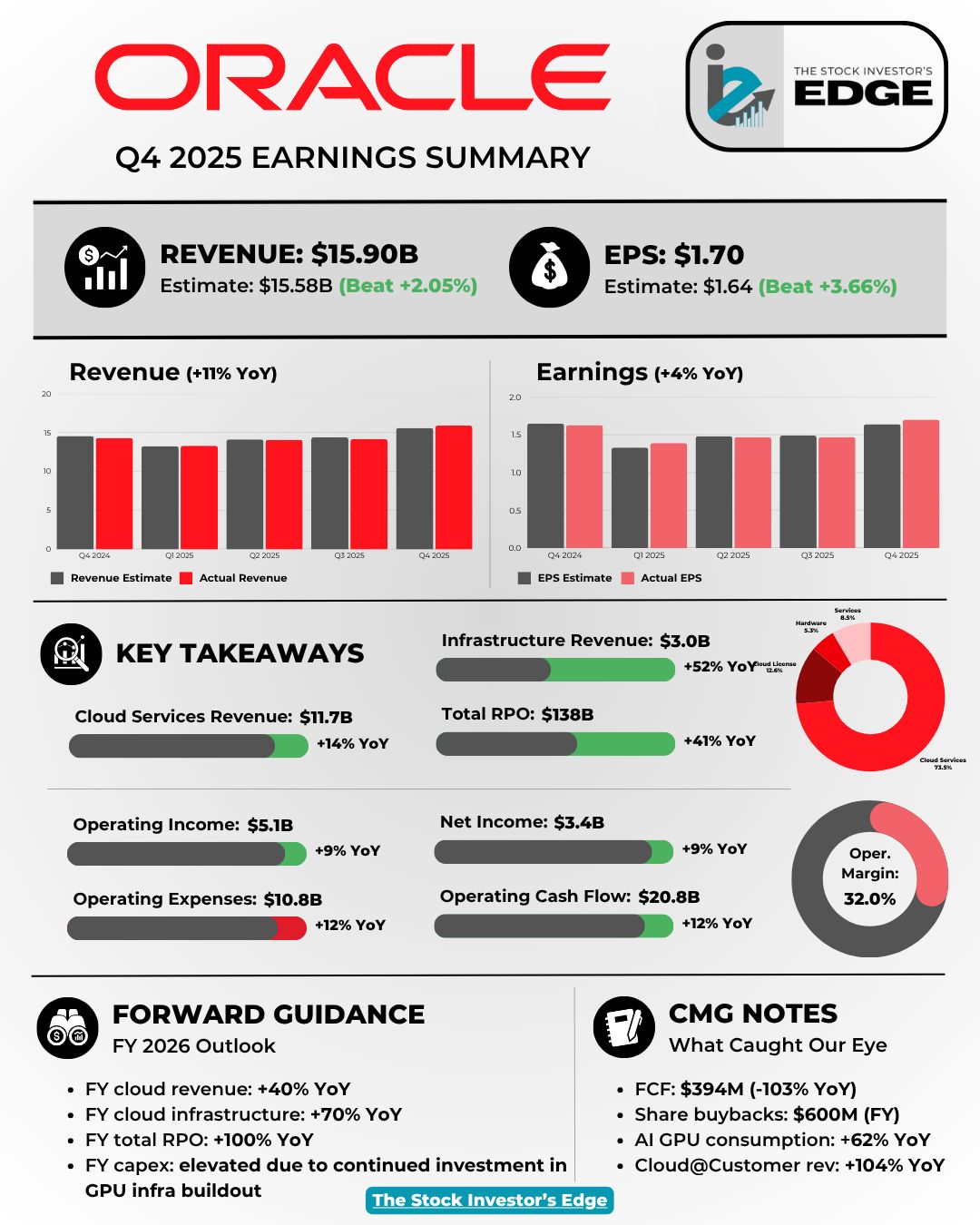

Oracle $ORCL ( ▲ 3.62% ) capped off its fiscal year with a robust Q4 beat, fueled by soaring cloud demand, record levels of deferred revenue, and a massive ramp in AI GPU infrastructure. With Q4 revenue up 11% and adjusted EPS up 5%, Oracle’s pivot from legacy software to a cloud-first powerhouse is taking shape. And if management is right, FY26 could mark a breakout year.

🔑 Key Points

Cloud Momentum: Cloud services revenue rose to $11.7B (+14% YoY), with OCI surging 52% to $3.0B. Management sees >70% OCI growth in FY26.

RPO Surge: Remaining performance obligations jumped 41% to $138B, with FY26 guidance forecasting >100% YoY growth.

AI Demand: OCI consumption revenue rose 62% YoY, driven by AI workloads and expanded multicloud deployments.

Cash Flow Tradeoff: Operating cash flow rose 12% to $20.8B, while free cash flow fell to -$394M due to major CapEx investments.

Capital Return: Buybacks slowed to $600M for FY25, but Oracle maintained its $0.50/share quarterly dividend.

👀 What You Need to Know

Oracle’s breakout this quarter reflects growing investor conviction in its cloud and AI strategy. Strong execution across infrastructure, consumption, and multicloud is shifting the narrative from legacy software to platform-scale growth. While high CapEx raises questions about timing on margin expansion, the stock’s move shows the market believes Oracle is on the right side of the AI buildout.

ORCL shares are +16.6% so far this week.

🔐 Edge Takeaway: Oracle is no longer just catching up in the cloud, it’s now a serious contender in AI infrastructure. With…upgrade to Edge+ to read the Full Edge Takeaway.

Sponsored by Wallstreet Prep

Prompting to Problem-Solving

AI is already reshaping how top companies work across finance, operations, risk, marketing, and more.

But while the hype is everywhere, real business applications are just getting started.

This is your opportunity to go beyond ChatGPT and learn real practical use-cases for AI.

The AI for Business & Finance Certificate from Columbia Business School Exec Ed + Wall Street Prep helps you close that gap.

✅ Earn a certificate from a top business school

✅ Learn from a fantastic line-up of guest speakers from BlackRock, Morgan Stanley, OpenAI, and more

✅ Join live “virtual” office hours with Columbia Business School faculty

8 weeks. 100% online. No coding required.

👉 Save $300 with code SAVE300.

Adobe (ADBE)

Adobe $ADBE ( ▲ 3.26% ) posted another solid quarter, topping both revenue and EPS expectations and raising its full-year guidance on the back of strong Digital Media growth and continued AI momentum. With Creative and Experience Cloud platforms gaining traction, Adobe also reported higher annual recurring revenue (ARR) and strong forward bookings. Shareholder returns remained a focus, with $3.5B in buybacks during the quarter.

🔑 Key Points

Revenue Beat: Q2 revenue rose 11% YoY to $5.87B, topping estimates by 1.2% on broad-based strength across Digital Media and Experience Cloud.

EPS Strength: Adjusted EPS climbed 13% to $5.06, beating by $0.09 as margins expanded and Adobe maintained operating discipline.

Creative Growth: Creative revenue hit $4.0B (+10% YoY), fueled by adoption of AI features like Firefly in Photoshop and Illustrator.

Bookings Momentum: RPO rose 9% YoY to $19.7B, with 67% expected to convert within 12 months, reflecting strong renewal activity.

Capital Return: Adobe repurchased $3.5B in shares and raised FY25 EPS and revenue guidance across the board following the Q2 beat.

👀 What You Need to Know

While Adobe delivered a solid Q2 beat and raised FY25 guidance, investor skepticism lingers around AI monetization and Creative Cloud saturation. This quarter showed strong execution on margins, ARR, and RPO, but the Street appears unconvinced that Adobe’s innovation pipeline can reignite the kind of durable growth that once supported a premium multiple.

ADBE shares are -6.8% so far this week.

🔐 Edge Takeaway: Adobe’s quarter was solid as guidance was raised, AI usage is growing, and margin structure held firm. But the…upgrade to Edge+ to read the Full Edge Takeaway.

The Investor’s Edge Discord is a HUGE benefit of being a subscriber - don’t miss out!

Before we continue with the rest of the earnings recap, please don’t forget to join our our Discord server!

If you want these recaps as soon as the earnings are released, you need to be on the Discord:

Join us on Discord and let's level up our investing game together. The future of trading awaits—and you're invited to be a part of it! 🌟

Thank you for reading this week’s Earnings Recap.

If you enjoyed this newsletter, be sure to give this a LIKE and LEAVE US A COMMENT. You can share your thoughts on the earnings, let us know that you appreciate the content or even just say hello.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This is not investing advice. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.