Good morning investors!

Every Thursday we release our latest “Deep Dive” — a high level, easy to follow stock analysis designed to give our IE+ members an EDGE when it comes to properly valuing a company. We do the heavy lifting so you can make more sound investing decisions.

Today’s deep dive target is Palo Alto Networks — the world’s largest cybersecurity company.

In today’s article we will look at the company’s performance, recent results, and dive deeper into its valuation to determine whether the stock is a BUY, SELL, or HOLD as we begin 2024, based on our opinion alone.

Before we share our research, what are your thoughts on Palo Alto?

Alright, grab your coffee and let’s dive in.

Company Background

Palo Alto Networks, founded in 2005 by Nir Zuk in Santa Clara, California, is an American multinational cybersecurity company.

The core product is a platform that includes advanced firewalls and cloud-based offerings that extend those firewalls to cover other aspects of security. The company serves over 70,000 organizations in over 150 countries, including 85 of the Fortune 100.

The company has expanded over the years, offering new enterprise cybersecurity services beyond its original next-generation firewall offering, such as Traps endpoint protection, Wildfire malware prevention, machine learning, and data analytics.

Nikesh Arora is the current Chairman and CEO of Palo Alto.

Source of Revenue

Palo Alto engages in the provision of network security solutions to enterprises, service providers, and government entities. It operates through the following geographical segments:

United States

Israel

Other countries

Company Financials

In this section we will go over the company’s recent earnings results and dive into their financial statements.

Recent Earnings Report

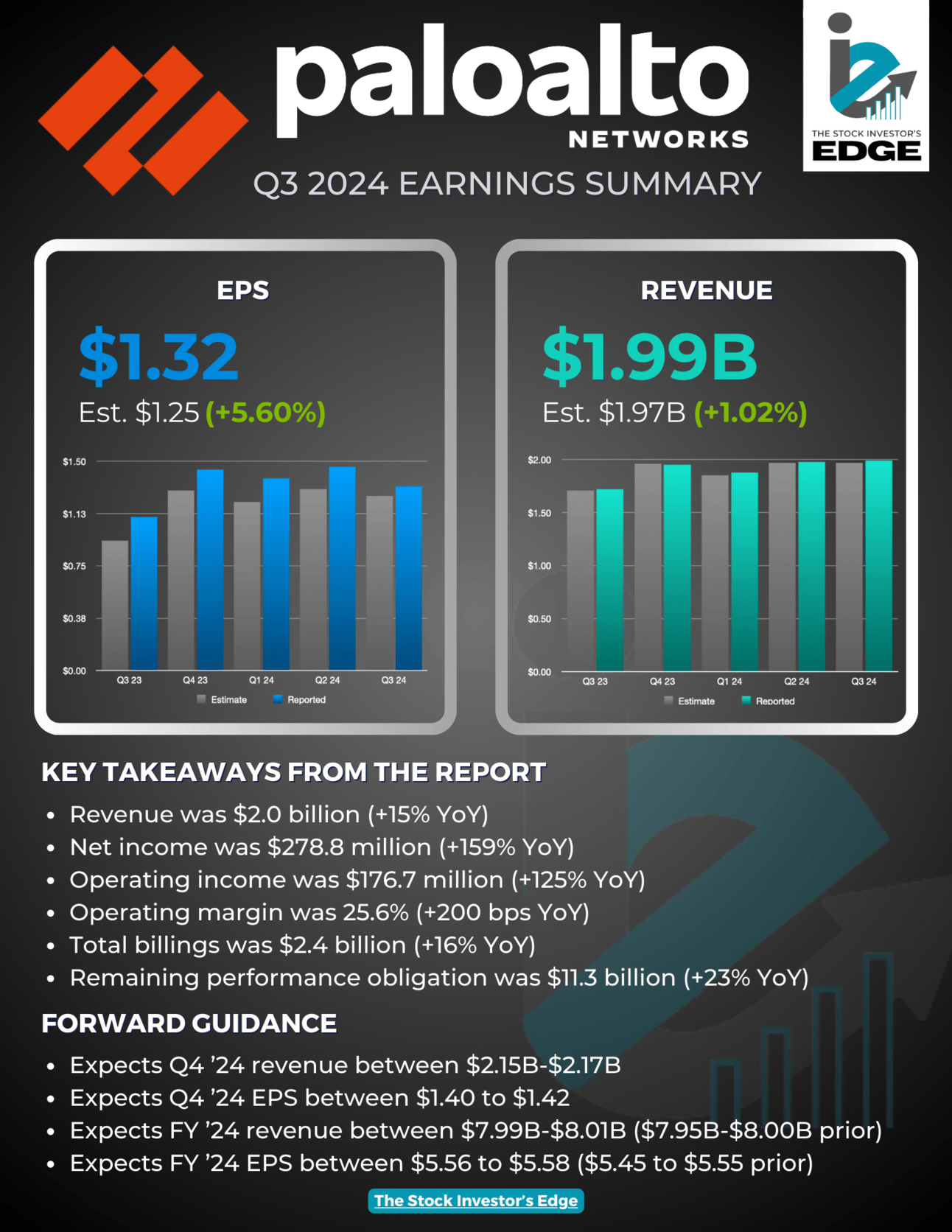

In its recent quarterly report, Palo Alto Networks exceeded analyst expectations but issued a fourth-quarter billings forecast that fell short, reflecting cautious corporate spending on cybersecurity.

The company reported a 15% increase in revenue to $1.98 billion, slightly above the $1.97 billion forecast, and adjusted earnings of $1.32 per share, beating the expected $1.25 per share. Third-quarter billings were $2.33 billion, just below the $2.34 billion estimate.

Companies are spending carefully on cybersecurity due to persistent inflation and economic uncertainty, and many are diversifying their cybersecurity vendors to avoid dependency and manage risks associated with high-profile security breaches.

For the fourth quarter, Palo Alto projected billings between $3.43 billion and $3.48 billion, aligning with analysts' mid-point estimate of $3.45 billion.

The company adjusted its annual billings forecast to a range of $10.13 billion to $10.18 billion, slightly narrowing from the previous range of $10.10 billion to $10.20 billion.

After an initial decline, Palo Alto is up +5.3% since reporting earnings on May 20th.

Income Statement

Palo Alto’s 5 year revenue compound annual growth rate (CAGR) is +23.1% while its 10 year revenue CAGR is +30.8%. The cybersecurity’s net income data is strong as well, with a 5 year net income CAGR of +116.0%.

As cybersecurity becomes even more critical for companies across the globe, Palo Alto is taking full advantage by carving out a significant portion of the market share. This has allowed the company to grow its revenues year after year and even become profitable over the past few years.

These are the types of trends we like to see from growth companies. While we understand the need to fuel the growth through spending, we much prefer profitable companies.

Here’s a breakdown of Palo Alto’s latest income statement:

Palo Alto’s annual income statement over the last 6 years:

Balance Sheet

Palo Alto’s balance sheet looks pretty good on the surface.

Shareholder equity is rising as asset growth has outpaced the increase in the company’s liabilities. In fact, the company’s debt to equity ratio has declined from 108.2% to 26.0% over the last 5 years.

However, there are some concerns as both short term and long term liabilities are not currently covered by assets.

In our opinion, as long as the company continues to execute as it has, this will not be an issue. Especially when you consider Palo Alto has more cash on hand than its total debt and its debt is well covered by its operating cash flow.

Here’s a breakdown of Palo Alto’s current balance sheet:

Palo Alto’s annual balance sheet over the last 6 years:

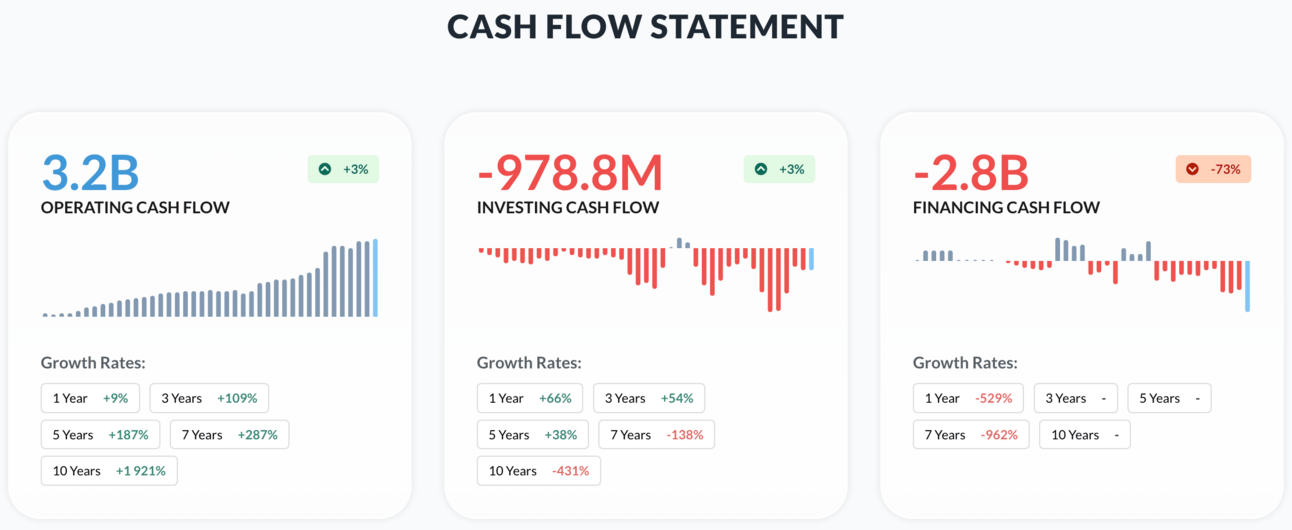

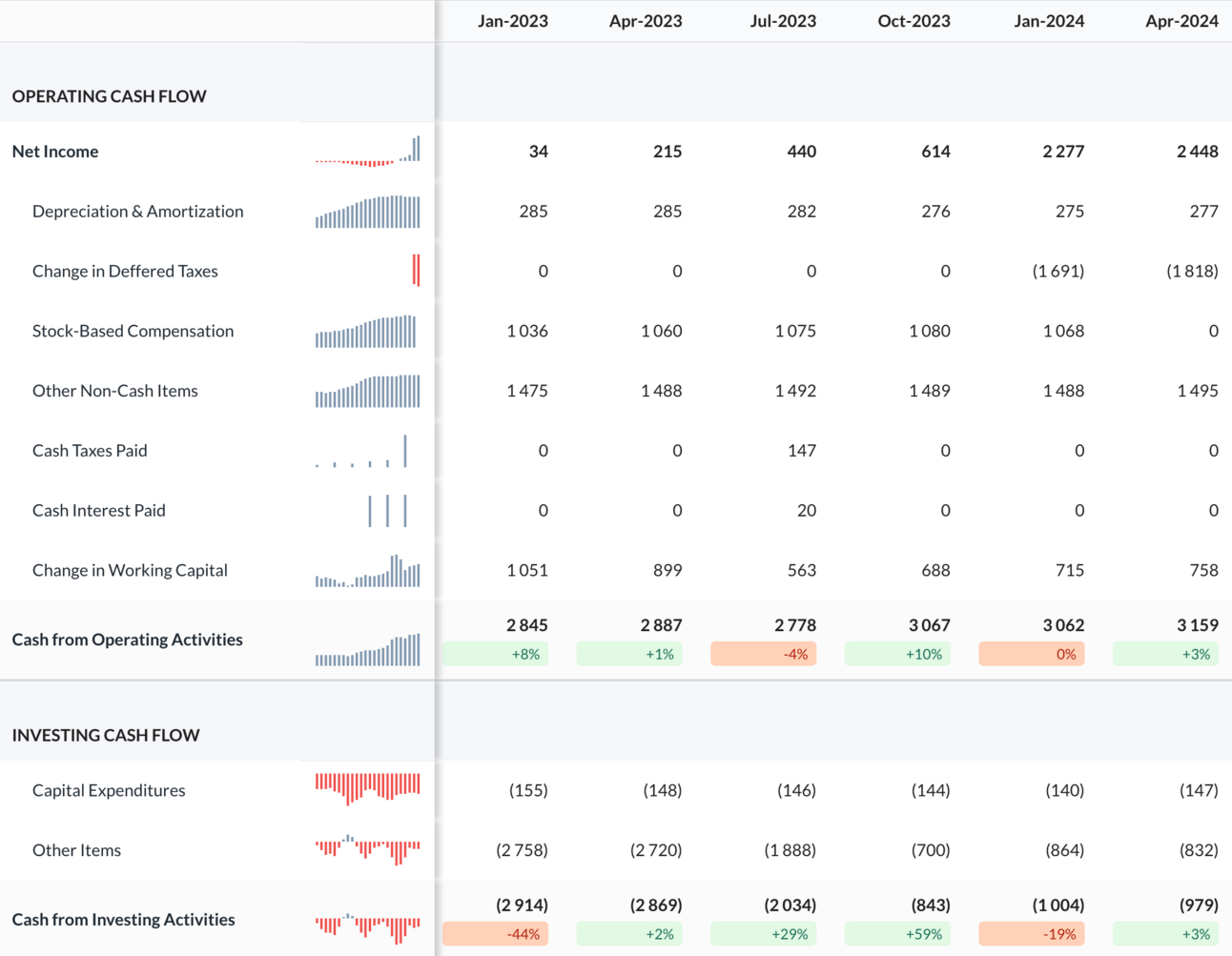

Cash Flow Statement

Palo Alto’s cash flow has been steadily growing over the years. This has allowed the company to perform share buybacks and invest in research and development.

Here’s a breakdown of Palo Alto’s current cash flow statement:

Palo Alto’s cash flow statement over the last 6 years:

Fundamental Analysis

Now that we better understand Palo Alto’s business and financials, it’s time to see whether current valuations make sense.

Valuations

In order to determine whether buying Palo Alto’s at these prices makes sense, we are going to rely on several valuation ratios, including our very own price models.

Here’s a look at our stock screener for Palo Alto. We’ll break down what this all means and exactly how we use it for making our investment decisions.

Looking at the screener, Palo Alto is overvalued based on a few key metrics, but as we mentioned earlier, the financial metrics are strong. As is usually the case, there is more to the overall picture so let’s take a deeper look and see if we can make sense of it all.

Palo Alto’s current price… upgrade to Edge+ to read the rest of this Deep Dive. Take advantage of our 4th of July Sale and get 30% off our regular price!

Have you been eyeing the Stock Investor’s Edge+ community but hesitated due to the cost? Now's your chance to join the Edge+ club at an unbeatable price!

For a limited time, our 4th of July Sale offers you a whopping 30% off on an annual subscription. Don’t miss out—this incredible deal ends Tuesday, July 8th. Take advantage of this amazing deal and take your investing to the next level!

Edge+ members get expert market analysis straight to their inbox as well as access to all of the following benefits:

Still not sure if the IE+ club is for you? We are now offering a FREE 7 day trial to see how much value we truly provide. Don't just take our word for it — come see for yourself why this opportunity is too good to miss! 👇

Thank you for joining us for this Deep Dive of Palo Alto.

If you enjoyed this deep dive, be sure to LEAVE A COMMENT. We look forward to hearing your thoughts on Palo Alto and our analysis. And let us know what stocks you want to see in the future.

Thank you, and until next time investors!

Mark & Chris

The Investor’s Edge

Disclosure

This deep dive is for educational and informational purposes only. The authors are NOT financial advisors, thus cannot recommend for you to personally to buy or sell any positions. Positions taken on a particular stock are opinions of the authors and only the authors. It is very important that you do your own research and make investments based on your own personal circumstances, preferences, goals and risk tolerance.