Welcome to the +423 new subscribers who joined our Dividend Investor’s Edge community this past week. If this is your first time reading, but you have not yet subscribed, join our fast growing investing community of ~9.1K investors.

Seeking Alpha is a great place for investors to gain tons of insights on individual stocks or ETFs. The site has a SPECIAL offer right now where you can gain access to Seeking Alpha PREMIUM for only $99, normally $239. Seeking Alpha PREMIUM allows you access to ALL articles (no paywalls), Top Stock Picks, Expert Analysis, and Education webinars, podcasts, and article.

Click HERE to receive this special promotion. You can try it out for 7-days completely FREE.

*This is sponsored advertising content.

Market Talk ⏪

Here is a look at 5 topics from the week prior and/or related to the week ahead for investors to be mindful of:

More than 1/3 of the S&P 500 reports earnings this week. We get some likely market moving reports this week, many from the communications mega tec sector, as Meta Platforms, Alphabet, Microsoft, and Amazon all report this week. Those four stocks alone make up nearly 15% of the S&P 500.

Stocks are priced to disappoint. The Communication Services sector has led the way this year, up 20% year to date, followed by Information Technology, which is up 19%. Both of those sectors have huge reports this week, and with stocks in that sector up that much, a lot might already be priced into those stocks. A lot will weigh on the guidance management gives in their reports and conference calls. Many are expecting analyst EPS revisions downward in the coming weeks, which makes the S&P 500 that much more expensive.

Apple the BANK. Last week, on the heels of a mini financial crisis, Apple announced a high-yield savings account that could earn depositors 4.15%. This product is available to users within its Apple Card product. An account could easily be setup right from you iPhone.

The end of the road for Bed Bath & Beyond. On Sunday, the end of the road came as Bed Bath & Beyond filed for chapter 11 bankruptcy protection. This does not come as a surprise as the struggling retailer had been closing stores and launched a last ditch effort to raise money to keep the company operating, which was unsuccessful. The company has 360 namesake stores and 120 buybuy Baby stores that will remain open as the company looks to auction off and liquidate assets.

Elon Musk lost nearly $13 billion in a matter of 24 hours. Last week was a rather rough week for the richest man in the US, Elon Musk. He saw his net worth lose $13 billion in a matter of 24 hours after Tesla reported earnings that disappointed and saw the stock fall nearly 10%. Elon’s net worth is still $164 billion, so I think he will be fine for a little while. Also last week, Elon Musk’s SpaceX rocket launched and exploded mid flight. This was a test flight and no astronauts were onboard.

Deep Dive 📰

Become a PREMIUM subscriber today for ONLY $1 PER DAY and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Top 5 Dividend Stocks Newsletter (NEW)

I recently published my latest Monthly Dividend Portfolio Update for premium subscribers to enjoy. We will also have a NEW Deep Dive coming out this week for premium subscribers.

Go PREMIUM today!

US Markets 🇺🇸

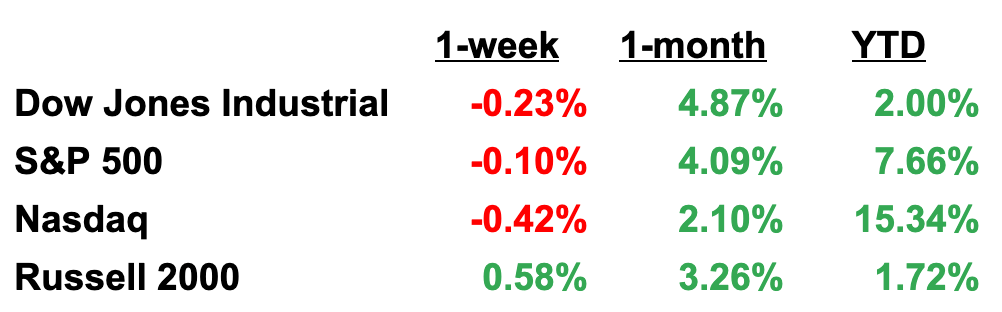

Here is a performance summary for US Equities:

Here is a look at US Treasuries:

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

When it comes to the Fear and Greed Index, we have seen the markets move higher over the past few weeks, but stalling a bit last week. As such, the Fear & Greed Index was largely unchanged from the prior week, firmly remaining in the Greed state. Currently, the index has a reading of 65, which is slightly up from the prior week reading of 68.

Earnings on Deck 💰

The biggest week of earnings thus far with over 1/3 of the S&P 500 reporting earnings this week. Here is a look at who's reporting this week:

Dividend News 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Atlantic Equities upgrades Comcast to overweight from neutral

Wells Fargo downgrades Valero and Marathon Petroleum to equal weight from overweight

Truist initiating Waste Management as buy

UBS upgrades Exxon to buy from neutral

Oppenheimer names Visa a top pick

Jefferies upgrades General Electric to buy from hold

Jefferies downgrades Raytheon to hold from buy

Wells Fargo upgrades Emerson Electric to overweight from equal weight

HBSC upgrades AT&T to buy from hold

Argus upgrades Dollar General to buy from hold

Cantor Fitzgerald initiates CVS as buy

Cantor Fitzgerald initiates UnitedHealth as buy

This Week 📆

Monday

Dallas Fed manufacturing survey (April)

Tuesday

Philadelphia Fed service sector survey (April)

FHFA Home Price index (February)

S&P Case-Shiller home price indexes (February)

Conference Board consumer confidence survey (April)

New home sales (March)

Richmond Fed index (April)

Wednesday

Durable goods orders (March)

Wholesale inventories (March)

Thursday

Jobless claims

Q1 GDP (first preliminary)

Pending home sales (March)

Kansas City Fed manufacturing index (April)

Friday

Personal income (March)

Consumer spending (March)

Core PCE (March)

Chicago (PMI) April

Other Resources 📺

If you have not done so yet, definitely check out my growing YouTube community where I publish weekly videos on Dividend Stocks I am looking at.

Here is a look at my latest video: 3 of the BEST Dividend Kings For The Rest of 2023:

Another video I put out last week, which was a BIG HIT was: Skip JEPI and buy thes Dividend ETFs:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark