If this is your first time reading, welcome to The Dividend Investor’s Edge where we are a thriving community of more than 10,000 subscribers striving to be better and more well informed investors. After completion of the newsletter, if you could do me a HUGE favor and LIKE the article, it would be greatly appreciated to let us know you enjoy what you read.

Cash Flow University is a discord investing community with more than 300 members striving to build cash flow by utilizing options in a safe manner. Come join us today to see our trades and learn how to add $1000s in passive income EVERY month. JOIN TODAY!

Click HERE to check out CFU.

*This is sponsored advertising content.

Market Talk ⏪

We always begin with 5 important topics from the week prior and/or related to the week ahead for investors to be mindful of.

Fitch downgrades US credit rating: The global ratings agency Fitch downgraded the credit rating of the US from AAA down to AA+ this week. Fitch announced that the downgrade is in anticipation of the expected fiscal deterioration in the next three years and the overall increasing debt of the country. US stock futures and the stock markets in Europe and Asia declined in response to the concerning downgrade. Of the big three credit agencies (Moody’s, S&P, and Fitch), only Moody’s has the US with a top credit rating of AAA.

Private sector added more jobs in July, but the Non-Farm Payroll report was not as stellar: The payroll processing firm ADP reported this week that private sector companies added 324,000 jobs in July, outpacing the Dow Jones estimate of 175,000. The majority of the private sector jobs hike was driven by the hospitality industry, including restaurants, hotels, and bars. The higher than expected jobs addition further strengthens the stability of the US jobs market despite the dreary economic conditions. On the flip side, the more closely watched Non-Farm payroll showed 187,000 jobs added during the month which fell short of the 200,000 estimated by Dow Jones. Health care, social assistance, financial activities and wholesale trade were the leading sectors for job creation.

The Bank of England increases interest rates in the UK by quarter-point: The Bank of England followed the monetary policy of the US Federal Reserve and announced another interest rate hike from 5.0% to 5.25% on Thursday. It is the 14th consecutive interest rate hike by the bank and has led the interest rates to reach their highest levels in the past 15 years. The officials indicate that strong growth in wages in recent months has been a deterrent to bringing down inflation and caused them to continue with their rate hiking plans.

US construction spending saw a steep rise in June: The construction spending in the US increased strongly by 0.5% for the month of June. The construction spending in June 2023 was 3.5% higher than during the same period last year, while the spending for the first six months of 2023 has been reported to be 3% more than the same period in 2022.

Apple reported less than stellar Q3 earnings results. The tech giant reported Q3 earnings after the bell on Thursday that BEAT on both the top and bottom lines, but also showed yet another quarter of negative revenue growth. The company has failed to give any sort of formal guidance since 2020, but CFO Luca Maestri commented on the earnings call that the company’s next quarter will be another quarter of negative revenue growth. Trading at a multiple above 30x with falling revenue growth does not bode well for the stock, which saw its share price fall nearly 5% on Friday, which was the stocks worst day since September 2022. AAPL shares account for more than 7% of the S&P 500.

Deep Dive 📰

Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Valuation Dashboard

Subscriber only content

Premium subscribers will be receiving my MONTHLY PORTFOLIO UPDATE this week, so make sure you are signed up so you can get a look at what I have been buying and selling.

Go PREMIUM today!

US Markets 🇺🇸

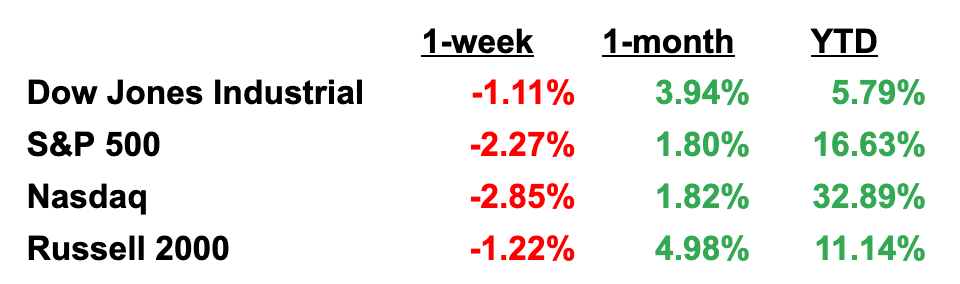

Here is a performance summary for US Equities:

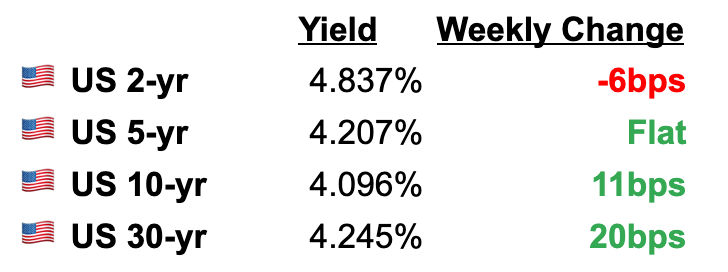

Here is a look at US Treasuries:

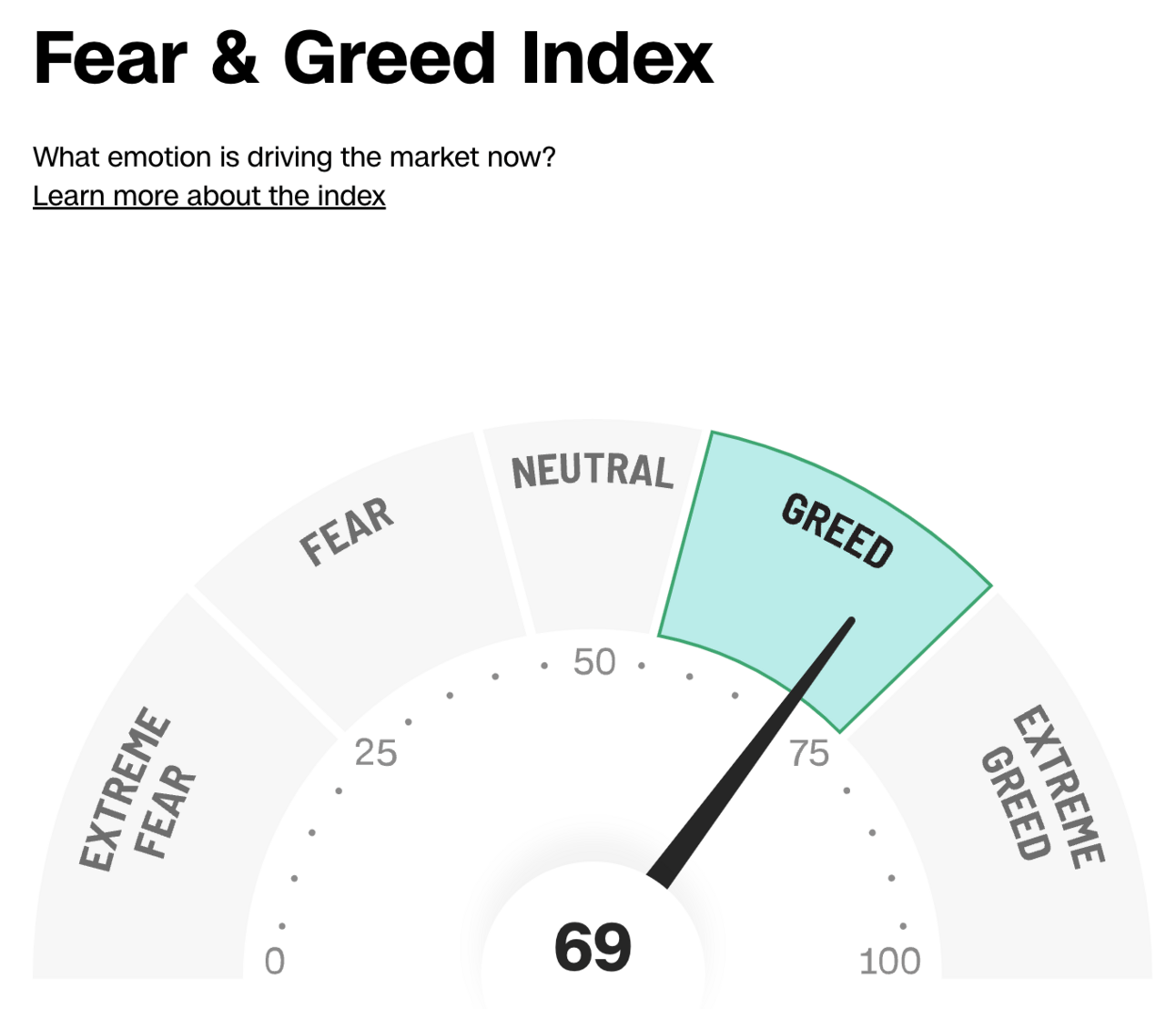

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

In the last week, the Fear & Greed Index went down yet again and has now moved from a rating of Extreme Greed into Greed territory, which does not come as a surprise given the uptick in volatility we have seen in the past week plus. Currently, the index has a reading of 69, which is lower than the prior week’s reading of 78.

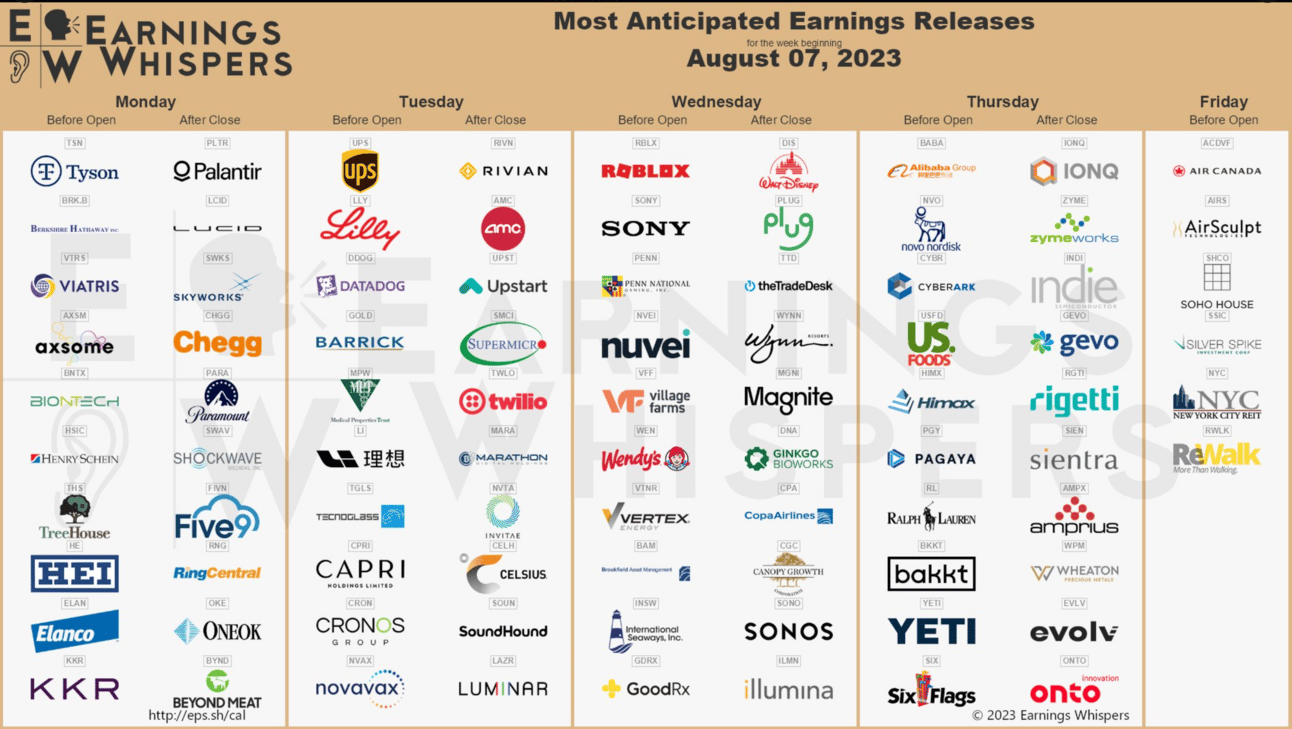

Earnings on Deck 💰

We have seen roughly 80% of S&P 500 companies report their latest earnings results thus far with about 80% beating expectations, although expectations have been lowered a fair amount. We have yet another busy week of earnings this week as well. Here are the companies reporting this week:

Analyst Upgrades/Downgrades 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Goldman Sachs upgrades Chevron to buy from neutral

Morgan Stanley names Keurig Dr Pepper a top pick

Jefferies downgrades Ford to hold from buy

RBC downgrades CSX to sector perform from outperform

Oppenheimer downgrades General Electric to perform from outperform

Credit Suisse downgrades UPS to neutral from outperform

TD Cowen upgrades Ross to outperform from market perform

Deutsche Bank downgrades Qualcomm to hold from buy

Evercore ISI downgrades Simon Property to in line from outperform

Economic Data This Week 📆

Monday

Consumer Credit (June)

Tuesday

NFIB Small Business Index (July)

Trade Balance (June)

Wholesale Inventories (June)

Wednesday

None

Thursday

CPI (July)

Initial jobless claims (week ended Aug. 5)

Hourly earnings (July)

Friday

PPI (July)

Other Resources 📺

If you have not done so yet, check out my growing YouTube community of more than ~31,500 like-minded investors where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: 3 of the BEST Dividend Stocks To Buy In August 2023:

Here is another video I put out last week: How To Invest Your FIRST $1,000:

Here are a few others of my latest videos:

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at [email protected].

Happy Investing!

Mark